I Don't Have A 1099 Form

I Don't Have A 1099 Form - For examples, see 12.3 list c documents that establish employment. Web the official printed version of the irs form is scannable, but the online version of it, printed from the website, is not. If they can't get a copy, they can contact the irs for help. Employment authorization document issued by the department of homeland security. If they can't get the forms,. This doesn’t mean you don’t have to report. Its automated computer system compares income you report on your return with payers' information. Web if a 1099 form is not received, taxpayers are still responsible for paying the taxes owed on any income earned during the tax year. Follow these steps to enter your income. Individual taxpayers don’t complete 1099 forms.

From google ads experts to. You don’t need to pay taxes if your clients don’t provide you with a 1099. A penalty may be imposed for filing forms that cannot be scanned. There are maximum fines per year for small. And to ask the touchier question, can you argue that since there was no form, it must not be taxable? If you receive an incorrect 1099 form and the payer. The payer fills out the form with the appropriate details and sends copies to you and the irs,. Its automated computer system compares income you report on your return with payers' information. Web if you don’t report taxable income from a 1099, you’ll probably hear from the irs. For examples, see 12.3 list c documents that establish employment.

A penalty may be imposed for filing forms that cannot be scanned. Here’s what happens if you don’t file a 1099 by robby nelson, cpa updated march 4, 2022 for lots of freelancers, contract labor is the key to stay on top of things professionally. If you receive an incorrect 1099 form and the payer. If they can't get a copy, they can contact the irs for help. Employment authorization document issued by the department of homeland security. There are maximum fines per year for small. Web deal with a missing form. Login to your turbotax account click federal taxes from the left side of your screen click on the . Follow these steps to enter your income. Received a payment and other reporting.

1099 Archives Deb Evans Tax Company

This doesn’t mean you don’t have to report. Employment authorization document issued by the department of homeland security. The payer fills out the form with the appropriate details and sends copies to you and the irs,. If you receive an incorrect 1099 form and the payer. Received a payment and other reporting.

How To File Form 1099NEC For Contractors You Employ VacationLord

For examples, see 12.3 list c documents that establish employment. And to ask the touchier question, can you argue that since there was no form, it must not be taxable? If you receive an incorrect 1099 form and the payer. Employment authorization document issued by the department of homeland security. Login to your turbotax account click federal taxes from the.

1099 MISC Form 2022 1099 Forms TaxUni

Received a payment and other reporting. Web what happens if you don't file a 1099? A penalty may be imposed for filing forms that cannot be scanned. Web if i don't receive a 1099, do i have to report income? Web if a 1099 form is not received, taxpayers are still responsible for paying the taxes owed on any income.

What's Form 1099MISC Used For? Tax attorney, 1099 tax form, Tax forms

Web put differently, if you don’t get a form 1099, is it income in the first place? Employment authorization document issued by the department of homeland security. Web the irs compares reported income on form 1040 with the information reported on 1099 forms. The payer fills out the form with the appropriate details and sends copies to you and the.

The One Box On Your 1099 That May Hurt You Steve Spangenberg

A penalty may be imposed for filing forms that cannot be scanned. You don’t need to pay taxes if your clients don’t provide you with a 1099. Here’s what happens if you don’t file a 1099 by robby nelson, cpa updated march 4, 2022 for lots of freelancers, contract labor is the key to stay on top of things professionally..

11 Common Misconceptions About Irs Form 11 Form Information Free

See here for more info: The payer fills out the form with the appropriate details and sends copies to you and the irs,. Web deal with a missing form. Web if i don't receive a 1099, do i have to report income? If they can't get a copy, they can contact the irs for help.

W9 vs 1099 IRS Forms, Differences, and When to Use Them

There are maximum fines per year for small. From google ads experts to. Web the official printed version of the irs form is scannable, but the online version of it, printed from the website, is not. See here for more info: Web what happens if you don't file a 1099?

