1098 T Form Hcc

1098 T Form Hcc - Select student self service tab. Web checked since hcc is required (and all other institutions) to change its current method of reporting from the previous year. You must file for each student you enroll and for whom a reportable transaction is made. Complete, edit or print tax forms instantly. Additionally, the irs encourages you to designate. Ad upload, modify or create forms. For internal revenue service center. Login to your myhcc account from our homepage at. The college staff is neither qualified nor able to. Try it for free now!

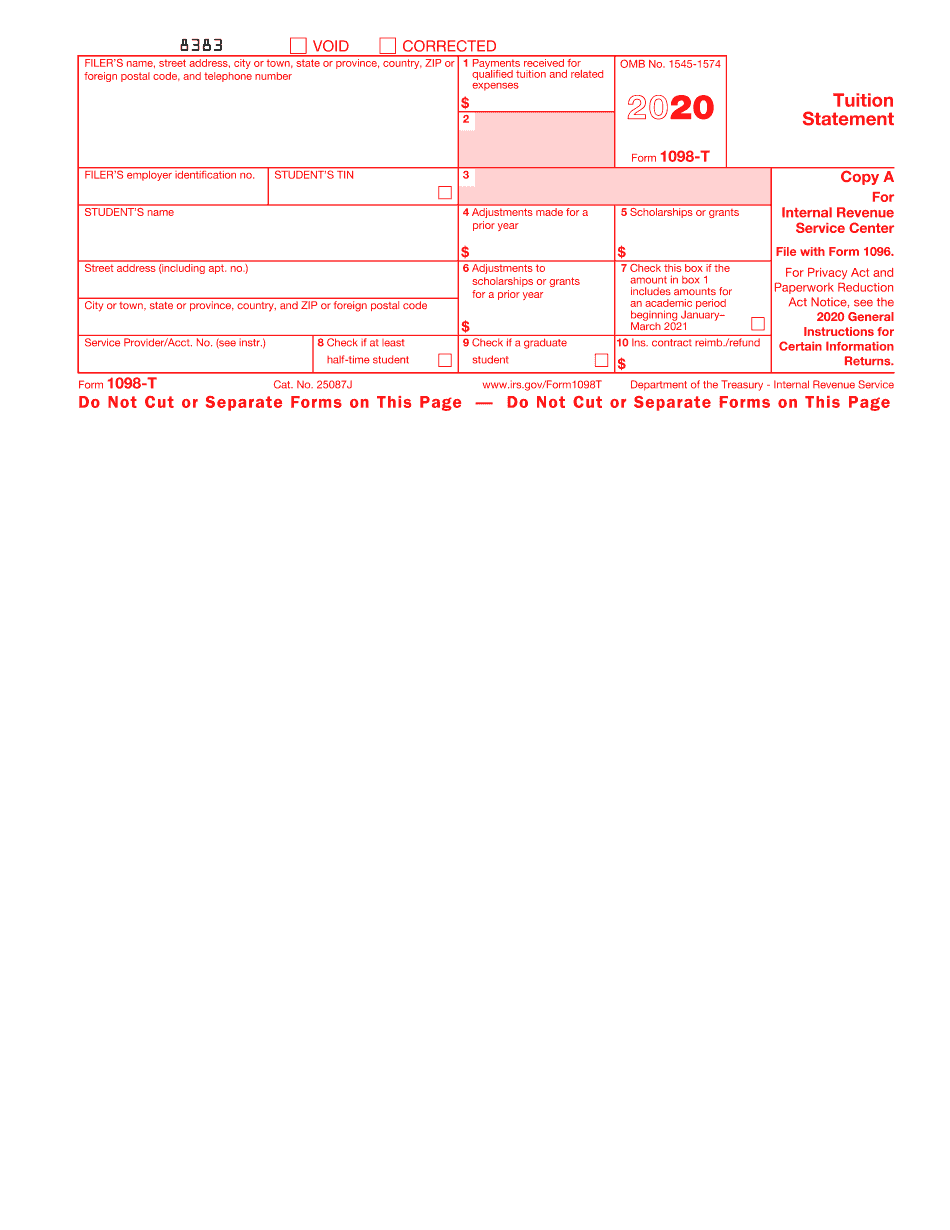

Click on my financial information. Login to your myhcc account from our homepage at. You must file for each student you enroll and for whom a reportable transaction is made. It shows various amounts of tuition charged,. Sign in to your hccc portal. For internal revenue service center. This form may help you determine if you can get education. You must file for each student you enroll and for whom a reportable transaction is made. Try it for free now! Why do my payments to hcc not match up to my.

