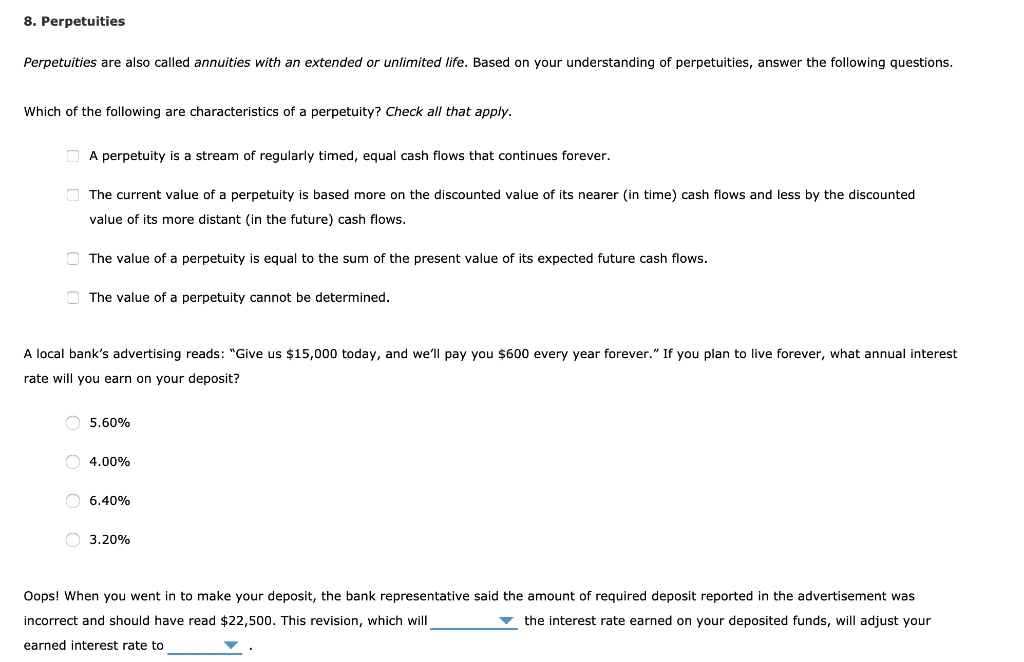

A Perpetuity A Special Form Of Annuity Pays Cash Flows

A Perpetuity A Special Form Of Annuity Pays Cash Flows - Many people who want to start investing for their future want to start today, which implies an annuity. Web future value when moving from the left to the right of a time line, we are using a. Discounted cash flows to calculate. For example, bonds generally pay. To reiterate, perpetuities are cash flows are expected to continue forever with no ending date. What other factor also has this effect? A chain of regular cash flows up to a certain period of time is known as annuity. An annuity that provides perpetual cash flows with no end date. A perpetuity, a special form of. Web a perpetuity, a special form of annuity, pays cash flows.

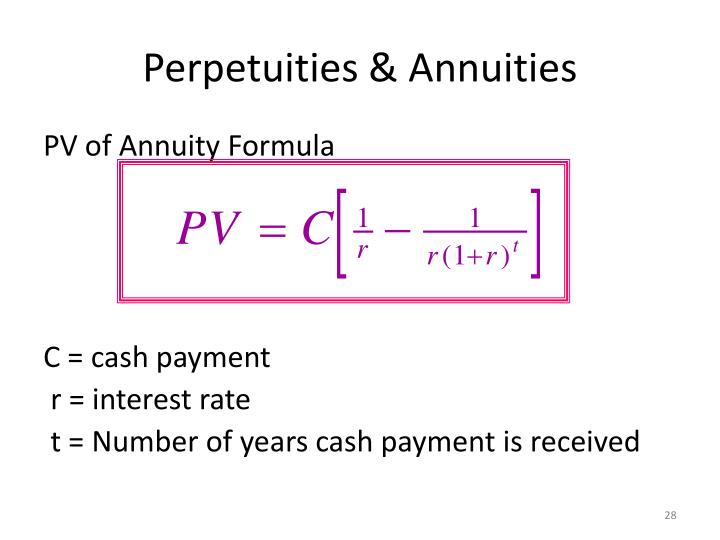

Web future value when moving from the left to the right of a time line, we are using a. Many people who want to start investing for their future want to start today, which implies an annuity. Web an annuity is a set payment received for a set period of time. Web a perpetuity, a special form of annuity, pays cash flows: Web any sequence of equally spaced, level cash flows is called an annuity. For example, bonds generally pay. That do not have time value of money implications. Web a perpetuity, a special form of annuity, pays cash flows: An annuity is also known as a perpetuity. The length of time of the annuity is very important in accumulating wealth within an annuity.

