A Health Insurer Must Provide A Proof Of Loss Form

A Health Insurer Must Provide A Proof Of Loss Form - The insured's consideration given for a health insurance policy is. Web a proof of loss is a formal document you must file with an insurance company that initiates the claim process after a property loss. Web the notice of claims provision requires a policyowner to. Web under the uniform required provision proof of loss under a health insurance policy should normally be filed within how many days. The first premium payment and the application. An insurer receives proof of loss for an acceptable medical expense claim under an individual health insurance policy. Notify an insurer of a claim within a specified time. A majority of the cases hold that submission of a proof beyond the 60 day deadline is not fatal to a claim. Tim has an accident and health insurance policy that may not be changed in any way by the insurer up to a stated age, as long as the premiums. Web a health insurer must provide a proof of loss form.

In the majority of states, an insurer must provide a proof of loss form to an insured if the insured requests one. Web a health insurer must provide a proof of loss form. Web a health insurer must provide a proof of loss form. How many days of skilled nursing will medicare pay benefits. Tim has an accident and health insurance policy that may not be changed in any way by the insurer up to a stated age, as long as the premiums. Which of the following health insurance policy provisions specifies the health care services a policy will provide? Web a proof of loss is a formal document you must file with an insurance company that initiates the claim process after a property loss. The proprietors of a business may deduct the cost of a medical expense plan because they are employed individuals instead of employees. Within 15 days of receipt of the notice of loss. Notify an insurer of a claim within a specified time.

Within 15 days of receipt of the notice of loss. Web study with quizlet and memorize flashcards containing terms like which of the following actions may an insurance company not do in a health policy that contains a guaranteed renewable premium benefit? Within 15 days of the actual loss. Web a health insurer must provide a proof of loss form. The insured's consideration given for a health insurance policy is. This form supports the insureds claim and the value of the insured’s loss to the insurance company. A majority of the cases hold that submission of a proof beyond the 60 day deadline is not fatal to a claim. Within 10 days of receipt of the notice of loss. Within 15 days of receipt of the notice of loss. In the majority of states, an insurer must provide a proof of loss form to an insured if the insured requests one.

Another Reason Health Insurance Premiums Continue to Rise The 2020

Web a proof of loss is a document filled out upon request by the insurance company by the policyholder when property damage occurs resulting in an insurance claim. It is an official, notarized, sworn statement from you to your insurer regarding the scope of damage to your property. Web a health insurer must provide a proof of loss form. Within.

Proof of Loss Homeowners Insurance

Web a proof of loss is a document filled out upon request by the insurance company by the policyholder when property damage occurs resulting in an insurance claim. Within 10 days of the actual loss. The first premium payment and the application. How many days of skilled nursing will medicare pay benefits. Web a proof of loss is a formal.

EHealth Declaration Form MINOAN HEALTH DECLARATION FORM / Dubai

Under what circumstance does an accident and health insurer have the right to request an autopsy. The first premium payment and the application. Tim has an accident and health insurance policy that may not be changed in any way by the insurer up to a stated age, as long as the premiums. Which of the following health insurance policy provisions.

Specified overview health insurer TBR Nederland

A majority of the cases hold that submission of a proof beyond the 60 day deadline is not fatal to a claim. The proprietors of a business may deduct the cost of a medical expense plan because they are employed individuals instead of employees. Within 10 days of the actual loss. Under what circumstance does an accident and health insurer.

Understanding Proof of Loss Declarations Avner Gat Public Adjusters

Web under the uniform required provision proof of loss under a health insurance policy should normally be filed within how many days. In the majority of states, an insurer must provide a proof of loss form to an insured if the insured requests one. Within 15 days of receipt of the notice of loss. Within 10 days of the actual.

Proof Of Health Insurance designonpeavine

Under the time of payment of claims provision, the insurer must pay the benefits. It is an official, notarized, sworn statement from you to your insurer regarding the scope of damage to your property. An insured must notify an insurer of a medical claim within how many days after an accident? Within 15 days of receipt of the notice of.

What is a Proof of Loss? Claims Aid Consultants Public Adjusters

An insurer receives proof of loss for an acceptable medical expense claim under an individual health insurance policy. Within 10 days of the actual loss. An insured must notify an insurer of a medical claim within how many days after an accident? Within 15 days of receipt of the notice of loss. How many days of skilled nursing will medicare.

Insurance License Blog National Online Insurance School

What if an insured does not submit proof within set period of time? Within 15 days of the actual loss. The insured's consideration given for a health insurance policy is. Tim has an accident and health insurance policy that may not be changed in any way by the insurer up to a stated age, as long as the premiums. Who.

Homeowners' Insurers Must Furnish Blank Proof Of Loss Forms Within 60

Web the notice of claims provision requires a policyowner to. Which of the following health insurance policy provisions specifies the health care services a policy will provide? Web a health insurer must provide a proof of loss form. Web a proof of loss is a formal document you must file with an insurance company that initiates the claim process after.

