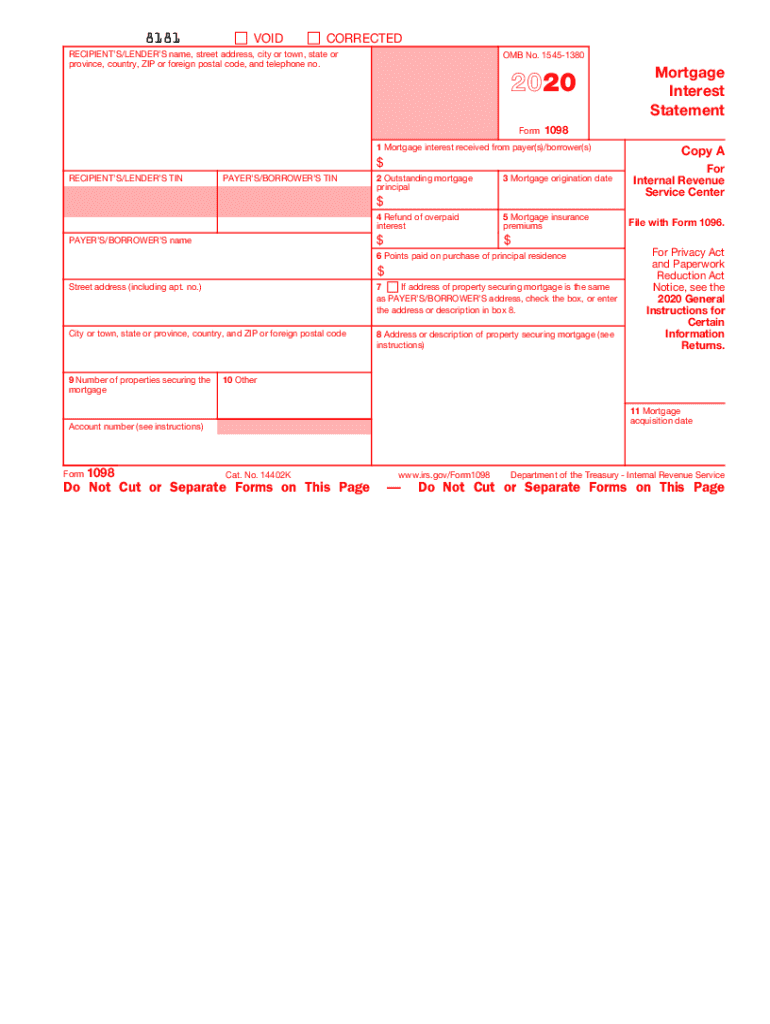

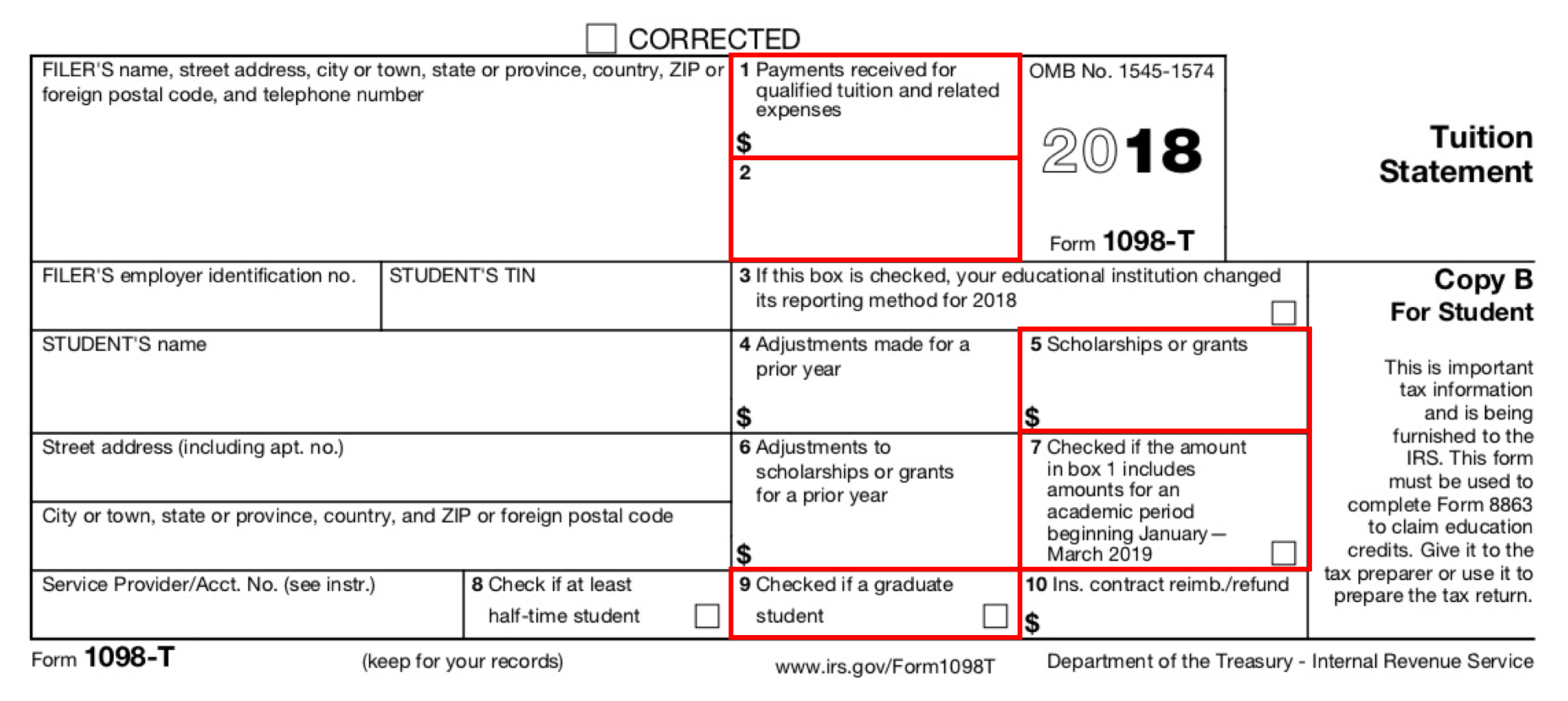

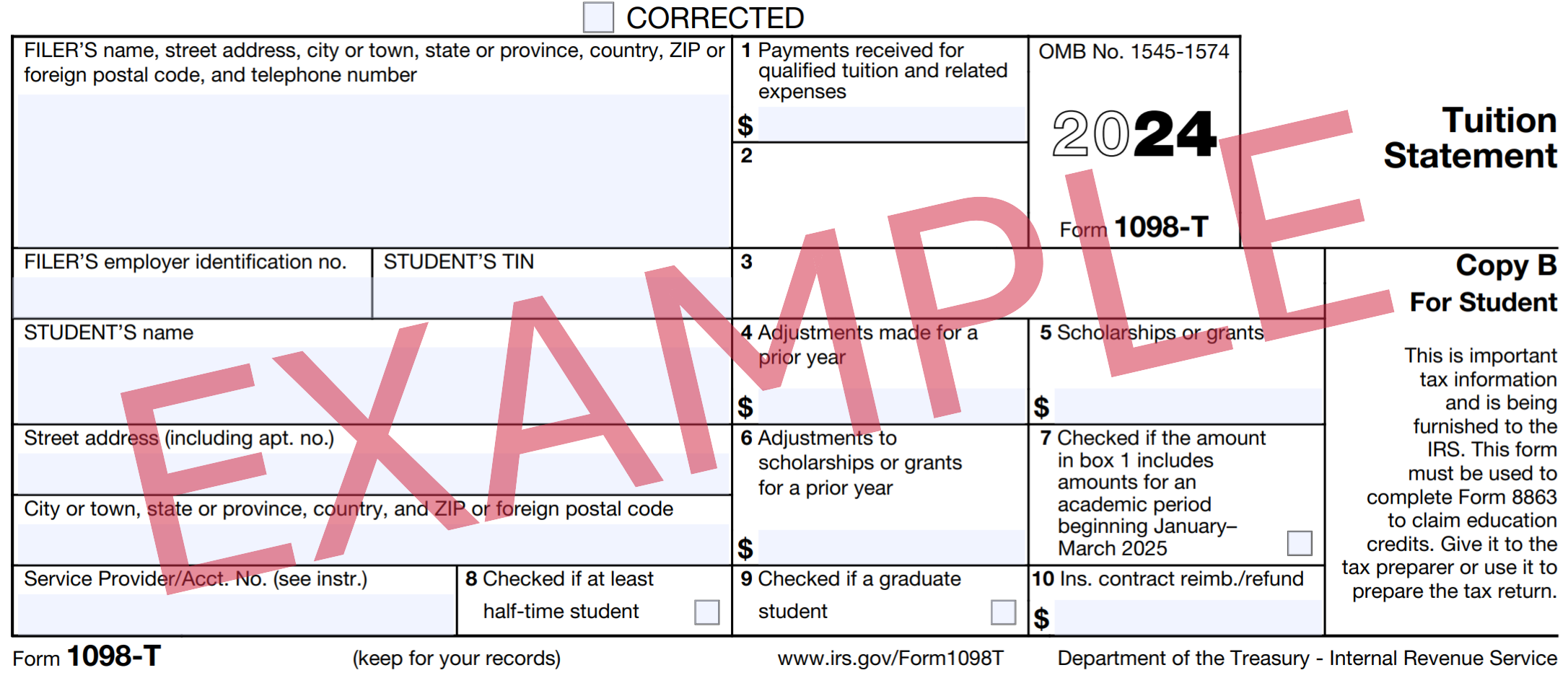

1098 -T Form

1098 -T Form - Ad complete irs tax forms online or print government tax documents. To print your tax forms, go to your banner. Complete, edit or print tax forms instantly. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web definition irs form 1098 is a mortgage interest statement. The 1098t forms are now available for students to print. Edit, sign and save irs tuition statement form. The irs form 1098 informs you how much interest you paid on your mortgage loan for the last tax year. Web form 1098 is a form that is used to report mortgage interest paid. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction.

Web a mortgage interest statement or form 1098 is filled out by the lender to report the amount of mortgage interest during the year. The irs form 1098 informs you how much interest you paid on your mortgage loan for the last tax year. To print your tax forms, go to your banner. Please follow the instructions below. Payments received for qualified tuition and related expenses. It's a tax form used by businesses and lenders to report mortgage interest paid to them of $600 or more. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. This box reports the total amount. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web what is irs tax form 1098, mortgage interest statement?

Ad complete irs tax forms online or print government tax documents. Web what is irs tax form 1098, mortgage interest statement? Complete, edit or print tax forms instantly. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Edit, sign and save irs tuition statement form. To print your tax forms, go to your banner. It's a tax form used by businesses and lenders to report mortgage interest paid to them of $600 or more. Please follow the instructions below. Web definition irs form 1098 is a mortgage interest statement.

