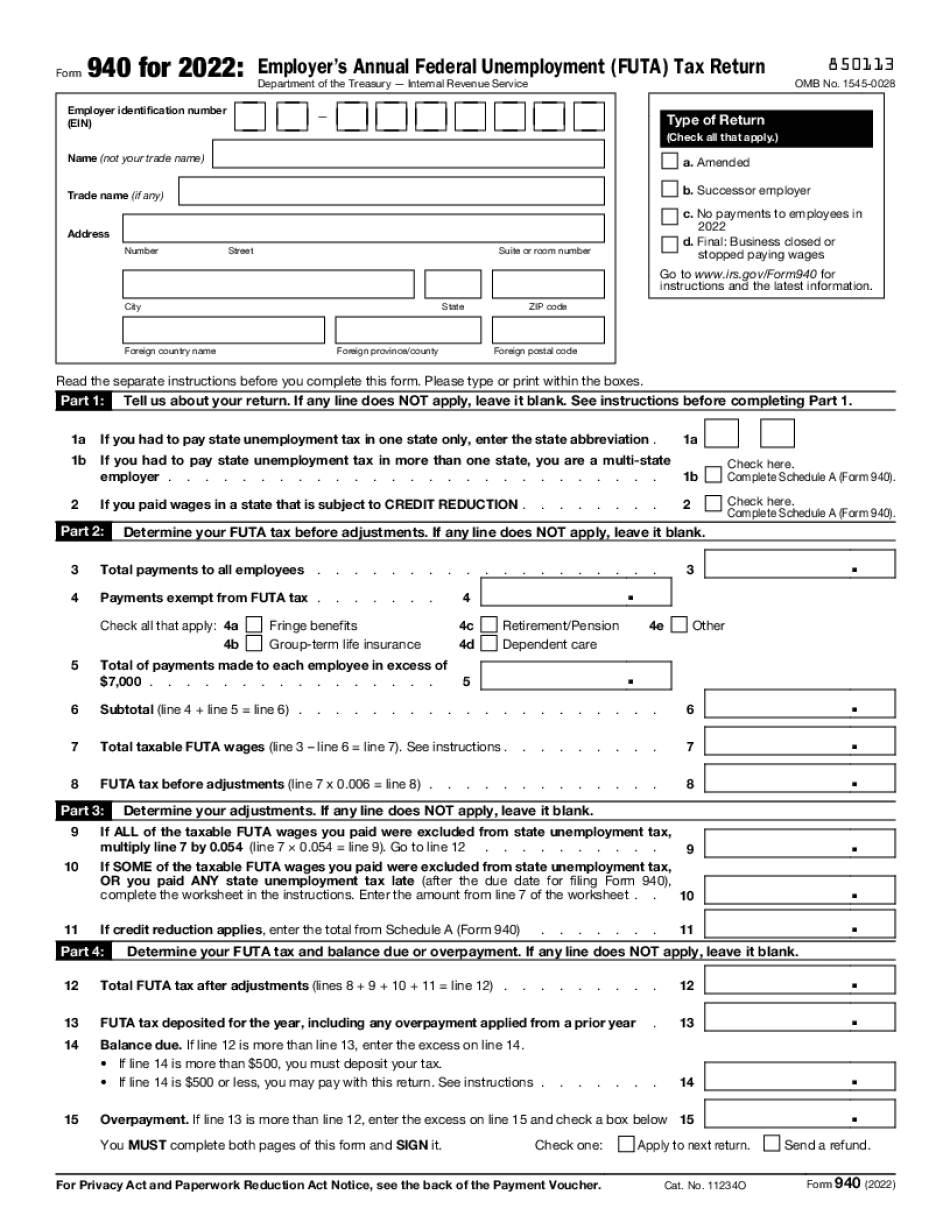

2022 Form 940 Schedule A

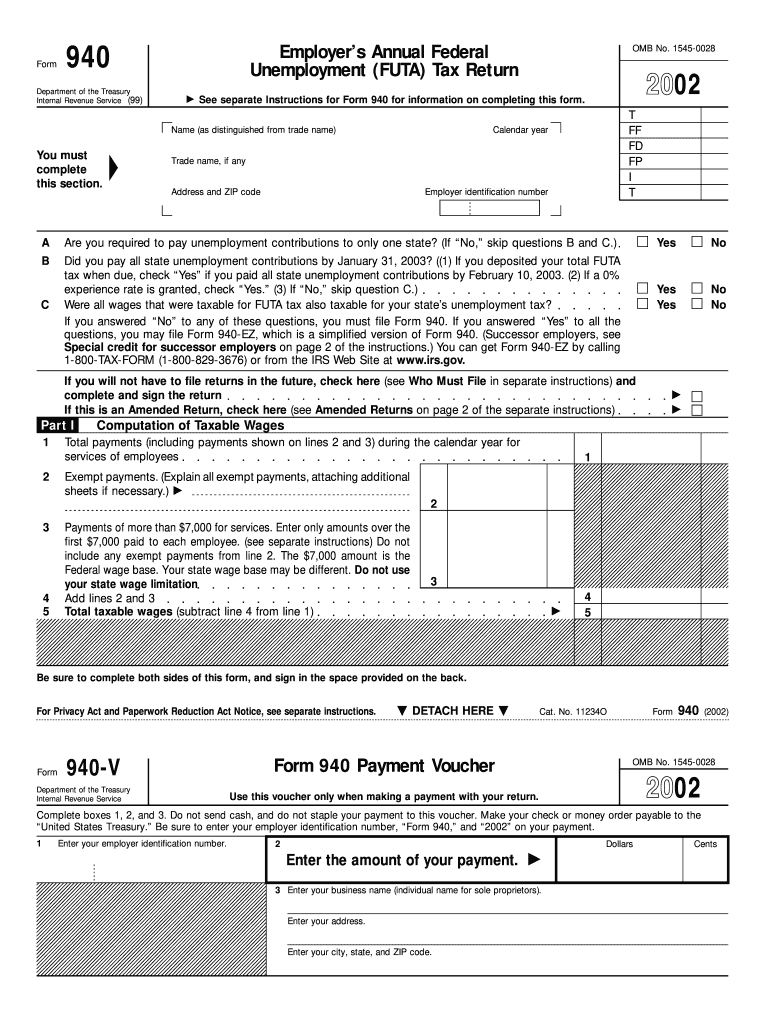

2022 Form 940 Schedule A - | 12/02/22 the irs has released the 2022 form 940, employer’s annual federal. Web go to print reports, tax reports, select form 940, input year to process, print. Web for tax year 2022, there are credit reduction states. Web the draft of form 940 schedule a indicates that california, connecticut, illinois, new york, and the virgin islands will still be in credit reduction status for tax year. Complete schedule a (form 940). Web use schedule a (form 940) to figure the credit reduction. The deadline to file form 940 with the irs for the 2022 tax year is january 31, 2023. A 940 schedule a form must be filled out in every state in which an employer has paid unemployment tax for that tax. Web the due date for filing form 940 for 2022 is january 31, 2023. If you paid wages subject to the unemployment tax laws of these states, check the box on line 2 and fill out schedule a.

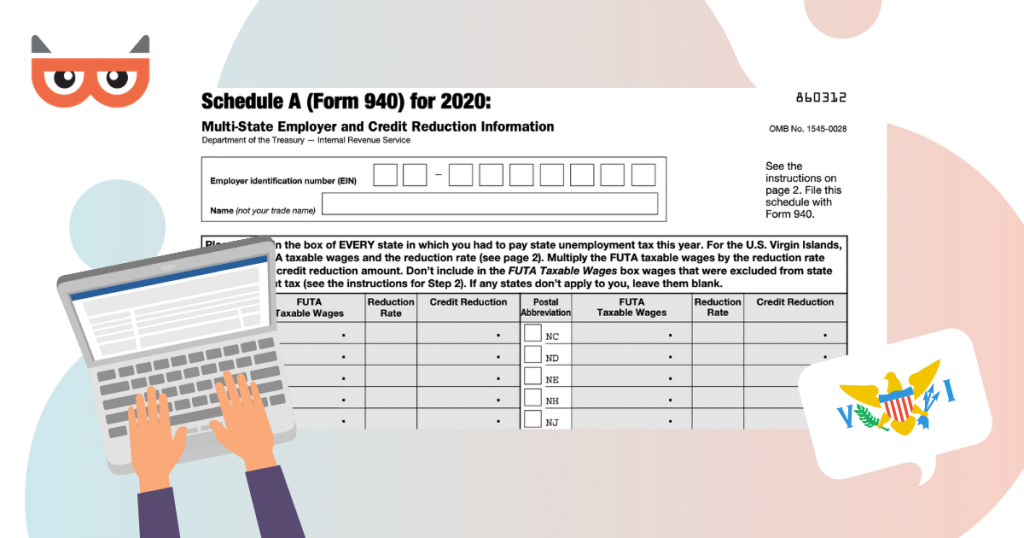

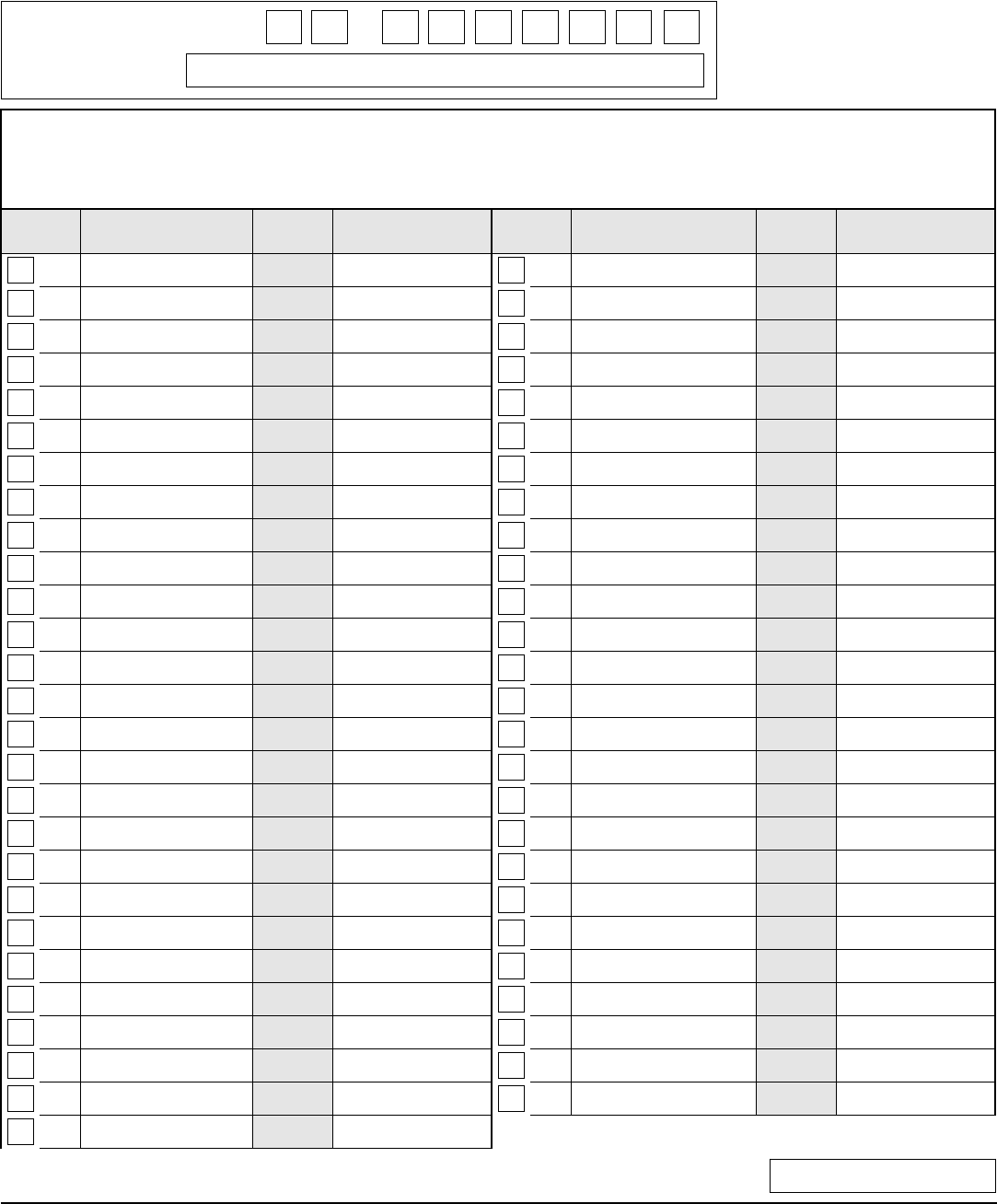

Web complete schedule a (form 940). 2 if you paid wages in a state that is subject to credit reduction. In the input screen, select the checkbox on line 1b or line 2 to make the schedule. Web schedule a (form 940) is used by employers who are required by the irs to pay state unemployment tax in more than one state, or if the employer paid wages in any state and. Web for tax year 2022, there are credit reduction states. Web go to print reports, tax reports, select form 940, input year to process, print. Name (not your trade name) see the instructions on page 2. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. Web the draft of form 940 schedule a indicates that california, connecticut, illinois, new york, and the virgin islands will still be in credit reduction status for tax year. A 940 schedule a form must be filled out in every state in which an employer has paid unemployment tax for that tax.

