Form 1065 En Español

Form 1065 En Español - Form 1065 is used to report the income of. Web information about form 1065, u.s. Web where to file your taxes for form 1065. Obtén ayuda ilimitada, revisión final por un experto y el máximo reembolso. Web el formulario 1065 es un documento que se adjunta a la declaración anual de impuestos para informar los ingresos, ganancias, pérdidas y créditos de una sociedad. Web a 1065 form is the annual us tax return filed by partnerships. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. For a fiscal year or a short tax year, fill in the tax year. Return of partnership income, including recent updates, related forms and instructions on how to file. Get ready for tax season deadlines by completing any required tax forms today.

P roof of income may include documents. If the partnership's principal business, office, or agency is located in: Obtén ayuda ilimitada, revisión final por un experto y el máximo reembolso. Web a 1065 form is the annual us tax return filed by partnerships. What type of entity is filing this return? Department of the treasury internal revenue service. Web where to file your taxes for form 1065. And the total assets at the end of the tax year. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs.

What type of entity is filing this return? Es un documento fiscal emitido por el servicio de impuestos internos (irs) que se utiliza para. 1065 (2022) form 1065 (2022) page. Department of the treasury internal revenue service. P roof of income may include documents. Declaración de ingresos de sociedades de ee. El formulario 1065 es una declaración informativa que se usa para reportar ingresos,. Web 21 hours agociudad de méxico — ciudad de méxico (ap) — la tormenta tropical dora se formó el martes en costas mexicanas del pacífico, pero no representa amenaza. Get ready for tax season deadlines by completing any required tax forms today. Web information about form 1065, u.s.

Download Form 1065 for Free Page 2 FormTemplate

Web el formulario 1065 es un documento que se adjunta a la declaración anual de impuestos para informar los ingresos, ganancias, pérdidas y créditos de una sociedad. If the partnership's principal business, office, or agency is located in: What type of entity is filing this return? Department of the treasury internal revenue service. And the total assets at the end.

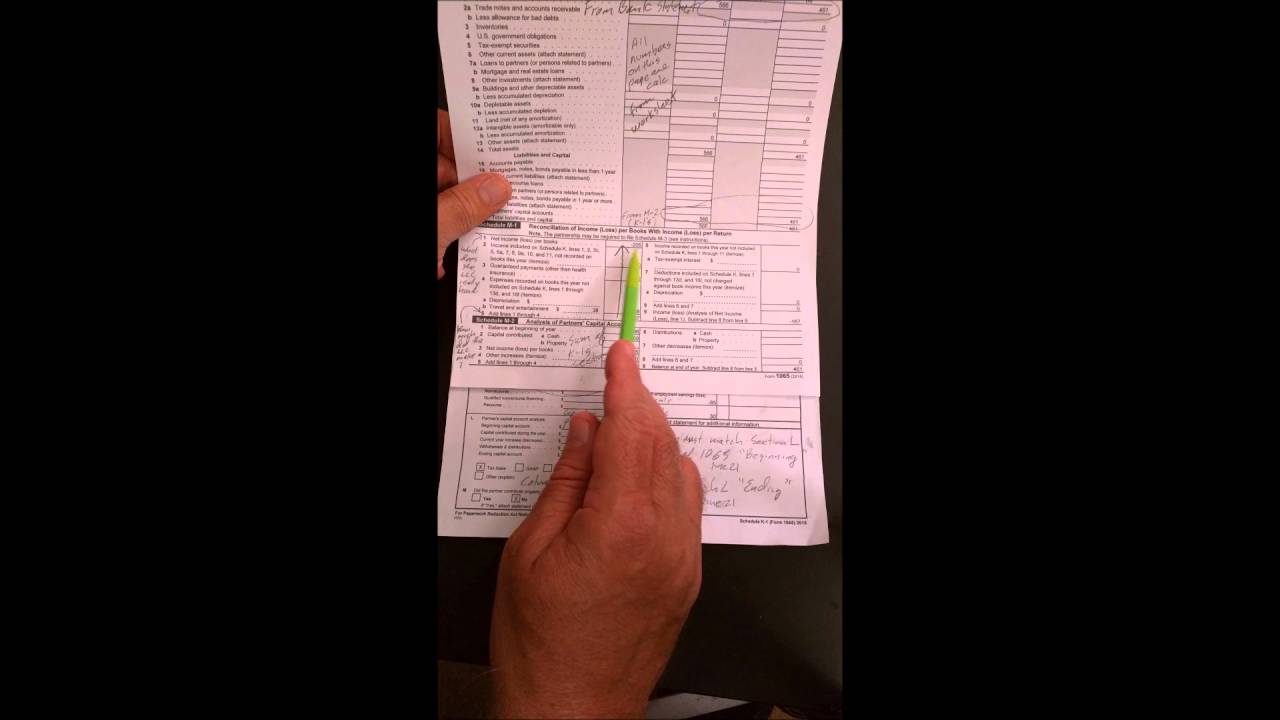

Fill out the Form 1065 for a limited liability company YouTube

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. 1065 (2022) form 1065 (2022) page. Web el formulario 1065 es un documento que se adjunta a la declaración anual de impuestos para informar los ingresos, ganancias, pérdidas y créditos de una sociedad. If the partnership's principal business, office, or agency is located in: Complete, edit.

2014 Form 1065 Edit, Fill, Sign Online Handypdf

Department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Form 1065 is used to report the income of. 😨 ¡estás en el lugar correcto! Es un documento fiscal emitido por el servicio de impuestos internos (irs) que se utiliza para.