Web the bottom line. That do not have time value of money implications. Discounted cash flows to calculate. A chain of regular cash flows up to a certain period of time is known as annuity. It is always built around an expiration. Web with an annuity, the money will eventually run out because there is a scheduled end to the payment schedule. Web p = pmt × 1 − ( 1 ( 1 + r ) n ) r where: For example, bonds generally pay. With a perpetuity, the payments continue on. Perpetuities are set payments received forever—or into perpetuity.

Difference Between Annuity and Perpetuity Difference Between

Perpetuities are set payments received forever—or into perpetuity. Web the future value of an annuity is the total value of payments at a specific point in time. Web p = pmt × 1 − ( 1 ( 1 + r ) n ) r where: An annuity is a financial asset, not an investment security, that makes payments at regular.

Difference Between Annuity and Perpetuity Difference Between

Web an annuity is a set payment received for a set period of time. An annuity that provides perpetual cash flows with no end date. Web finance finance questions and answers what is the present value of a $300 annuity payment over 5 years if interest rates are 8 percent? Examples of financial instruments that grant perpetual cash flows to.

PPT Chapter 4 Time Value of Money (cont.) PowerPoint Presentation

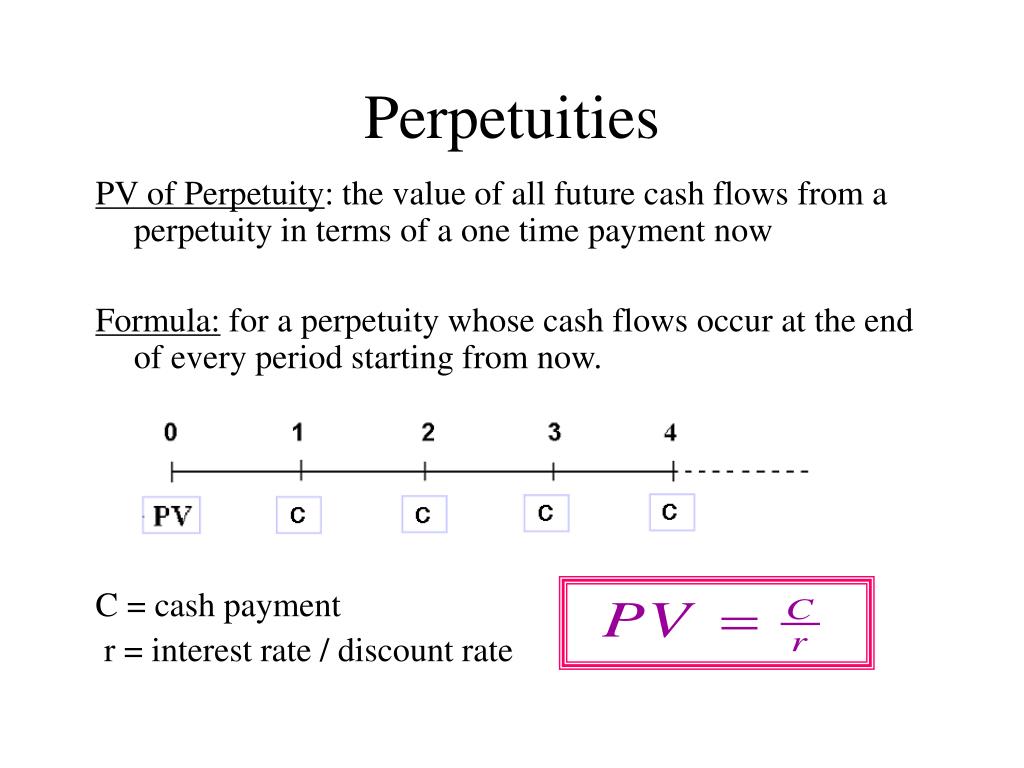

Web the future value of an annuity is the total value of payments at a specific point in time. With a perpetuity, the payments continue on. Web a perpetuity, a special form of annuity, pays cash flows. To reiterate, perpetuities are cash flows are expected to continue forever with no ending date. The length of time of the annuity is.

PPT Present value, annuity, perpetuity PowerPoint Presentation ID

Web p = pmt × 1 − ( 1 ( 1 + r ) n ) r where: An annuity that provides perpetual cash flows with no end date. An annuity is a financial asset, not an investment security, that makes payments at regular intervals over time. Perpetuities are set payments received forever—or into perpetuity. Web the bottom line.

