941X Form 2021

941X Form 2021 - This form on mytax illinois at. Web the third round of economic impact payments occurred in 2021, more than two years ago. Taxpayers can use form 941x to make changes to the original form 941 that they’ve already filed. File 941 x for employee retention credit is it possible to file both an erc and a ppp in the same tax year? This worksheet 2 is applicable only for the second quarter of 2021. This is reported on the revised form 941 worksheet 1. For instructions and the latest information. Purpose of the form 941 worksheet 4. Read the separate instructions before you complete form 941. Social security and medicare taxes apply to the wages of household workers you pay $2,300 or more in cash wages in 2021.

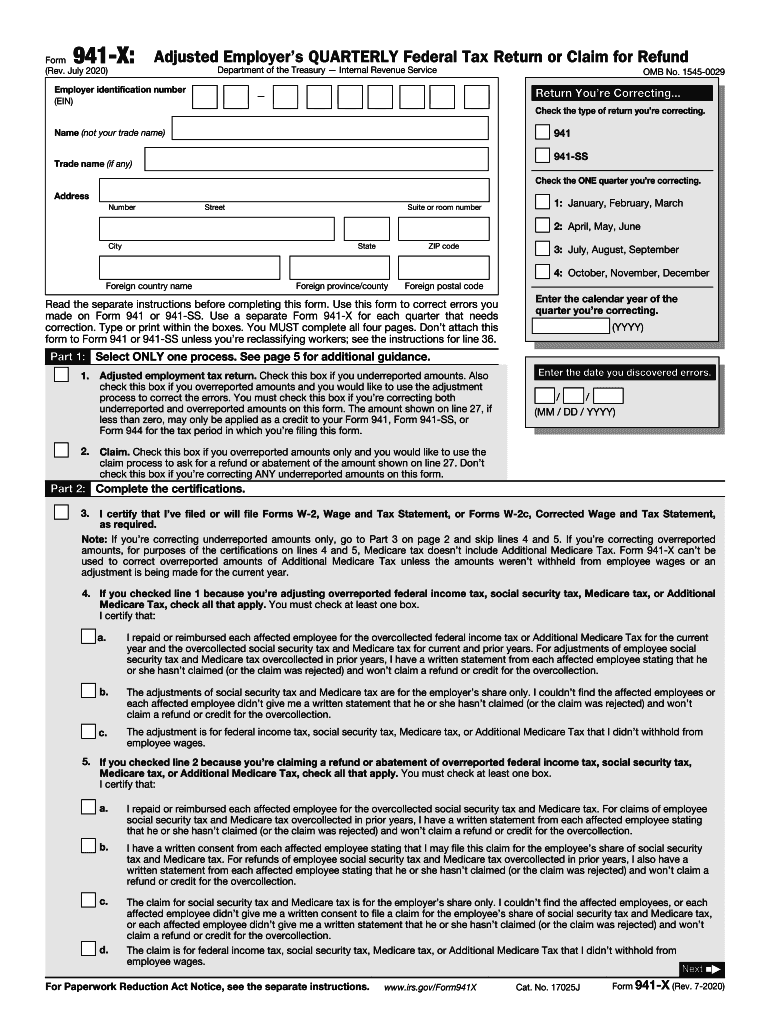

April, may, june read the separate instructions before completing this form. July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. See the instructions for line 42. An employer is required to file an irs 941x in the event of an error on a previously filed form 941. This worksheet 2 is applicable only for the second quarter of 2021. Web there is no wage base limit for medicare tax. If you're correcting a quarter that began Web the third round of economic impact payments occurred in 2021, more than two years ago. This form and any required support to: Click the arrow with the inscription next to jump from field to field.

Click the arrow with the inscription next to jump from field to field. 1 choose the tax year & quarter. You must complete all five pages. The term “nonrefundable” is a misnomer if the taxpayer did not claim the erc, and instead paid the employer’s share of the social security tax via federal tax deposits. Web there is no wage base limit for medicare tax. See the instructions for line 42. Social security and medicare taxes apply to election workers who are paid $2,000 or more in cash or an equivalent form of compensation in 2021. Purpose of the form 941 worksheet 4. The adjustments also entail administrative errors and alterations to employee retention tax credits. Web report for this quarter of 2021 (check one.) 1:

Worksheet 2 941x

The adjustments also entail administrative errors and alterations to employee retention tax credits. If you're correcting a quarter that began Web the third round of economic impact payments occurred in 2021, more than two years ago. Purpose of the form 941 worksheet 4. This form and any required support to:

941x Fill out & sign online DocHub

This worksheet 2 is applicable only for the second quarter of 2021. You must complete all five pages. See the instructions for line 42. Is it possible to incorporate pay from qualified leave wages? Taxpayers can use form 941x to make changes to the original form 941 that they’ve already filed.

