2290 Form Instructions

2290 Form Instructions - The irs 2290 form in 2023 must be filed by individuals or businesses who own and operate heavy highway vehicles with a 55,000. Month new vehicle is first used. Enter the tax year and month you put your vehicles on the road during the tax period. Web the 2290 form, also known as the heavy highway vehicle use tax return, is a crucial document for truck owners and operators in the united states. Month form 2290 must be filed. Create an account or log in. Web form 2290 due dates for vehicles placed into service during reporting period. Web general instructions purpose of form use form 2290 for the following actions. And it does apply on highway motor vehicles with a taxable gross weight of 55,000. Upload, modify or create forms.

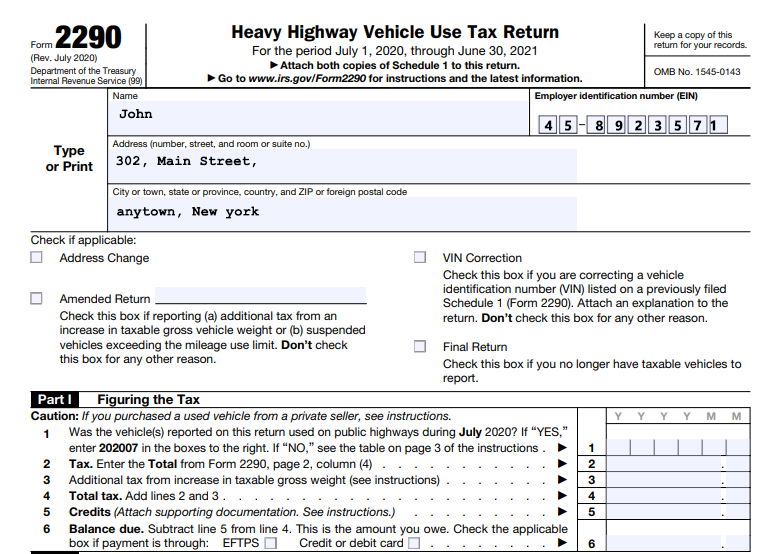

Use coupon code get20b & get 20% off. Month form 2290 must be filed. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through. Form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. Create an account or log in. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period except for any. Ad get ready for tax season deadlines by completing any required tax forms today. Easy, fast, secure & free to try. Web a 2290 form is the heavy highway vehicle use tax (hhvut). If you are a heavy vehicle owner / operator that has a taxable vehicle with a gross weight of 55,000 pounds or more, you must file form 2290.

Web a 2290 form is the heavy highway vehicle use tax (hhvut). Enter the sum you get on page 2, column 4 of form. Web general instructions purpose of form use form 2290 for the following actions. And it does apply on highway motor vehicles with a taxable gross weight of 55,000. Ad get ready for tax season deadlines by completing any required tax forms today. Form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. New customers will create an account and. Web a 2290 form is the heavy highway vehicle use tax (hhvut). Try it for free now! Use coupon code get20b & get 20% off.

Irs 2290 Form Instructions Form Resume Examples a6YnOeWVBg

Form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. Enter the tax year and month you put your vehicles on the road during the tax period. Upload, modify or create forms. Web general instructions purpose of form use form 2290 for the following actions. The irs.

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

Enter the tax year and month you put your vehicles on the road during the tax period. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. The form 2290 is used to pay the heavy vehicle use tax on heavy vehicles (trucks) operating on public highways. Web.

Ssurvivor Irs Form 2290 Schedule 1 Instructions

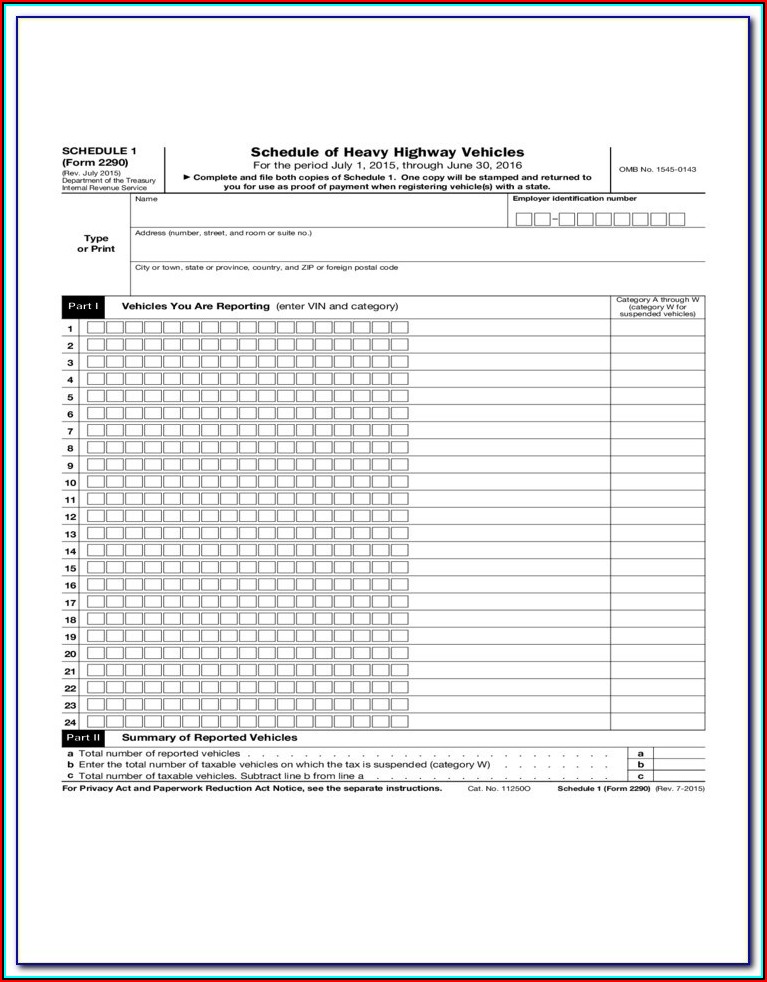

The form 2290 is used to pay the heavy vehicle use tax on heavy vehicles (trucks) operating on public highways. Web the heavy highway vehicle use tax is based on a vehicle gross taxable weight. Web whether you want to pay tax or request a tax suspension, you must follow form 2290 instructions to ensure your truck 2290 tax return.

IRS Form 2290 Instructions for 20232024 How to fill out 2290?

If you are a heavy vehicle owner / operator that has a taxable vehicle with a gross weight of 55,000 pounds or more, you must file form 2290. Web whether you want to pay tax or request a tax suspension, you must follow form 2290 instructions to ensure your truck 2290 tax return is paid on time and to avoid.

Form 2290 Irs Instructions Form Resume Examples A19XaqoY4k

Month form 2290 must be filed. Form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through. Web the form 2290 instructions 2022.

Form 2290 Instructions 2015 Form Resume Examples wRYPvyW24a

Web general instructions purpose of form use form 2290 for the following actions. Web form 2290 due dates for vehicles placed into service during reporting period. If you are a heavy vehicle owner / operator that has a taxable vehicle with a gross weight of 55,000 pounds or more, you must file form 2290. Upload, modify or create forms. Use.

Irs Form 2290 Instructions 2017 Universal Network

Create an account or log in. File form 2290 easily with eform2290.com. And it does apply on highway motor vehicles with a taxable gross weight of 55,000. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through. It must be filed and paid annually for.

File 20222023 Form 2290 Electronically 2290 Schedule 1

Use coupon code get20b & get 20% off. Current customers can simply log in to access their account and start filing. The form 2290 is used to pay the heavy vehicle use tax on heavy vehicles (trucks) operating on public highways. Web the 2290 form, also known as the heavy highway vehicle use tax return, is a crucial document for.

General instructions for form 2290

Enter the tax year and month you put your vehicles on the road during the tax period. If you are a heavy vehicle owner / operator that has a taxable vehicle with a gross weight of 55,000 pounds or more, you must file form 2290. Create an account or log in. Use coupon code get20b & get 20% off. Form.

File IRS 2290 Form Online for 20222023 Tax Period

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. • figure and pay the tax due on highway motor vehicles used during the period with a taxable gross. New customers will create an account and. The irs mandates that everyone. Web general instructions purpose of form use form 2290 for the following actions.

Web Form 2290 Due Dates For Vehicles Placed Into Service During Reporting Period.

The irs 2290 form in 2023 must be filed by individuals or businesses who own and operate heavy highway vehicles with a 55,000. Web the 2290 form, also known as the heavy highway vehicle use tax return, is a crucial document for truck owners and operators in the united states. Ad get ready for tax season deadlines by completing any required tax forms today. It must be filed and paid annually for every truck that drives on public highways and weighs over 55,000 lbs.

Web The Form 2290 Instructions 2022 Apply To The Relevant Tax Year.

Web general instructions purpose of form use form 2290 for the following actions. With accurate form 2290 instructions, you’ll know how to report mileage on taxable vehicles. Try it for free now! Upload, modify or create forms.

Easy, Fast, Secure & Free To Try.

Month new vehicle is first used. And it does apply on highway motor vehicles with a taxable gross weight of 55,000. Web steps to file form 2290 step 1: Use coupon code get20b & get 20% off.

Web A 2290 Form Is The Heavy Highway Vehicle Use Tax (Hhvut).

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period except for any. The form 2290 is used to pay the heavy vehicle use tax on heavy vehicles (trucks) operating on public highways. The irs mandates that everyone.