If futa taxes were deposited on the correct deadlines, form 940 isn’t due until february 10,. Web for tax year 2022, there are credit reduction states. The deadline to file form 940 with the irs for the 2022 tax year is january 31, 2023. | 12/02/22 the irs has released the 2022 form 940, employer’s annual federal. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. Web employers from these states are required to pay additional unemployment tax when filing form 940 and schedule a. Web department of the treasury — internal revenue service employer identification number (ein) name as shown on form 940 type of filer (check one): Web the draft of form 940 schedule a indicates that california, connecticut, illinois, new york, and the virgin islands will still be in credit reduction status for tax year. Web 2022 12/15/2022 inst 940 (pr) instructions for form 940 (pr), employer's annual federal unemployment (futa) tax return (puerto rico version) 2022 12/15/2022 form 940. Web complete schedule a (form 940).

940 schedule a 2023 Fill online, Printable, Fillable Blank

Web department of the treasury — internal revenue service employer identification number (ein) name as shown on form 940 type of filer (check one): If futa taxes were deposited on the correct deadlines, form 940 isn’t due until february 10,. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if.

anexo b formulario 941 pr 2022 Fill Online, Printable, Fillable Blank

Web use schedule a (form 940) to figure the credit reduction. Web schedule a (form 940) for 2022: If you paid wages subject to the unemployment tax laws of these states, check the box on line 2 and fill out schedule a. Web go to print reports, tax reports, select form 940, input year to process, print. If futa taxes.

2022 Form 940 Schedule A

Even if you had only one worker this year, you need to manage your futa taxes, and. Web the federal unemployment tax return must be filed annually. Web 2022 12/15/2022 inst 940 (pr) instructions for form 940 (pr), employer's annual federal unemployment (futa) tax return (puerto rico version) 2022 12/15/2022 form 940. Web use schedule a (form 940) to figure.

2014 Form 940 (Schedule A) Edit, Fill, Sign Online Handypdf

The deadline to file form 940 with the irs for the 2022 tax year is january 31, 2023. Web go to print reports, tax reports, select form 940, input year to process, print. For more information, see the schedule a (form 940) instructions or visit irs.gov. A 940 schedule a form must be filled out in every state in which.

940 2002 Fill Out and Sign Printable PDF Template signNow

Web the irs has released the 2022 form 940, employer’s annual federal unemployment (futa) tax return, schedule a (form 940). Even if you had only one worker this year, you need to manage your futa taxes, and. Web the due date for filing form 940 for 2022 is january 31, 2023. Complete schedule a (form 940). | 12/02/22 the irs.

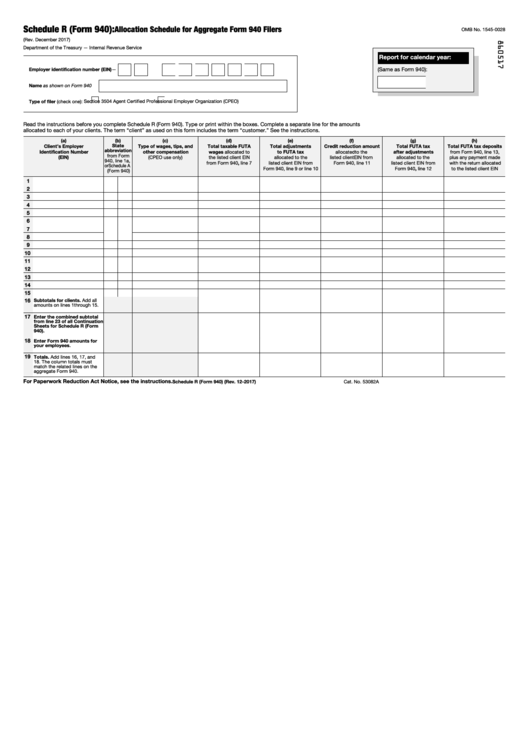

Fillable Schedule R (Form 940) Allocation Schedule For Aggregate Form

2 if you paid wages in a state that is subject to credit reduction. If you paid wages subject to the unemployment tax laws of these states, check the box on line 2 and fill out schedule a. Web mike kappel | oct 14, 2022 are you a small business owner with employees? Web go to print reports, tax reports,.

940 Form 2021 IRS Forms TaxUni

Web use schedule a (form 940) to figure the credit reduction. Complete schedule a (form 940). For more information, see the schedule a (form 940) instructions or visit irs.gov. If you paid wages subject to the unemployment tax laws of these states, check the box on line 2 and fill out schedule a. For 2022, form 940 is due on.

Form 940 and Schedule A YouTube

Even if you had only one worker this year, you need to manage your futa taxes, and. 2 if you paid wages in a state that is subject to credit reduction. Web department of the treasury — internal revenue service employer identification number (ein) name as shown on form 940 type of filer (check one): Web irs releases 2022 form.

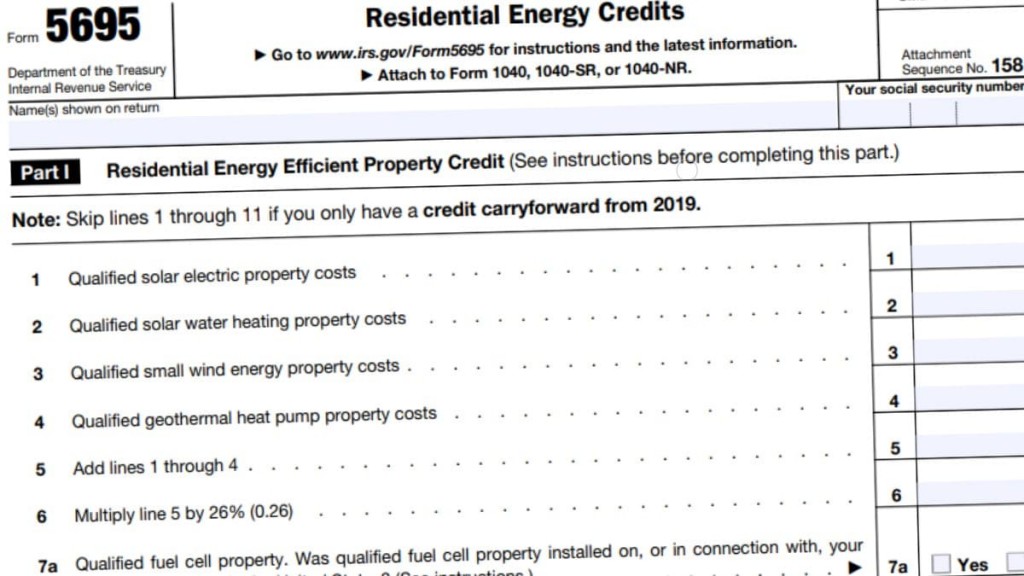

Learn how to prepare and print Form 941, Schedule B, and Form 940

If you paid wages subject to the unemployment tax laws of these states, check the box on line 2 and fill out schedule a. Name (not your trade name) see the instructions on page 2. Web mike kappel | oct 14, 2022 are you a small business owner with employees? Web the federal unemployment tax return must be filed annually..

Fill Free fillable Form 940 schedule R Allocation Schedule 2017 PDF form

Name (not your trade name) see the instructions on page 2. Web irs releases 2022 form 940, schedule a by: A 940 schedule a form must be filled out in every state in which an employer has paid unemployment tax for that tax. 2 if you paid wages in a state that is subject to credit reduction. The deadline to.

2 If You Paid Wages In A State That Is Subject To Credit Reduction.

| 12/02/22 the irs has released the 2022 form 940, employer’s annual federal. Web the federal unemployment tax return must be filed annually. Web go to print reports, tax reports, select form 940, input year to process, print. Web for tax year 2022, there are credit reduction states.

If Futa Taxes Were Deposited On The Correct Deadlines, Form 940 Isn’t Due Until February 10,.

In the input screen, select the checkbox on line 1b or line 2 to make the schedule. Name (not your trade name) see the instructions on page 2. Web department of the treasury — internal revenue service employer identification number (ein) name as shown on form 940 type of filer (check one): Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts.

Web Employers From These States Are Required To Pay Additional Unemployment Tax When Filing Form 940 And Schedule A.

The deadline to file form 940 with the irs for the 2022 tax year is january 31, 2023. Web schedule a (form 940) is used by employers who are required by the irs to pay state unemployment tax in more than one state, or if the employer paid wages in any state and. Web 2022 12/15/2022 inst 940 (pr) instructions for form 940 (pr), employer's annual federal unemployment (futa) tax return (puerto rico version) 2022 12/15/2022 form 940. Web mike kappel | oct 14, 2022 are you a small business owner with employees?

Web The Due Date For Filing Form 940 For 2022 Is January 31, 2023.

Web the irs has released the 2022 form 940, employer’s annual federal unemployment (futa) tax return, schedule a (form 940). Complete schedule a (form 940). Web irs releases 2022 form 940, schedule a by: A 940 schedule a form must be filled out in every state in which an employer has paid unemployment tax for that tax.