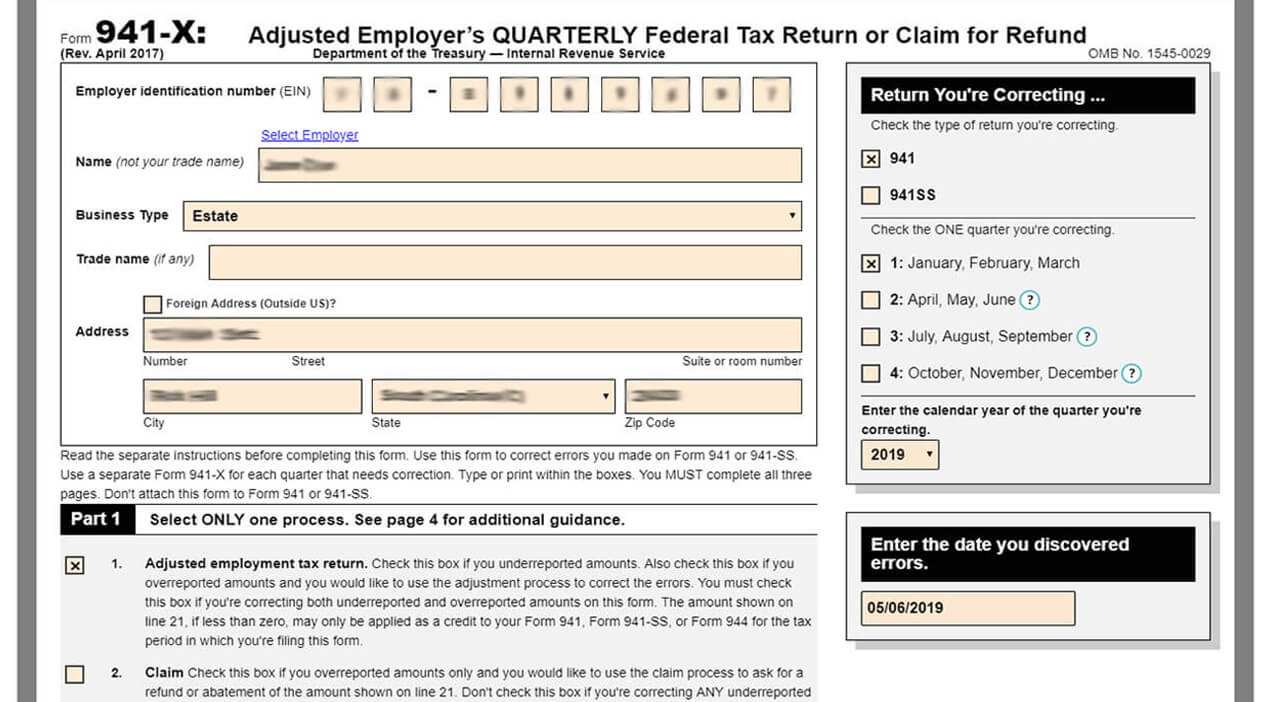

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

For more information, see the instructions for form 8974 and go to irs.gov/ researchpayrolltc. For instructions and the latest information. Read the separate instructions before you complete form 941. If you're correcting a quarter that began These instructions have been updated for changes under the american rescue plan act of 2021 (the arp).

Irs Forms 2020 Printable Fill Out and Sign Printable PDF Template

This worksheet 2 is applicable only for the second quarter of 2021. Type or print within the boxes. Click the arrow with the inscription next to jump from field to field. Web there is no wage base limit for medicare tax. As soon as you discover an error on form 941, you must take the following actions:

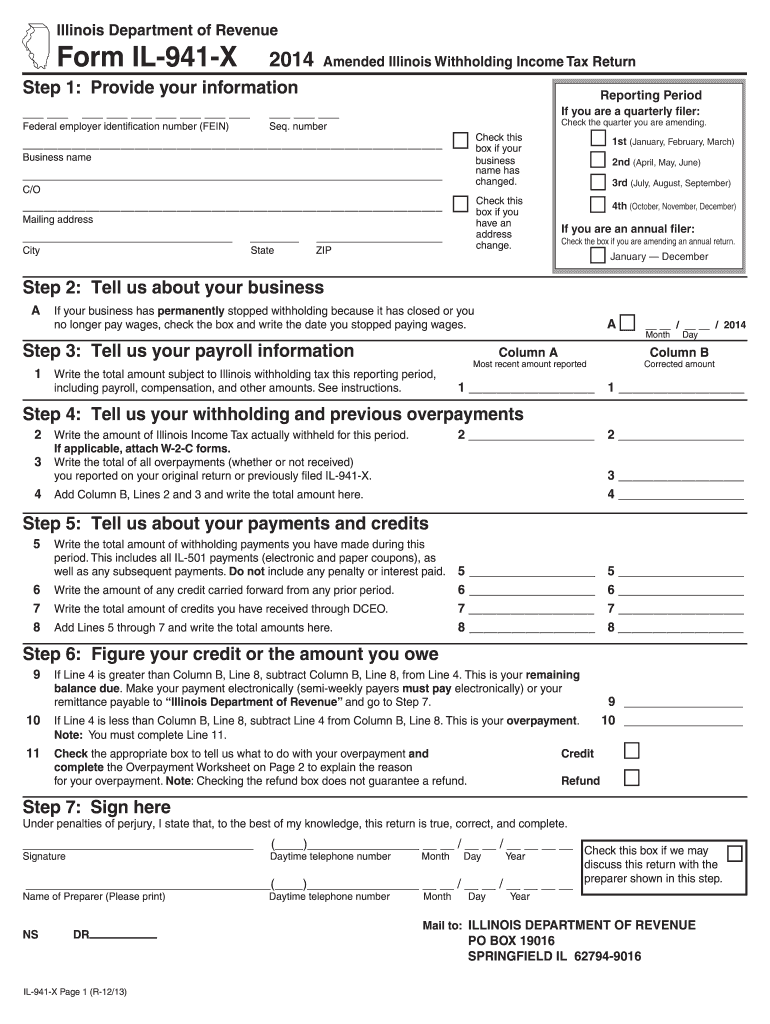

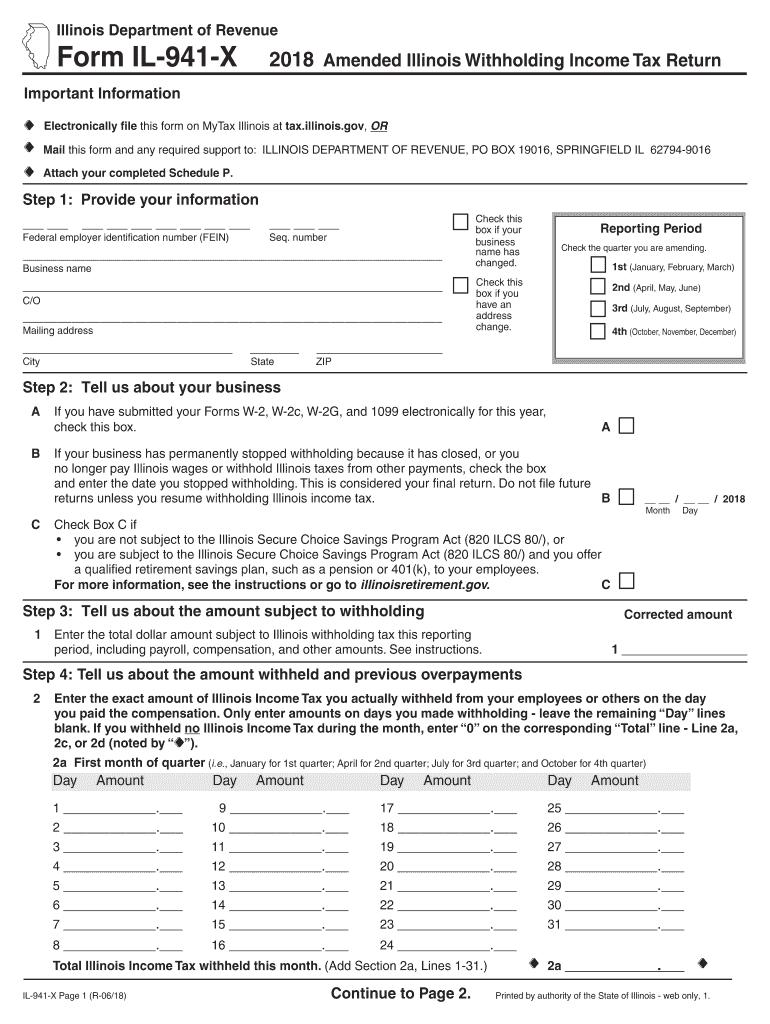

Il 941 X Form Fill Out and Sign Printable PDF Template signNow

Find which payroll quarters in 2020 and 2021 your association was qualified for. April, may, june read the separate instructions before completing this form. As soon as you discover an error on form 941, you must take the following actions: The instructions have also been revised to help taxpayers accommodate the new reporting guidelines. These messages can arrive in the.

IRS Form 941X Complete & Print 941X for 2022

1 choose the tax year & quarter. Read the separate instructions before you complete form 941. Web the new form 941 worksheet 2 for q2 2021 should be completed by all employers that paid qualified wages for the employee retention credit after april 1, 2021. The term “nonrefundable” is a misnomer if the taxpayer did not claim the erc, and.

IL DoR IL941X 2021 Fill out Tax Template Online US Legal Forms

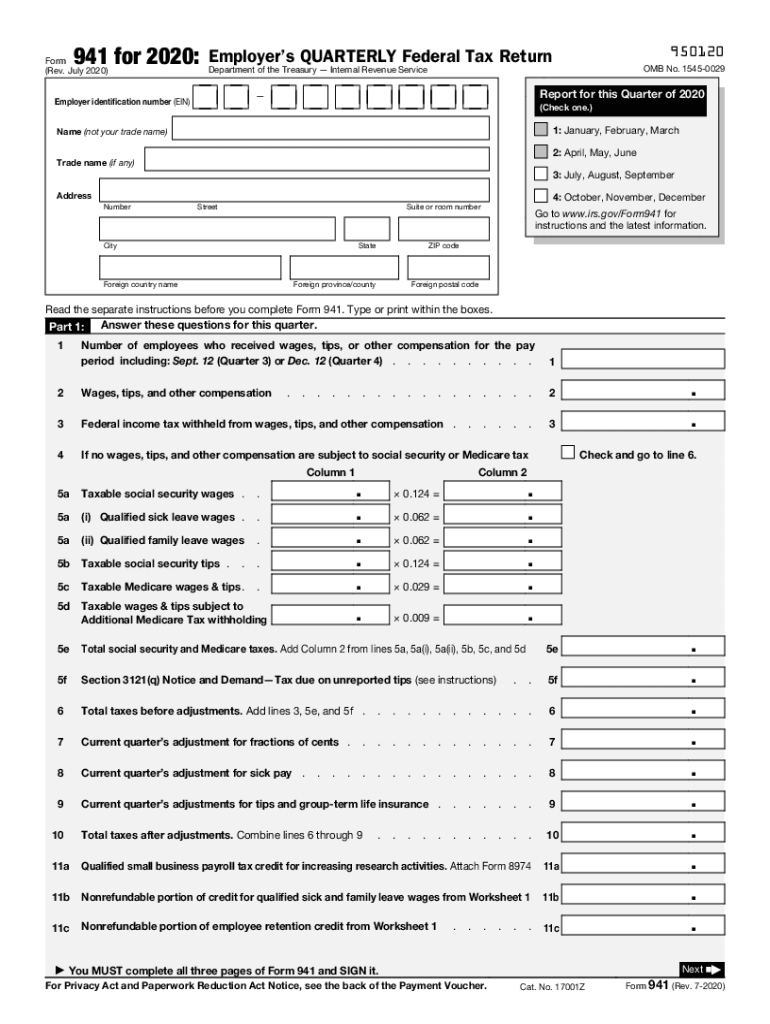

Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Type or print within the boxes. Find which payroll quarters in 2020 and 2021 your association was qualified for. Purpose of the form 941 worksheet 4. Social security and medicare taxes apply to election workers who are paid $2,000 or more.

Simple Form 941X 2018 Fill Out and Sign Printable PDF Template signNow

Social security and medicare taxes apply to the wages of household workers you pay $2,300 or more in cash wages in 2021. For instructions and the latest information. See the instructions for line 42. 1 choose the tax year & quarter. These messages can arrive in the form of an unsolicited text or email to lure unsuspecting victims to provide.

