2022 Form 593

2022 Form 593 - Web the 593 form is a california specific form used to determine whether or not there should be state tax withheld on a property sale by the seller (individual, business entity, trust,. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated the real estate withholding tax statement in january 2023, so this is the latest version of form 593, fully updated for tax year 2022. Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has. _________________________ part i remitter information • reep • qualified intermediary buyer/transferee. Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: Web failure to make correct estimated payments can result in interest or penalties. Web common questions about individual california real estate withholding (form 593) solved • by intuit • 30 • updated july 12, 2022 select the links below for solutions. Web effective january 1, 2022, a qualified intermediary’s (qi) withholding obligation will be limited to available funds in those situations where the qi does not. Web how do i enter ca form 593 real estate withholding?

Web forms, instructions and publications search. Web on january 1, 2020, our new form 593, real estate withholding statement went live. For more information on how to complete form 593,. Web effective january 1, 2022, a qualified intermediary’s (qi) withholding obligation will be limited to available funds in those situations where the qi does not. Inputs for ca form 593,. The new form is a combination of the prior: You can download or print. Web how do i enter ca form 593 real estate withholding? Web failure to make correct estimated payments can result in interest or penalties. Web 593 escrow or exchange no.

Web failure to make correct estimated payments can result in interest or penalties. Form 593, real estate withholding. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add. Web download or print the 2022 california 593 booklet (real estate withholding booklet) for free from the california franchise tax board. This form is for income earned in tax year 2022, with tax returns due in april. The new form is a combination of the prior: Web 593 escrow or exchange no. We last updated the payment voucher for. Web the 593 form is a california specific form used to determine whether or not there should be state tax withheld on a property sale by the seller (individual, business entity, trust,. You can download or print.

