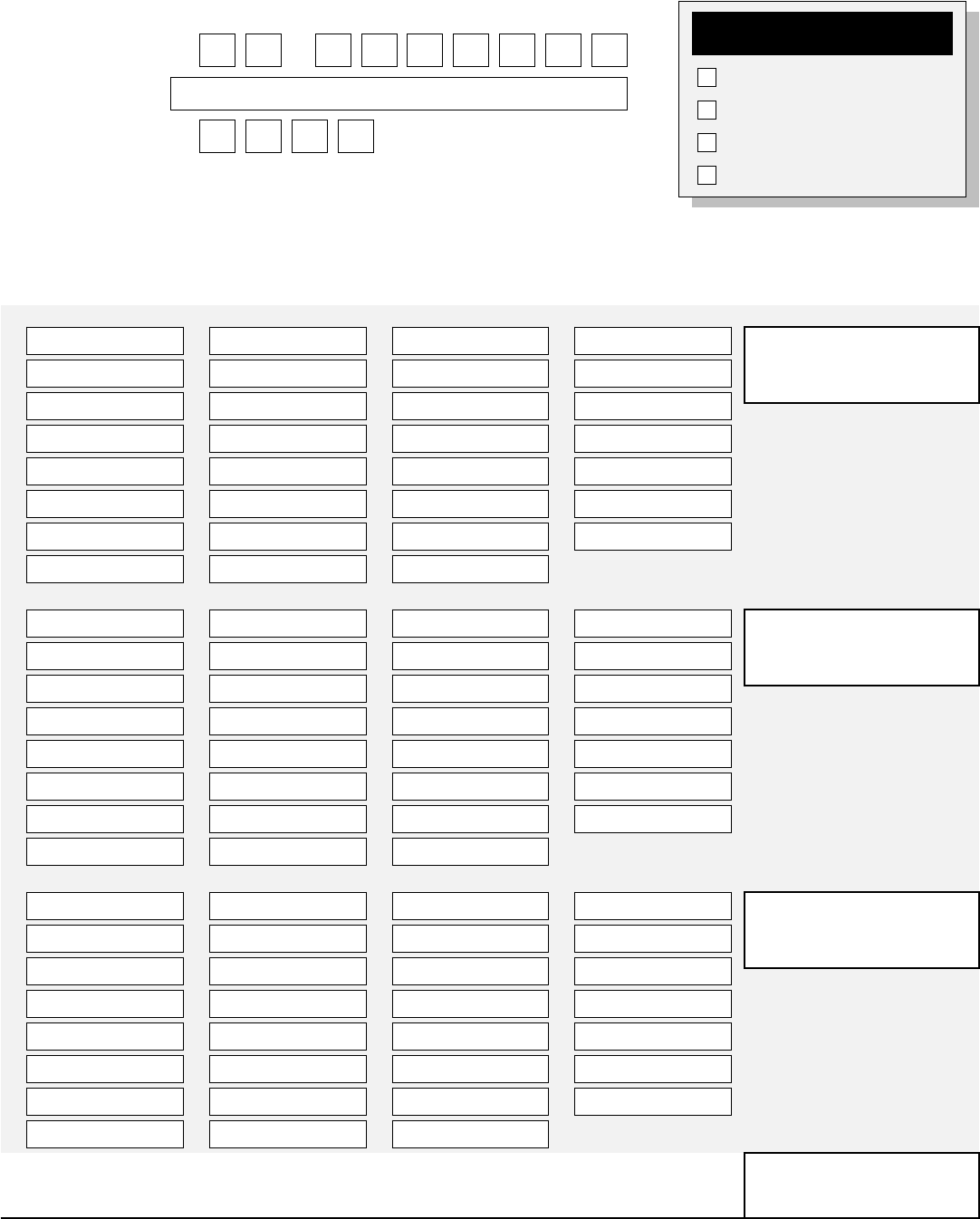

2023 Form 941 Schedule B

2023 Form 941 Schedule B - July 22, 2023 5:00 a.m. This includes medicare, social security, and federal income taxes. Reserve assets totaled $246,206 million as of the end of that week, compared to $247,977 million as of the end of the prior week. Businesses seeking a solution for getting caught up on their quarterly 941 filings can benefit greatly from this. This will help taxpayers feel more prepared when it is time to meet. If you haven't received a payment. Taxbandits also supports prior year filings of form 941 for 2022, 2021, and 2020. This is the final week the social security administration is sending out payments for july. Enter your tax liability for each month and total liability for the quarter, then go to part 3. Official reserve assets and other foreign currency assets (approximate market value, in us.

