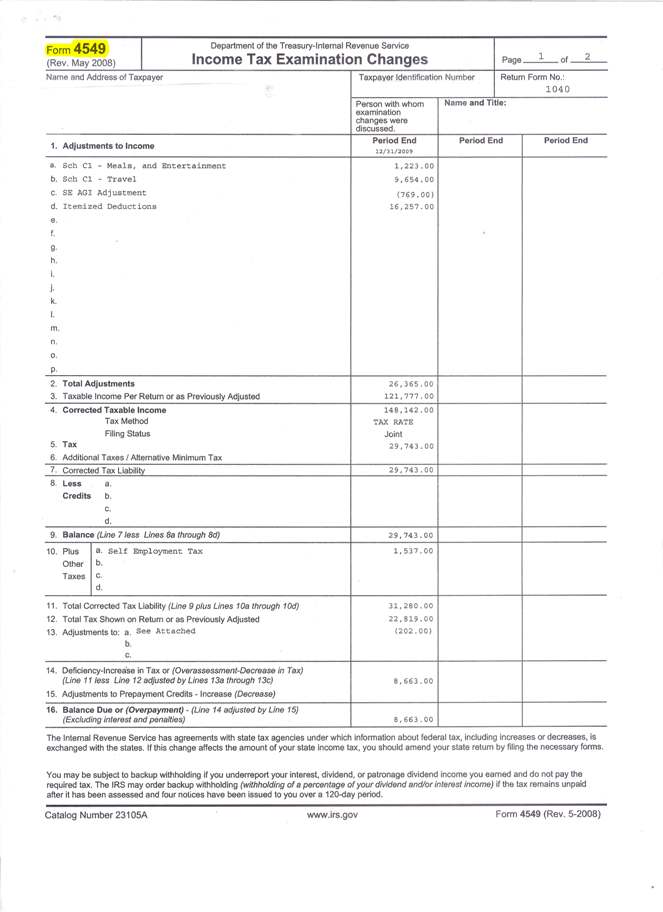

4549 Tax Form

4549 Tax Form - If your return (s) are. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. Form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which. It can be used to claim children and other relatives as deductions for tax purposes. Edit, sign and print tax forms on any device with uslegalforms. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the. This letter is used by the office of. Web how it works open the form 4549 signature and follow the instructions easily sign the 4549 with your finger send filled & signed form 4549 or save rate the irs form 4549. If you want to pay off your tax debt through an installment. The agency may think you failed to.

Complete, sign, print and send your tax documents easily with us legal forms. Get ready for tax season deadlines by completing any required tax forms today. This form means the irs is questioning your tax return. Web form 4549 department of the treasury lnternal revenue service report of income tax examination changes taxpayer identification number i return form number. December 1, 2022 audit reconsiderations did you get a notice from the irs saying your tax return was audited. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. Edit, sign and print tax forms on any device with uslegalforms. Web the irs form 4549 is the form in which you declare your dependents. January 12, 2022 | last updated: Form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which.

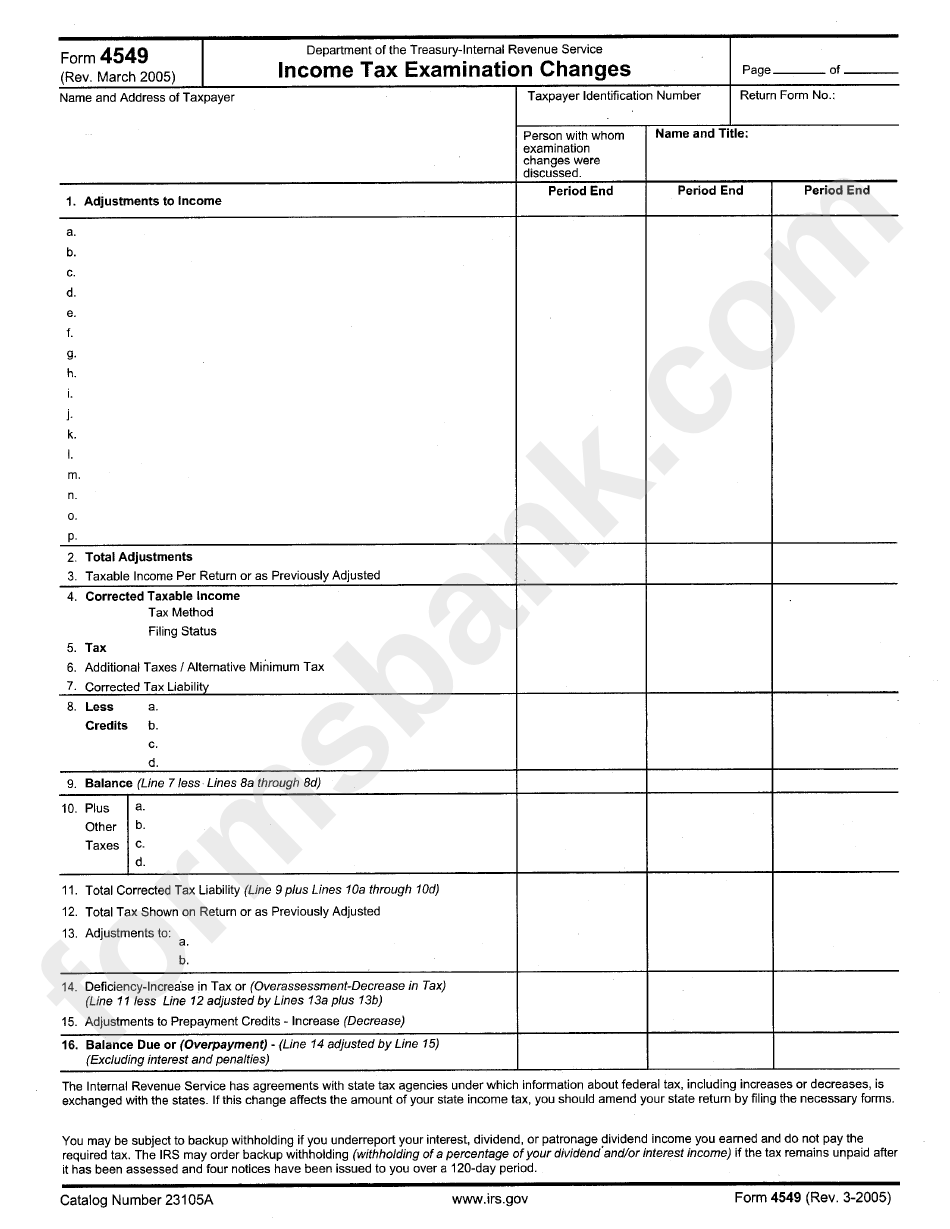

Web a copy of your audit report (irs form 4549). Once enrolled in eftps, you. January 12, 2022 | last updated: This letter is used by the office of. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. For optimal functionality, save the form to your computer before completing or printing. Form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which. Complete, sign, print and send your tax documents easily with us legal forms. Web the title of irs form 4549 is income tax examination changes, which of course signifies that your income tax return is being changed, often for the worse. Web how it works open the form 4549 signature and follow the instructions easily sign the 4549 with your finger send filled & signed form 4549 or save rate the irs form 4549.

Audit Form 4549 Tax Lawyer Response to IRS Determination

Web the title of irs form 4549 is income tax examination changes, which of course signifies that your income tax return is being changed, often for the worse. Web form 4549, income tax examination changes, can be a refund claim thomson reuters tax & accounting may 30, 2019 · 5 minute read chief counsel advice. Agreed rars require the taxpayer’s.

IRS Audit Letter 692 Sample 1

If your return (s) are. Web a regular agreed report (form 4549) may contain up to three tax years. It can be used to claim children and other relatives as deductions for tax purposes. This form means the irs is questioning your tax return. Get ready for tax season deadlines by completing any required tax forms today.

