2021 Form 5500 Due Date

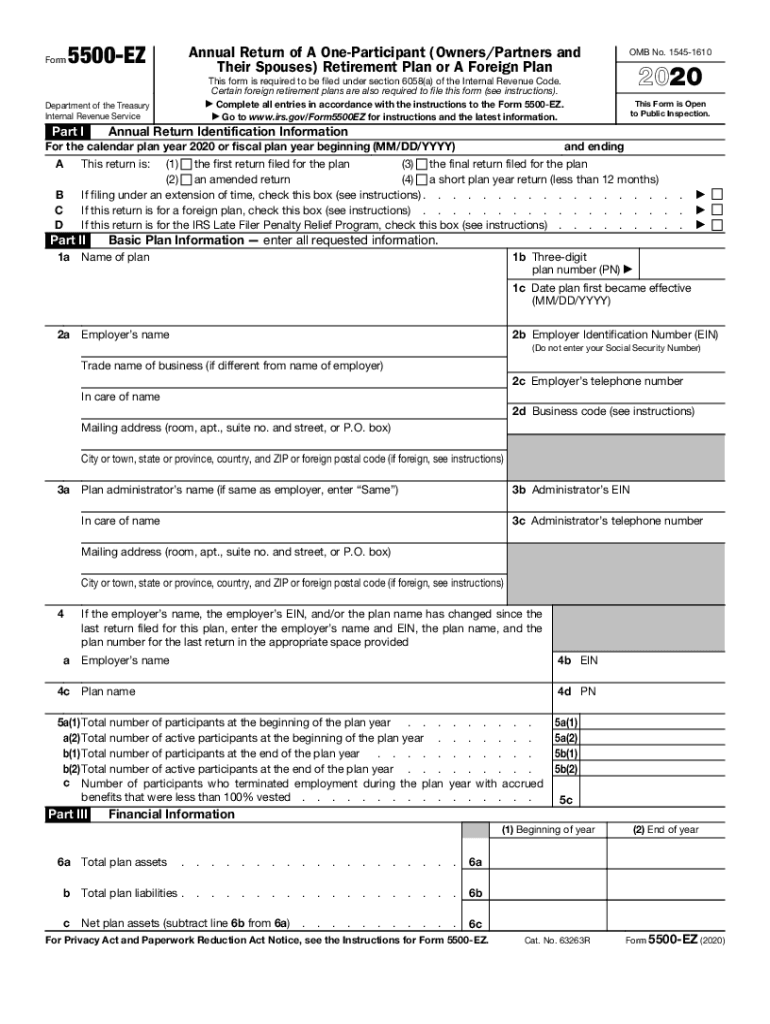

2021 Form 5500 Due Date - In 2021, that is monday, aug. Department of labor’s employee benefits security administration (ebsa), the. Web however, in 2021, july 31 is a saturday; Web paper forms for filing. When that date falls on a weekend, the form is due on the next business day. Who should i contact with questions about a cp216h notice? Web where can i get more information about employee benefit plans? 2020, and before july 15,. Web this form is required to be filed for employee benefit plans under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and sections 6057(b). By the 30th day after the due date.

Web education about us quick links form 5500 filing season is in full swing! The general rule is that form 5500s must be filed by the last day of the seventh. By the 30th day after the due date. Web this form is required to be filed for employee benefit plans under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and sections 6057(b). 2020, and before july 15,. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corporation today. Department of labor’s employee benefits security administration (ebsa), the. Web form 5500 due date. In 2021, that is monday, aug. Web 2021 form 5500:

When that date falls on a weekend, the form is due on the next business day. Department of labor’s employee benefits security administration (ebsa), the. Form 5500 ( annual return/report of employee benefit plan) is due the last day of the seventh month after the plan year ends, which is july 31 for calendar. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on the next business day that is not a saturday, sunday, or federal. Web compliance form 5500 filing deadline is approaching june 7, 2021 each year, employee benefit plan administrators are generally required to file a return/report. Web the employer will be required to check a box on the 2021 form 5500 indicating that it elects to treat the plan as retroactively adopted as of the last day of its. Jun 24, 2021 | all, compliance, fsa, hra form 5500 is an employee. By the 30th day after the due date. (updated may 18, 2022) tips for next year be sure to. Who should i contact with questions about a cp216h notice?

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

In 2021, that is monday, aug. Web however, in 2021, july 31 is a saturday; On december 29, 2021, the u.s. Web the employer will be required to check a box on the 2021 form 5500 indicating that it elects to treat the plan as retroactively adopted as of the last day of its. If the deadline falls on a.

IRS Extends Deadline for Forms 5500 Due before July 15, 2020

On december 29, 2021, the u.s. Web this form is required to be filed for employee benefit plans under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and sections 6057(b). Web the employer will be required to check a box on the 2021 form 5500 indicating that it elects to treat the plan as.

Due Date for furnishing FORM GSTR1 for April 2021 extended amid COVID19

2020, and before july 15,. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on the next business day that is not a saturday, sunday, or federal. On december 29, 2021, the u.s. The general rule is that form 5500s must be filed by the last day of the seventh. Web 2021 form.