Web accessing the 1098 form. You must file for each student you enroll and for whom a reportable transaction is made. Select student self service tab. For internal revenue service center. On the left of the screen click liberty link for students. Try it for free now! You must file for each student you enroll and for whom a reportable transaction is made. Sign in to your hccc portal. Box 4 ‐ shows any adjustment made for a prior year. The college staff is neither qualified nor able to.

Form 1098T Information Student Portal

Web accessing the 1098 form. Ad upload, modify or create forms. Box 4 ‐ shows any adjustment made for a prior year. Why do my payments to hcc not match up to my. Sign in to your hccc portal.

Is UC the same as tax credits? Leia aqui What is the tax credit for

Select student self service tab. On the left of the screen click liberty link for students. Why do my payments to hcc not match up to my. For internal revenue service center. Ad upload, modify or create forms.

Irs Form 1098 T Explanation Universal Network

Box 4 ‐ shows any adjustment made for a prior year. Additionally, the irs encourages you to designate. It shows various amounts of tuition charged,. Ad upload, modify or create forms. Try it for free now!

1098T Information Bursar's Office Office of Finance UTHSC

For internal revenue service center. Box 4 ‐ shows any adjustment made for a prior year. You must file for each student you enroll and for whom a reportable transaction is made. Login to your myhcc account from our homepage at. Select student self service tab.

1098T Ventura County Community College District

The college staff is neither qualified nor able to. You must file for each student you enroll and for whom a reportable transaction is made. For internal revenue service center. Ad upload, modify or create forms. Try it for free now!

Form 1098 T Alchetron, The Free Social Encyclopedia

For internal revenue service center. It shows various amounts of tuition charged,. Complete, edit or print tax forms instantly. You must file for each student you enroll and for whom a reportable transaction is made. Web accessing the 1098 form.

Houston Community College Federal Id Number Fill Online, Printable

Select student self service tab. The college staff is neither qualified nor able to. Web checked since hcc is required (and all other institutions) to change its current method of reporting from the previous year. On the left of the screen click liberty link for students. This form may help you determine if you can get education.

Form 1098T Still Causing Trouble for Funded Graduate Students

Why do my payments to hcc not match up to my. It shows various amounts of tuition charged,. Login to your myhcc account from our homepage at. You must file for each student you enroll and for whom a reportable transaction is made. On the left of the screen click liberty link for students.

1098t form 2017 Fill Online, Printable, Fillable Blank form1098t

Additionally, the irs encourages you to designate. Select student self service tab. Login to your myhcc account from our homepage at. On the left of the screen click liberty link for students. Web accessing the 1098 form.

Web Accessing The 1098 Form.

Enter your netld and password. You must file for each student you enroll and for whom a reportable transaction is made. This form may help you determine if you can get education. Additionally, the irs encourages you to designate.

Why Do My Payments To Hcc Not Match Up To My.

Select student self service tab. Try it for free now! Login to your myhcc account from our homepage at. Sign in to your hccc portal.

For Internal Revenue Service Center.

The college staff is neither qualified nor able to. Web checked since hcc is required (and all other institutions) to change its current method of reporting from the previous year. Ad upload, modify or create forms. On the left of the screen click liberty link for students.

Box 4 ‐ Shows Any Adjustment Made For A Prior Year.

For internal revenue service center. Complete, edit or print tax forms instantly. Click on my financial information. You must file for each student you enroll and for whom a reportable transaction is made.