15G Form For Pf

15G Form For Pf - Then you can fill form 15g epfo. It should be filled by the citizens of india. Web form 15g pf withdrawal pdf to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax for pf. Web the employee provident fund (epf) form 15g is a special variation of form 15g that is used for withdrawals from the epf. Web quick steps to complete and design form 15g for pf online: Show details we are not affiliated with any brand or entity on this form. The step to fill up and submit form 15g online on epf portal. Web form 15g, a declaration form, is for the people who are holders of a fixed deposit account to fill out. Web if your income for that financial year is lesser than taxable limit you can submit form 15g or 15h. Use get form or simply click on the template preview to open it in the editor.

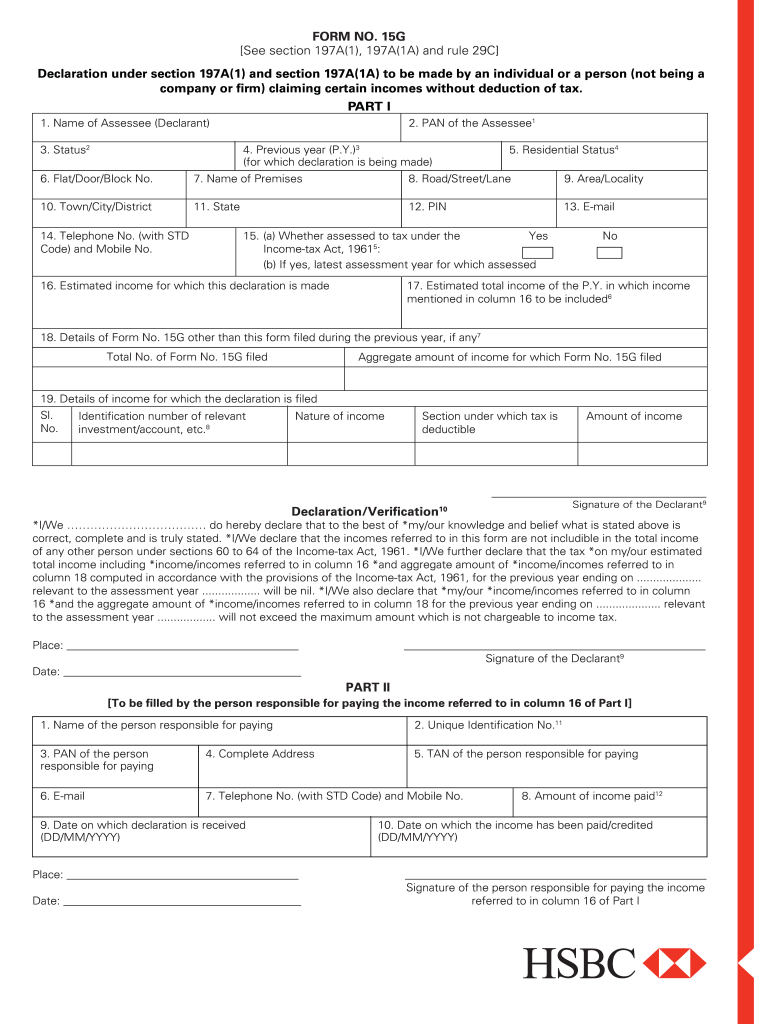

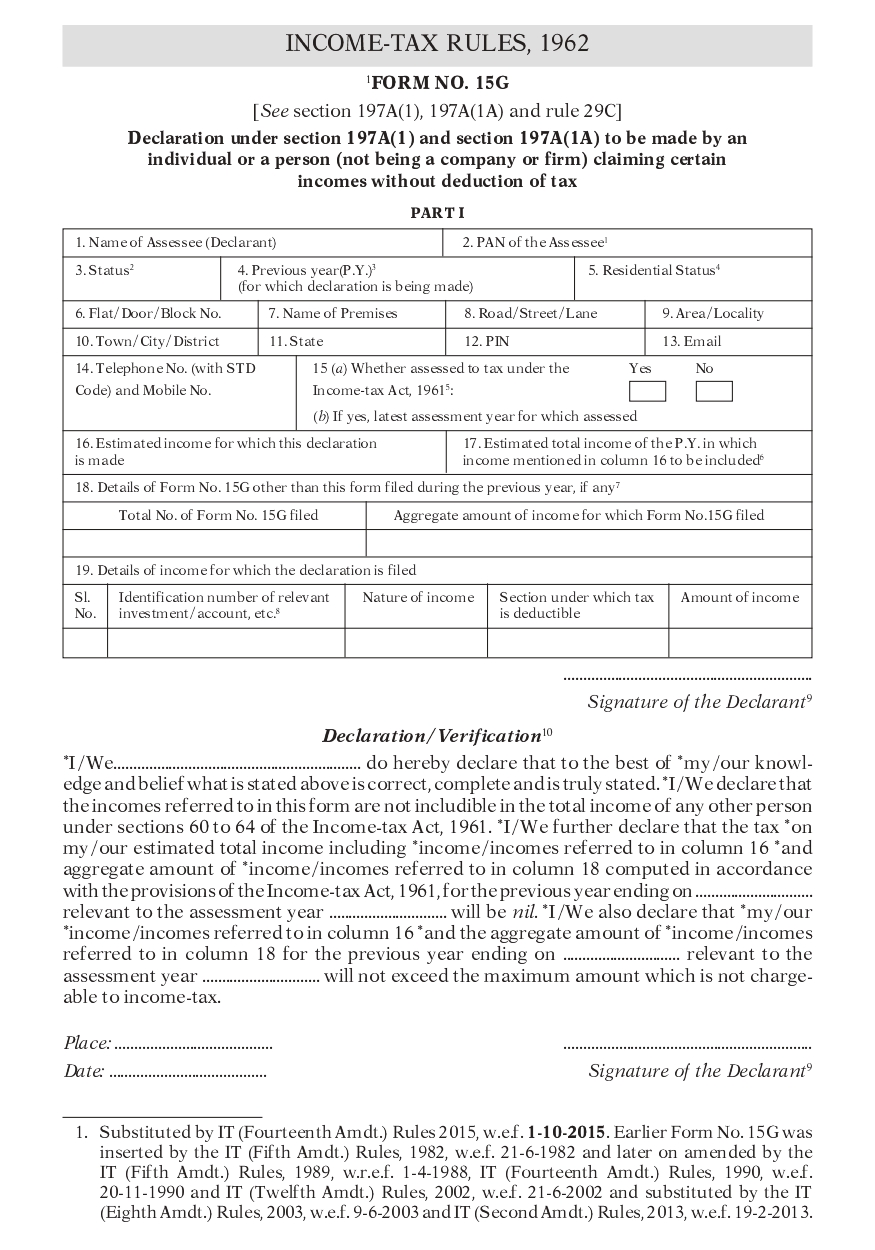

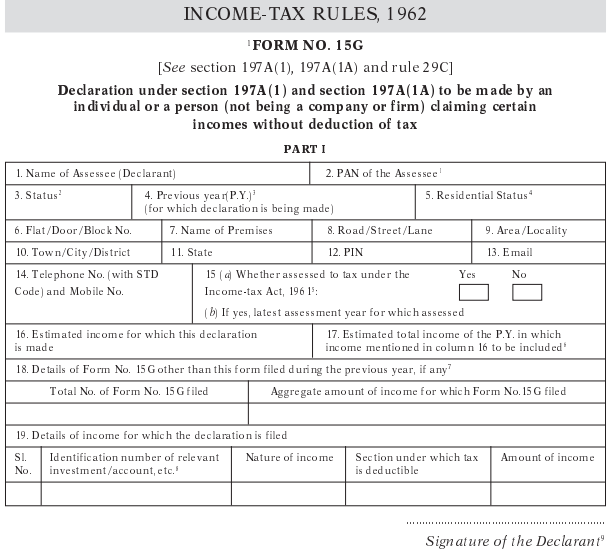

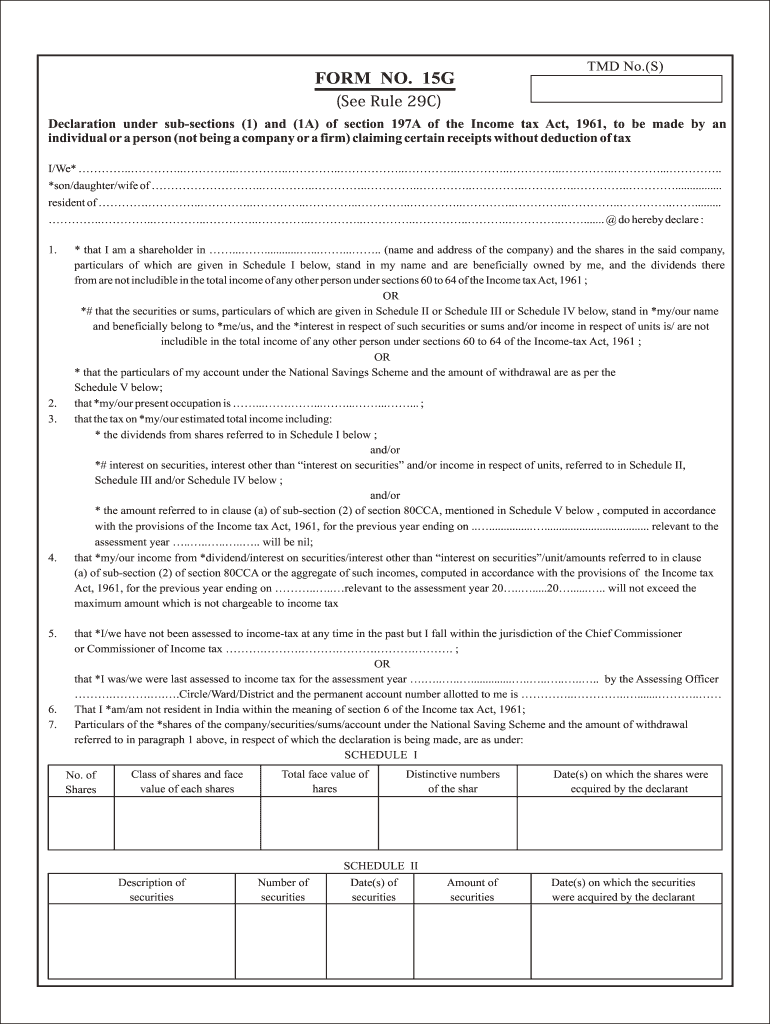

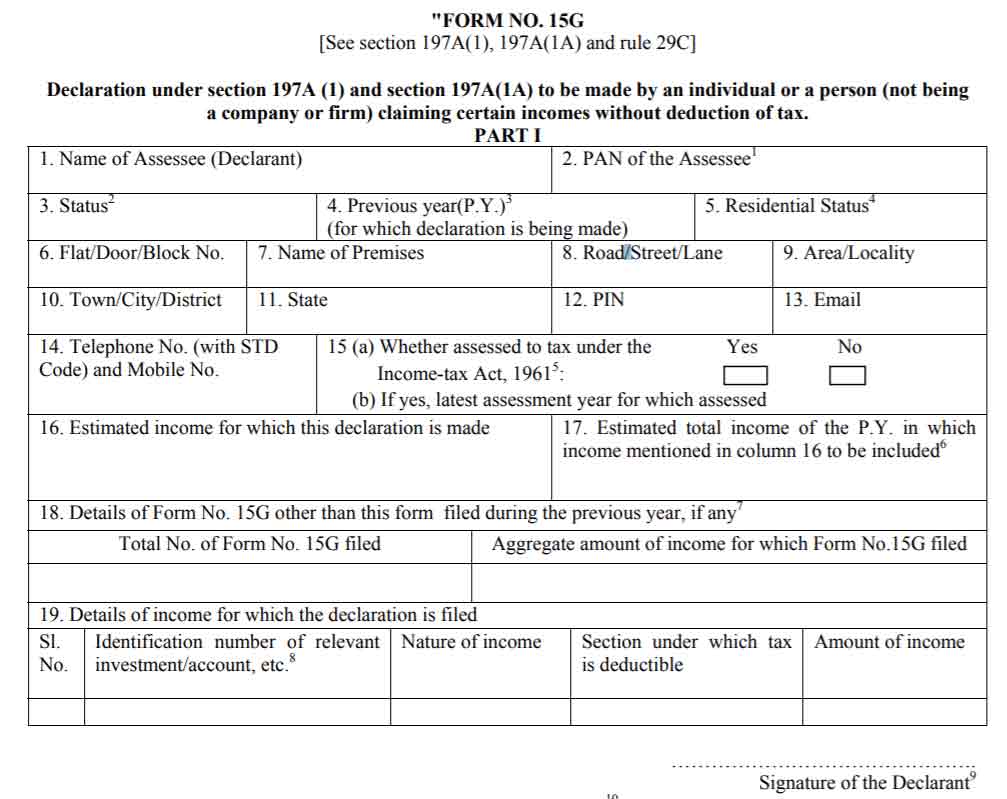

Web up to $40 cash back form 15g for pf withdrawal form no. Web form 15g, a declaration form, is for the people who are holders of a fixed deposit account to fill out. These individuals must be 60 years or less or hufs. It should be filled by the citizens of india. Use get form or simply click on the template preview to open it in the editor. The tax on total income. Start completing the fillable fields and. It is important for claimants to note that any false declaration of form 15g may result in a. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or. Web form 15g pf withdrawal pdf to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax for pf.