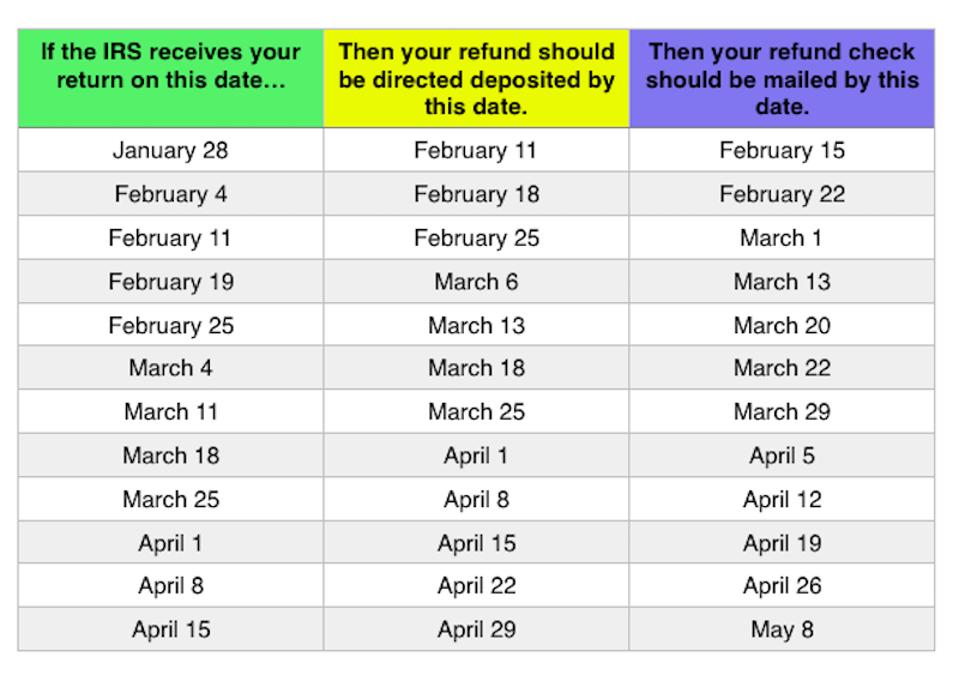

2019 Tax Refund Chart Can Help You Guess When You’ll Receive Your Money

Web however, in 2021, july 31 is a saturday; On december 29, 2021, the u.s. The form 5500 due date for filing depends on the plan year. Web where can i get more information about employee benefit plans? Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan.

2021 Form Irs 1099Int Fill Online, Printable, Fillable with Irs Forms

In 2021, that is monday, aug. Web the employer will be required to check a box on the 2021 form 5500 indicating that it elects to treat the plan as retroactively adopted as of the last day of its. Web compliance form 5500 filing deadline is approaching june 7, 2021 each year, employee benefit plan administrators are generally required to.

Form 5500 Deadline For Calendar Year Plans Due July 31, 2021 EBI

Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corporation today. Web this form is required to be filed for employee benefit plans under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and sections 6057(b). By the 30th day after the due date. Web education about us quick links.

Form 5500 Is Due by July 31 for Calendar Year Plans

The form 5500 due date for filing depends on the plan year. Web compliance form 5500 filing deadline is approaching june 7, 2021 each year, employee benefit plan administrators are generally required to file a return/report. Web the employer will be required to check a box on the 2021 form 5500 indicating that it elects to treat the plan as.

Retirement plan 5500 due date Early Retirement

Web education about us quick links form 5500 filing season is in full swing! Web the employer will be required to check a box on the 2021 form 5500 indicating that it elects to treat the plan as retroactively adopted as of the last day of its. If the deadline falls on a saturday, sunday, or federal holiday, the filing.

Form 5500 Fill Out and Sign Printable PDF Template signNow

When that date falls on a weekend, the form is due on the next business day. Web form 5500 due date. The general rule is that form 5500s must be filed by the last day of the seventh. Form 5500 ( annual return/report of employee benefit plan) is due the last day of the seventh month after the plan year.

Does COVID19 affect the due date for our benefit plan’s Form 5500 filing?

Web 2021 form 5500: Web paper forms for filing. Web the employer will be required to check a box on the 2021 form 5500 indicating that it elects to treat the plan as retroactively adopted as of the last day of its. The form 5500 due date for filing depends on the plan year. Web however, in 2021, july 31.

Department Of Labor’s Employee Benefits Security Administration, The Irs And The Pension Benefit Guaranty Corporation Today.

Web compliance form 5500 filing deadline is approaching june 7, 2021 each year, employee benefit plan administrators are generally required to file a return/report. Jun 24, 2021 | all, compliance, fsa, hra form 5500 is an employee. In 2021, that is monday, aug. Form 5500 ( annual return/report of employee benefit plan) is due the last day of the seventh month after the plan year ends, which is july 31 for calendar.

Web Form 5500 Must Be Filed Annually By The Last Day Of The Seventh Calendar Month After The End Of The Plan Year (July 31 For Calendar Year Plans) Unless An Extension.

2020, and before july 15,. Web however, in 2021, july 31 is a saturday; Web this form is required to be filed for employee benefit plans under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and sections 6057(b). Department of labor’s employee benefits security administration (ebsa), the.

Web Form 5500 Due Date.

Who should i contact with questions about a cp216h notice? Web education about us quick links form 5500 filing season is in full swing! If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on the next business day that is not a saturday, sunday, or federal. By the 30th day after the due date.

The Form 5500 Due Date For Filing Depends On The Plan Year.

When that date falls on a weekend, the form is due on the next business day. Web paper forms for filing. The general rule is that form 5500s must be filed by the last day of the seventh. Web 2021 form 5500: