1099 Form Pennsylvania

1099 Form Pennsylvania - The state of pennsylvania also mandates the filing of form rev. This page provides the latest resources on pennsylvania state 1099 filing including compliance rules, sending 1099. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. Accurate & dependable 1099 right to your email quickly and easily. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Do not report negative figures,. Csv format) and contain a data. Pennsylvania has a flat state income tax of 3.07% , which is administered by the pennsylvania department of revenue. You may also have a filing requirement. Pa personal income tax guide.

Web this tax form provides the total amount of money you were paid in benefits from the office of unemployment compensation in the prior calendar year, as well as any adjustments or. Ad in a few easy steps, you can create your own 1099 forms and have them sent to your email. The state of pennsylvania also mandates the filing of form rev. Csv format) and contain a data. Do not report negative figures,. Accurate & dependable 1099 right to your email quickly and easily. This form is used to indicate the amount of payments made to a particular social security number. This page provides the latest resources on pennsylvania state 1099 filing including compliance rules, sending 1099. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. You may also have a filing requirement.

Web looking for pennsylvania 1099 filing requirements? Taxformfinder provides printable pdf copies of. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. The state of pennsylvania also mandates the filing of form rev. Web this tax form provides the total amount of money you were paid in benefits from the office of unemployment compensation in the prior calendar year, as well as any adjustments or. Do not report negative figures,. This guide explains the information on the form and. You may also have a filing requirement. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. Pennsylvania has a flat state income tax of 3.07% , which is administered by the pennsylvania department of revenue.

Filing 1099 Forms In Pa Universal Network

Web you must obtain a pa employer account id, if reporting greater than zero. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. This page provides the latest resources on pennsylvania state 1099 filing including compliance rules, sending 1099. This form is used to indicate the amount of payments.

