8822 B Form

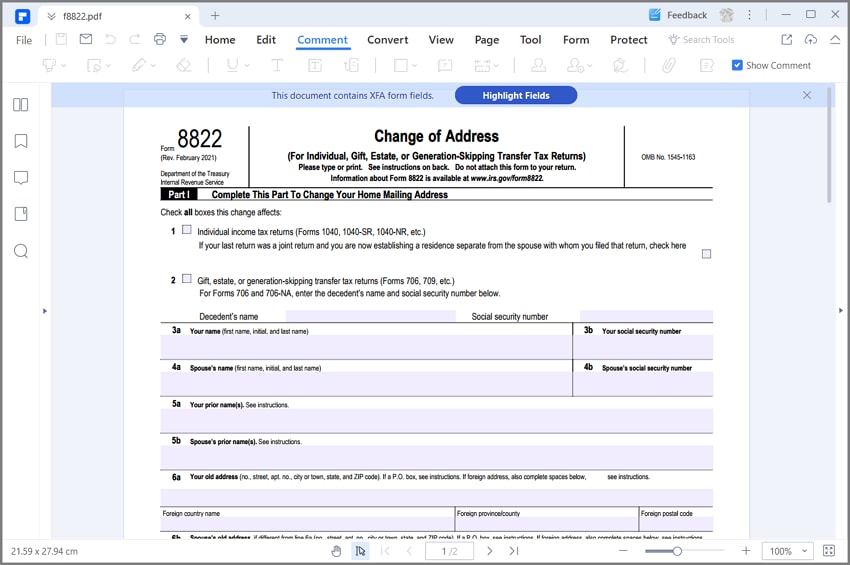

8822 B Form - Web form 8822 (such as legislation enacted after we release it) is at www.irs.gov/form8822. If this change also affects the mailing address for your children who filed income tax returns, complete and file a However, you must report changes in the identity of your responsible party to the irs within 60 days. Only businesses with an employer identification number (ein) can use this form for changes to their address and responsible party. Web how it works browse for the 8822 b customize and esign irs form 8822 printable send out signed irs business name change or print it rate the irs form 8822 b printable 4.7 satisfied 215 votes handy tips for filling out irs 8822 b online printing and scanning is no longer the best way to manage documents. Purpose of form you can use form 8822 to notify the internal revenue service if you changed your home mailing address. Filling out form 8822 form 8822 requires only basic information, including: Generally, it takes 4 to 6 weeks to process your address or responsible party change. The type of tax return you file, your old mailing address and your new mailing address.

Generally, it takes 4 to 6 weeks to process your address or responsible party change. Only businesses with an employer identification number (ein) can use this form for changes to their address and responsible party. The type of tax return you file, your old mailing address and your new mailing address. Web how it works browse for the 8822 b customize and esign irs form 8822 printable send out signed irs business name change or print it rate the irs form 8822 b printable 4.7 satisfied 215 votes handy tips for filling out irs 8822 b online printing and scanning is no longer the best way to manage documents. Web form 8822 (such as legislation enacted after we release it) is at www.irs.gov/form8822. However, you must report changes in the identity of your responsible party to the irs within 60 days. Purpose of form you can use form 8822 to notify the internal revenue service if you changed your home mailing address. Filling out form 8822 form 8822 requires only basic information, including: If this change also affects the mailing address for your children who filed income tax returns, complete and file a

Filling out form 8822 form 8822 requires only basic information, including: The type of tax return you file, your old mailing address and your new mailing address. However, you must report changes in the identity of your responsible party to the irs within 60 days. Generally, it takes 4 to 6 weeks to process your address or responsible party change. Web how it works browse for the 8822 b customize and esign irs form 8822 printable send out signed irs business name change or print it rate the irs form 8822 b printable 4.7 satisfied 215 votes handy tips for filling out irs 8822 b online printing and scanning is no longer the best way to manage documents. Web form 8822 (such as legislation enacted after we release it) is at www.irs.gov/form8822. Only businesses with an employer identification number (ein) can use this form for changes to their address and responsible party. If this change also affects the mailing address for your children who filed income tax returns, complete and file a Purpose of form you can use form 8822 to notify the internal revenue service if you changed your home mailing address.

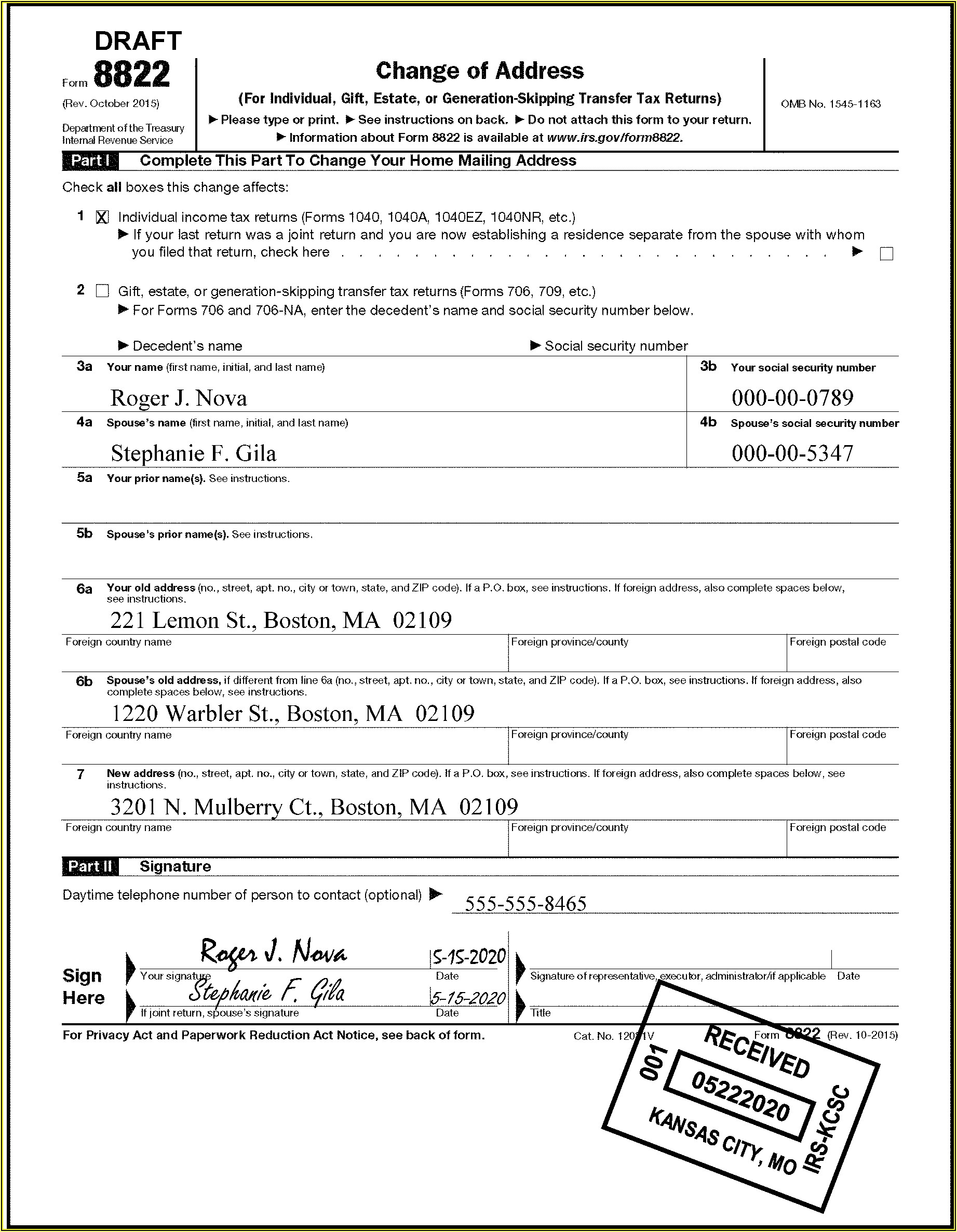

IRS Form 8822 The Best Way to Fill it

Generally, it takes 4 to 6 weeks to process your address or responsible party change. The type of tax return you file, your old mailing address and your new mailing address. If this change also affects the mailing address for your children who filed income tax returns, complete and file a Web form 8822 (such as legislation enacted after we.

Gallery of Irs form 8822 B 2017 Unique 1040ez Dependent Worksheet

Web how it works browse for the 8822 b customize and esign irs form 8822 printable send out signed irs business name change or print it rate the irs form 8822 b printable 4.7 satisfied 215 votes handy tips for filling out irs 8822 b online printing and scanning is no longer the best way to manage documents. However, you.

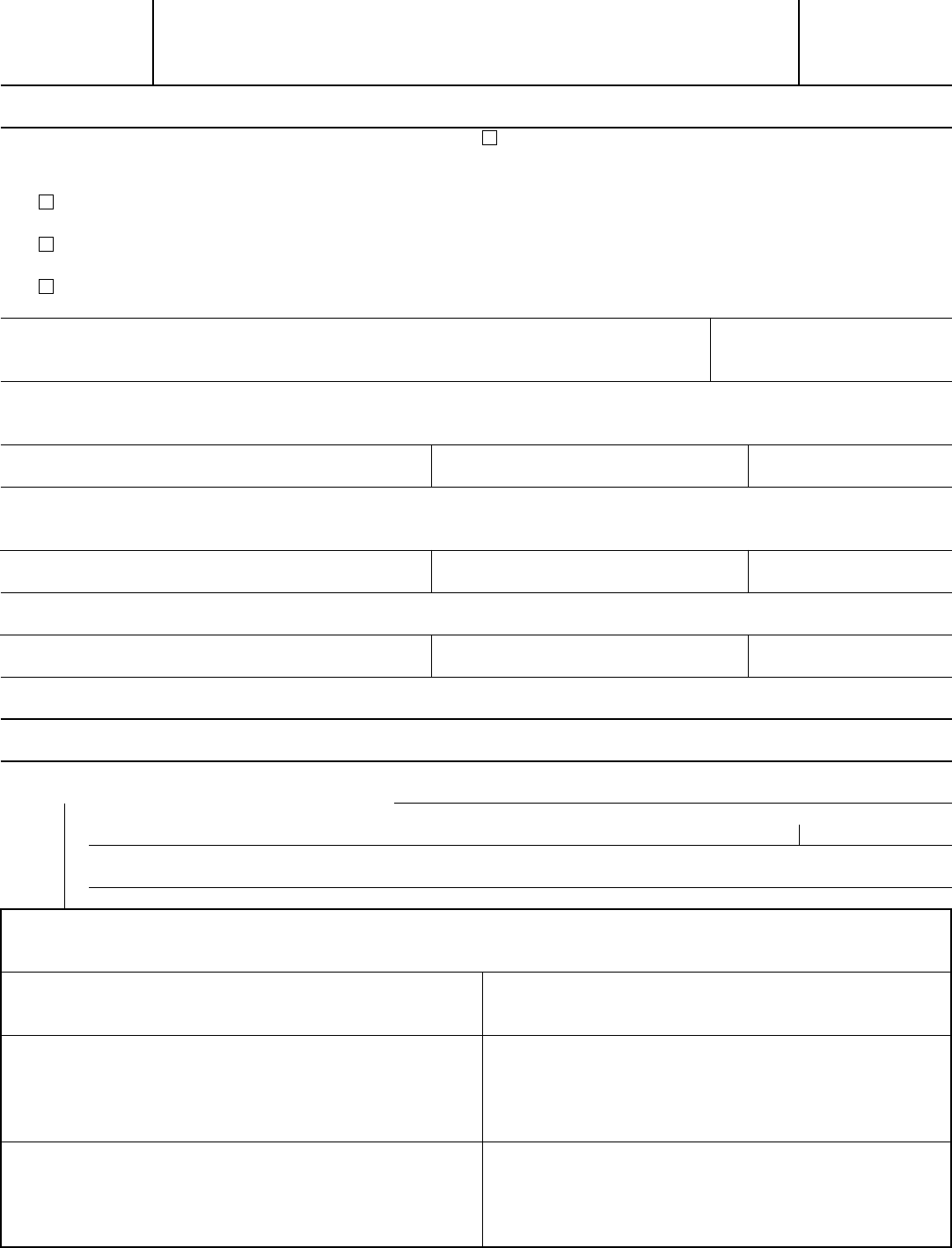

Form 8822 B 2019 Fillable and Editable PDF Template

Filling out form 8822 form 8822 requires only basic information, including: If this change also affects the mailing address for your children who filed income tax returns, complete and file a Web form 8822 (such as legislation enacted after we release it) is at www.irs.gov/form8822. Purpose of form you can use form 8822 to notify the internal revenue service if.

Form 8822B — How to complete and submit IRS Form 8822B

However, you must report changes in the identity of your responsible party to the irs within 60 days. The type of tax return you file, your old mailing address and your new mailing address. Only businesses with an employer identification number (ein) can use this form for changes to their address and responsible party. Filling out form 8822 form 8822.

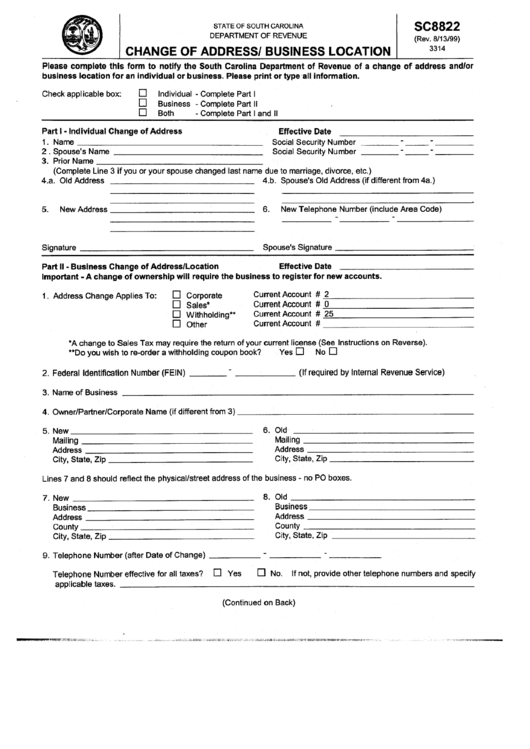

Form Sc 8822 Change Of Address / Business Location printable pdf download

Generally, it takes 4 to 6 weeks to process your address or responsible party change. Only businesses with an employer identification number (ein) can use this form for changes to their address and responsible party. However, you must report changes in the identity of your responsible party to the irs within 60 days. The type of tax return you file,.

Form 8822b Edit, Fill, Sign Online Handypdf

However, you must report changes in the identity of your responsible party to the irs within 60 days. Generally, it takes 4 to 6 weeks to process your address or responsible party change. Only businesses with an employer identification number (ein) can use this form for changes to their address and responsible party. Filling out form 8822 form 8822 requires.

Gallery of Irs form 8822 B 2017 Best Of Power attorney form Mississippi

Only businesses with an employer identification number (ein) can use this form for changes to their address and responsible party. Filling out form 8822 form 8822 requires only basic information, including: However, you must report changes in the identity of your responsible party to the irs within 60 days. Web how it works browse for the 8822 b customize and.

Fill Free fillable Form 8822B Change of Address or Responsible

Generally, it takes 4 to 6 weeks to process your address or responsible party change. Purpose of form you can use form 8822 to notify the internal revenue service if you changed your home mailing address. Only businesses with an employer identification number (ein) can use this form for changes to their address and responsible party. The type of tax.

Printable Irs Form 8822 B Form Resume Examples X42M7drYkG

Generally, it takes 4 to 6 weeks to process your address or responsible party change. Web how it works browse for the 8822 b customize and esign irs form 8822 printable send out signed irs business name change or print it rate the irs form 8822 b printable 4.7 satisfied 215 votes handy tips for filling out irs 8822 b.

How to fill out form 8822 B 2020 YouTube

Filling out form 8822 form 8822 requires only basic information, including: Generally, it takes 4 to 6 weeks to process your address or responsible party change. Web how it works browse for the 8822 b customize and esign irs form 8822 printable send out signed irs business name change or print it rate the irs form 8822 b printable 4.7.

Web How It Works Browse For The 8822 B Customize And Esign Irs Form 8822 Printable Send Out Signed Irs Business Name Change Or Print It Rate The Irs Form 8822 B Printable 4.7 Satisfied 215 Votes Handy Tips For Filling Out Irs 8822 B Online Printing And Scanning Is No Longer The Best Way To Manage Documents.

Filling out form 8822 form 8822 requires only basic information, including: The type of tax return you file, your old mailing address and your new mailing address. Generally, it takes 4 to 6 weeks to process your address or responsible party change. Purpose of form you can use form 8822 to notify the internal revenue service if you changed your home mailing address.

Only Businesses With An Employer Identification Number (Ein) Can Use This Form For Changes To Their Address And Responsible Party.

However, you must report changes in the identity of your responsible party to the irs within 60 days. If this change also affects the mailing address for your children who filed income tax returns, complete and file a Web form 8822 (such as legislation enacted after we release it) is at www.irs.gov/form8822.