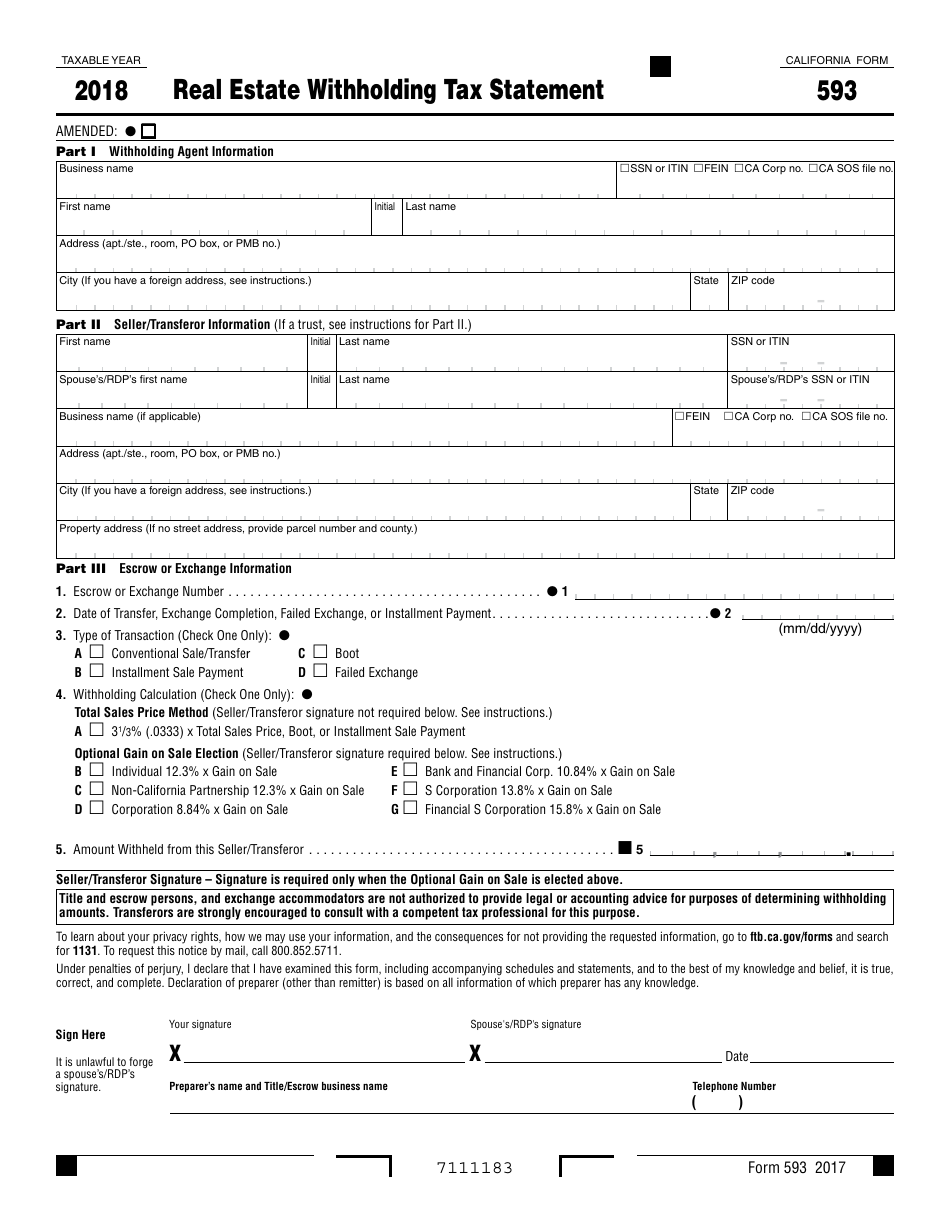

2022 Form 593 Real Estate Withholding Tax Statement

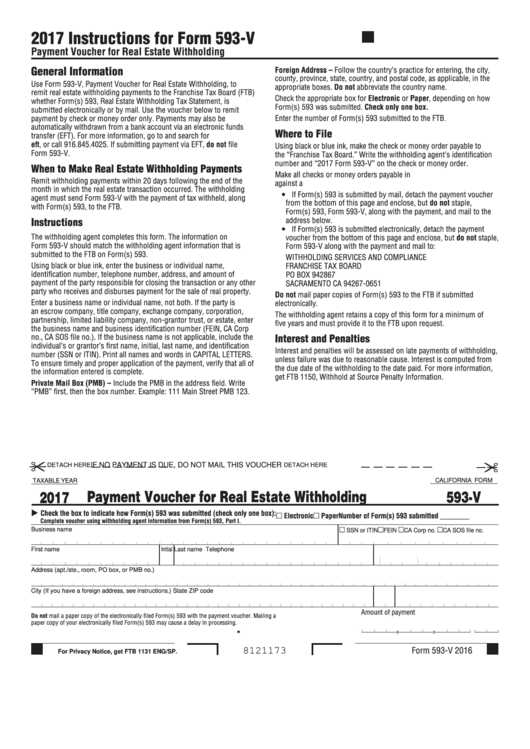

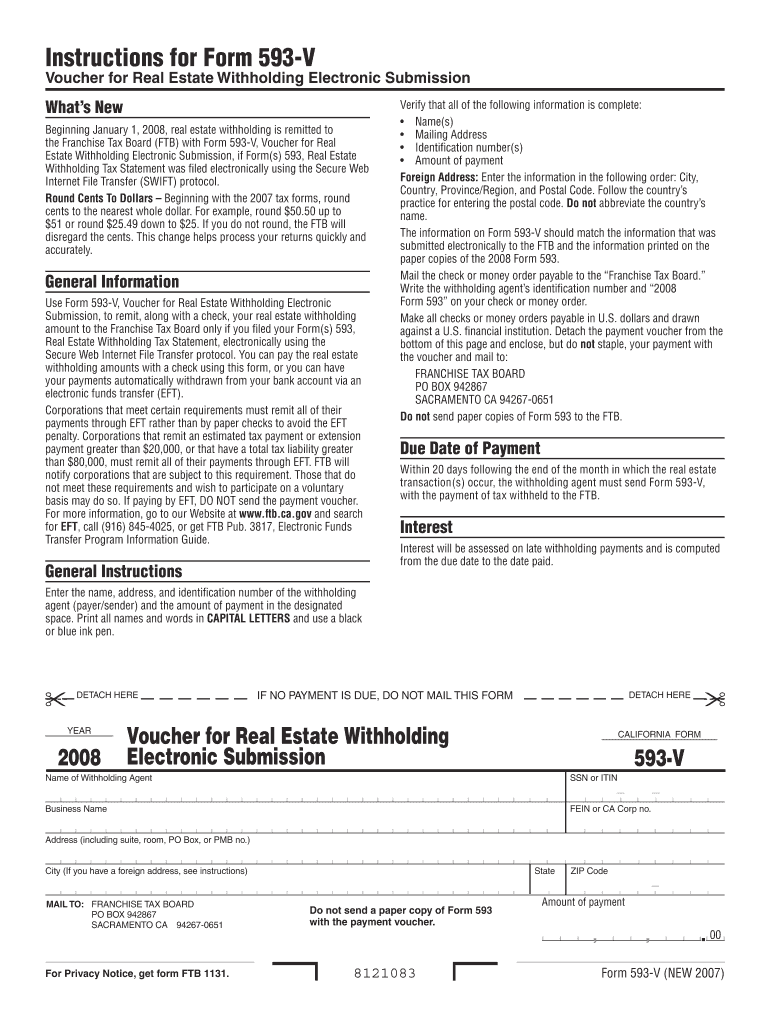

Web this form contains instructions on how to proceed with submitting a payment voucher for real estate withholding and where to file it. You can download or print. The new form is a combination of the prior: Web 593 escrow or exchange no. Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has.

Form 593 Download Fillable PDF or Fill Online Real Estate Withholding

Web the 593 form is a california specific form used to determine whether or not there should be state tax withheld on a property sale by the seller (individual, business entity, trust,. We last updated the payment voucher for. Web up to $40 cash back this is how it works. The new form is a combination of the prior: Inputs.

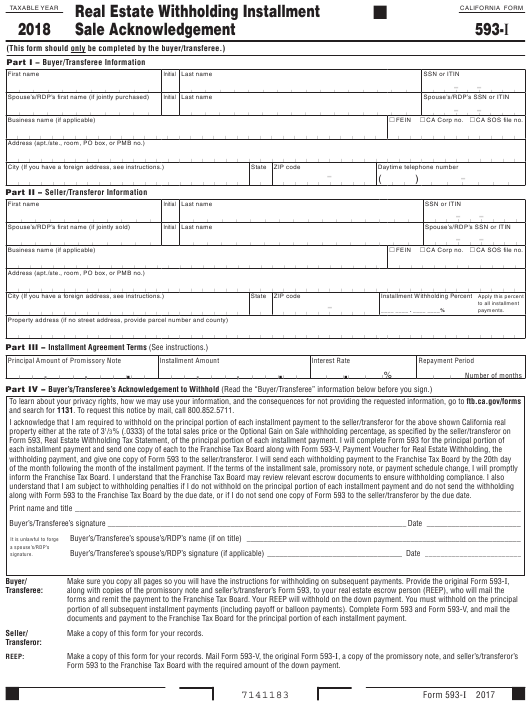

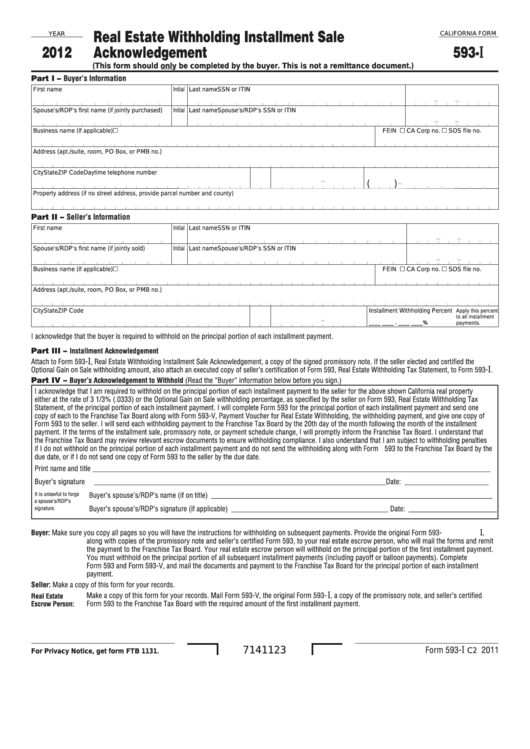

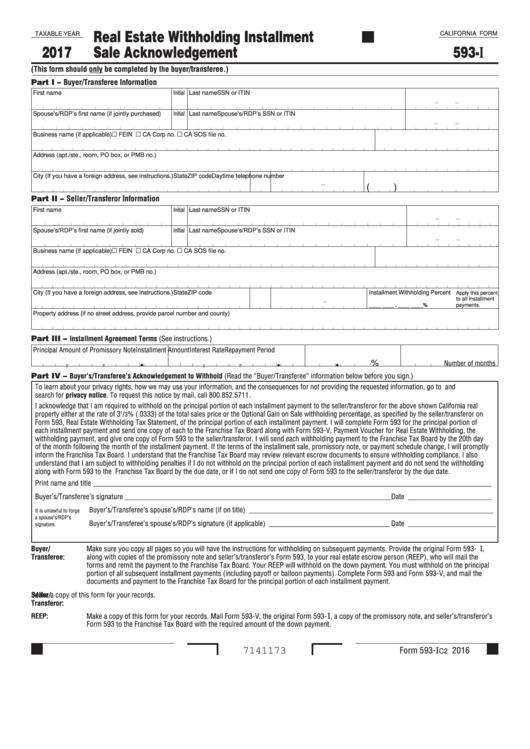

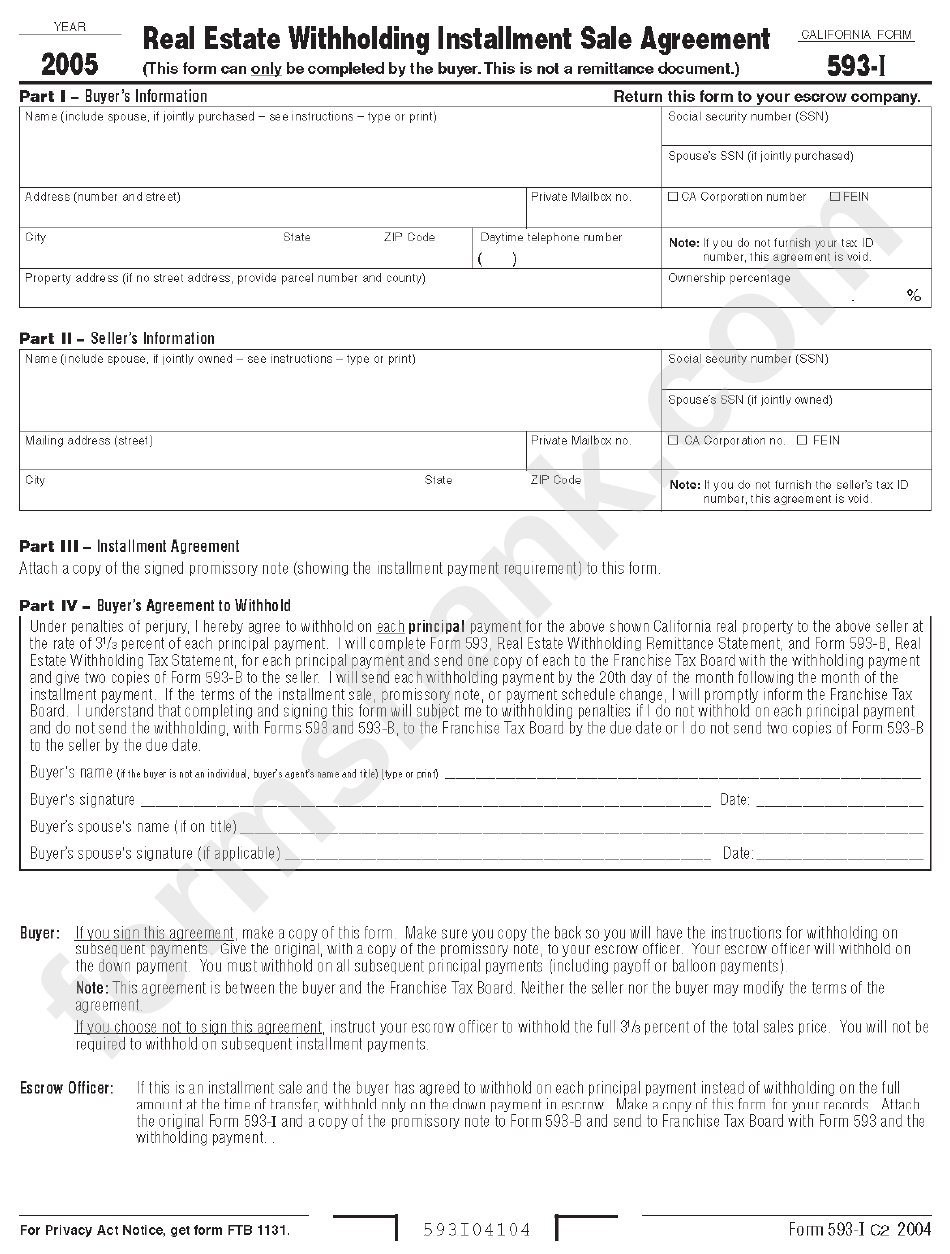

Fillable California Form 593I Real Estate Withholding Installment

Web this article will assist you with entering the california real estate withholding reported on form 593 to print on the individual return form 540, line 73. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add. Web 593 escrow or exchange no. Page last reviewed or updated: Web forms, instructions and publications search.

Fillable Form 593V Payment Voucher For Real Estate Withholding

Web failure to make correct estimated payments can result in interest or penalties. Inputs for ca form 593,. Page last reviewed or updated: Web effective january 1, 2022, a qualified intermediary’s (qi) withholding obligation will be limited to available funds in those situations where the qi does not. For more information on how to complete form 593,.

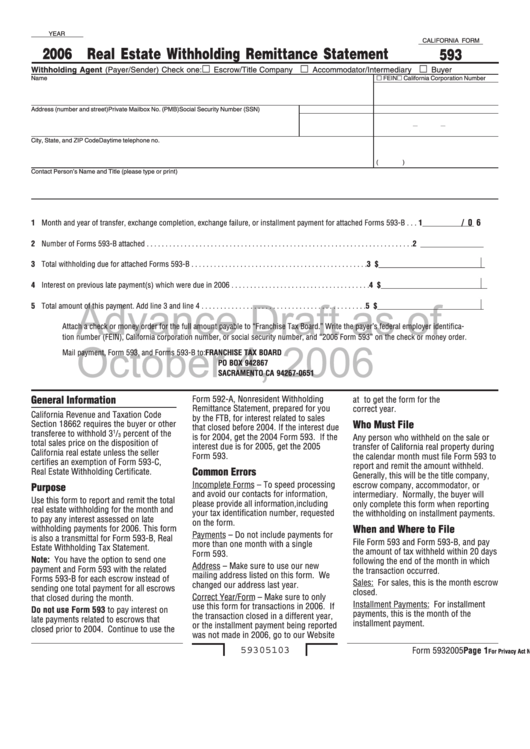

California Form 593 Draft Real Estate Withholding Remittance

Inputs for ca form 593,. Web we last updated the real estate withholding tax statement in january 2023, so this is the latest version of form 593, fully updated for tax year 2022. Web this form contains instructions on how to proceed with submitting a payment voucher for real estate withholding and where to file it. Web up to $40.

593 V Form California Franchise Tax Board Ft Ca Fill Out and Sign

Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: For more information on how to complete form 593,. Web download or print the 2022 california 593 booklet (real estate withholding booklet) for free from the california franchise tax board. Web this article will assist you with entering the california real estate.

Fillable California Form 593I Real Estate Withholding Installment

Web this form contains instructions on how to proceed with submitting a payment voucher for real estate withholding and where to file it. Inputs for ca form 593,. Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: Web on january 1, 2020, our new form 593, real estate withholding statement went.

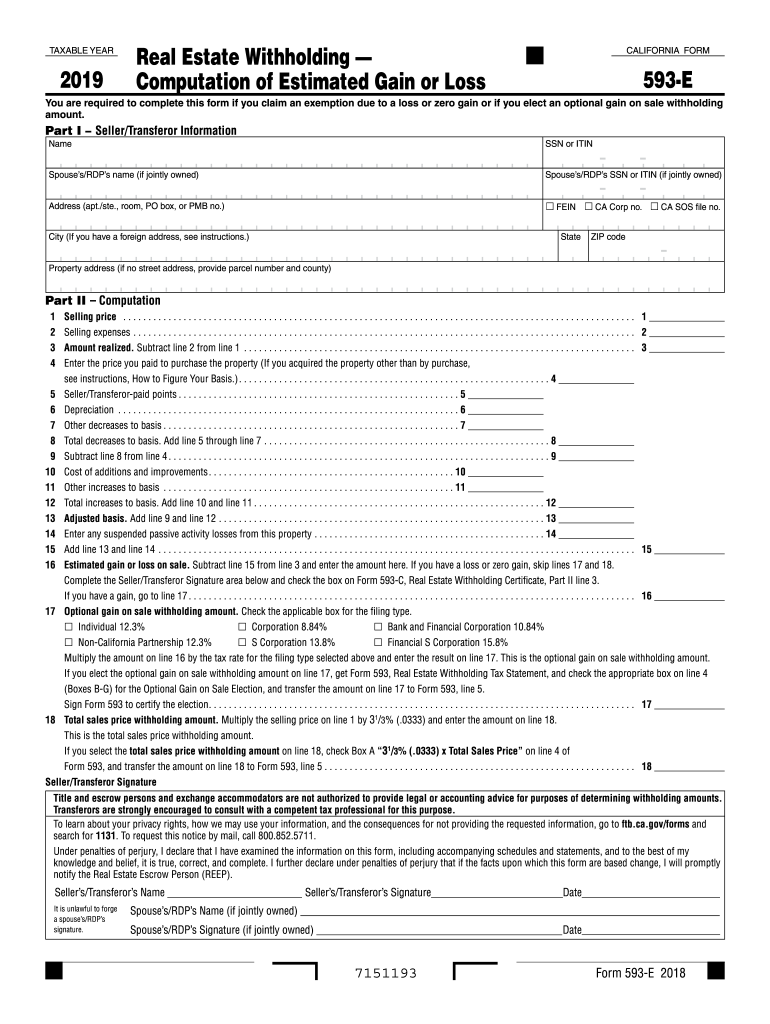

California form 593 e Fill out & sign online DocHub

For more information on how to complete form 593,. Web failure to make correct estimated payments can result in interest or penalties. The new form is a combination of the prior: Web forms, instructions and publications search. Web for withholding on a sale, the remitter will need the original completed form 593 and two copies:

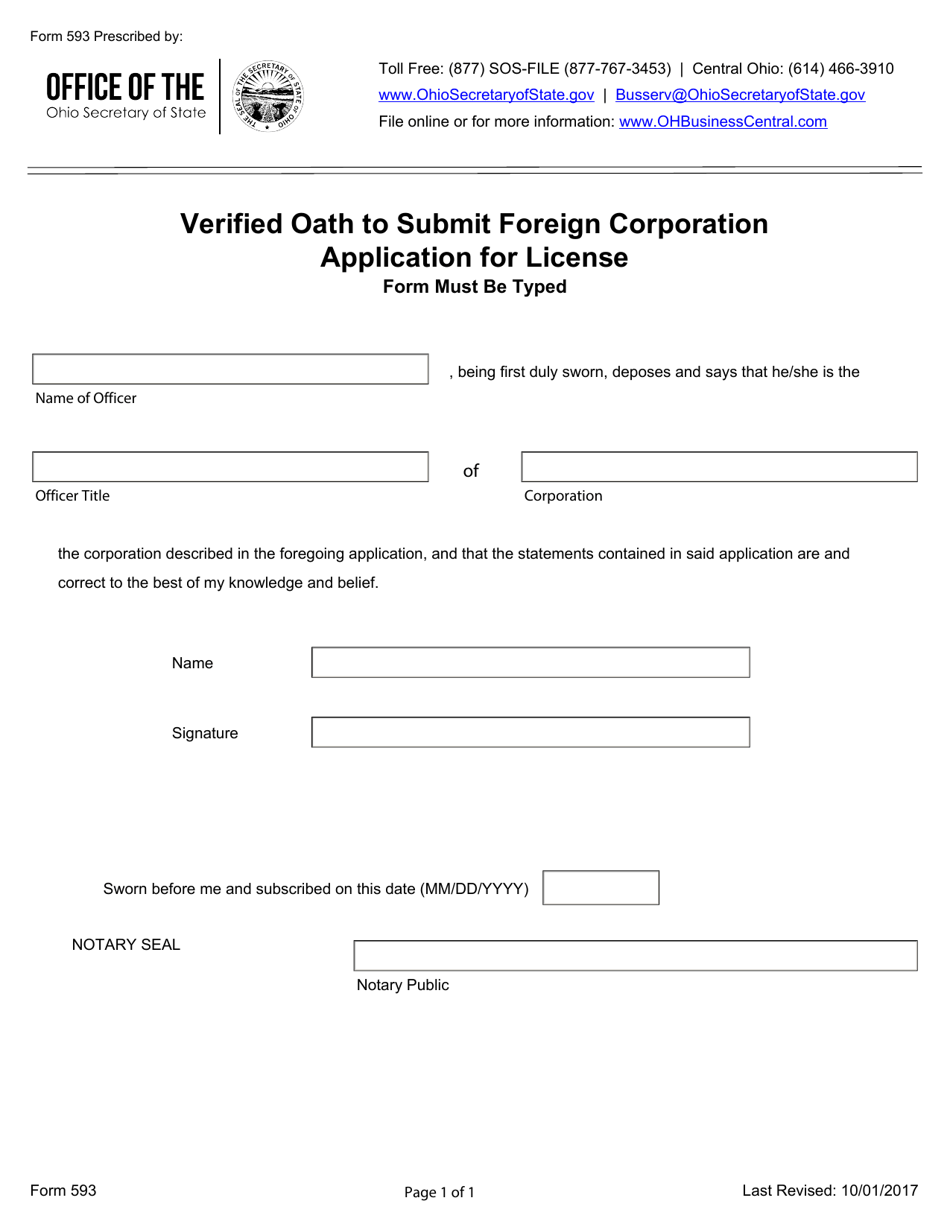

Form 593 Download Fillable PDF or Fill Online Verified Oath to Submit

Web the 593 form is a california specific form used to determine whether or not there should be state tax withheld on a property sale by the seller (individual, business entity, trust,. Web we last updated the real estate withholding tax statement in january 2023, so this is the latest version of form 593, fully updated for tax year 2022..

The New Form Is A Combination Of The Prior:

Web download or print the 2022 california 593 booklet (real estate withholding booklet) for free from the california franchise tax board. Web forms, instructions and publications search. Web 593 escrow or exchange no. Web common questions about individual california real estate withholding (form 593) solved • by intuit • 30 • updated july 12, 2022 select the links below for solutions.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has. Web the 593 form is a california specific form used to determine whether or not there should be state tax withheld on a property sale by the seller (individual, business entity, trust,. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add. Web we now have one form 593, real estate withholding statement, which is filed with ftb after every real estate transaction.

Web On January 1, 2020, Our New Form 593, Real Estate Withholding Statement Went Live.

Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: Web up to $40 cash back this is how it works. Inputs for ca form 593,. Web this article will assist you with entering the california real estate withholding reported on form 593 to print on the individual return form 540, line 73.

Web Failure To Make Correct Estimated Payments Can Result In Interest Or Penalties.

Page last reviewed or updated: Web effective january 1, 2022, a qualified intermediary’s (qi) withholding obligation will be limited to available funds in those situations where the qi does not. Web we last updated the real estate withholding tax statement in january 2023, so this is the latest version of form 593, fully updated for tax year 2022. Form 593, real estate withholding.