945-A Form 2022

945-A Form 2022 - This form should be completed by semiweekly schedule depositors. Edit, sign and save irs 945 form. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Download your updated document, export it to the cloud, print it from the editor, or share. The irs form 945 is known as the. Web get the 2022 form 945. If line 3 is less than $2,500, don’t complete line 7 or. Web this form is also known as the employer's quarterly tax form and is used by employers to report the federal withholdings from most types of employees. Form 945 is the annual record of federal tax liability. Web efile 945 now why efile with tax1099 easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation.

Web irs releases 2022 draft form 945 by erisa news | june 27 2022 the irs has made available a draft 2022 form 945 annual return of withheld federal income. One source of these withheld taxes is backup. Get your online template and fill it in using progressive features. Annual return of withheld federal income tax completed. See the instructions for these forms for their due dates. Download your updated document, export it to the cloud, print it from the editor, or share. Enjoy smart fillable fields and interactivity. Web draft instructions for the 2022 form 945, annual return of withheld federal income tax, were released sept. If line 4 is more than line 3, enter the difference. Form 945 is the annual record of federal tax liability.

Please use the link below. Edit, sign and save irs 945 form. It notifies the irs of a. Web irs releases 2022 draft form 945 by erisa news | june 27 2022 the irs has made available a draft 2022 form 945 annual return of withheld federal income. Web draft instructions for the 2022 form 945, annual return of withheld federal income tax, were released sept. Web get the 2022 form 945. File your federal and federal tax returns online with turbotax in minutes. Annual return of withheld federal income tax completed. What is irs form 945 and who should file them? Web enter your ein, “form 945,” and “2022” on your check or money order.

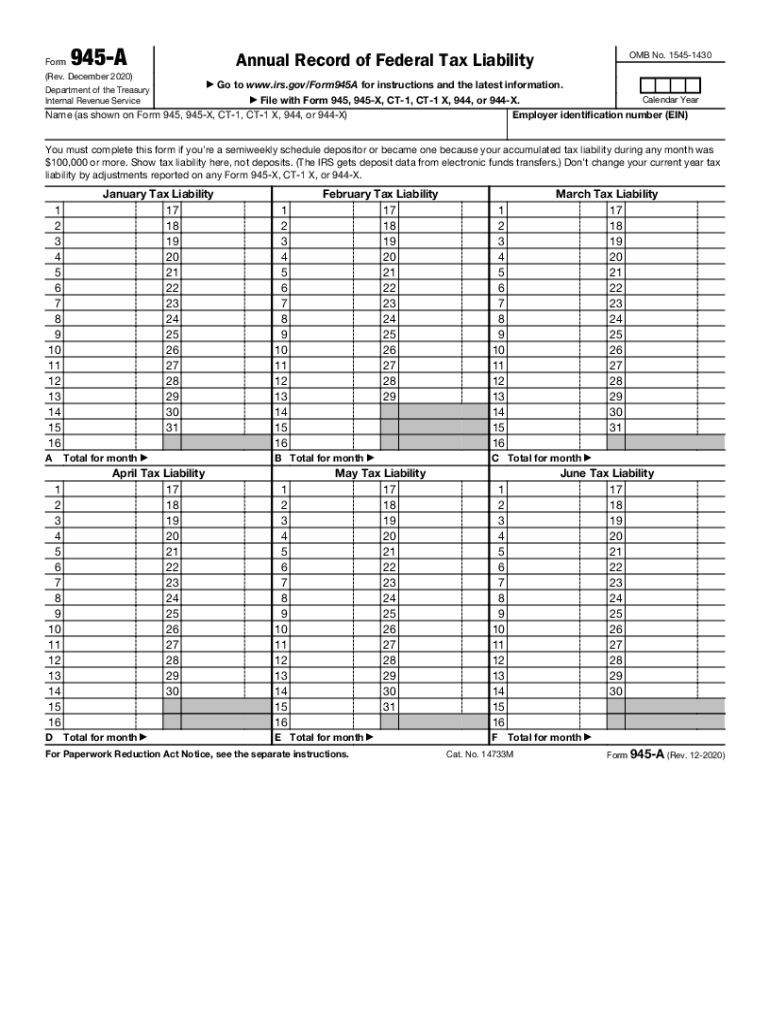

2020 Form IRS 945A Fill Online, Printable, Fillable, Blank pdfFiller

Annual return of withheld federal income tax completed. Uslegalforms allows users to edit, sign, fill & share all type of documents online. If line 3 is less than $2,500, don’t complete line 7 or. Get your online template and fill it in using progressive features. See the instructions for these forms for their due dates.

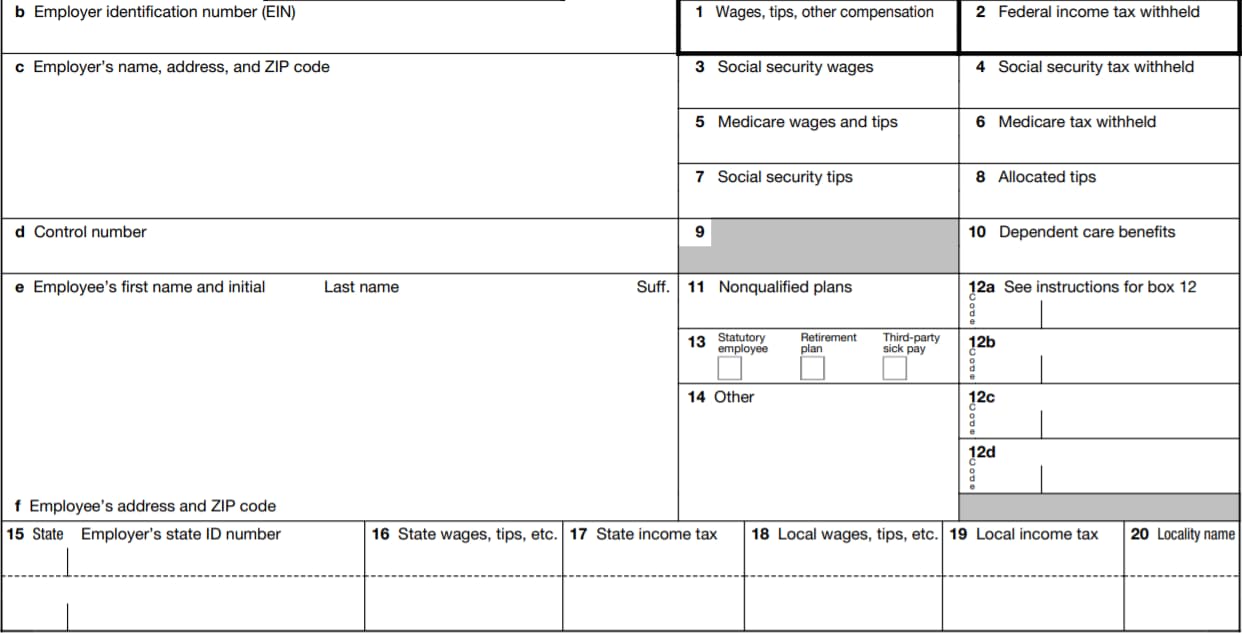

W2 Form 2022 Fillable PDF

Web how to fill out and sign 945 online? Get ready for this year's tax season quickly and safely with pdffiller! Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms. Edit, sign and save irs 945 form. If line 3 is $2,500 or more and you deposited all taxes.

File Form 945 Online Efile 945 Form 945 2020 945 Schedule A

One source of these withheld taxes is backup. Uslegalforms allows users to edit, sign, fill & share all type of documents online. This form should be completed by semiweekly schedule depositors. Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web irs releases 2022 draft form 945 by erisa news.

2021 IRS Form 941 Deposit Rules and Schedule

Edit, sign and save irs 945 form. Get ready for tax season deadlines by completing any required tax forms today. Enjoy smart fillable fields and interactivity. Form 945 is the annual record of federal tax liability. Uslegalforms allows users to edit, sign, fill & share all type of documents online.

