2019 Form 990 Ez

2019 Form 990 Ez - Web ez (2019) l add lines 5b, 6c, and 7b to line 9 to determine gross receipts. Complete, edit or print tax forms instantly. All forms are printable and downloadable. Luckily, the irs has defined the qualities that. If gross receipts are $200,000 or more, or if total assets (part il, column (b)) are $500,000 or more, file. Once completed you can sign your fillable form or send for signing. M m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m yes no if yes,. Web on this page you may download the 990 series filings on record for 2019. Some months may have more than one entry. Get ready for tax season deadlines by completing any required tax forms today.

If gross receipts are $200,000 or more, or if total assets (part il, column (b)) are $500,000 or more, file. Once completed you can sign your fillable form or send for signing. Luckily, the irs has defined the qualities that. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Some months may have more than one entry. Complete, edit or print tax forms instantly. Web use fill to complete blank online irs pdf forms for free. Web on this page you may download the 990 series filings on record for 2019. Form 4562 (2017) (a) classification of property (e). Web ez (2019) l add lines 5b, 6c, and 7b to line 9 to determine gross receipts.

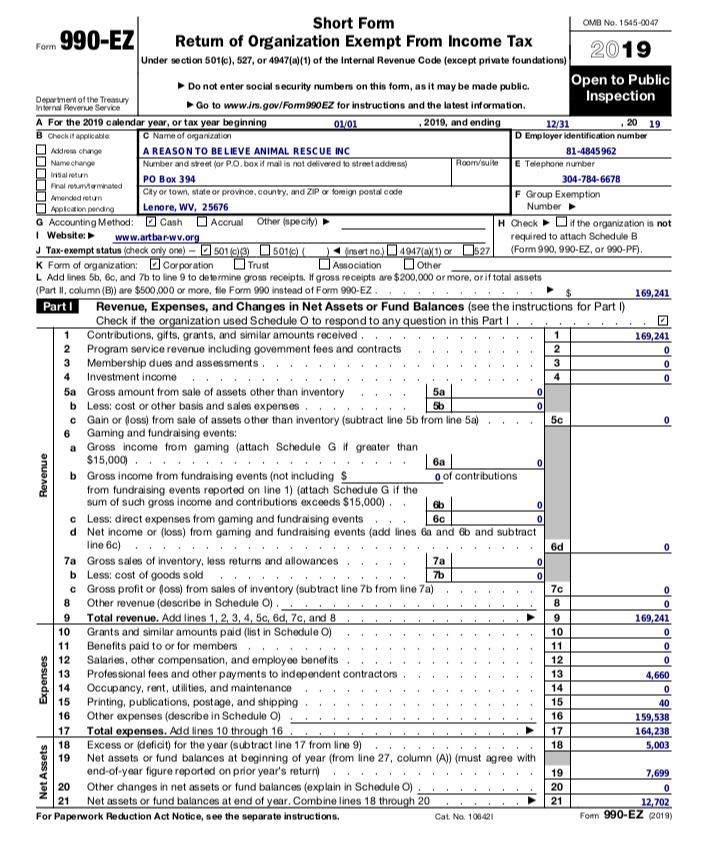

Web department of the treasury internal revenue service short form return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. The following are examples when form 990 must be utilized. Get ready for tax season deadlines by completing any required tax forms today. Form 4562 (2017) (a) classification of property (e). Web ez (2019) l add lines 5b, 6c, and 7b to line 9 to determine gross receipts. M m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m yes no if yes,. Web use fill to complete blank online irs pdf forms for free. Once completed you can sign your fillable form or send for signing. Luckily, the irs has defined the qualities that. This form is commonly used by eligible organizations to file an.

Download Instructions for IRS Form 990, 990EZ Schedule A Public

Web department of the treasury internal revenue service short form return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. This form is commonly used by eligible organizations to file an. Form 4562 (2017) (a) classification of property (e). The following are examples when form 990 must be utilized. M m m m m.

2019 Form 990 for Jezreel International Cause IQ

Complete, edit or print tax forms instantly. All forms are printable and downloadable. If gross receipts are $200,000 or more, or if total assets (part il, column (b)) are $500,000 or more, file. Once completed you can sign your fillable form or send for signing. Luckily, the irs has defined the qualities that.

IRS 990EZ Instructions 2019 Fill and Sign Printable Template Online

Form 4562 (2017) (a) classification of property (e). Once completed you can sign your fillable form or send for signing. Web ez (2019) l add lines 5b, 6c, and 7b to line 9 to determine gross receipts. The download files are organized by month. M m m m m m m m m m m m m m m m.

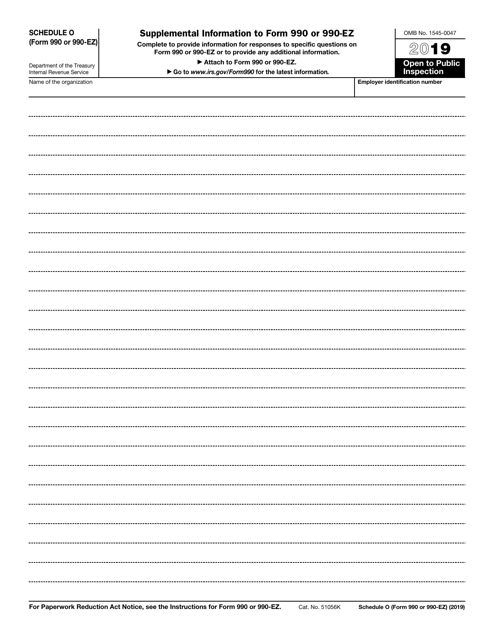

IRS Form 990 (990EZ) Schedule O Download Fillable PDF or Fill Online

If gross receipts are $200,000 or more, or if total assets (part il, column (b)) are $500,000 or more, file. All forms are printable and downloadable. Get ready for tax season deadlines by completing any required tax forms today. This form is commonly used by eligible organizations to file an. Form 4562 (2017) (a) classification of property (e).

