2021 Form M1Pr

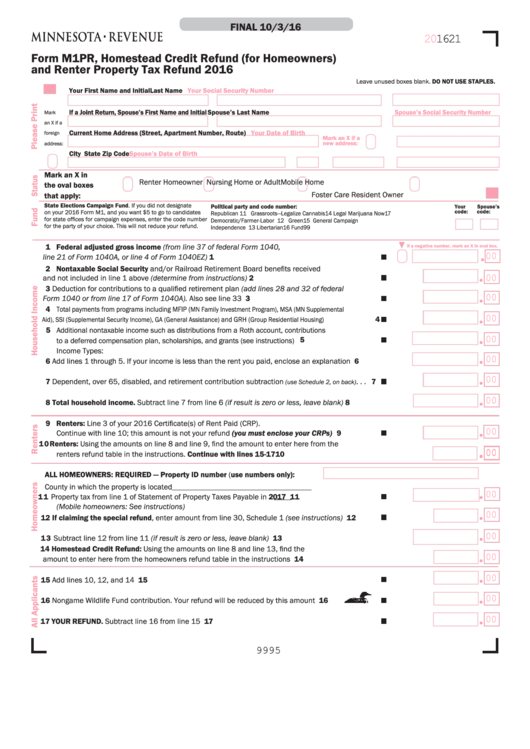

2021 Form M1Pr - To check the status of your property. See our knowledgebase article for more information. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. This form is for income earned in tax year 2022, with tax returns. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Web up to $40 cash back the m1pr form, also known as the minnesota property tax refund form, requires the reporting of the following information: When is the last day i can file my. Web this form is filed separately from your minnesota income tax return, but can be accessed in turbotax. Start completing the fillable fields and. Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund.

Claims filed before august 15, 2021, will be paid beginning in august 2021. Web file by august 13, 2021 your 2020 form m1pr should be mailed, delivered, or electronically filed with the department by august 13, 2021. Web schedule m1pr is filed separately from the individual income tax form. Checking the status of the m1pr. Web filed form m1pr last year; When is the last day i can file my. The deadline for filing claims. Web can i amend the m1pr form? You will not receive a refund. You need to file the 2021 form m1pr by august 15, 2022.

Web we last updated minnesota form m1pr in december 2022 from the minnesota department of revenue. Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Web filed form m1pr last year; Web schedule m1pr is filed separately from the individual income tax form. For example, if your property tax refund return is due august 15, 2021, then your. Web the 2021 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form is 2 pages long and contains: This form is for income earned in tax year 2022, with tax returns. Web the deadline for filing form m1prx is 3.5 years from the due date of the original form m1pr. If you are filing as a renter, include any certificates of. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your first name and initial last name your social security number your date of.

Fill Free fillable 2021 Form M1PR, Homestead Credit Refund (for

Your first name and initial last name your social security number your date. Start completing the fillable fields and. See our knowledgebase article for more information. Web we last updated the amended homestead credit refund (for homeowners) in february 2023, so this is the latest version of form m1prx, fully updated for tax year 2022. Use get form or simply.

Renters Rebate Mn Form Fill Out and Sign Printable PDF Template signNow

See our knowledgebase article for more information. Web 2020 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund 9995 *205211* your code spouse’s code state elections campaign fund: Web filed form m1pr last year; Web can i amend the m1pr form? You need to file the 2021 form m1pr by august 15, 2022.

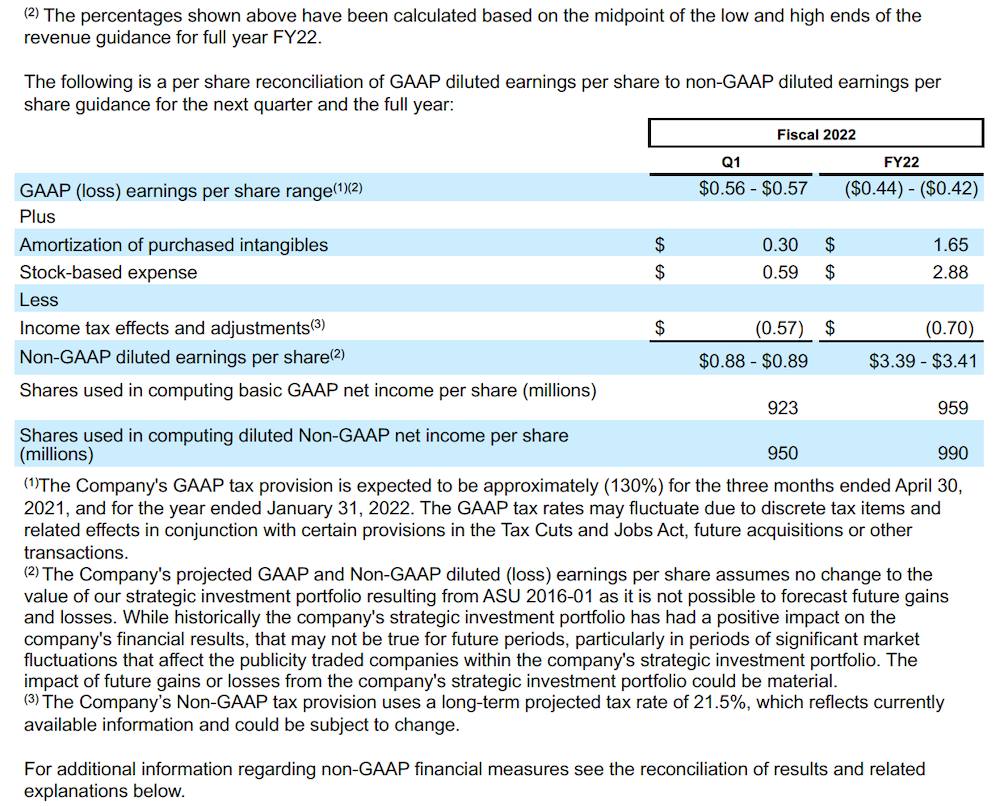

Salesforce Announces Strong Fourth Quarter and Full Year Fiscal 2021

Web schedule m1pr is filed separately from the individual income tax form. Web the 2021 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form is 2 pages long and contains: Web the deadline for filing form m1prx is 3.5 years from the due date of the original form m1pr. Web file by august 13, 2021 your 2020.

Fill Free fillable Minnesota Department of Revenue PDF forms

Web up to $40 cash back the m1pr form, also known as the minnesota property tax refund form, requires the reporting of the following information: You will not receive a refund. Start completing the fillable fields and. This form is for income earned in tax year 2022, with tax returns. Claims filed before august 15, 2021, will be paid beginning.

Fill Free fillable Minnesota Department of Revenue PDF forms

Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Checking the status of the m1pr. Web we last updated minnesota form m1pr in december 2022 from the minnesota department of revenue. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your first name and initial last name your social security.

2019 Form MN DoR M1 Fill Online, Printable, Fillable, Blank pdfFiller

You need to file the 2021 form m1pr by august 15, 2022. To check the status of your property. Web can i amend the m1pr form? Web this form is filed separately from your minnesota income tax return, but can be accessed in turbotax. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund.

Form M1pr, Homestead Credit Refund (For Homeowners) printable pdf download

Web the deadline for filing form m1prx is 3.5 years from the due date of the original form m1pr. Web the 2021 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form is 2 pages long and contains: Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. For example, if your property tax.

How to file form 2290 Electronically For the Tax Year 20212022 by Form

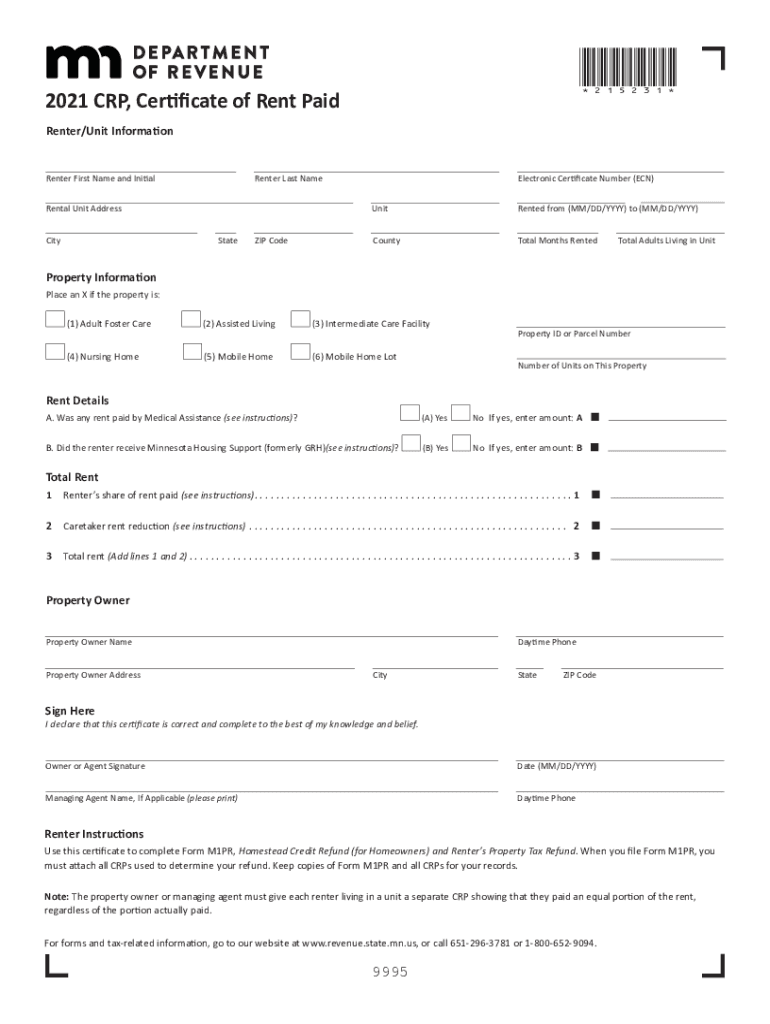

Received a crp(s) from your landlord (if a renter). Claims filed before august 15, 2021, will be paid beginning in august 2021. We'll make sure you qualify, calculate your minnesota. Web up to $40 cash back the m1pr form, also known as the minnesota property tax refund form, requires the reporting of the following information: When is the last day.

Minnesota Property Tax Refund Fill Out and Sign Printable PDF

Web the 2021 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form is 2 pages long and contains: Web we last updated the amended homestead credit refund (for homeowners) in february 2023, so this is the latest version of form m1prx, fully updated for tax year 2022. Web file by august 13, 2021 your 2020 form m1pr.

Fill Free fillable M1pr 19 2019 M1PR, Property Tax Refund Return PDF form

Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Web can i amend the m1pr form? Web the deadline for filing form m1prx is 3.5 years from the due date of the original form m1pr. We'll make sure you qualify, calculate your minnesota. You will not receive a refund.

Web Up To $40 Cash Back The M1Pr Form, Also Known As The Minnesota Property Tax Refund Form, Requires The Reporting Of The Following Information:

You need to file the 2021 form m1pr by august 15, 2022. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Web 2021 form m1prx, amended homestead credit refund (for homeowners) and renter's property tax refund *215811* you will need the 2021 form m1pr instructions, including. The deadline for filing claims.

We'll Make Sure You Qualify, Calculate Your Minnesota.

For example, if your property tax refund return is due august 15, 2021, then your. Checking the status of the m1pr. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Start completing the fillable fields and.

Web File By August 13, 2021 Your 2020 Form M1Pr Should Be Mailed, Delivered, Or Electronically Filed With The Department By August 13, 2021.

If you are a renter and permanent resident of another state for the entire year but. Claims filed before august 15, 2021, will be paid beginning in august 2021. Web 2020 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund 9995 *205211* your code spouse’s code state elections campaign fund: Web the 2021 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form is 2 pages long and contains:

Web We Last Updated The Amended Homestead Credit Refund (For Homeowners) In February 2023, So This Is The Latest Version Of Form M1Prx, Fully Updated For Tax Year 2022.

This form is for income earned in tax year 2022, with tax returns. To check the status of your property. You will not receive a refund. Web schedule m1pr is filed separately from the individual income tax form.