IRS 4136 20202022 Fill out Tax Template Online US Legal Forms

File your federal and federal tax returns online with turbotax in minutes. Edit, sign and save irs 945 form. Web how to fill out and sign 945 online? See the instructions for these forms for their due dates. It notifies the irs of a.

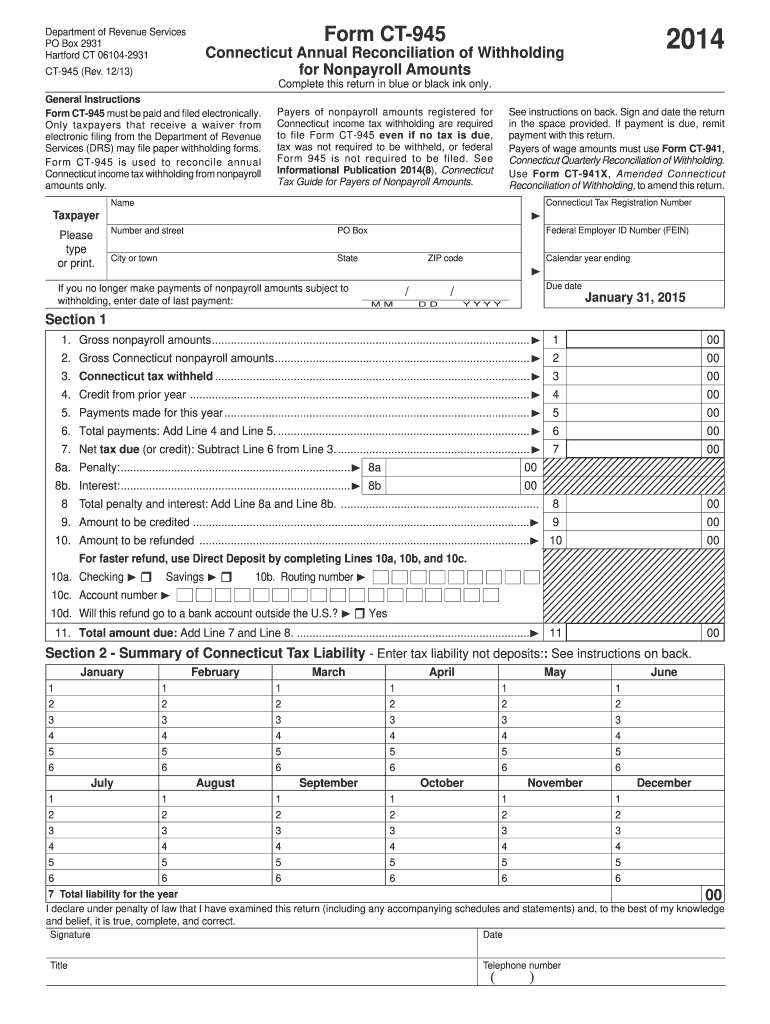

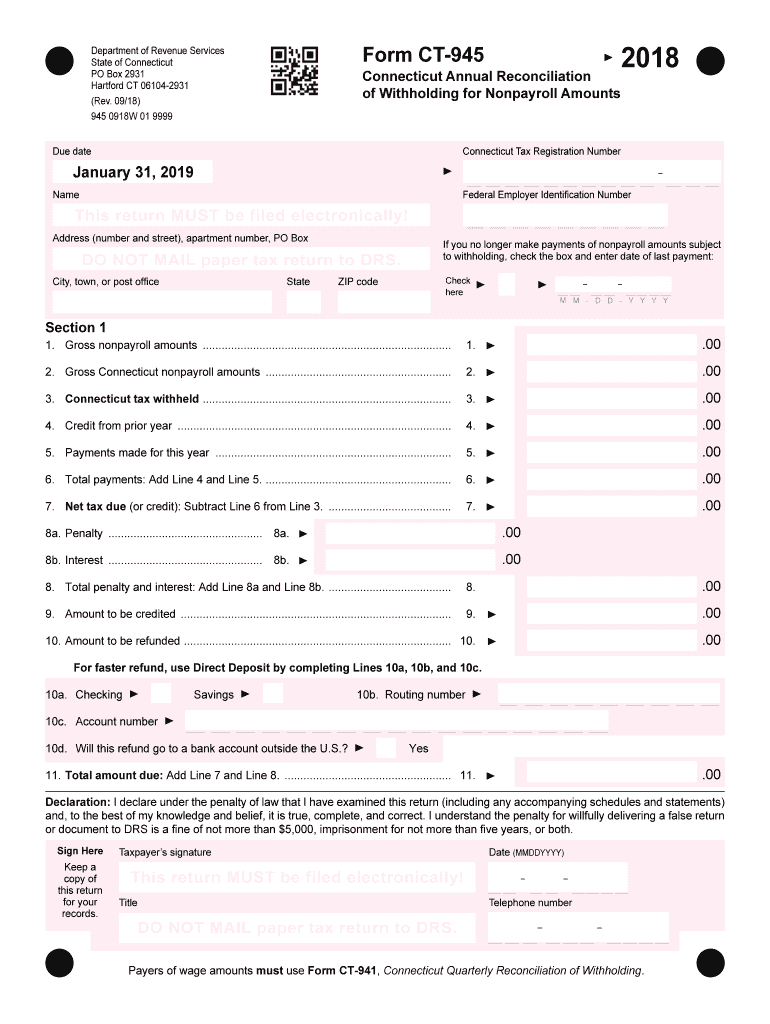

CT DRS CT945 2014 Fill out Tax Template Online US Legal Forms

Edit, sign and save irs 945 form. Web this form is also known as the employer's quarterly tax form and is used by employers to report the federal withholdings from most types of employees. Web how to fill out and sign 945 online? Web efile 945 now why efile with tax1099 easy and secure efiling quick and accurate reporting state.

Form 5695 2021 2022 IRS Forms TaxUni

Get ready for tax season deadlines by completing any required tax forms today. Web get the 2022 form 945. Complete, edit or print tax forms instantly. Web the irs form 945 is the form in the united states of america to report federal income taxes that are withheld from the contractual employees. Web efile your federal tax return now efiling.