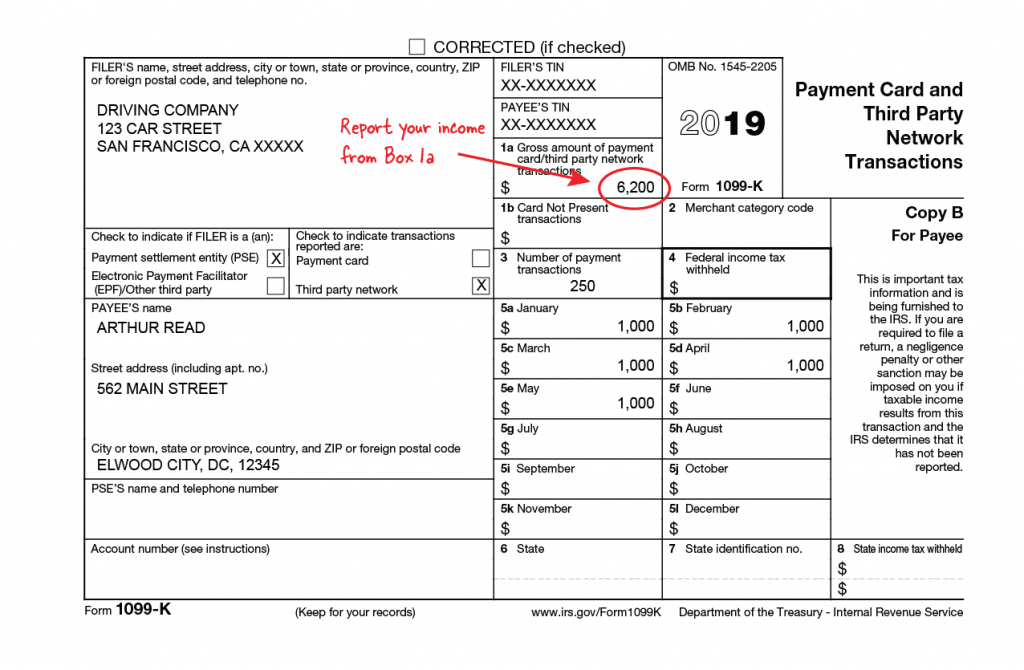

All About Forms 1099MISC and 1099K Brightwater Accounting

Web if a 1099 form is not received, taxpayers are still responsible for paying the taxes owed on any income earned during the tax year. Login to your turbotax account click federal taxes from the left side of your screen click on the . Web deal with a missing form. Web what happens if you don't file a 1099? Follow.

Irs Printable 1099 Form Printable Form 2022

Login to your turbotax account click federal taxes from the left side of your screen click on the . Web if you don’t report taxable income from a 1099, you’ll probably hear from the irs. A penalty may be imposed for filing forms that cannot be scanned. Web if i don't receive a 1099, do i have to report income?.

Uber Tax Forms What You Need to File Shared Economy Tax

Here’s what happens if you don’t file a 1099 by robby nelson, cpa updated march 4, 2022 for lots of freelancers, contract labor is the key to stay on top of things professionally. If they can't get a copy, they can contact the irs for help. The irs requires that you report all of your income, even if it's less.

Web Put Differently, If You Don’t Get A Form 1099, Is It Income In The First Place?

Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. There are maximum fines per year for small. The payer fills out the form with the appropriate details and sends copies to you and the irs,. From google ads experts to.

Web If You Don’t Report Taxable Income From A 1099, You’ll Probably Hear From The Irs.

Web the official printed version of the irs form is scannable, but the online version of it, printed from the website, is not. Web if a 1099 form is not received, taxpayers are still responsible for paying the taxes owed on any income earned during the tax year. For examples, see 12.3 list c documents that establish employment. Its automated computer system compares income you report on your return with payers' information.

See Here For More Info:

Here’s what happens if you don’t file a 1099 by robby nelson, cpa updated march 4, 2022 for lots of freelancers, contract labor is the key to stay on top of things professionally. A penalty may be imposed for filing forms that cannot be scanned. Web if i don't receive a 1099, do i have to report income? Web what happens if you don't file a 1099?

Web Deal With A Missing Form.

Login to your turbotax account click federal taxes from the left side of your screen click on the . If they can't get a copy, they can contact the irs for help. If you receive an incorrect 1099 form and the payer. #general #taxes maria malyk updated on: