2022 Form 2555

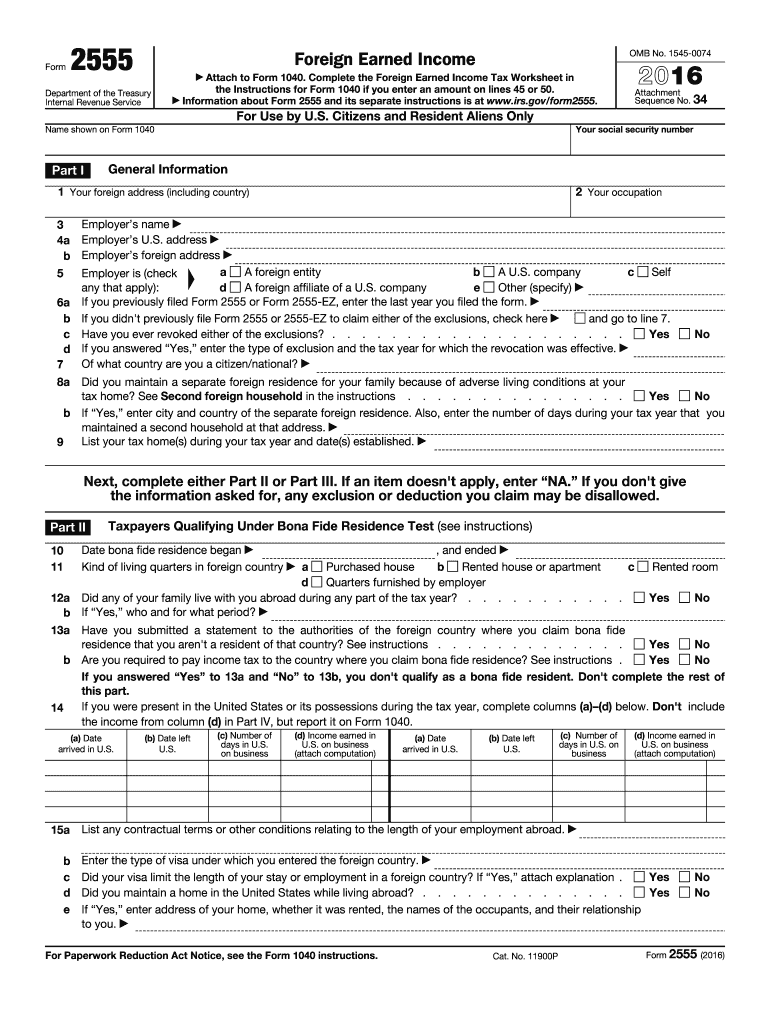

2022 Form 2555 - Company c self any that apply): Ad download or email irs 2555 & more fillable forms, register and subscribe now! Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web april 2, 2022 form 2555 can make an expat’s life a lot easier! D a foreign affiliate of a u.s. Web enter the following in the form 2555 share of gross foreign earned income/expenses field. If the period for which you qualify for the foreign earned income exclusion includes only part of the year,. Upload, modify or create forms. Web 235 rows purpose of form. Web the foreign earned income exclusion (feie, using irs form 2555) allows you to exclude a certain amount of your foreign earned income from us tax.

Web taxslayer support foreign earned income exclusion form 2555 if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Ad access irs tax forms. Web subtract line 44 from line 43. Web the foreign earned income exclusion (feie, using irs form 2555) allows you to exclude a certain amount of your foreign earned income from us tax. Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. This form is for income earned in tax year 2022, with tax returns due in april. Go to www.irs.gov/form2555 for instructions and the. Enter the code that represents the appropriate allocation of the entity's foreign. Get ready for tax season deadlines by completing any required tax forms today.

Web taxslayer support foreign earned income exclusion form 2555 if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign. If you qualify, you can use form. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Company e other (specify) 6 a if you previously filed form 2555 or. Ad download or email irs 2555 & more fillable forms, register and subscribe now! Company c self any that apply): Upload, modify or create forms. In the blank space next to line 8, enter “form 2555.” on schedule 1 (form. Go to www.irs.gov/form2555 for instructions and the. Ad edit, sign and print tax forms on any device with signnow.