Updated Form 941 Worksheet 1, 2, 3 and 5 for Q2 2021 Revised 941

The adjustments also entail administrative errors and alterations to employee retention tax credits. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Is it possible to incorporate pay from qualified leave wages? Purpose of the form 941 worksheet 4..

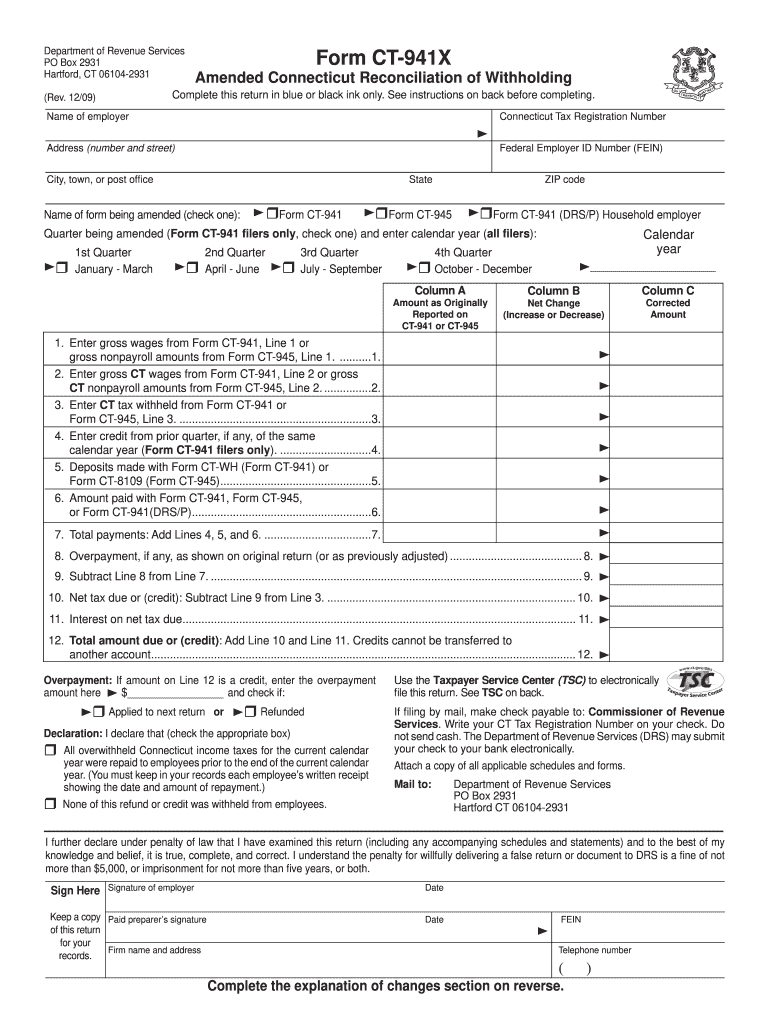

Ct Form 941 X Fill Out and Sign Printable PDF Template signNow

Social security and medicare taxes apply to the wages of household workers you pay $2,300 or more in cash wages in 2021. Web there is no wage base limit for medicare tax. These messages can arrive in the form of an unsolicited text or email to lure unsuspecting victims to provide valuable personal and financial information. Read the separate instructions.

1 Choose The Tax Year & Quarter.

This form and any required support to: This is reported on the revised form 941 worksheet 1. Type or print within the boxes. Web the new form 941 worksheet 2 for q2 2021 should be completed by all employers that paid qualified wages for the employee retention credit after april 1, 2021.

Fill In The Required Details On The Page Header, Such As The Ein Number, Quarter, Company Name, And Year.

You must complete all five pages. As soon as you discover an error on form 941, you must take the following actions: Type or print within the boxes. File 941 x for employee retention credit is it possible to file both an erc and a ppp in the same tax year?

The Term “Nonrefundable” Is A Misnomer If The Taxpayer Did Not Claim The Erc, And Instead Paid The Employer’s Share Of The Social Security Tax Via Federal Tax Deposits.

See the instructions for line 42. Click the arrow with the inscription next to jump from field to field. An employer is required to file an irs 941x in the event of an error on a previously filed form 941. Web what is form 941x?

Read The Separate Instructions Before You Complete Form 941.

April, may, june read the separate instructions before completing this form. Web the third round of economic impact payments occurred in 2021, more than two years ago. July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. These instructions have been updated for changes under the american rescue plan act of 2021 (the arp).

.jpg)