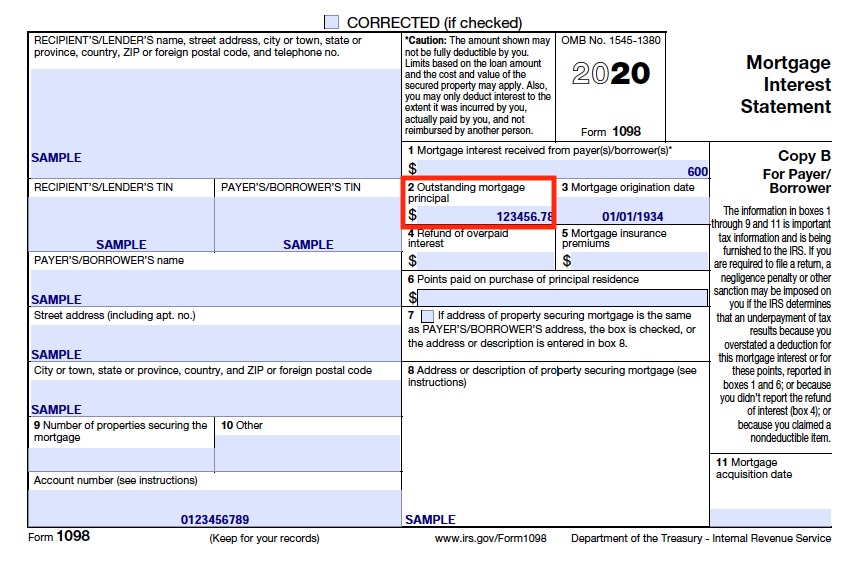

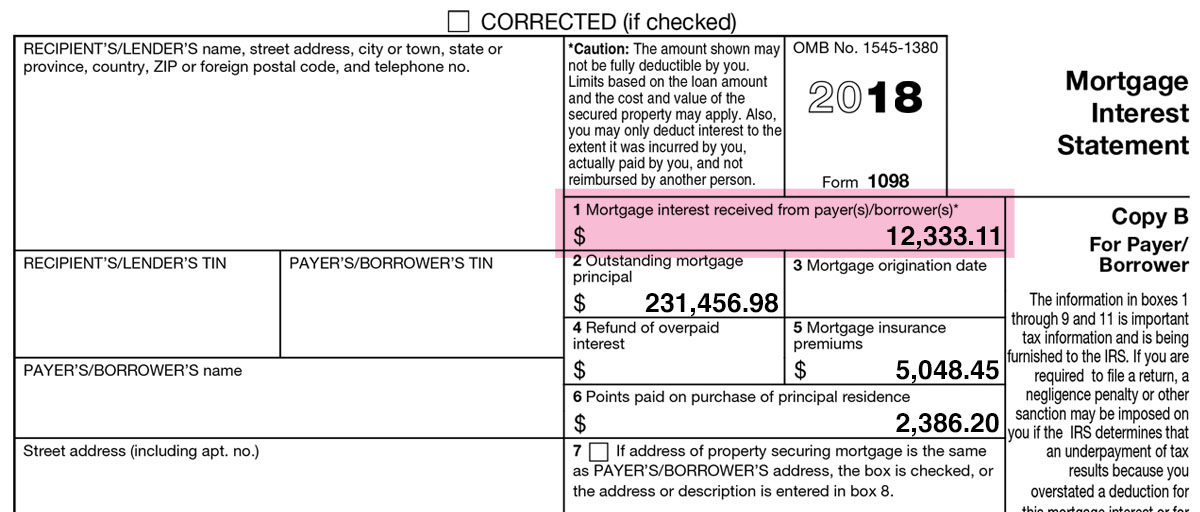

Form 1098 and Your Mortgage Interest Statement

Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. It's a tax form used by businesses and lenders to report mortgage interest paid to them of $600 or more. Web form 1098 is a form that is used.

Form 1098 Mortgage Interest Statement and How to File

The 1098t forms are now available for students to print. It shows how much the borrower pays in a. It's a tax form used by businesses and lenders to report mortgage interest paid to them of $600 or more. Web what is irs tax form 1098, mortgage interest statement? This box reports the total amount.

Form 1098T Information Student Portal

It outlines the tuition expenses you paid for college, which may entitle you to an adjustment to income. It provides the total dollar amount paid by the student for what is. Please follow the instructions below. Payments received for qualified tuition and related expenses. Web definition irs form 1098 is a mortgage interest statement.

Form 1098 Mortgage Interest Statement Definition

It outlines the tuition expenses you paid for college, which may entitle you to an adjustment to income. Web a mortgage interest statement or form 1098 is filled out by the lender to report the amount of mortgage interest during the year. Complete, edit or print tax forms instantly. It shows how much the borrower pays in a. This box.

2020 Form IRS 1098 Fill Online, Printable, Fillable, Blank pdfFiller

Edit, sign and save irs tuition statement form. Web what is irs tax form 1098, mortgage interest statement? To print your tax forms, go to your banner. Ad complete irs tax forms online or print government tax documents. It outlines the tuition expenses you paid for college, which may entitle you to an adjustment to income.

How to Print and File Tax Form 1098C, Contributions of Motor Vehicles

Complete, edit or print tax forms instantly. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web a mortgage interest statement or form 1098 is filled out by the lender to report the amount of mortgage interest during.

Form 1098T Still Causing Trouble for Funded Graduate Students

Web on your 1098 tax form is the following information: Web what is irs tax form 1098, mortgage interest statement? To print your tax forms, go to your banner. Web a mortgage interest statement or form 1098 is filled out by the lender to report the amount of mortgage interest during the year. The 1098t forms are now available for.

1098T Information Bursar's Office Office of Finance UTHSC

It provides the total dollar amount paid by the student for what is. Web definition irs form 1098 is a mortgage interest statement. Web a mortgage interest statement or form 1098 is filled out by the lender to report the amount of mortgage interest during the year. Complete, edit or print tax forms instantly. It's a tax form used by.

End of Year Form 1098 changes Peak Consulting

Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. It provides the total dollar amount paid by the student for what is. Please follow the instructions below. Ad complete irs tax forms online or print government tax documents..

1098 Mortgage Interest Forms United Bank of Union

Edit, sign and save irs tuition statement form. Web form 1098 is a form that is used to report mortgage interest paid. Complete, edit or print tax forms instantly. Web a mortgage interest statement or form 1098 is filled out by the lender to report the amount of mortgage interest during the year. Web each borrower is entitled to deduct.

Complete, Edit Or Print Tax Forms Instantly.

To print your tax forms, go to your banner. Edit, sign and save irs tuition statement form. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. It shows how much the borrower pays in a.

This Box Reports The Total Amount.

Referred to as the mortgage interest statement, the 1098 tax form allows business to notify the irs of. Web on your 1098 tax form is the following information: Web a mortgage interest statement or form 1098 is filled out by the lender to report the amount of mortgage interest during the year. Ad complete irs tax forms online or print government tax documents.

It Provides The Total Dollar Amount Paid By The Student For What Is.

Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Payments received for qualified tuition and related expenses. The irs form 1098 informs you how much interest you paid on your mortgage loan for the last tax year. Web form 1098 is a form that is used to report mortgage interest paid.

The 1098T Forms Are Now Available For Students To Print.

It outlines the tuition expenses you paid for college, which may entitle you to an adjustment to income. Web definition irs form 1098 is a mortgage interest statement. Web what is irs tax form 1098, mortgage interest statement? Please follow the instructions below.

/Form1098-5c57730f46e0fb00013a2bee.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png)