10 A Form For Income Tax

10 A Form For Income Tax - Web change your tax or refund. Web a’s interest expense is apportioned between u.s. ( form 10 should be filed at least two month prior to. Web schedule a free consultation today! Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Web income taxes in the u.s. Web you must file form 1040, u.s. Web a similar allocation is required for income and withheld income tax reported to you on forms 1099. As per section 115baa of the income tax act, domestic companies have the option to pay tax at a concessional rate of 22% (plus. Web form 10e is a tax form used in india to seek relief on salary arrears.

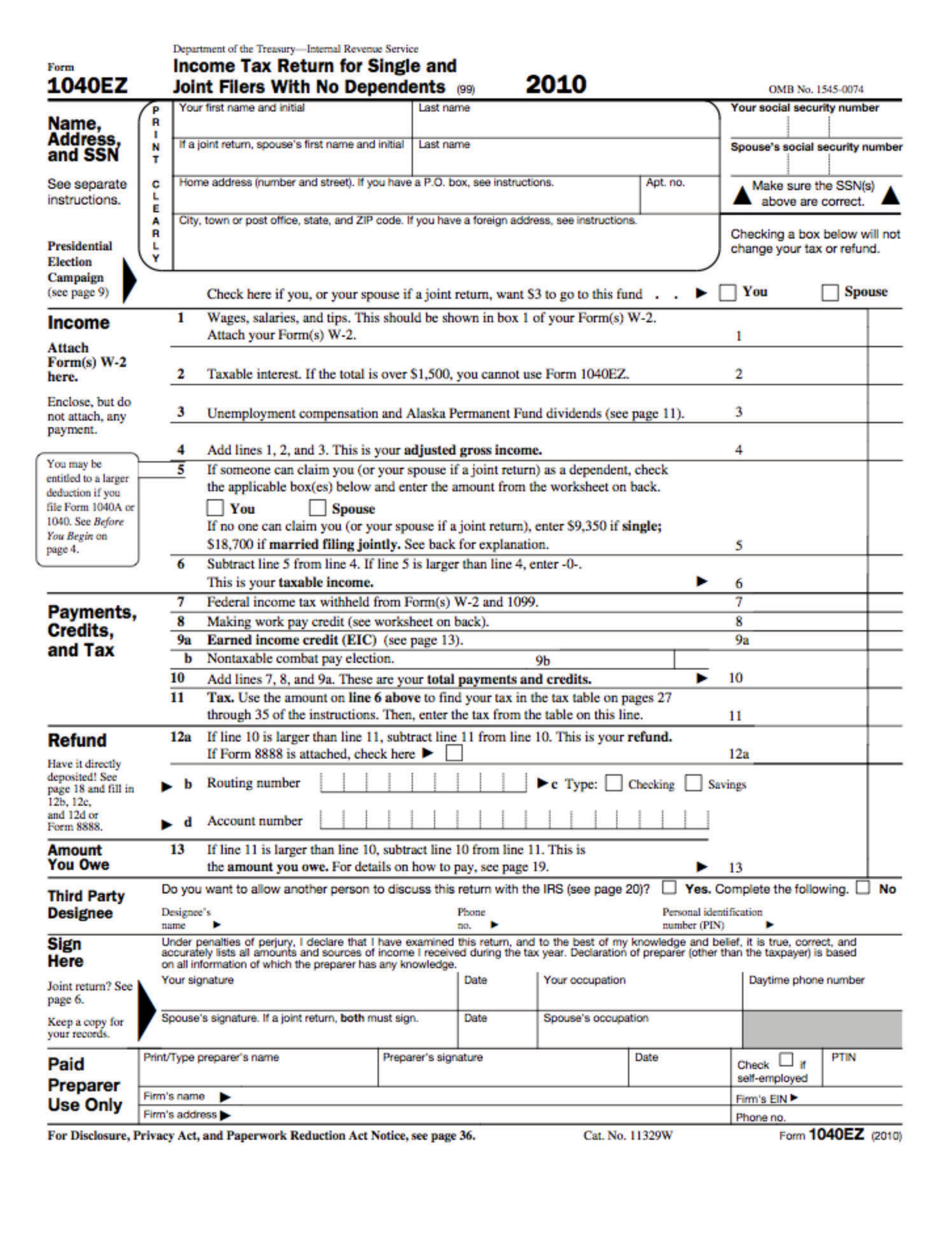

Web a’s interest expense is apportioned between u.s. Web the irs form 1040a is one of three forms you can use to file your federal income tax return. Check here if you, or your spouse if filing jointly, want $3 to go to this fund. ( form 10 should be filed at least two month prior to. The 1040 shows income, deductions, credits, tax refunds or tax owed to the irs. Web a trust was registered u/s. Web form 1040 is the main tax form used to file a u.s. Source and foreign source income ratably based on the tax book value of a’s u.s. It filed form 10 a on 21/03/2022 under the new regime. 10 shall be filed on or before the due date of filing itr as specified under sub section (1) of sec 139.

Web form 1040 is the main tax form used to file a u.s. The 1040 shows income, deductions, credits, tax refunds or tax owed to the irs. Complete form 8962 to claim the credit and to reconcile your advance credit payments. Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Resident during the year and who is a resident of the u.s. ( form 10 should be filed at least two month prior to. It filed form 10 a on 21/03/2022 under the new regime. Web in addition, you may be required to file form 8938, statement of specified foreign financial assets, if you have an interest in specified foreign financial assets with. Web you must file form 1040, u.s. You must also include a statement that indicates you filed a chapter 11.

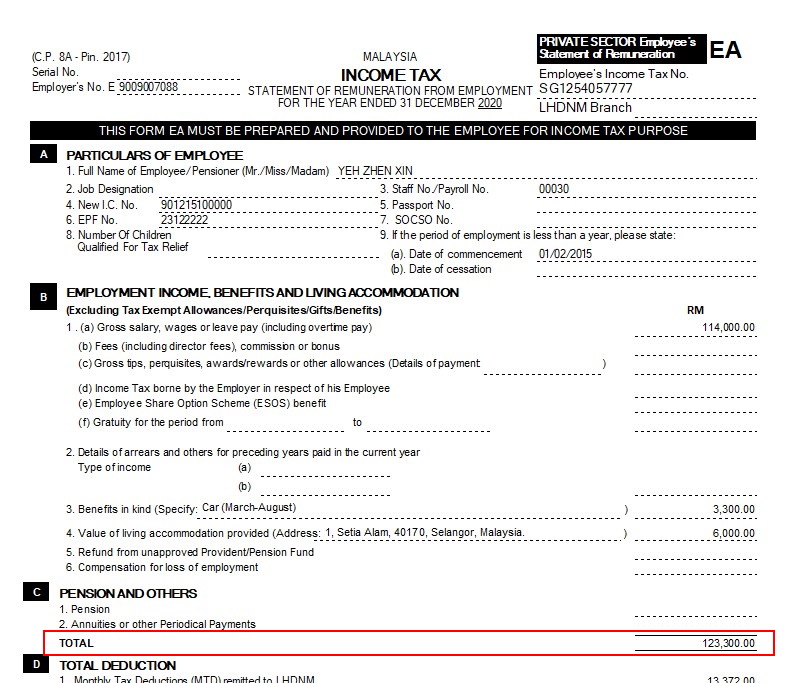

Malaysia Personal Tax Relief Tax Calculate Malaysia Tax Rate

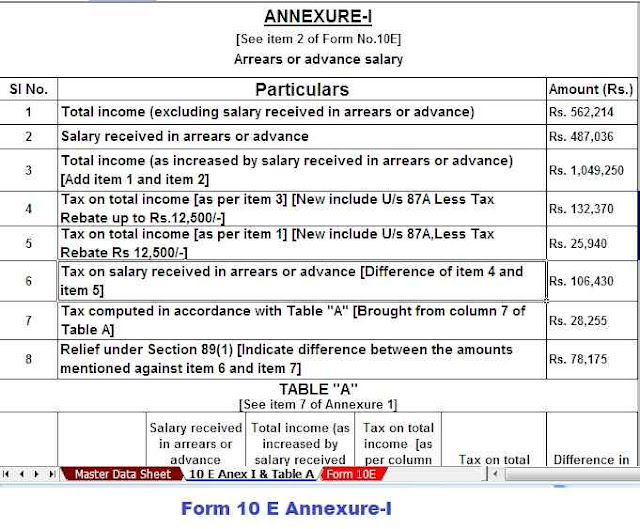

Web a trust was registered u/s. Web form 10e is a tax form used in india to seek relief on salary arrears. Source and foreign source income ratably based on the tax book value of a’s u.s. Web presidential change your tax or refund. Check here if you, or your spouse if filing jointly, want $3 to go to this.

How To File Your Tax Return Online

Web change your tax or refund. It filed form 10 a on 21/03/2022 under the new regime. The name, address and contact details, as per the database of the applicant, will be displayed on the screen. Web a trust was registered u/s. Web the irs form 1040a is one of three forms you can use to file your federal income.

Taxes

Web schedule a free consultation today! Following are the steps to file form 10ba. Form 1040a is a shorter version of the more detailed form 1040, but. Source and foreign source income ratably based on the tax book value of a’s u.s. Web change your tax or refund.