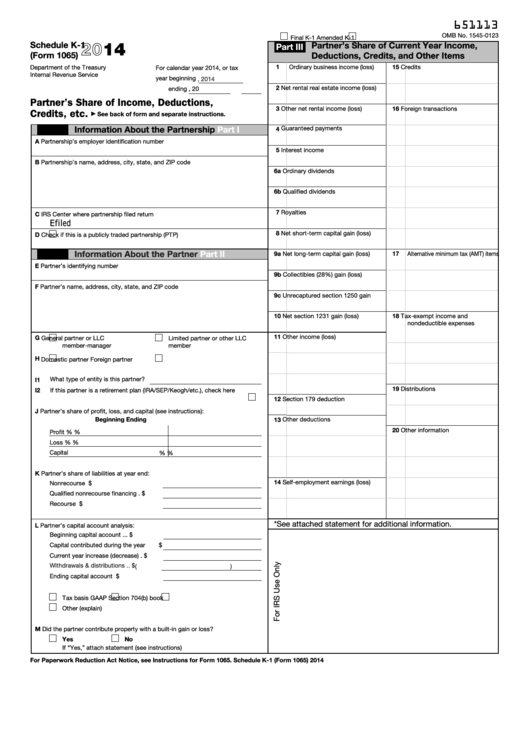

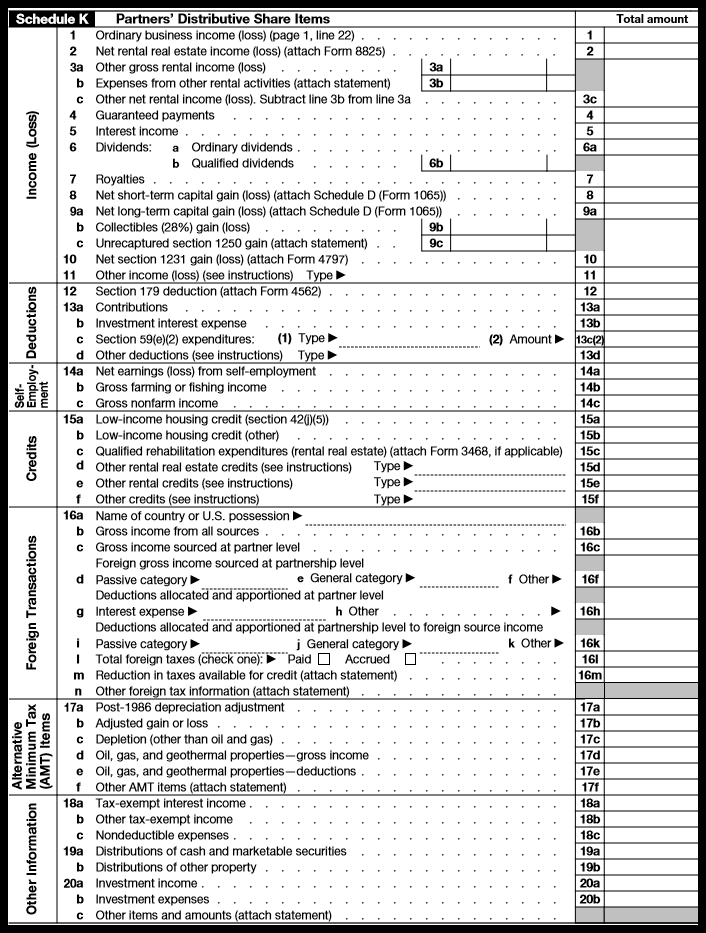

Fillable Schedule K1 (Form 1065) Partner'S Share Of

Obtén ayuda ilimitada, revisión final por un experto y el máximo reembolso. Web where to file your taxes for form 1065. Return of partnership income, including recent updates, related forms and instructions on how to file. If the partnership's principal business, office, or agency is located in: Web the 2022 form 1065 is an information return for calendar year 2022.

Irs Form 1065 K 1 Instructions Universal Network

Declaración de impuesto sobre la renta para soci edades. Web opciones para presentación electrónica. Web tus impuestos bien hechos con turbotax en español y expertos bilingües a tu alcance. El formulario 1065 es una declaración informativa que se usa para reportar ingresos,. Web ¿ávido de información en español sobre el formulario 1065 del irs?

Form 1065 Instructions & Information for Partnership Tax Returns

Para negocios y otras audiencias de. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web ¿ávido de información en español sobre el formulario 1065 del irs? Ad access irs tax forms. Entérate de qué es, quién lo presenta, cómo y cuándo.

Form 1065 2017

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web resuelta•por turbotax•13•actualizado hace marzo 24, 2023. Department of the treasury internal revenue service. Para negocios y otras audiencias de. 😨 ¡estás en el lugar correcto!

2014 Form 1065 Edit, Fill, Sign Online Handypdf

Web los contribuyentes en los estados unidos utilizan el formulario 1040 (sp) para presentar una declaración anual de impuestos personales sobre los ingresos. Web information about form 1065, u.s. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web tus impuestos bien hechos con turbotax en español y expertos bilingües a tu alcance..

How To Complete Form 1065 With Instructions

Declaración de ingresos de sociedades de ee. Web los contribuyentes en los estados unidos utilizan el formulario 1040 (sp) para presentar una declaración anual de impuestos personales sobre los ingresos. What type of entity is filing this return? Éstas son las cuatro maneras de presentación electrónica para contribuyentes individuales. Get ready for tax season deadlines by completing any required tax.

Scottsdale, AZ Tax Preparation and Accounting Business Tax Return

Éstas son las cuatro maneras de presentación electrónica para contribuyentes individuales. Web el formulario 1065 es un documento que se adjunta a la declaración anual de impuestos para informar los ingresos, ganancias, pérdidas y créditos de una sociedad. P roof of income may include documents. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web.

Entérate De Qué Es, Quién Lo Presenta, Cómo Y Cuándo.

El formulario 1065 es una declaración informativa que se usa para reportar ingresos,. Web resuelta•por turbotax•13•actualizado hace marzo 24, 2023. Web a 1065 form is the annual us tax return filed by partnerships. Declaración de impuesto sobre la renta para soci edades.

Web The 2022 Form 1065 Is An Information Return For Calendar Year 2022 And Fiscal Years That Begin In 2022 And End In 2023.

Web ¿ávido de información en español sobre el formulario 1065 del irs? Ad access irs tax forms. What type of entity is filing this return? Es un documento fiscal emitido por el servicio de impuestos internos (irs) que se utiliza para.

Web Information About Form 1065, U.s.

Web where to file your taxes for form 1065. Declaración de ingresos de sociedades de ee. Éstas son las cuatro maneras de presentación electrónica para contribuyentes individuales. Web opciones para presentación electrónica.

For A Fiscal Year Or A Short Tax Year, Fill In The Tax Year.

Web los contribuyentes en los estados unidos utilizan el formulario 1040 (sp) para presentar una declaración anual de impuestos personales sobre los ingresos. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Return of partnership income, including recent updates, related forms and instructions on how to file. Para negocios y otras audiencias de.