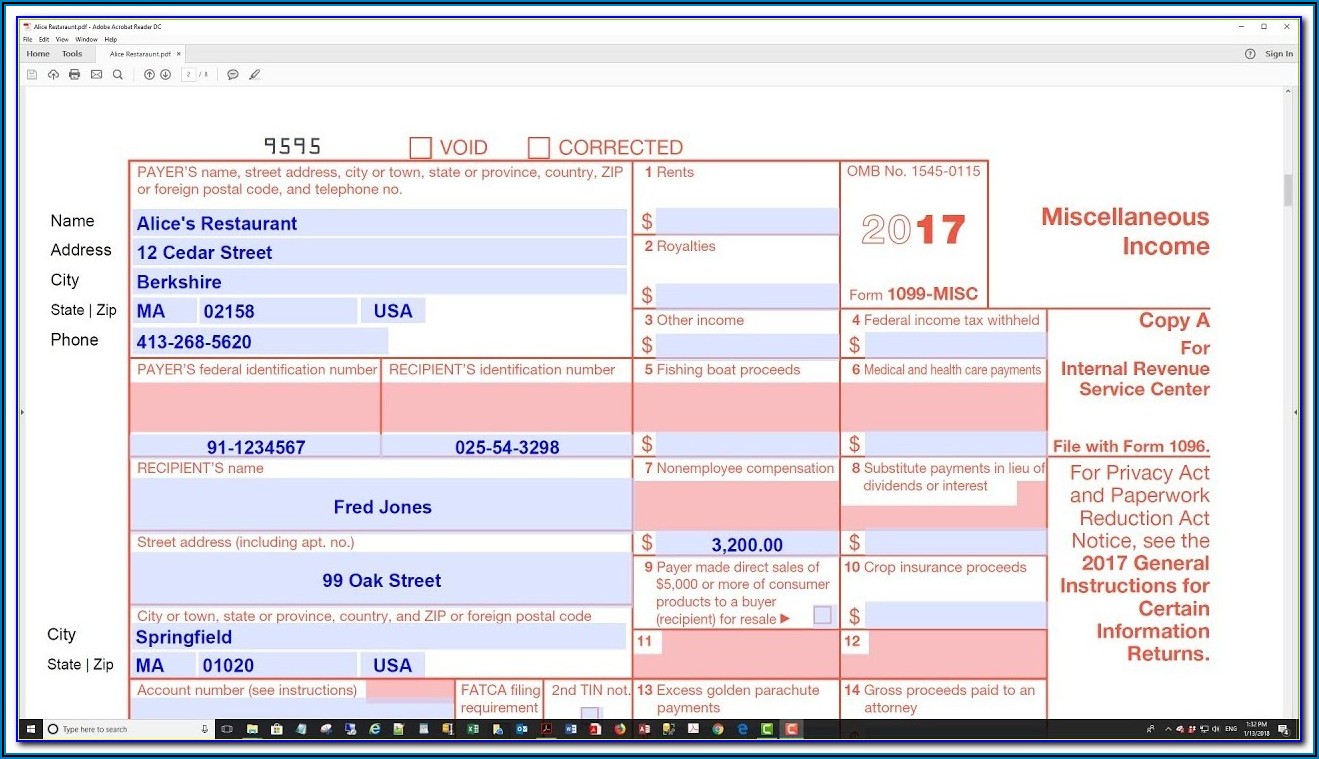

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

Web you must obtain a pa employer account id, if reporting greater than zero. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. Do not report negative figures,. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. The state of pennsylvania also.

Pennsylvania Form 1099 Filing Requirements Form Resume Template

Csv format) and contain a data. Pennsylvania has a flat state income tax of 3.07% , which is administered by the pennsylvania department of revenue. This page provides the latest resources on pennsylvania state 1099 filing including compliance rules, sending 1099. See the instructions for form. Ad ap leaders rely on iofm’s expertise to keep them up to date on.

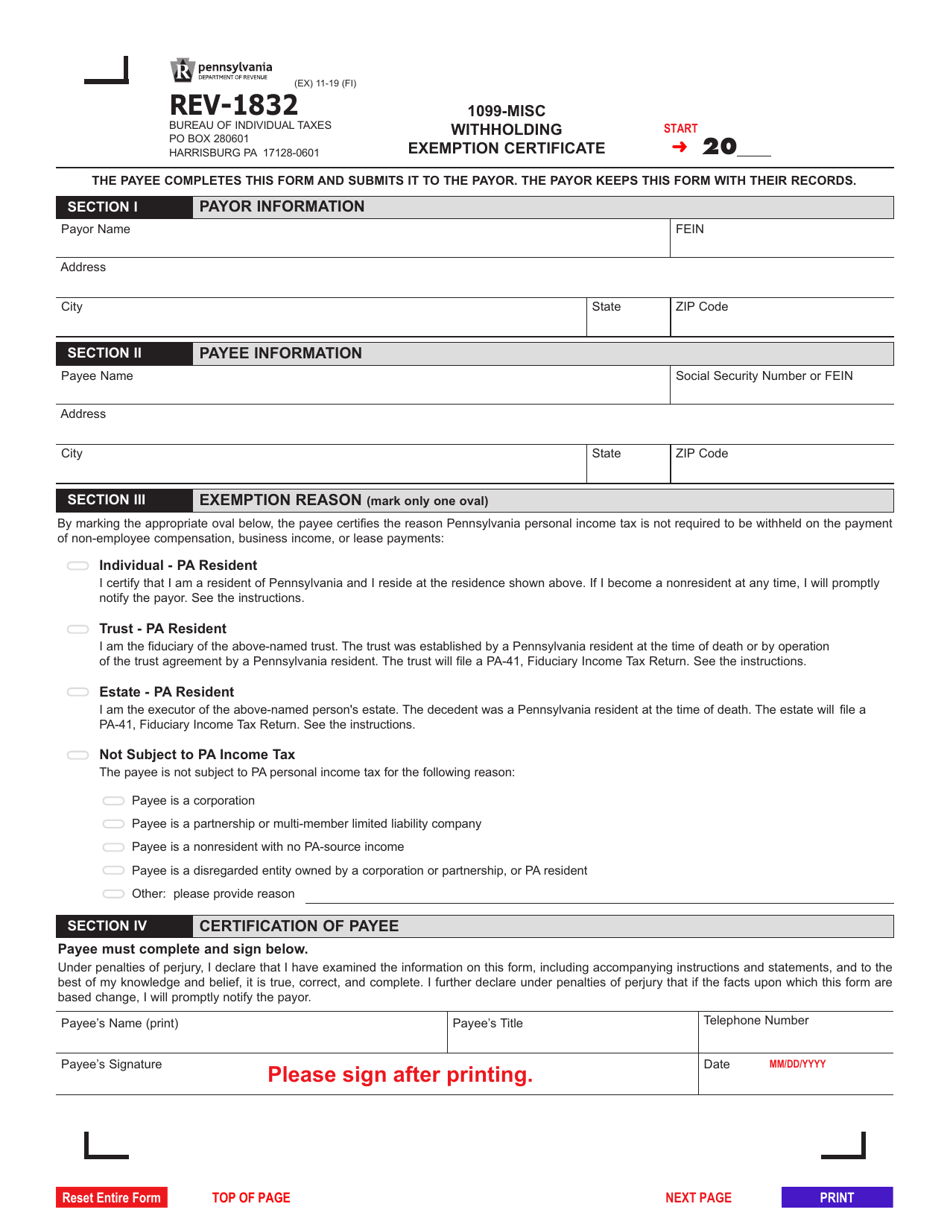

Form REV1832 Download Fillable PDF or Fill Online 1099misc

This form is used to indicate the amount of payments made to a particular social security number. Web you must obtain a pa employer account id, if reporting greater than zero. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. Accurate & dependable 1099 right to your email quickly.

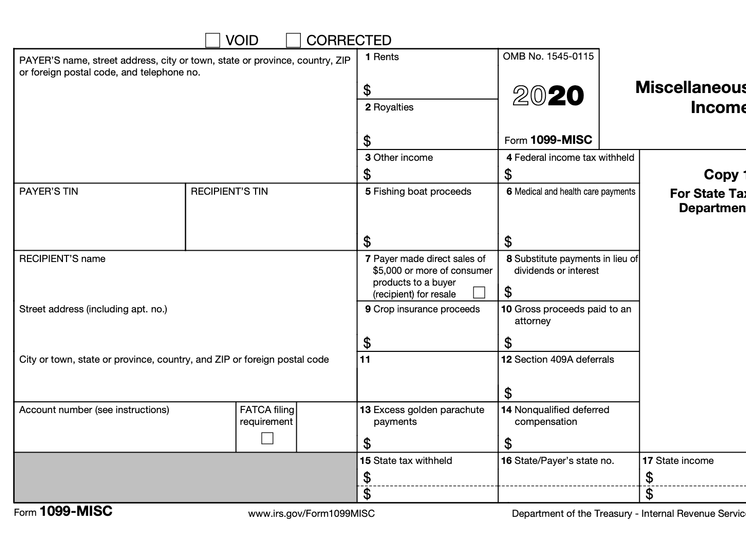

1099MISC Tax Basics

Do not report negative figures,. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. This guide explains the information on the form and. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. This form is used to indicate the amount of payments.

1099 Tax Forms Available Soon for Pa. Unemployment Claimants Erie

Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. Web this tax form provides the total amount of money you were paid in benefits from the office of unemployment compensation in the prior calendar year, as well as any adjustments or. Accurate & dependable 1099 right to your email.

How To File Form 1099NEC For Contractors You Employ VacationLord

This guide explains the information on the form and. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Web looking for pennsylvania 1099 filing requirements? Accurate & dependable 1099 right.

Sample of completed 1099int 205361How to calculate 1099int

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web looking for pennsylvania 1099 filing requirements? This form is used to indicate the amount of payments made to a particular social security number. Do not report negative figures,. Taxformfinder provides printable pdf copies of.