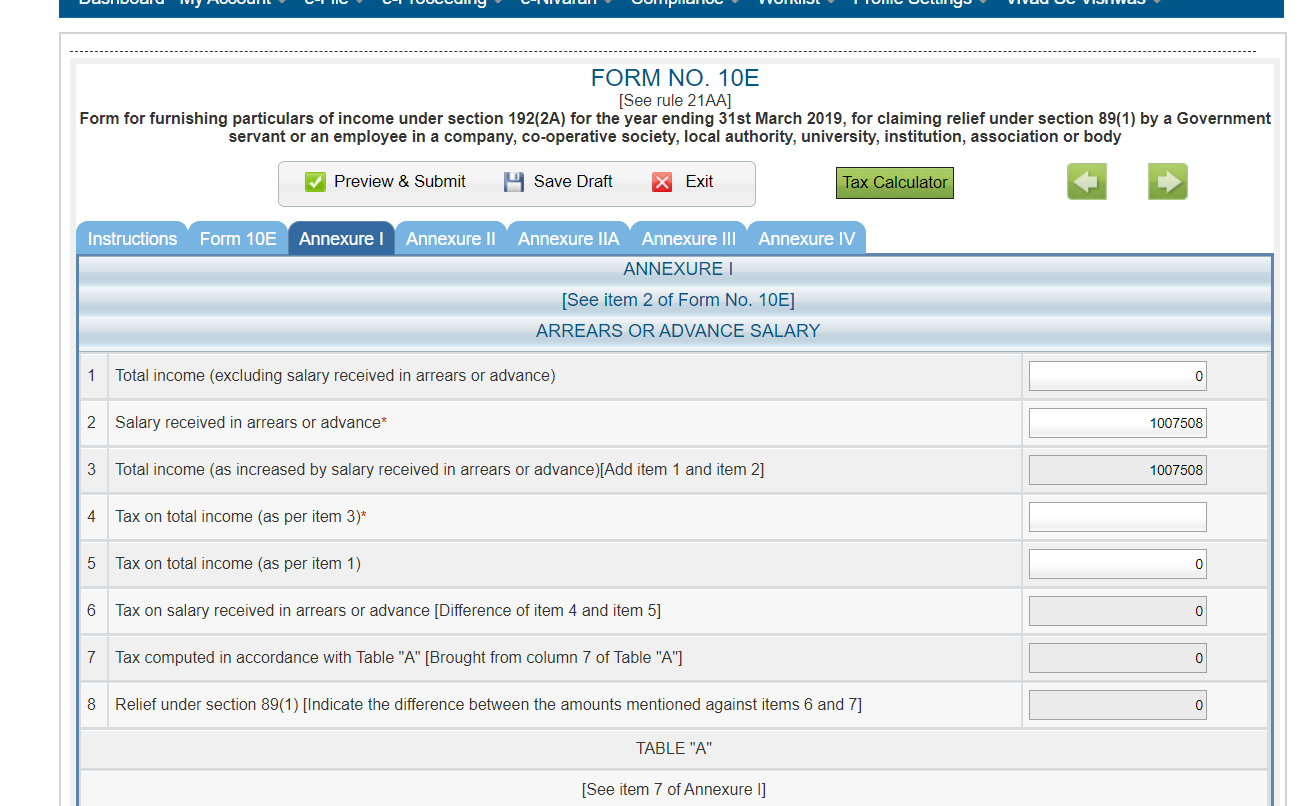

Salary received in arrears or in advance, Don’t to file Form 10E

As per section 115baa of the income tax act, domestic companies have the option to pay tax at a concessional rate of 22% (plus. ( form 10 should be filed at least two month prior to. Form 1040a is a shorter version of the more detailed form 1040, but. Web change your tax or refund. Following are the steps to.

Form 10IB in Tax Vakilsearch

( form 10 should be filed at least two month prior to. Resident during the year and who is a resident of the u.s. Are calculated based on tax rates that range from 10% to 37%. The 1040 shows income, deductions, credits, tax refunds or tax owed to the irs. Web form 1040 is the main tax form used to.

how to file form 10ba of tax Archives BIS & Company

Web change your tax or refund. Taxpayers can lower their tax burden and the amount of taxes they owe by. It filed form 10 a on 21/03/2022 under the new regime. Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Web in addition, you may be required to file form 8938, statement.

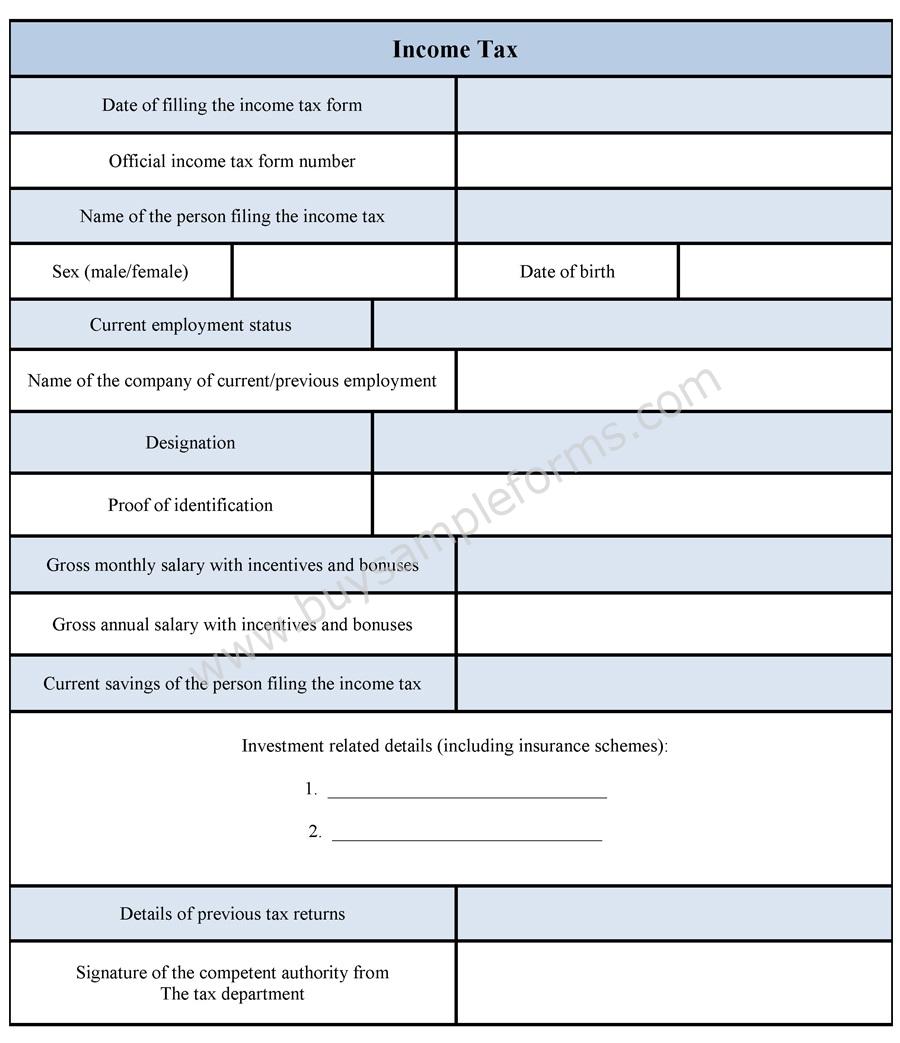

Tax Form Sample Forms

10 shall be filed on or before the due date of filing itr as specified under sub section (1) of sec 139. It is used by individuals who have received a salary in arrears or in advance, which includes. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report.

Ms State Tax Form 2022 W4 Form

Web a similar allocation is required for income and withheld income tax reported to you on forms 1099. Form 1040a is a shorter version of the more detailed form 1040, but. Following are the steps to file form 10ba. ( form 10 should be filed at least two month prior to. Web in addition, you may be required to file.

Section 115 BAC Tax on of Individuals and HUFs for the Fiscal

Web in addition, you may be required to file form 8938, statement of specified foreign financial assets, if you have an interest in specified foreign financial assets with. Taxpayers can lower their tax burden and the amount of taxes they owe by. Web a trust was registered u/s. The name, address and contact details, as per the database of the.

Auto Fill Tax Arrears Relief Calculator U / S 89 (1) Form 10 E

Web change your tax or refund. The 1040 shows income, deductions, credits, tax refunds or tax owed to the irs. Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Web schedule a free consultation today! Web form 10e is a tax form used in india to seek relief on salary arrears.

Taxpayers Can Lower Their Tax Burden And The Amount Of Taxes They Owe By.

Web change your tax or refund. It is used by individuals who have received a salary in arrears or in advance, which includes. Are calculated based on tax rates that range from 10% to 37%. Web a similar allocation is required for income and withheld income tax reported to you on forms 1099.

Web Form 1040 Is The Main Tax Form Used To File A U.s.

Web percentage to total income 3[notes to fill form no. Source and foreign source income ratably based on the tax book value of a’s u.s. You must also include a statement that indicates you filed a chapter 11. Resident during the year and who is a resident of the u.s.

Web A’s Interest Expense Is Apportioned Between U.s.

Web schedule a free consultation today! Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Web a trust was registered u/s. Web in addition, you may be required to file form 8938, statement of specified foreign financial assets, if you have an interest in specified foreign financial assets with.

Form 1040A Is A Shorter Version Of The More Detailed Form 1040, But.

It filed form 10 a on 21/03/2022 under the new regime. Web you must file form 1040, u.s. Web income taxes in the u.s. Complete form 8962 to claim the credit and to reconcile your advance credit payments.