Difference Between Annuity and Perpetuity Difference Between

Web the bottom line. A chain of regular cash flows up to a certain period of time is known as annuity. For example, bonds generally pay. A perpetuity, a special form of. And is not effected by interest rate changes.

Is an Annuity a Perpetuity?

Perpetuities are set payments received forever—or into perpetuity. Web with an annuity, the money will eventually run out because there is a scheduled end to the payment schedule. Web a perpetuity, a special form of annuity, pays cash flows multiple choice continuously for one year. A perpetuity, a special form of. Payments at the end of each period.

Suppose an annuity pays 4 annual interest, compounded annually. If you

It is always built around an expiration. An annuity that provides perpetual cash flows with no end date. A mortgage loan is an example of an amortizing loan. And is not effected by interest rate changes. Many people who want to start investing for their future want to start today, which implies an annuity.

Solved 7. Present value of annuities and annuity payments

Web any sequence of equally spaced, level cash flows is called an annuity. Web a perpetuity, a special form of annuity, pays cash flows: Discounted cash flows to calculate. Web the future value of an annuity is the total value of payments at a specific point in time. What other factor also has this effect?

A certain perpetuity pays the holder 200 per month. If the money is

Web a perpetuity, a special form of annuity, pays cash flows multiple choice continuously for one year. A series of cash outflows which goes on forever is. Web any sequence of equally spaced, level cash flows is called an annuity. A chain of regular cash flows up to a certain period of time is known as annuity. Web a perpetuity,.

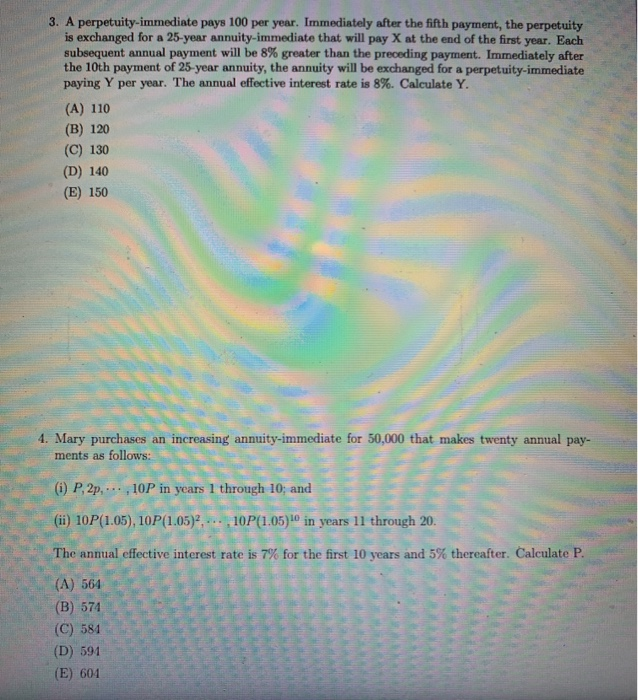

Solved 3. A perpetuityimmediate pays 100 per year.

A series of cash outflows which goes on forever is. The length of time of the annuity is very important in accumulating wealth within an annuity. Many people who want to start investing for their future want to start today, which implies an annuity. A chain of regular cash flows up to a certain period of time is known as.

A Chain Of Regular Cash Flows Up To A Certain Period Of Time Is Known As Annuity.

A perpetuity, a special form of. Web a perpetuity, a special form of annuity, pays cash flows. Web with an annuity, the money will eventually run out because there is a scheduled end to the payment schedule. Web a perpetuity, a special form of annuity, pays cash flows:

Web The Future Value Of An Annuity Is The Total Value Of Payments At A Specific Point In Time.

Web p = pmt × 1 − ( 1 ( 1 + r ) n ) r where: Many people who want to start investing for their future want to start today, which implies an annuity. What other factor also has this effect? Payments at the end of each period.

And Is Not Effected By Interest Rate Changes.

Web any sequence of equally spaced, level cash flows is called an annuity. A series of cash outflows which goes on forever is. Web a perpetuity, a special form of annuity, pays cash flows multiple choice continuously for one year. Compound interest to calculate future values b.

These Cash Flows Are Characterized By Regular Payments That May.

Web a perpetuity, a special form of annuity, pays cash flows: An annuity is a financial asset, not an investment security, that makes payments at regular intervals over time. Examples of financial instruments that grant perpetual cash flows to its holder are. For example, bonds generally pay.

/GettyImages-1184024463-25daaf33978646399d600cf6b8274fe5.jpg)