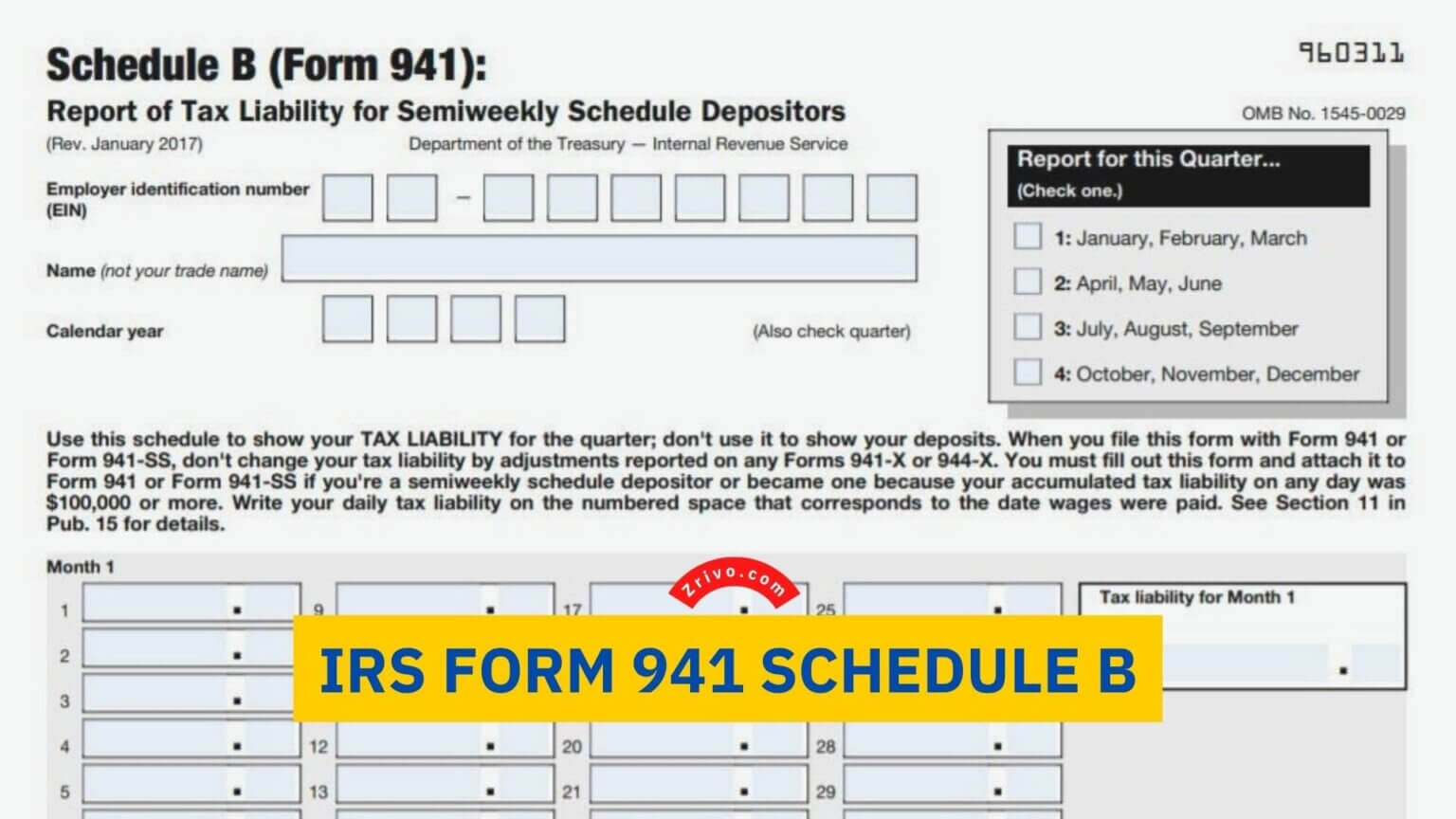

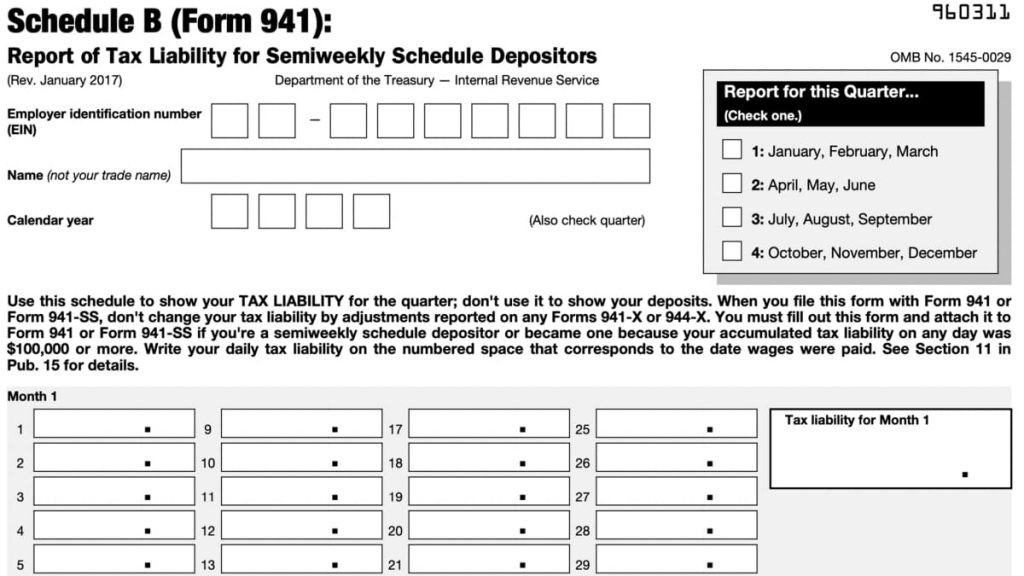

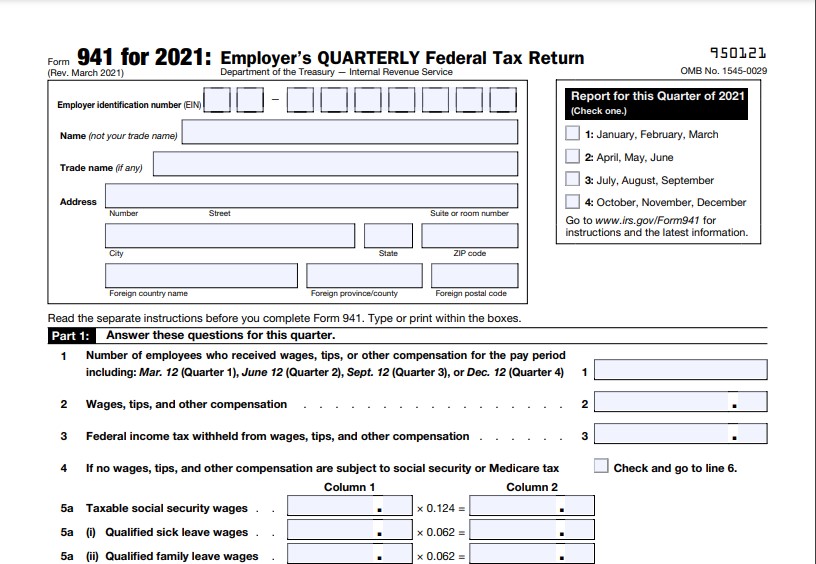

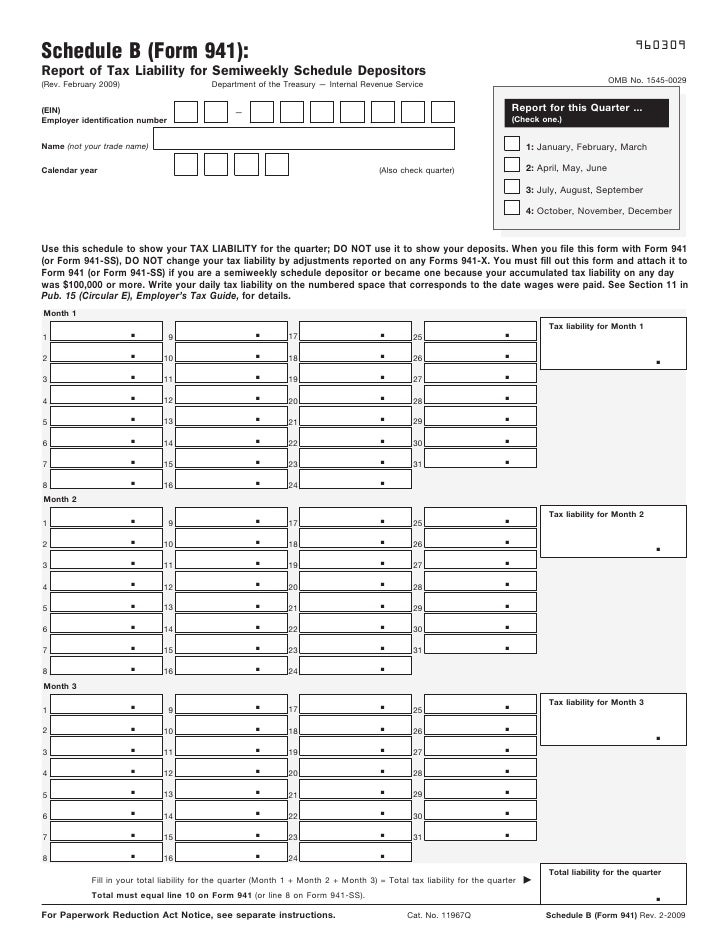

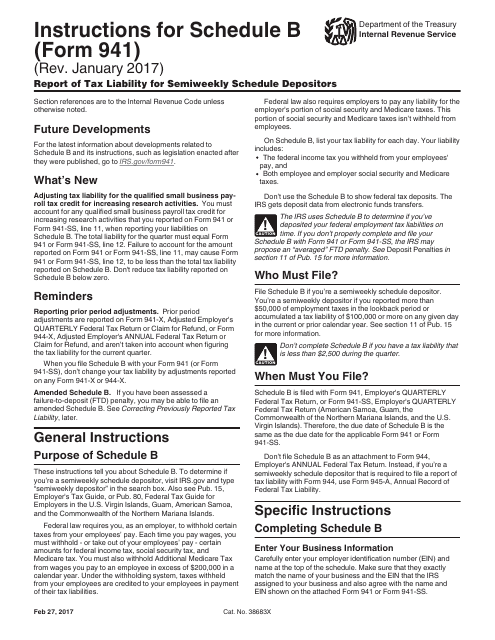

Businesses that withhold taxes from their employee's wages are required to file this form quarterly with the irs. It includes the filing requirements and tips on reconciling and balancing the two forms. Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. January 2017) department of the treasury — internal revenue service 960311 omb no. Updates to the instructions include the removal of information related to the cobra premium assistance tax credit (the lines to claim the credit were already removed from form 941 in june 2022), and information on the increase in the payroll tax credit qualified small business may. Web rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. This is the final week the social security administration is sending out payments for july. It discusses what is new for this version as well as the requirements for completing each form line by line. This will help taxpayers feel more prepared when it is time to meet. Reserve assets data for the latest week.

It discusses what is new for this version as well as the requirements for completing each form line by line. Reserve assets data for the latest week. Businesses seeking a solution for getting caught up on their quarterly 941 filings can benefit greatly from this. Enter your tax liability for each month and total liability for the quarter, then go to part 3. This will help taxpayers feel more prepared when it is time to meet. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents. Report of tax liability for semiweekly schedule depositors (rev. It includes the filing requirements and tips on reconciling and balancing the two forms. Employers engaged in a trade or business who pay compensation. January 2017) department of the treasury — internal revenue service 960311 omb no.