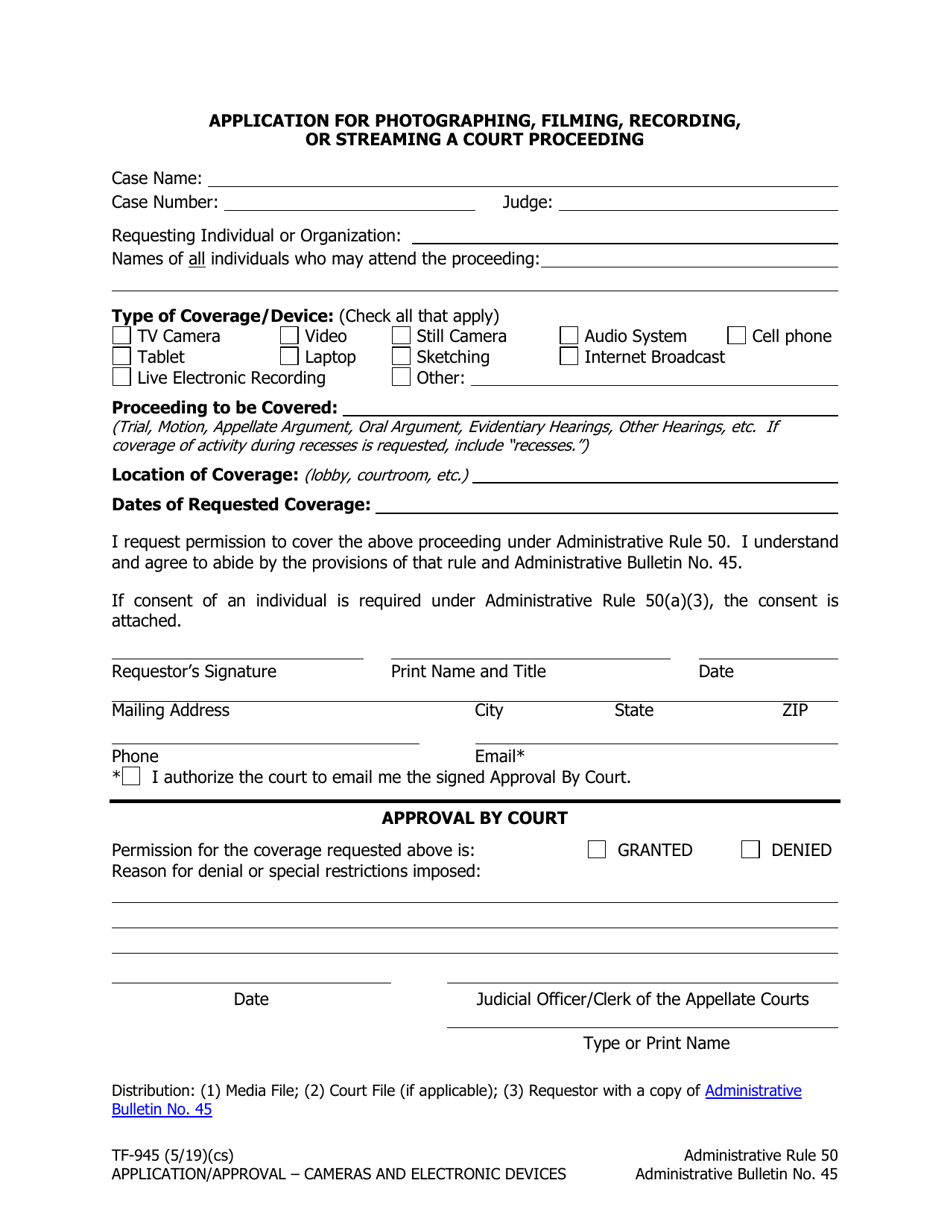

Form TF945 Download Fillable PDF or Fill Online Application for

Web the irs form 945 is the form in the united states of america to report federal income taxes that are withheld from the contractual employees. One source of these withheld taxes is backup. Web draft instructions for the 2022 form 945, annual return of withheld federal income tax, were released sept. Web enter your ein, “form 945,” and “2022”.

1099 NEC Form 2022

One source of these withheld taxes is backup. Annual return of withheld federal income tax completed. Complete, edit or print tax forms instantly. Follow the simple instructions below:. If line 4 is more than line 3, enter the difference.

Ct 945 Fill Out and Sign Printable PDF Template signNow

Get ready for this year's tax season quickly and safely with pdffiller! If line 4 is more than line 3, enter the difference. Get your online template and fill it in using progressive features. Please use the link below. See the instructions for these forms for their due dates.

Follow The Simple Instructions Below:.

Web the irs form 945 is the form in the united states of america to report federal income taxes that are withheld from the contractual employees. Get your online template and fill it in using progressive features. Please use the link below. Web irs releases 2022 draft form 945 by erisa news | june 27 2022 the irs has made available a draft 2022 form 945 annual return of withheld federal income.

Annual Return Of Withheld Federal Income Tax Completed.

Web information about form 945, annual return of withheld federal income tax, including recent updates, related forms and instructions on how to file. Web draft instructions for the 2022 form 945, annual return of withheld federal income tax, were released sept. Get ready for this year's tax season quickly and safely with pdffiller! File your federal and federal tax returns online with turbotax in minutes.

Download Your Updated Document, Export It To The Cloud, Print It From The Editor, Or Share.

Complete, edit or print tax forms instantly. The irs form 945 is known as the. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web enter your ein, “form 945,” and “2022” on your check or money order.

Ad Access Irs Tax Forms.

This form should be completed by semiweekly schedule depositors. Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms. If line 3 is less than $2,500, don’t complete line 7 or. See the instructions for these forms for their due dates.