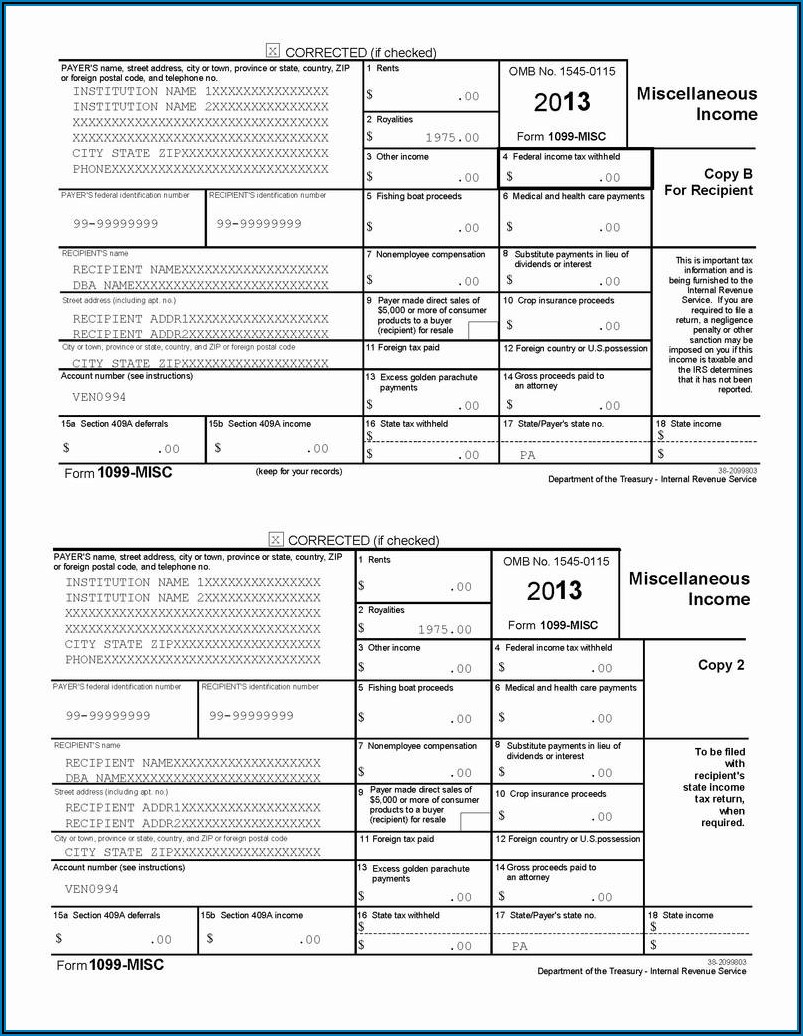

Pennsylvania Form 1099 Filing Requirements Form Resume Template

See the instructions for form. Web this tax form provides the total amount of money you were paid in benefits from the office of unemployment compensation in the prior calendar year, as well as any adjustments or. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Do not report negative.

1099 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

The state of pennsylvania also mandates the filing of form rev. This page provides the latest resources on pennsylvania state 1099 filing including compliance rules, sending 1099. Do not report negative figures,. Csv format) and contain a data. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered.

Web Looking For Pennsylvania 1099 Filing Requirements?

Web this tax form provides the total amount of money you were paid in benefits from the office of unemployment compensation in the prior calendar year, as well as any adjustments or. Do not report negative figures,. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. The state of pennsylvania also mandates the filing of form rev.

Web You Must Obtain A Pa Employer Account Id, If Reporting Greater Than Zero.

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. This form is used to indicate the amount of payments made to a particular social security number. Ad in a few easy steps, you can create your own 1099 forms and have them sent to your email. Accurate & dependable 1099 right to your email quickly and easily.

Web This Is The Easiest Way To Electronically Fill Out The Forms And Prevent Losing Any Information That You’ve Entered.

This guide explains the information on the form and. Taxformfinder provides printable pdf copies of. Csv format) and contain a data. This page provides the latest resources on pennsylvania state 1099 filing including compliance rules, sending 1099.

Pa Personal Income Tax Guide.

Pennsylvania has a flat state income tax of 3.07% , which is administered by the pennsylvania department of revenue. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. For pennsylvania personal income tax purposes, the 1099. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered.