8863 Form 2020

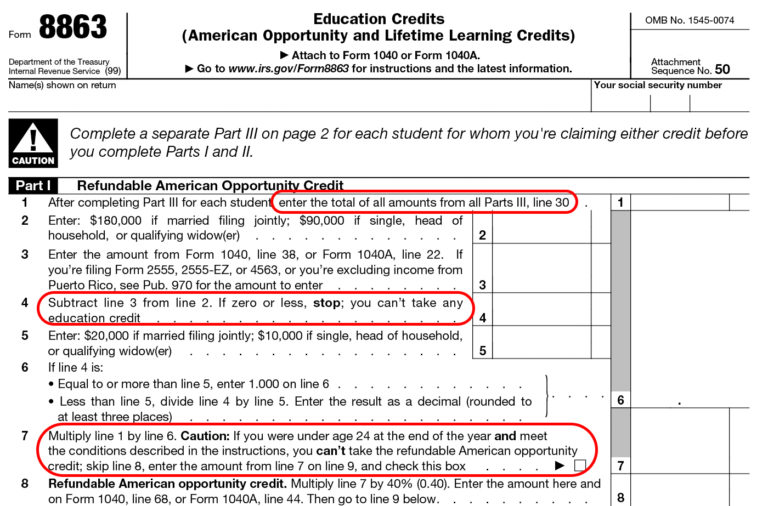

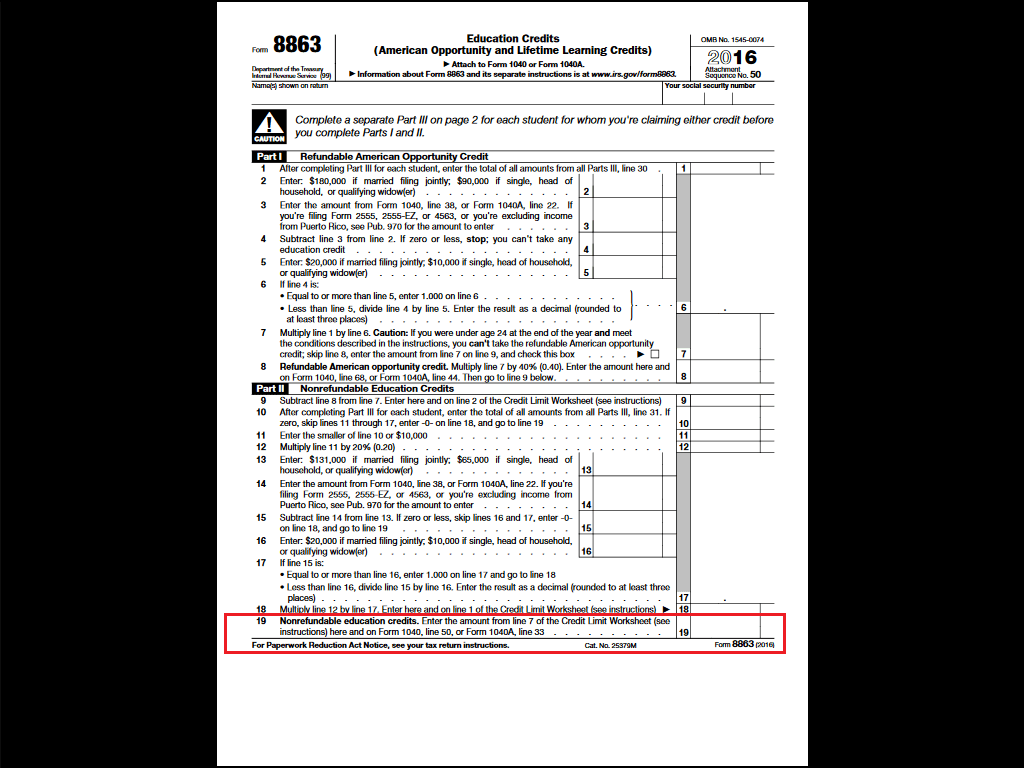

8863 Form 2020 - 50 name(s) shown on return your social security number Enter the amount from form 8863, line 18. Who can claim an education credit. Form 8863 typically accompanies your 1040 form, and this particular document contains information on expenses paid for qualifying students, along with their name and social security number. Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2020 form 8863: • enter $10,000 or your actual expenses, whichever is smaller, then multiply this number by 20 percent. The tax credit is calculated by applying 100 percent of the first $2,000 in expenses plus 25 percent of the excess. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. You may be able to claim an education credit if you, your spouse, or a dependent you claim on your tax return was a student enrolled at or attending an eligible educational institution. The irs offers a few educational tax credits students can take advantage of to help offset the high cost of education in the u.s.

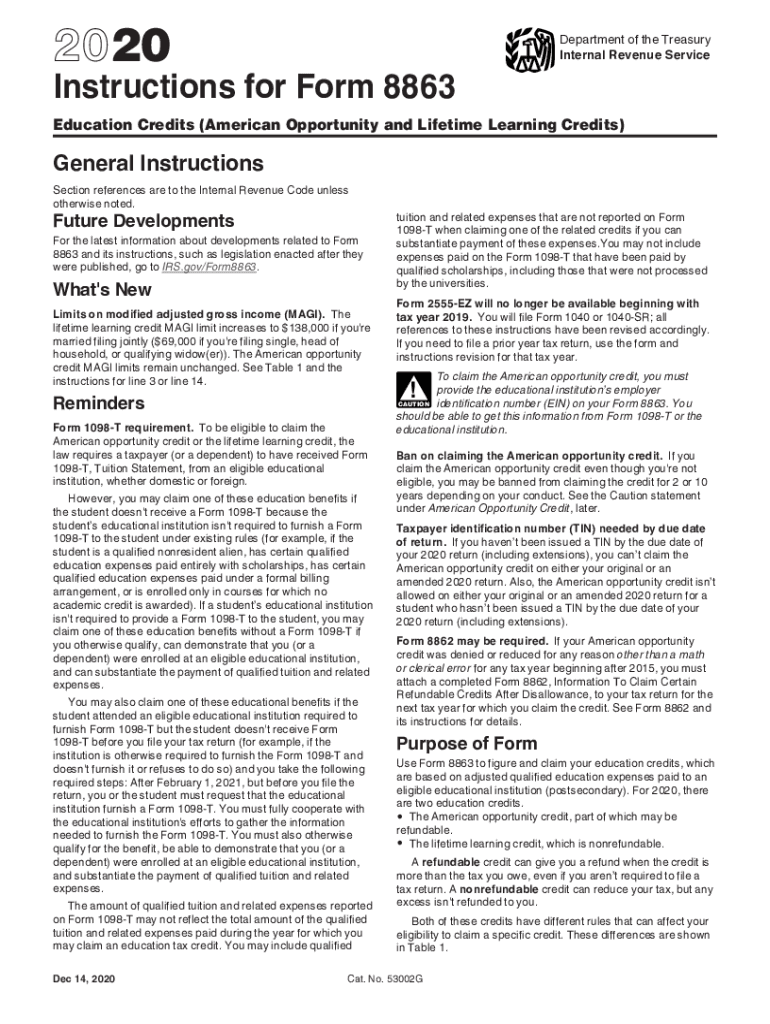

Web • to compute the amount of your lifetime learning credit, enter the name, social security number, and qualified expenses of each applicable student on irs form 8863. 50 name(s) shown on return your social security number For 2020, the credits are based on the amount of You may be able to claim an education credit if you, your spouse, or a dependent you claim on your tax return was a student enrolled at or attending an eligible educational institution. Education credits (american opportunity and lifetime learning credits) 2019 inst 8863 Web what is form 8863? Education credits (american opportunity and lifetime learning credits) 2020 inst 8863: The tax credit is calculated by applying 100 percent of the first $2,000 in expenses plus 25 percent of the excess. Web identification number (ein) on your form 8863. Web irs form 8863 is a two page form that entitles eligible tax payers for the american opportunity tax credit.

Web what is form 8863? Web identification number (ein) on your form 8863. Form 8863 typically accompanies your 1040 form, and this particular document contains information on expenses paid for qualifying students, along with their name and social security number. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Enter the amount from form 8863, line 18. Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2020 form 8863: Web irs form 8863 is a two page form that entitles eligible tax payers for the american opportunity tax credit. You may be able to claim an education credit if you, your spouse, or a dependent you claim on your tax return was a student enrolled at or attending an eligible educational institution. Go to www.irs.gov/form8863 for instructions and the latest information. For 2020, the credits are based on the amount of

NS 8863

This includes the american opportunity credit (aotc) and the lifetime learning credit (llc). • enter $10,000 or your actual expenses, whichever is smaller, then multiply this number by 20 percent. Education credits (american opportunity and lifetime learning credits) 2020 inst 8863: Form 8863 typically accompanies your 1040 form, and this particular document contains information on expenses paid for qualifying students,.

Form 8863Education Credits

Form 8863 typically accompanies your 1040 form, and this particular document contains information on expenses paid for qualifying students, along with their name and social security number. Web identification number (ein) on your form 8863. This includes the american opportunity credit (aotc) and the lifetime learning credit (llc). • enter $10,000 or your actual expenses, whichever is smaller, then multiply.

Form 8863 Instructions Information On The Education 1040 Form Printable

Education credits (american opportunity and lifetime learning credits) 2019 inst 8863 Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2020 form 8863: Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. For 2020, the credits are based on.

Fill Free fillable Form 8863 Education Credits 2019 PDF form

Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. • enter $10,000 or your actual expenses, whichever is smaller, then multiply this number by 20 percent. Web • to compute the amount of your lifetime learning credit, enter the name, social security number, and qualified.

Form 8863 Education Credits (American Opportunity and Lifetime

Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). This includes the american opportunity credit (aotc) and the lifetime learning credit (llc). The irs offers a few educational tax credits students can take advantage of to help offset the high cost of education in the u.s. Who can claim an.

2020 Form IRS Instruction 8863 Fill Online, Printable, Fillable, Blank

Enter the amount from form 8863, line 18. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. You may be able to claim an education credit if you, your spouse, or a dependent you claim on your tax return was a student.

IRS 8863 Line 23 Fill and Sign Printable Template Online US Legal Forms

Education credits (american opportunity and lifetime learning credits) 2019 inst 8863 The irs offers a few educational tax credits students can take advantage of to help offset the high cost of education in the u.s. This includes the american opportunity credit (aotc) and the lifetime learning credit (llc). Web identification number (ein) on your form 8863. 50 name(s) shown on.

AOTC & LLC Two Higher Education Tax Benefits For US Taxpayers The

Education credits (american opportunity and lifetime learning credits) 2020 inst 8863: Web what is form 8863? Form 8863 typically accompanies your 1040 form, and this particular document contains information on expenses paid for qualifying students, along with their name and social security number. Web identification number (ein) on your form 8863. The tax credit is calculated by applying 100 percent.

IRS Form8863 Foster Blog

Education credits (american opportunity and lifetime learning credits) 2019 inst 8863 Web irs form 8863 is a two page form that entitles eligible tax payers for the american opportunity tax credit. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Form 8863 typically accompanies your 1040 form, and this particular.

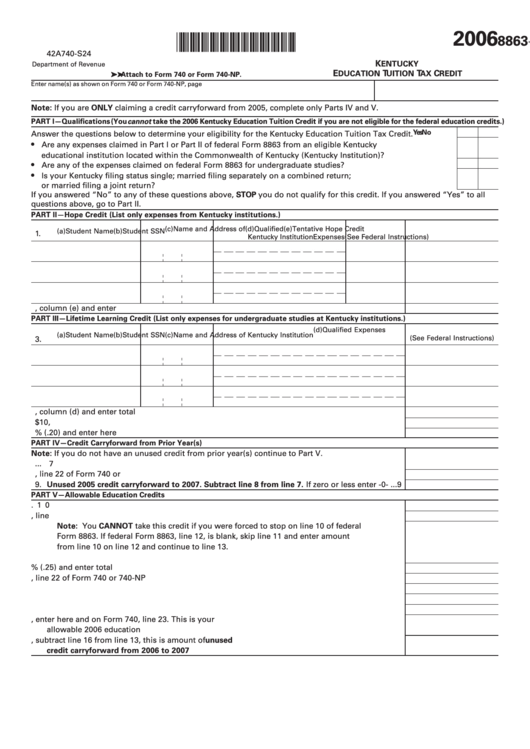

Form 8863K Education Tuition Tax Credit printable pdf download

This includes the american opportunity credit (aotc) and the lifetime learning credit (llc). Go to www.irs.gov/form8863 for instructions and the latest information. Web identification number (ein) on your form 8863. Education credits (american opportunity and lifetime learning credits) 2020 inst 8863: Web what is form 8863?

Education Credits (American Opportunity And Lifetime Learning Credits) 2019 Inst 8863

The tax credit is calculated by applying 100 percent of the first $2,000 in expenses plus 25 percent of the excess. Form 8863 typically accompanies your 1040 form, and this particular document contains information on expenses paid for qualifying students, along with their name and social security number. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Who can claim an education credit.

Go To Www.irs.gov/Form8863 For Instructions And The Latest Information.

The irs offers a few educational tax credits students can take advantage of to help offset the high cost of education in the u.s. This includes the american opportunity credit (aotc) and the lifetime learning credit (llc). Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2020 form 8863: Web irs form 8863 is a two page form that entitles eligible tax payers for the american opportunity tax credit.

Education Credits (American Opportunity And Lifetime Learning Credits) 2020 Inst 8863:

Enter the amount from form 8863, line 18. For 2020, the credits are based on the amount of Web • to compute the amount of your lifetime learning credit, enter the name, social security number, and qualified expenses of each applicable student on irs form 8863. • enter $10,000 or your actual expenses, whichever is smaller, then multiply this number by 20 percent.

You May Be Able To Claim An Education Credit If You, Your Spouse, Or A Dependent You Claim On Your Tax Return Was A Student Enrolled At Or Attending An Eligible Educational Institution.

Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Web what is form 8863? Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Web identification number (ein) on your form 8863.