IRS Form 990EZ 2018 2019 Printable & Fillable Sample in PDF

All forms are printable and downloadable. Form 4562 (2017) (a) classification of property (e). Complete, edit or print tax forms instantly. The following are examples when form 990 must be utilized. The download files are organized by month.

2019 2020 IRS Form 990 or 990EZ Schedule L Editable Online Blank

M m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m yes no if yes,. Web ez (2019) l add lines 5b, 6c, and.

Irs Form 990 Ez Online Universal Network

All forms are printable and downloadable. Once completed you can sign your fillable form or send for signing. This form is commonly used by eligible organizations to file an. Luckily, the irs has defined the qualities that. Form 4562 (2017) (a) classification of property (e).

ARTBAR 2019 Form 990EZ A Reason to Believe Animal Rescue, Inc.

Web ez (2019) l add lines 5b, 6c, and 7b to line 9 to determine gross receipts. This form is commonly used by eligible organizations to file an. Get ready for tax season deadlines by completing any required tax forms today. The following are examples when form 990 must be utilized. Complete, edit or print tax forms instantly.

Download Instructions for IRS Form 990, 990EZ Schedule G Supplemental

Web on this page you may download the 990 series filings on record for 2019. Some months may have more than one entry. The download files are organized by month. Complete, edit or print tax forms instantly. The following are examples when form 990 must be utilized.

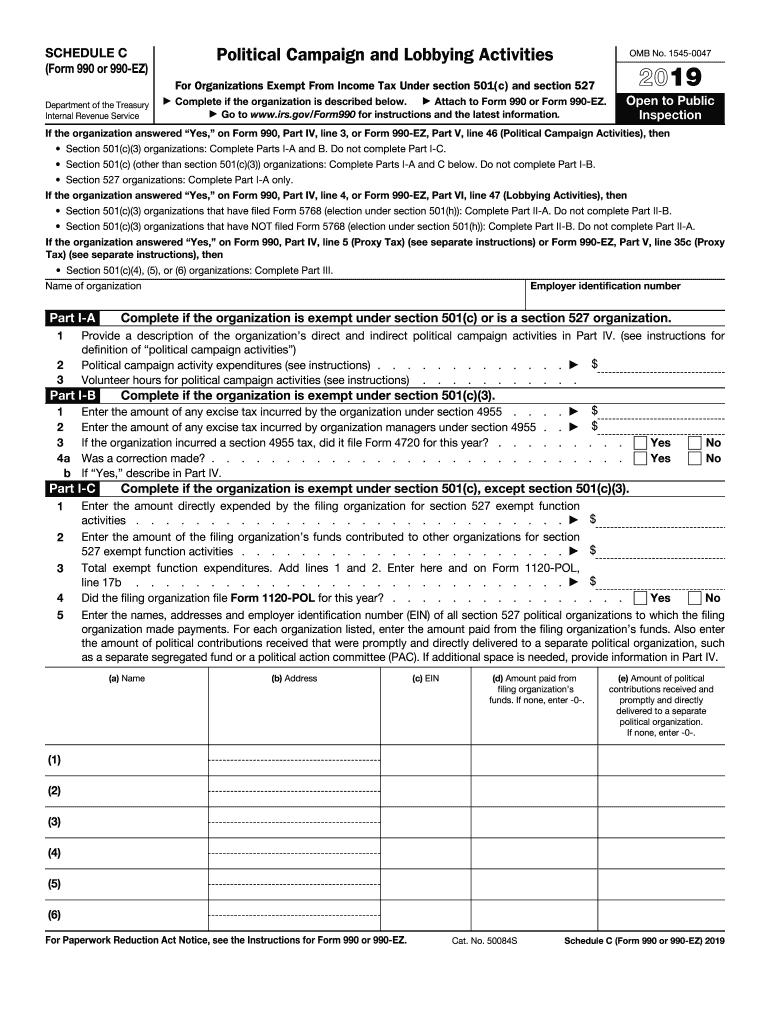

IRS 990 or 990EZ Schedule C 2019 Fill and Sign Printable Template

A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Web department of the treasury internal revenue service short form return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. If gross receipts are $200,000 or more, or if total assets (part il, column (b)) are $500,000 or.

A Supporting Organization Described In Section 509 (A) (3) Is Required To File Form 990 (Or.

All forms are printable and downloadable. Get ready for tax season deadlines by completing any required tax forms today. M m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m yes no if yes,. Form 4562 (2017) (a) classification of property (e).

Once Completed You Can Sign Your Fillable Form Or Send For Signing.

Web department of the treasury internal revenue service short form return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web use fill to complete blank online irs pdf forms for free. Luckily, the irs has defined the qualities that. Complete, edit or print tax forms instantly.

This Form Is Commonly Used By Eligible Organizations To File An.

Some months may have more than one entry. The download files are organized by month. The following are examples when form 990 must be utilized. Web on this page you may download the 990 series filings on record for 2019.

If Gross Receipts Are $200,000 Or More, Or If Total Assets (Part Il, Column (B)) Are $500,000 Or More, File.

Web ez (2019) l add lines 5b, 6c, and 7b to line 9 to determine gross receipts.