IRS Form 941 Schedule B 2023

Official reserve assets and other foreign currency assets (approximate market value, in us. July 22, 2023 5:00 a.m. Businesses that withhold taxes from their employee's wages are required to file this form quarterly with the irs. Updates to the instructions include the removal of information related to the cobra premium assistance tax credit (the lines to claim the credit were.

Schedule B (Form 941) Report of Tax Liability for Semiweekly Schedule

This will help taxpayers feel more prepared when it is time to meet. Businesses that withhold taxes from their employee's wages are required to file this form quarterly with the irs. As indicated in this table, u.s. Reserve assets totaled $246,206 million as of the end of that week, compared to $247,977 million as of the end of the prior.

2023 Form 941 Generator Create Fillable Form 941 Online

This includes medicare, social security, and federal income taxes. If you haven't received a payment. Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. As indicated in this table, u.s. January 2017) department of the treasury — internal revenue.

941 Form 2023 schedule b Fill online, Printable, Fillable Blank

(check one.) employer identification number (ein) — 1: Updates to the instructions include the removal of information related to the cobra premium assistance tax credit (the lines to claim the credit were already removed from form 941 in june 2022), and information on the increase in the payroll tax credit qualified small business may. Web rock hill, sc / accesswire.

IRS Fillable Form 941 2023

This is the final week the social security administration is sending out payments for july. Updates to the instructions include the removal of information related to the cobra premium assistance tax credit (the lines to claim the credit were already removed from form 941 in june 2022), and information on the increase in the payroll tax credit qualified small business.

Form 941 Printable & Fillable Per Diem Rates 2021

As indicated in this table, u.s. Updates to the instructions include the removal of information related to the cobra premium assistance tax credit (the lines to claim the credit were already removed from form 941 in june 2022), and information on the increase in the payroll tax credit qualified small business may. This will help taxpayers feel more prepared when.

Form 941 Employer's Quarterly Federal Tax Return Form 941 Employer…

Web rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. This will help taxpayers feel more prepared when it is time to meet. January 2017) department of the treasury — internal revenue service 960311 omb no. Reserve assets data.

Form 941 Schedule B Edit, Fill, Sign Online Handypdf

Web rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Reserve assets data for the latest week. Official reserve assets and other foreign currency assets (approximate market value, in us. July 22, 2023 5:00 a.m. Web the treasury department.

ezPaycheck Payroll How to Prepare Quarterly Tax Report

Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023. Web semiweekly schedule depositor, attach schedule b (form 941). Employers engaged in a trade or business who pay compensation. Web the form 941 for 2023 contains no major changes. It discusses what is new for this version as well as.

Download Instructions for IRS Form 941 Schedule B Report of Tax

As indicated in this table, u.s. This will help taxpayers feel more prepared when it is time to meet. Web rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. This is the final week the social security administration is.

January 2017) Department Of The Treasury — Internal Revenue Service 960311 Omb No.

(check one.) employer identification number (ein) — 1: Total must equal line 12. Web the treasury department today released u.s. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents.

As Indicated In This Table, U.s.

Businesses that withhold taxes from their employee's wages are required to file this form quarterly with the irs. July 22, 2023 5:00 a.m. Web schedule b (form 941): Employers engaged in a trade or business who pay compensation.

Web This Webinar Covers The Irs Form 941 And Its Accompanying Form Schedule B For The First Quarter Of 2023.

Web semiweekly schedule depositor, attach schedule b (form 941). You were a monthly schedule depositor for the entire quarter. Reserve assets totaled $246,206 million as of the end of that week, compared to $247,977 million as of the end of the prior week. It discusses what is new for this version as well as the requirements for completing each form line by line.

Enter Your Tax Liability For Each Month And Total Liability For The Quarter, Then Go To Part 3.

Businesses seeking a solution for getting caught up on their quarterly 941 filings can benefit greatly from this. Updates to the instructions include the removal of information related to the cobra premium assistance tax credit (the lines to claim the credit were already removed from form 941 in june 2022), and information on the increase in the payroll tax credit qualified small business may. Taxbandits also supports prior year filings of form 941 for 2022, 2021, and 2020. This includes medicare, social security, and federal income taxes.