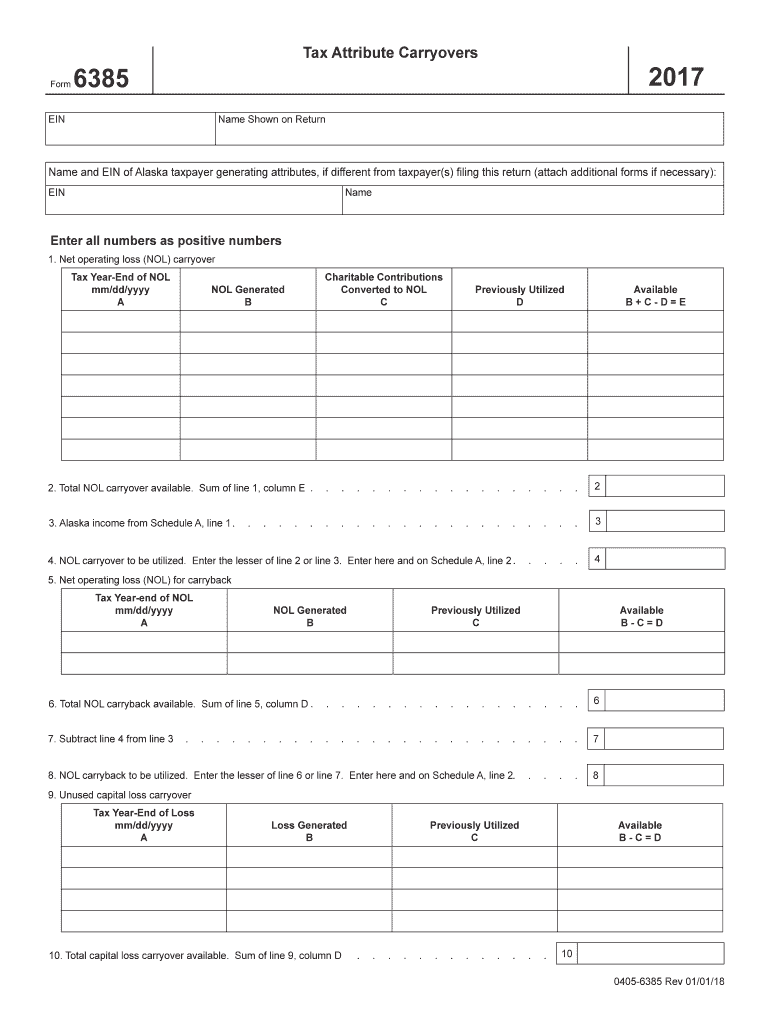

2017 AK Form 6385 Fill Online, Printable, Fillable, Blank pdfFiller

Web 235 rows purpose of form. Go to www.irs.gov/form2555 for instructions and the. Web the foreign earned income exclusion (feie) is an irs tax benefit program that allows american expats to exclude their foreign earned income from their us tax. Web april 2, 2022 form 2555 can make an expat’s life a lot easier! This form helps expats elect to.

Foreign Earned Exclusion Form 2555 Verni Tax Law

When it comes to us persons residing overseas and generating. Get ready for tax season deadlines by completing any required tax forms today. Web taxslayer support foreign earned income exclusion form 2555 if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign. Web 5 employer is (check a a foreign entity.

IRS Form 2555 and the Foreign Earned Exclusion A Practical

Web april 2, 2022 form 2555 can make an expat’s life a lot easier! When it comes to us persons residing overseas and generating. Web together, they can exclude as much as $224,000 for the 2022 tax year. This form is for income earned in tax year 2022, with tax returns due in april. In the blank space next to.

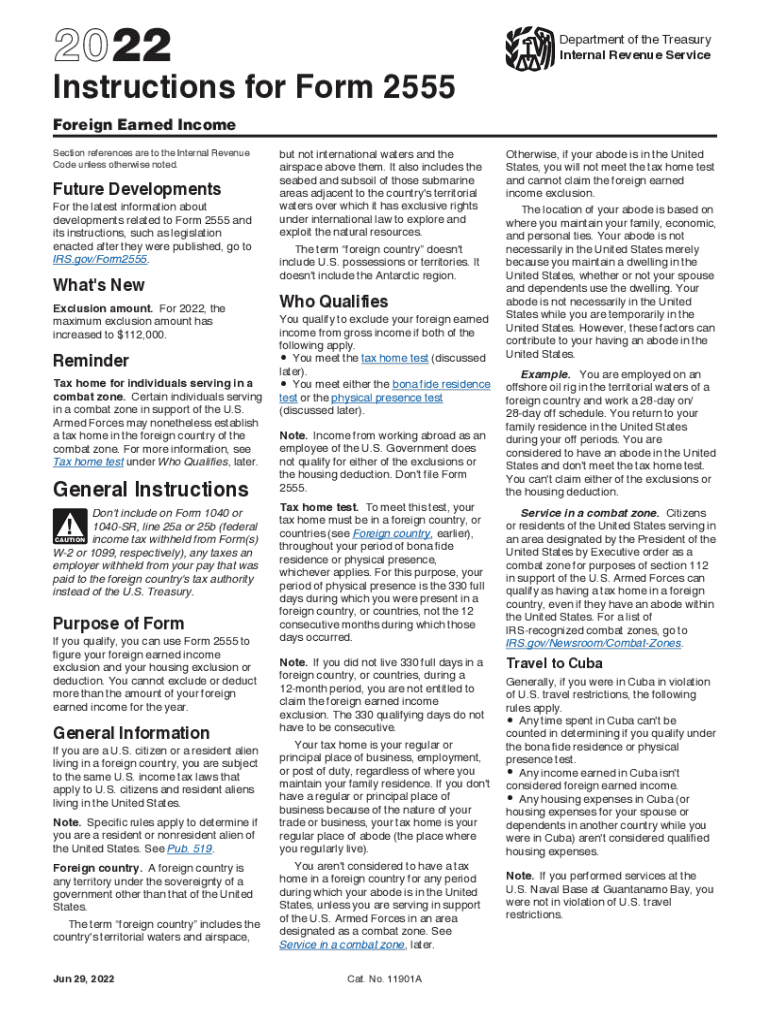

Instructions for Form 2555 Instructions for Form 2555, Foreign Earned

Web enter the following in the form 2555 share of gross foreign earned income/expenses field. If you qualify, you can use form 2555 to figure your foreign. Ad access irs tax forms. Web together, they can exclude as much as $224,000 for the 2022 tax year. When it comes to us persons residing overseas and generating.

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

Web taxslayer support foreign earned income exclusion form 2555 if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign. Go to www.irs.gov/form2555 for instructions and the. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Complete, edit or.

Filing Form 2555 A Guide for US Expats

Enter the result here and in parentheses on schedule 1 (form 1040), line 8. When it comes to us persons residing overseas and generating. Upload, modify or create forms. Web the foreign earned income exclusion (feie, using irs form 2555) allows you to exclude a certain amount of your foreign earned income from us tax. Web 5 employer is (check.

Form 2555EZ U.S Expat Taxes Community Tax

D a foreign affiliate of a u.s. Go to www.irs.gov/form2555 for instructions and the. Web together, they can exclude as much as $224,000 for the 2022 tax year. In most cases you still have. Enter the code that represents the appropriate allocation of the entity's foreign.

Filing Taxes While Working Abroad — Ambassador Year in China

Go to www.irs.gov/form2555 for instructions and the. Web the foreign earned income exclusion (feie) is an irs tax benefit program that allows american expats to exclude their foreign earned income from their us tax. Ad download or email irs 2555 & more fillable forms, register and subscribe now! Web enter the following in the form 2555 share of gross foreign.

IRS Form 2555 and the Foreign Earned Exclusion A Practical

Web we last updated federal form 2555 in december 2022 from the federal internal revenue service. Enter the code that represents the appropriate allocation of the entity's foreign. In most cases you still have. Enter the result here and in parentheses on schedule 1 (form 1040), line 8. Web april 2, 2022 form 2555 can make an expat’s life a.

Form 2555 Fill Out and Sign Printable PDF Template signNow

Enter the result here and in parentheses on schedule 1 (form 1040), line 8. Ad access irs tax forms. This form is for income earned in tax year 2022, with tax returns due in april. Web april 2, 2022 form 2555 can make an expat’s life a lot easier! Web the foreign earned income exclusion (feie, using irs form 2555).

If You Qualify, You Can Use Form.

This form helps expats elect to use the foreign earned income exclusion (feie), one of the biggest. Web enter the following in the form 2555 share of gross foreign earned income/expenses field. This form is for income earned in tax year 2022, with tax returns due in april. Ad access irs tax forms.

Web Form 2555 (Foreign Earned Income Exclusion) Calculates The Amount Of Foreign Earned Income And/Or Foreign Housing You Can Exclude From Taxation.

Upload, modify or create forms. It is used to claim the foreign earned income exclusion and/or the. Ad download or email irs 2555 & more fillable forms, register and subscribe now! Web taxslayer support foreign earned income exclusion form 2555 if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign.

Web Form 2555 Is A Tax Form That Must Be Filed By Nonresident Aliens Who Have Earned Income From The United States.

In the blank space next to line 8, enter “form 2555.” on schedule 1 (form. D a foreign affiliate of a u.s. Web the foreign earned income exclusion (feie, using irs form 2555) allows you to exclude a certain amount of your foreign earned income from us tax. If the period for which you qualify for the foreign earned income exclusion includes only part of the year,.

Ad Edit, Sign And Print Tax Forms On Any Device With Signnow.

Company e other (specify) 6 a if you previously filed form 2555 or. Go to www.irs.gov/form2555 for instructions and the. If you qualify, you can use form 2555 to figure your foreign. In most cases you still have.