It should be filled by the citizens of india. Use get form or simply click on the template preview to open it in the editor. Web up to $40 cash back form 15g for pf withdrawal form no. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or. Web form 15g, a declaration form, is for the people who are holders of a fixed deposit account to fill out. Epf members can declare that. These individuals must be 60 years or less or hufs. Show details we are not affiliated with any brand or entity on this form. It is important for claimants to note that any false declaration of form 15g may result in a. 15g see section 197a(1), 197a(1a) and rule 29c declaration under section 197a(1) and section 197a(1a) to be made by.

Form 15g For Pf Withdrawal Pdf Fill Online, Printable, Fillable

Web how it works upload the form 15g download edit & sign pf form 15g download pdf from anywhere save your changes and share 15g rate the download form 15g for pf. Web quick steps to complete and design form 15g for pf online: Web up to $40 cash back form 15g for pf withdrawal form no. Then you can.

15g Form For Pf Withdrawal Rules abilitylasopa

Start completing the fillable fields and. It is important for claimants to note that any false declaration of form 15g may result in a. Web use a form 15g for pf withdrawal 2015 template to make your document workflow more streamlined. Web form 15g, a declaration form, is for the people who are holders of a fixed deposit account to.

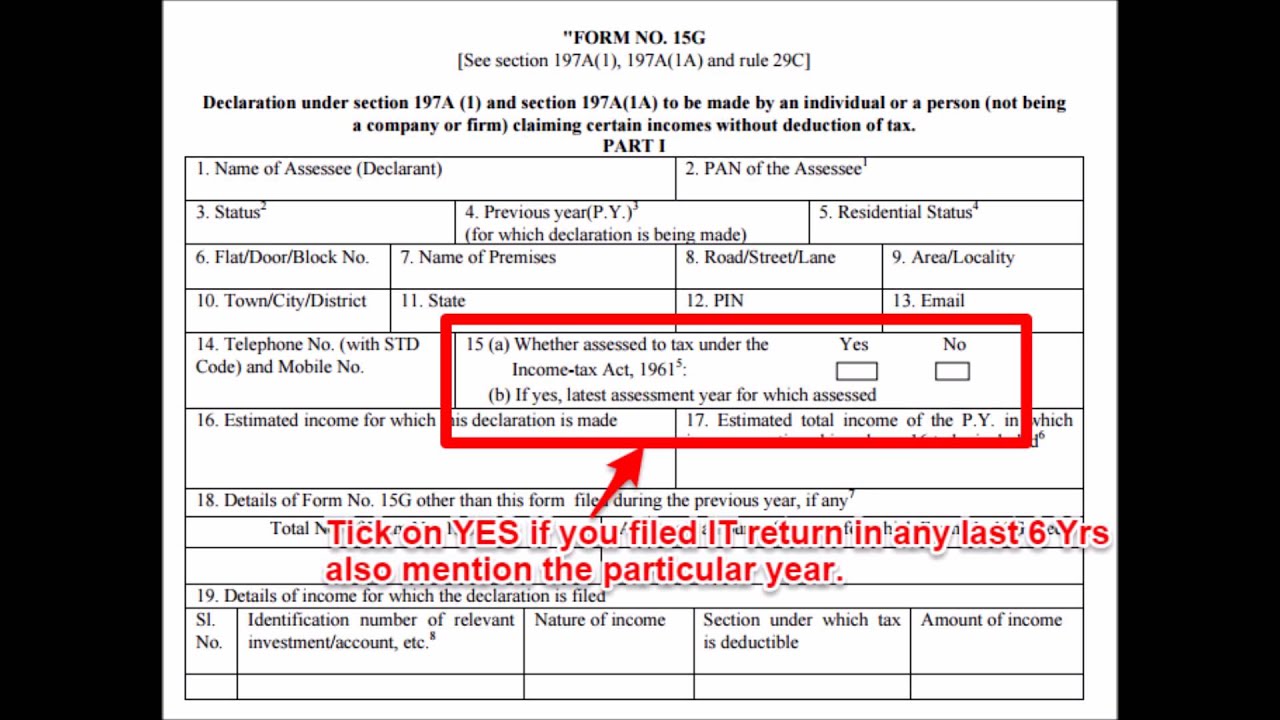

How To Fill Form 15G For PF Withdrawal YouTube

If your total work experience is less then 5 year and pf amount more then 50,000. Web how it works upload the form 15g download edit & sign pf form 15g download pdf from anywhere save your changes and share 15g rate the download form 15g for pf. Then you can fill form 15g epfo. Web up to $40 cash.