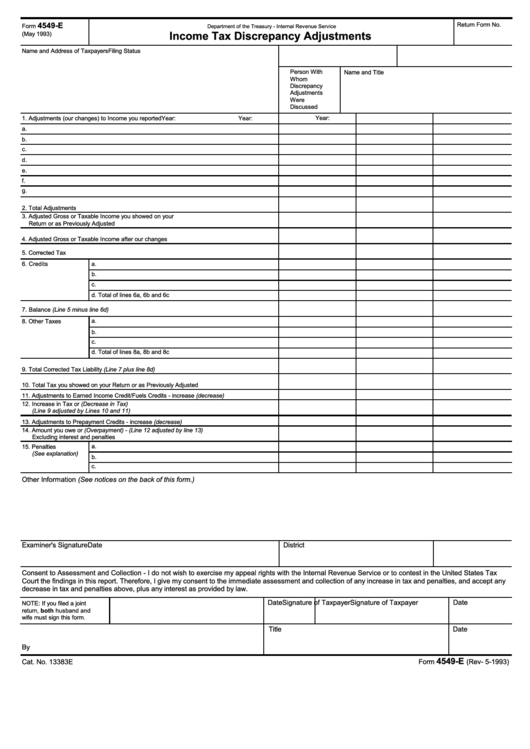

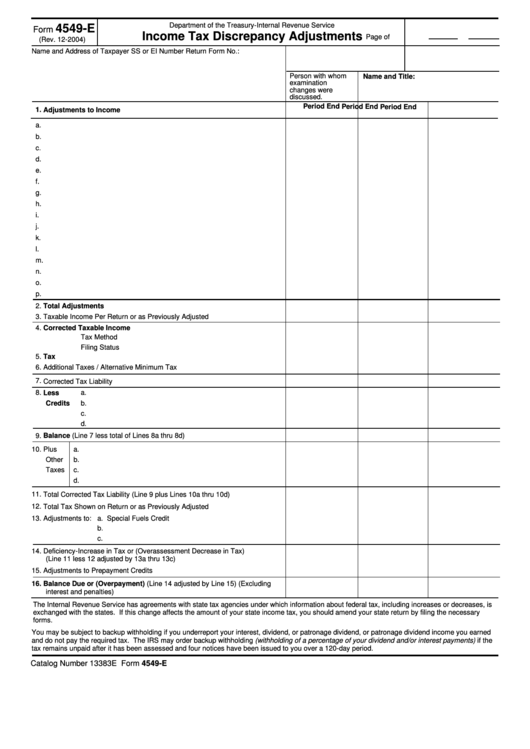

Fillable Form 4549E Tax Discrepancy Adjustments Form

Web the title of irs form 4549 is income tax examination changes, which of course signifies that your income tax return is being changed, often for the worse. Web form 4549 department of the treasury lnternal revenue service report of income tax examination changes taxpayer identification number i return form number. This letter is used by the office of. Web.

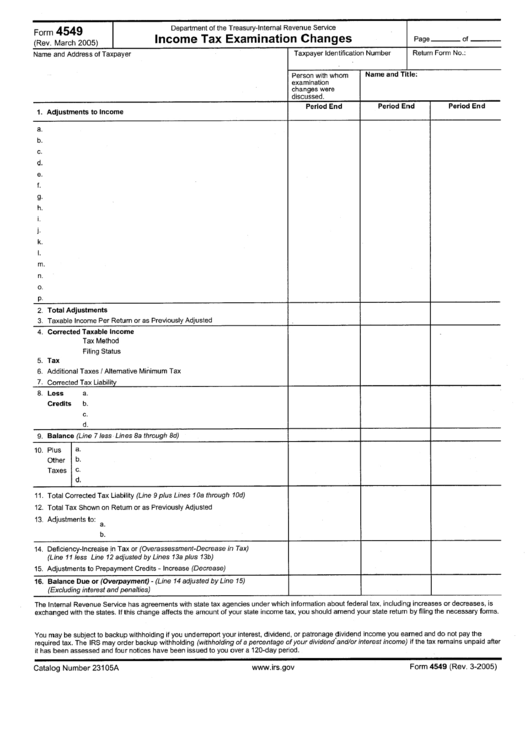

Form 4549 Tax Examination Changes March 2005 printable pdf

January 12, 2022 | last updated: Form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which. Web the title of irs form 4549 is income tax examination changes, which of course signifies that your income tax return is being changed, often for the worse. Web a copy of your audit report (irs.

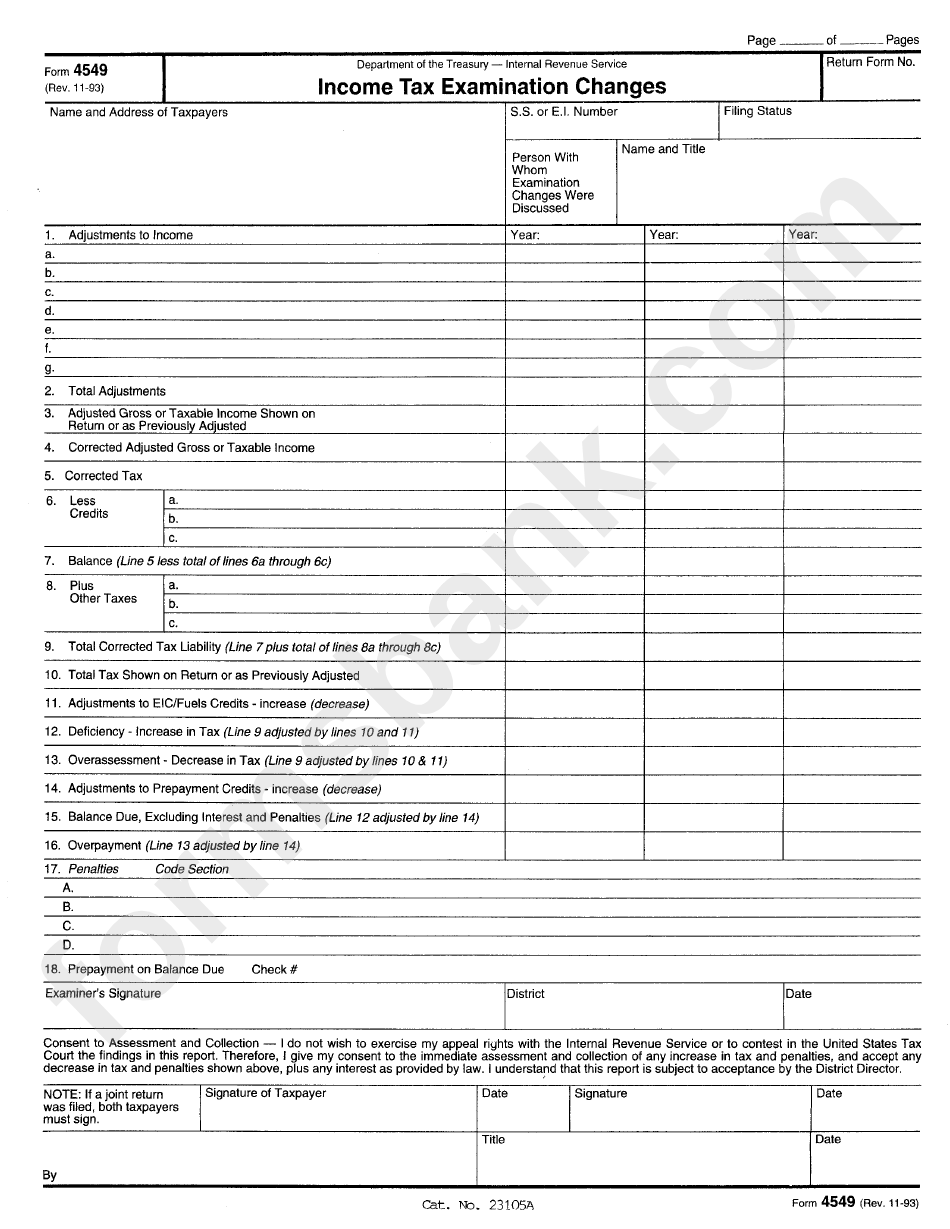

Form 4549 Tax Examination Changes Internal Revenue Service

Web significant hardship as a result of a tax problem. It can be used to claim children and other relatives as deductions for tax purposes. Web the irs form 4549 is the form in which you declare your dependents. Complete, sign, print and send your tax documents easily with us legal forms. Agreed rars require the taxpayer’s signature and include.

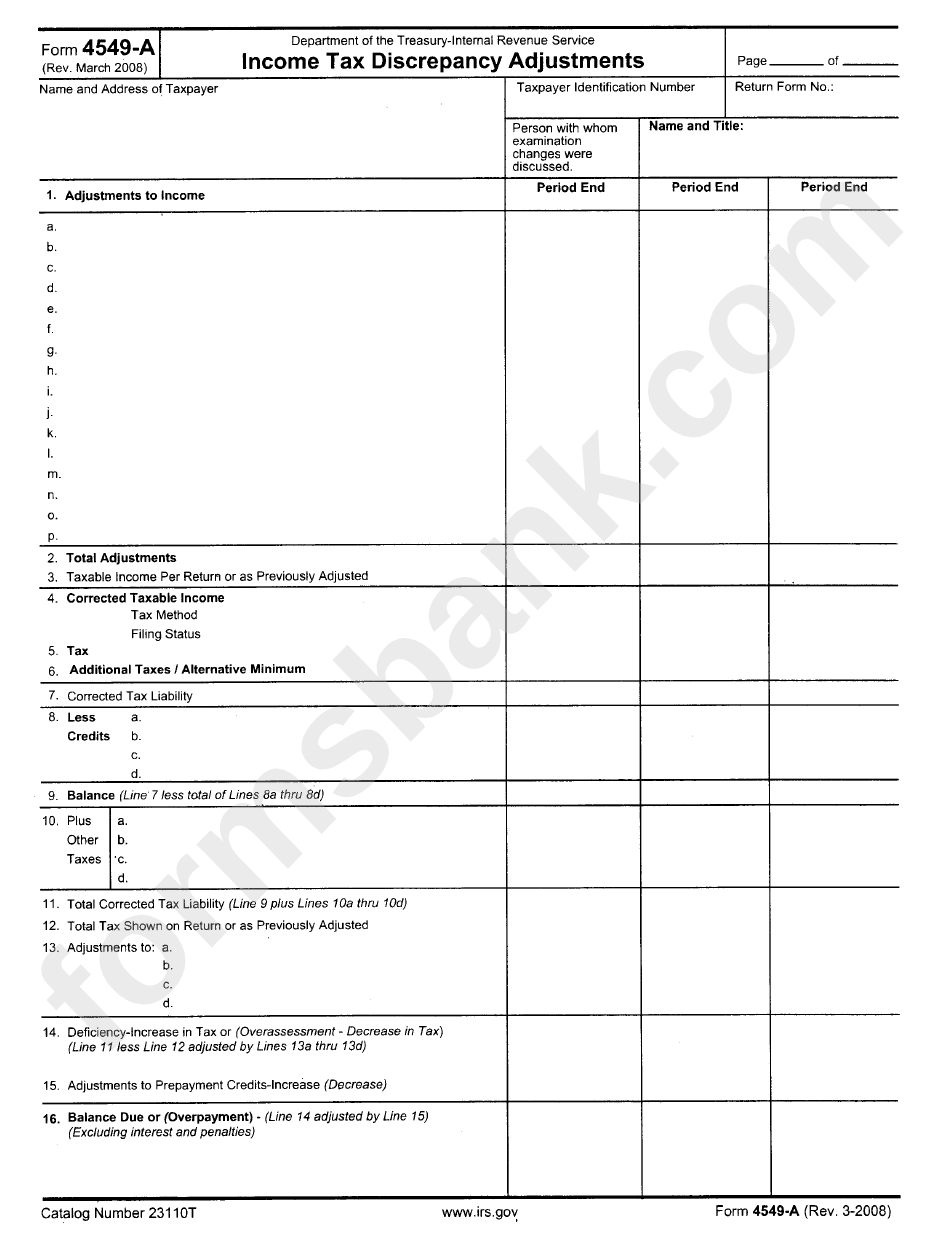

Form 4549A Tax Discrepancy Adjustments printable pdf download

If you want to pay off your tax debt through an installment. Web significant hardship as a result of a tax problem. It can be used to claim children and other relatives as deductions for tax purposes. Complete, edit or print tax forms instantly. Web form 4549, income tax examination changes, can be a refund claim thomson reuters tax &.

Fillable Form 4549E Tax Discrepancy Adjustments Internal

Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. Form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited..

IRS Notices Colonial Tax Consultants

Web the title of irs form 4549 is income tax examination changes, which of course signifies that your income tax return is being changed, often for the worse. Once enrolled in eftps, you. This form means the irs is questioning your tax return. If your return (s) are. Download blank or fill out online in pdf format.

Form 4549 Tax Examination Changes March 2005 printable pdf

Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the. The agency may think you failed to. Web a copy of your audit report (irs form 4549). Download blank or fill out online in pdf format. Web the title of irs form 4549 is income tax examination changes, which of course signifies that.

13 FORM 4549 PAYMENT FormPayment

Web the title of irs form 4549 is income tax examination changes, which of course signifies that your income tax return is being changed, often for the worse. Once enrolled in eftps, you. Form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which. If your return (s) are. Agreed rars require the.

Web Significant Hardship As A Result Of A Tax Problem.

Complete, edit or print tax forms instantly. Web how it works open the form 4549 signature and follow the instructions easily sign the 4549 with your finger send filled & signed form 4549 or save rate the irs form 4549. Web the irs form 4549 is the form in which you declare your dependents. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited.

Web The Title Of Irs Form 4549 Is Income Tax Examination Changes, Which Of Course Signifies That Your Income Tax Return Is Being Changed, Often For The Worse.

If you want to pay off your tax debt through an installment. Once enrolled in eftps, you. For optimal functionality, save the form to your computer before completing or printing. Web a regular agreed report (form 4549) may contain up to three tax years.

Web A Copy Of Your Audit Report (Irs Form 4549).

Form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which. Web form 4549 department of the treasury lnternal revenue service report of income tax examination changes taxpayer identification number i return form number. It can be used to claim children and other relatives as deductions for tax purposes. Get ready for tax season deadlines by completing any required tax forms today.

This Letter Is Used By The Office Of.

Web form 4549, income tax examination changes, can be a refund claim thomson reuters tax & accounting may 30, 2019 · 5 minute read chief counsel advice. Edit, sign and print tax forms on any device with uslegalforms. January 12, 2022 | last updated: This form means the irs is questioning your tax return.