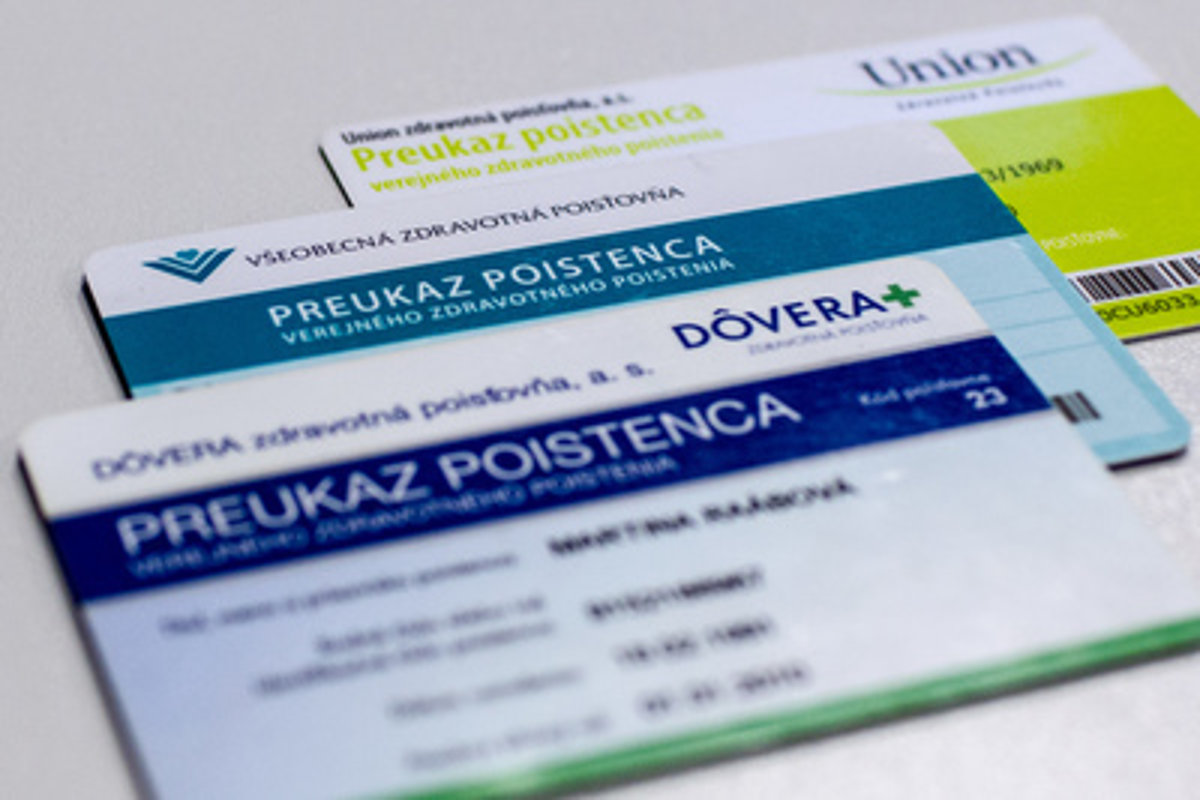

Health insurers sue ministry spectator.sme.sk

It is an official, notarized, sworn statement from you to your insurer regarding the scope of damage to your property. The proprietors of a business may deduct the cost of a medical expense plan because they are employed individuals instead of employees. Within 15 days of receipt of the notice of loss. Web the notice of claims provision requires a.

An Insured Must Notify An Insurer Of A Medical Claim Within How Many Days After An Accident?

It is an official, notarized, sworn statement from you to your insurer regarding the scope of damage to your property. Within 15 days of receipt of the notice of loss. Within 10 days of the actual loss. Web study with quizlet and memorize flashcards containing terms like which of the following actions may an insurance company not do in a health policy that contains a guaranteed renewable premium benefit?

Web A Health Insurer Must Provide A Proof Of Loss Form.

Tim has an accident and health insurance policy that may not be changed in any way by the insurer up to a stated age, as long as the premiums. How many days of skilled nursing will medicare pay benefits. An insurer receives proof of loss for an acceptable medical expense claim under an individual health insurance policy. Web under the uniform required provision proof of loss under a health insurance policy should normally be filed within how many days.

This Form Supports The Insureds Claim And The Value Of The Insured’s Loss To The Insurance Company.

Web the notice of claims provision requires a policyowner to. Web a proof of loss is a formal document you must file with an insurance company that initiates the claim process after a property loss. Web a health insurer must provide a proof of loss form. What if an insured does not submit proof within set period of time?

Within 10 Days Of Receipt Of The Notice Of Loss.

Who is protected with the other insurance with this insurer provision. The above question a health insurer must provide a. The proprietors of a business may deduct the cost of a medical expense plan because they are employed individuals instead of employees. The first premium payment and the application.