EPF Form 15G Download Sample Filled Form 15G For PF Withdrawal GST

Show details we are not affiliated with any brand or entity on this form. Web form 15g, a declaration form, is for the people who are holders of a fixed deposit account to fill out. Then you can fill form 15g epfo. Web quick steps to complete and design form 15g for pf online: Start completing the fillable fields and.

KnowHow To Download and Fill Form 15G Online & Offline

Web up to $40 cash back form 15g for pf withdrawal form no. 15g see section 197a(1), 197a(1a) and rule 29c declaration under section 197a(1) and section 197a(1a) to be made by. Web the employee provident fund (epf) form 15g is a special variation of form 15g that is used for withdrawals from the epf. Start completing the fillable fields.

Pf Form 15g Filled Sample Download Fill Out and Sign Printable PDF

Web form 15g is a declaration that can be filled out by bank fixed deposit holders (individuals less than 60 years of age and huf) to ensure that no tds (tax deduction at. Then you can fill form 15g epfo. Web if your income for that financial year is lesser than taxable limit you can submit form 15g or 15h..

How to fill newly launched Form 15G and Form 15H? YouTube

Web up to $40 cash back form 15g for pf withdrawal form no. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or. It should be filled by the citizens of india. Use get form or simply click on the template preview to.

Sample Filled Form 15G for PF Withdrawal in 2022

These individuals must be 60 years or less or hufs. Start completing the fillable fields and. Web use a form 15g for pf withdrawal 2015 template to make your document workflow more streamlined. Web criteria your age should be less then 60 years. Web form 15g, a declaration form, is for the people who are holders of a fixed deposit.

Form 15G How to Fill Form 15G for PF Withdrawal MoneyPiP

Web the employee provident fund (epf) form 15g is a special variation of form 15g that is used for withdrawals from the epf. Show details we are not affiliated with any brand or entity on this form. Then you can fill form 15g epfo. Web quick steps to complete and design form 15g for pf online: The tax on total.

Download Form 15G for PF Withdrawal 2022

It is important for claimants to note that any false declaration of form 15g may result in a. The tax on total income. Start completing the fillable fields and. Web form 15g is a declaration that can be filled out by bank fixed deposit holders (individuals less than 60 years of age and huf) to ensure that no tds (tax.

Web Form 15G Pf Withdrawal Pdf To Be Made By An Individual Or A Person (Not Being A Company Or Firm) Claiming Certain Incomes Without Deduction Of Tax For Pf.

These individuals must be 60 years or less or hufs. Web the employee provident fund (epf) form 15g is a special variation of form 15g that is used for withdrawals from the epf. Web how it works upload the form 15g download edit & sign pf form 15g download pdf from anywhere save your changes and share 15g rate the download form 15g for pf. Web form 15g is a declaration that can be filled out by bank fixed deposit holders (individuals less than 60 years of age and huf) to ensure that no tds (tax deduction at.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

Web quick steps to complete and design form 15g for pf online: If your total work experience is less then 5 year and pf amount more then 50,000. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or. It should be filled by the citizens of india.

Show Details We Are Not Affiliated With Any Brand Or Entity On This Form.

Web use a form 15g for pf withdrawal 2015 template to make your document workflow more streamlined. Then you can fill form 15g epfo. The tax on total income. 15g see section 197a(1), 197a(1a) and rule 29c declaration under section 197a(1) and section 197a(1a) to be made by.

It Is Important For Claimants To Note That Any False Declaration Of Form 15G May Result In A.

Web form 15g helps pf account holders to avoid tds, if applicable. Web if your income for that financial year is lesser than taxable limit you can submit form 15g or 15h. The step to fill up and submit form 15g online on epf portal. Web form 15g, a declaration form, is for the people who are holders of a fixed deposit account to fill out.