1031 Tax Exchange Form

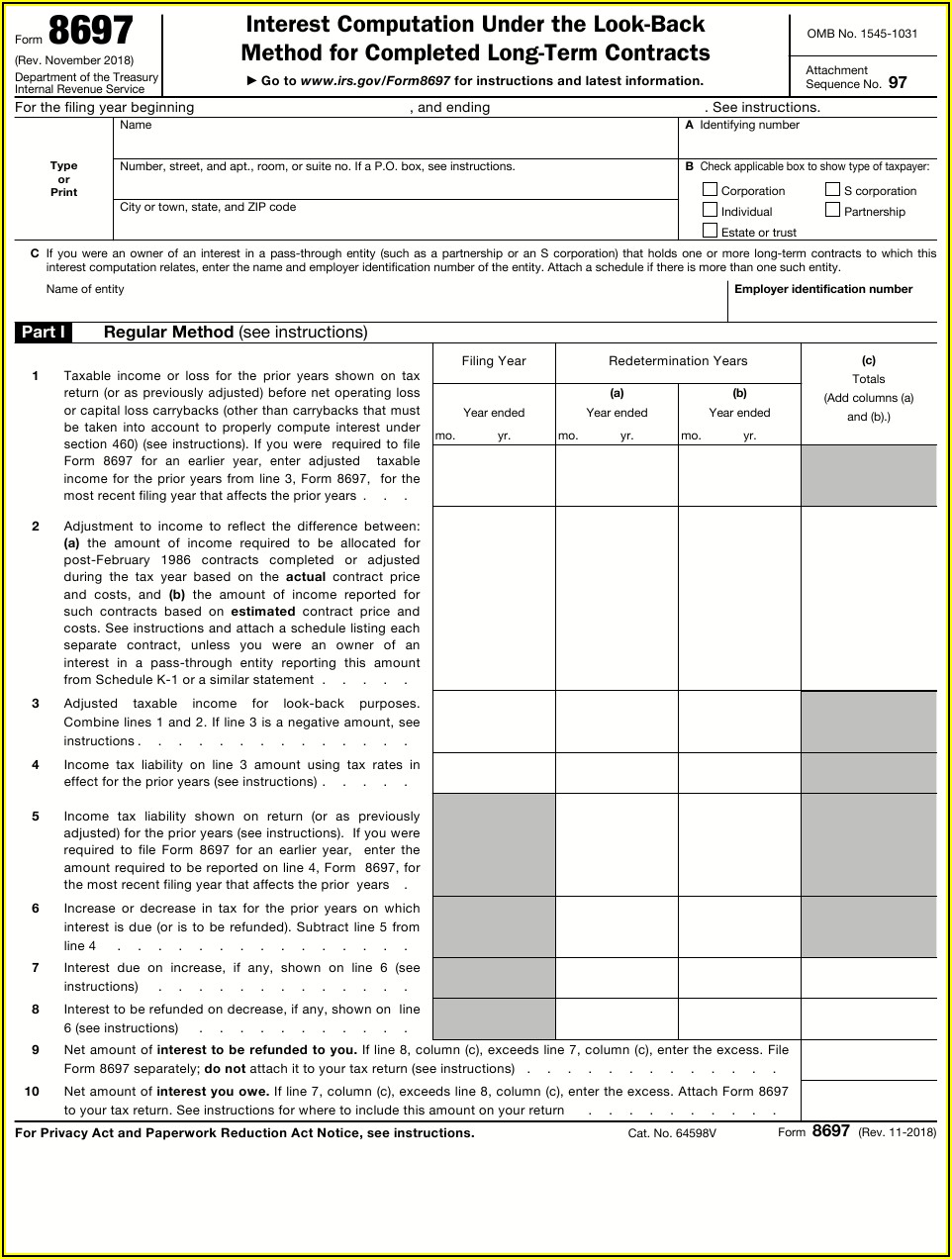

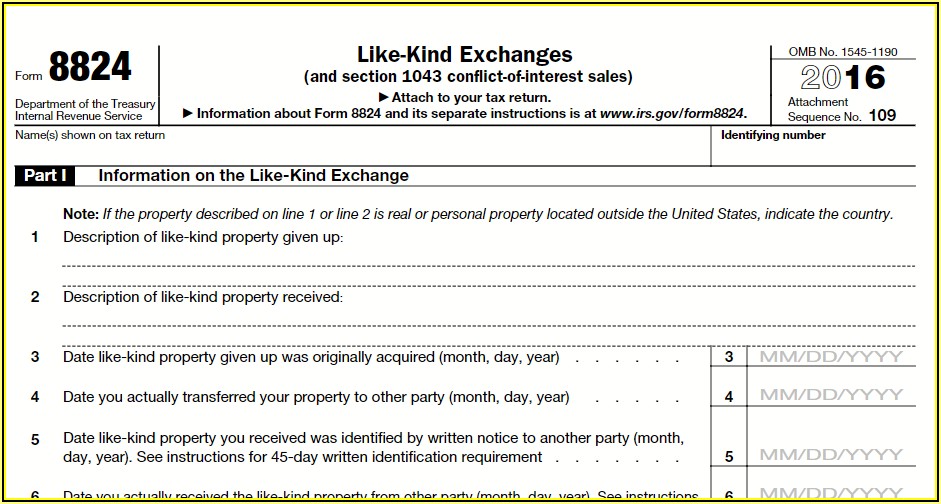

1031 Tax Exchange Form - Web a 1031 exchange, named after section 1031 of the u.s. See definition of real property, later, for more details. So let’s say you bought a real estate property five years ago. The form requires a description of the relinquished and replacement property, acquisition and transfer dates, and other information. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. Internal revenue code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to. The term—which gets its name from section 1031 of the internal. This is where you describe the relinquished and replacement property, the dates the relinquished property was acquired and transferred, the dates the replacement property was identified and received, and information about related parties. Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. An exchange of real property held primarily for sale still.

Internal revenue code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to. Yesno if both lines 9 and 10 are “no” and this is the year of the exchange, go to part iii. See definition of real property, later, for more details. Web all 1031 exchanges are reported on irs form 8824. Web what is a 1031 exchange? So let’s say you bought a real estate property five years ago. An exchange of real property held primarily for sale still. Web you can’t recognize a loss. This is where you describe the relinquished and replacement property, the dates the relinquished property was acquired and transferred, the dates the replacement property was identified and received, and information about related parties. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred.

Yesno if both lines 9 and 10 are “no” and this is the year of the exchange, go to part iii. Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. The form requires a description of the relinquished and replacement property, acquisition and transfer dates, and other information. Web what is a 1031 exchange? The term—which gets its name from section 1031 of the internal. Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into another similar property within a certain period of time. Web all 1031 exchanges are reported on irs form 8824. So let’s say you bought a real estate property five years ago. See definition of real property, later, for more details. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred.

What is a 1031 TaxExchange? Mayfair RE by Alex Tiburzi

Yesno if both lines 9 and 10 are “no” and this is the year of the exchange, go to part iii. This is where you describe the relinquished and replacement property, the dates the relinquished property was acquired and transferred, the dates the replacement property was identified and received, and information about related parties. The form requires a description of.

What Is A 1031 Exchange? Properties & Paradise BlogProperties

Web a 1031 exchange, named after section 1031 of the u.s. So let’s say you bought a real estate property five years ago. The form requires a description of the relinquished and replacement property, acquisition and transfer dates, and other information. The term—which gets its name from section 1031 of the internal. Under the tax cuts and jobs act, section.

Tax Form 1031 Exchange Universal Network

Web all 1031 exchanges are reported on irs form 8824. Web you can’t recognize a loss. See definition of real property, later, for more details. Internal revenue code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to. Basically, a 1031 exchange allows you to avoid paying capital.

1031 Exchange Tax Forms Form Resume Examples yKVBEXlYMB

This is where you describe the relinquished and replacement property, the dates the relinquished property was acquired and transferred, the dates the replacement property was identified and received, and information about related parties. Web what is a 1031 exchange? Internal revenue code, is a way to postpone capital gains tax on the sale of a business or investment property by.

1031 Exchange Order Form

Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Web a 1031 exchange, named after section 1031 of the u.s. This is where you describe the relinquished and replacement property, the dates the relinquished property was acquired and transferred, the dates the replacement.

1031 Exchange Tax Forms Form Resume Examples xm1ezYDKrL

See definition of real property, later, for more details. Yesno if both lines 9 and 10 are “no” and this is the year of the exchange, go to part iii. This is where you describe the relinquished and replacement property, the dates the relinquished property was acquired and transferred, the dates the replacement property was identified and received, and information.

Irs Form Section 1031 Universal Network

See definition of real property, later, for more details. Yesno if both lines 9 and 10 are “no” and this is the year of the exchange, go to part iii. Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Web a 1031 exchange.

turbotax entering 1031 exchange Fill Online, Printable, Fillable

Web you can’t recognize a loss. The form requires a description of the relinquished and replacement property, acquisition and transfer dates, and other information. Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. See definition of real property, later, for more details. An.

1031 Exchange Tax Forms Form Resume Examples yKVBEXlYMB

Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Web all 1031 exchanges are reported on irs form 8824. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. So.

IRS 1031 Tax Deferred Exchange Rules 1031 Exchange Rules 2021

An exchange of real property held primarily for sale still. Web what is a 1031 exchange? See definition of real property, later, for more details. Web a 1031 exchange, named after section 1031 of the u.s. Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or.

Yesno If Both Lines 9 And 10 Are “No” And This Is The Year Of The Exchange, Go To Part Iii.

Internal revenue code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to. An exchange of real property held primarily for sale still. The term—which gets its name from section 1031 of the internal. So let’s say you bought a real estate property five years ago.

The Form Requires A Description Of The Relinquished And Replacement Property, Acquisition And Transfer Dates, And Other Information.

Web what is a 1031 exchange? See definition of real property, later, for more details. Web a 1031 exchange, named after section 1031 of the u.s. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred.

Basically, A 1031 Exchange Allows You To Avoid Paying Capital Gains Tax When You Sell An Investment Real Estate Property If You Reinvest Your Profits Into Another Similar Property Within A Certain Period Of Time.

Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Web all 1031 exchanges are reported on irs form 8824. Web you can’t recognize a loss. This is where you describe the relinquished and replacement property, the dates the relinquished property was acquired and transferred, the dates the replacement property was identified and received, and information about related parties.