Alabama Form A4

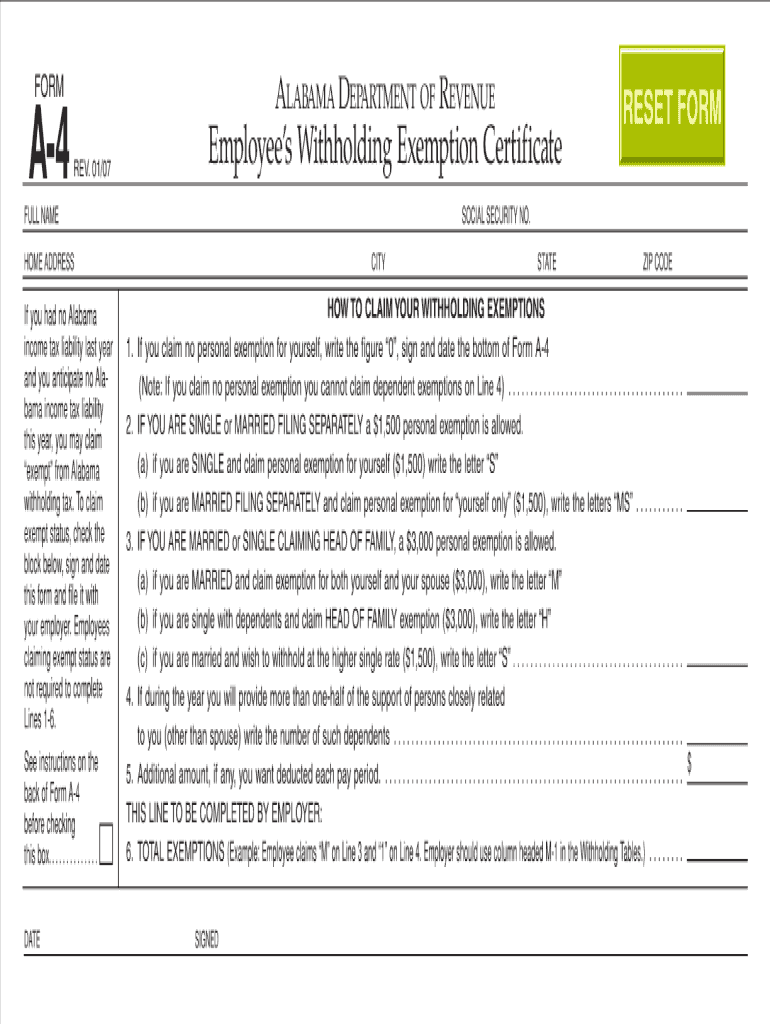

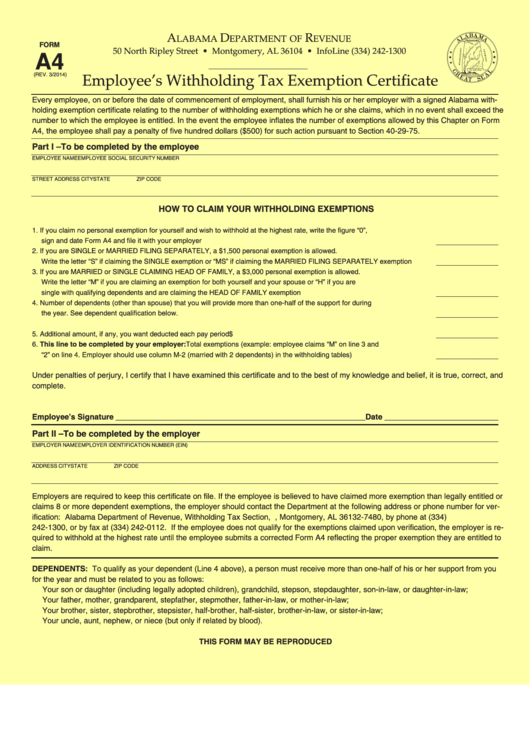

Alabama Form A4 - Authorization for access to third party records by alabama department of revenue employees. Employee’s full name socialsecurity no. Nonresident military spouse withholding exemption certificate (revised september 2019) To claim exempt status, check this block, sign and. Military spouses residency relief act. To obtain the best print quality, see additional instructions on the form faqs page. Web annual reconciliation of alabama income tax withheld. State of alabama a4 tax withholding form created date: View all forms, individual income tax faqs. Only use the print form button if the form you are printing does not have a green print button.

To claim exempt status, check this block, sign and. Authorization for access to third party records by alabama department of revenue employees. Only use the print form button if the form you are printing does not have a green print button. Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Application to become a bulk filer. Employee’s full name socialsecurity no. Nonresident military spouse withholding exemption certificate (revised september 2019) Employee’s withholding exemption certificate (revised march 2014) forma a4: Web annual reconciliation of alabama income tax withheld. Web if you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim ''exempt'' from alabama withholding tax.

Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Web if you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim ''exempt'' from alabama withholding tax. Employee’s full name socialsecurity no. Nonresident military spouse withholding exemption certificate (revised september 2019) To obtain the best print quality, see additional instructions on the form faqs page. Authorization for access to third party records by alabama department of revenue employees. To claim exempt status, check this block, sign and. Employee’s withholding exemption certificate (revised march 2014) forma a4: Military spouses residency relief act. View all forms, individual income tax faqs.

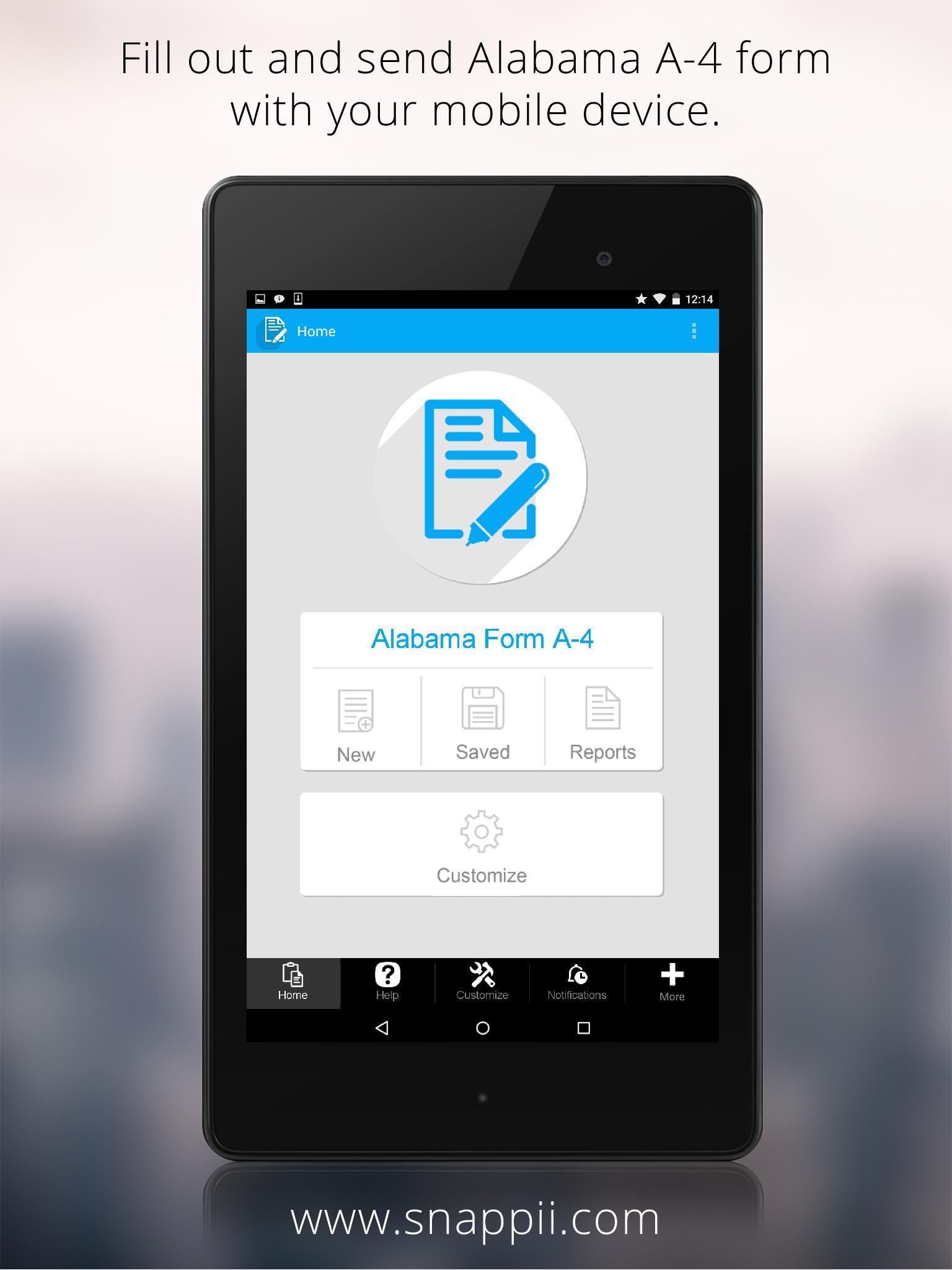

Alabama Form A4 for Android APK Download

Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Only use the print form button if the form you are printing does not have a green print button. Military spouses residency relief act. Web annual reconciliation of alabama income tax.

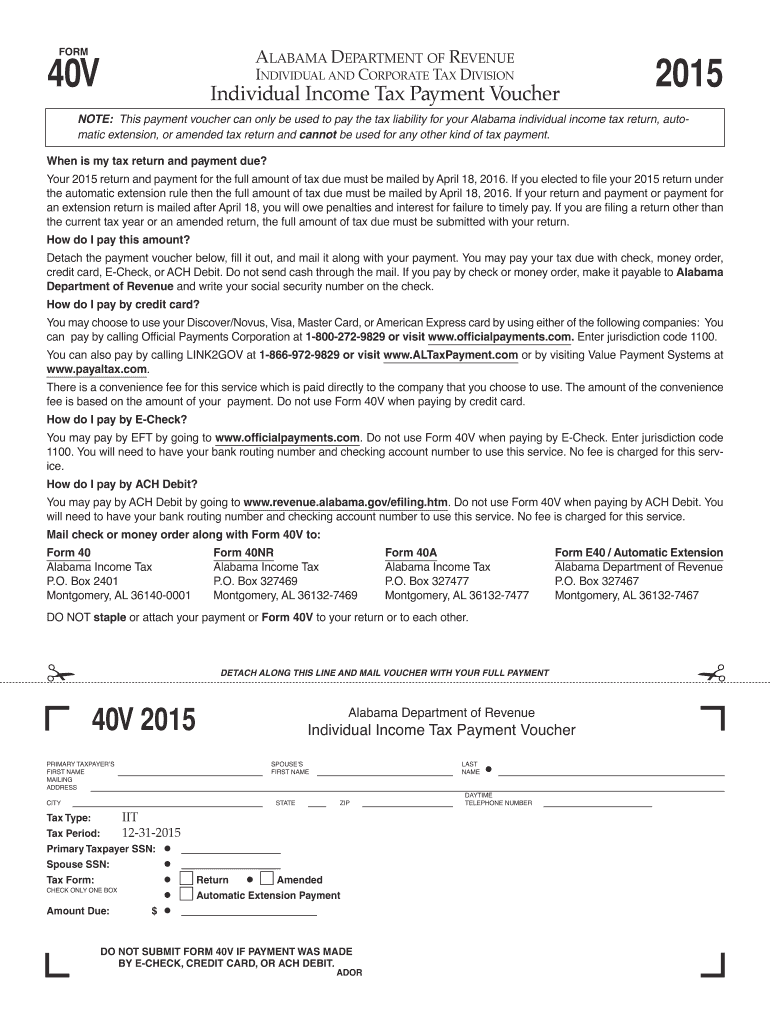

Alabama Form 40 Instructions 2019 Fill Out and Sign Printable PDF

State of alabama a4 tax withholding form created date: Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Web if you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you.

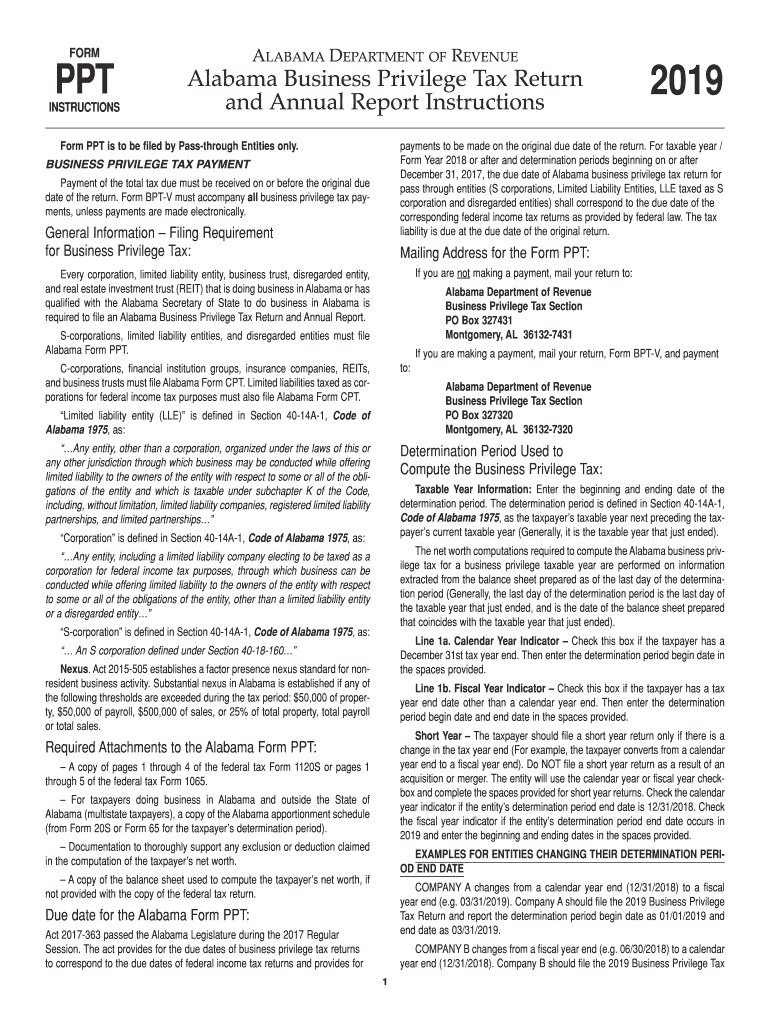

Alabama Form PPT Fill Out and Sign Printable PDF Template signNow

Authorization for access to third party records by alabama department of revenue employees. Application to become a bulk filer. Military spouses residency relief act. Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. View all forms, individual income tax faqs.

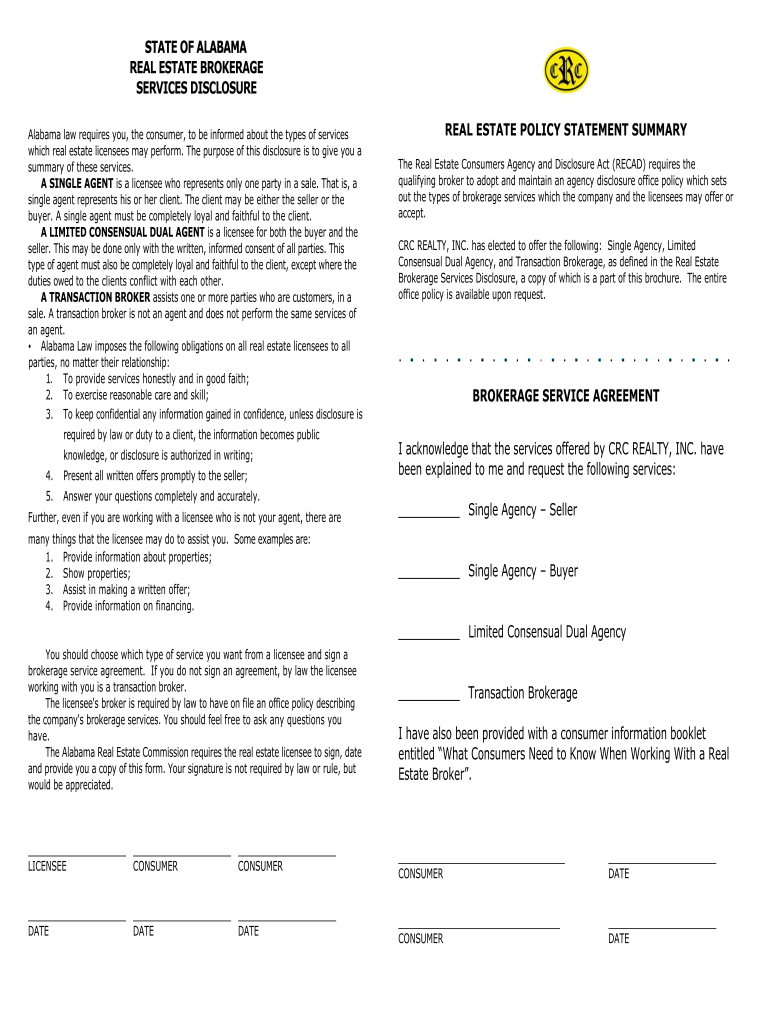

Alabama Recad Form Fill and Sign Printable Template Online US Legal

State of alabama a4 tax withholding form created date: Web if you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim ''exempt'' from alabama withholding tax. Web annual reconciliation of alabama income tax withheld. Only use the print form button if the form you are printing does not.

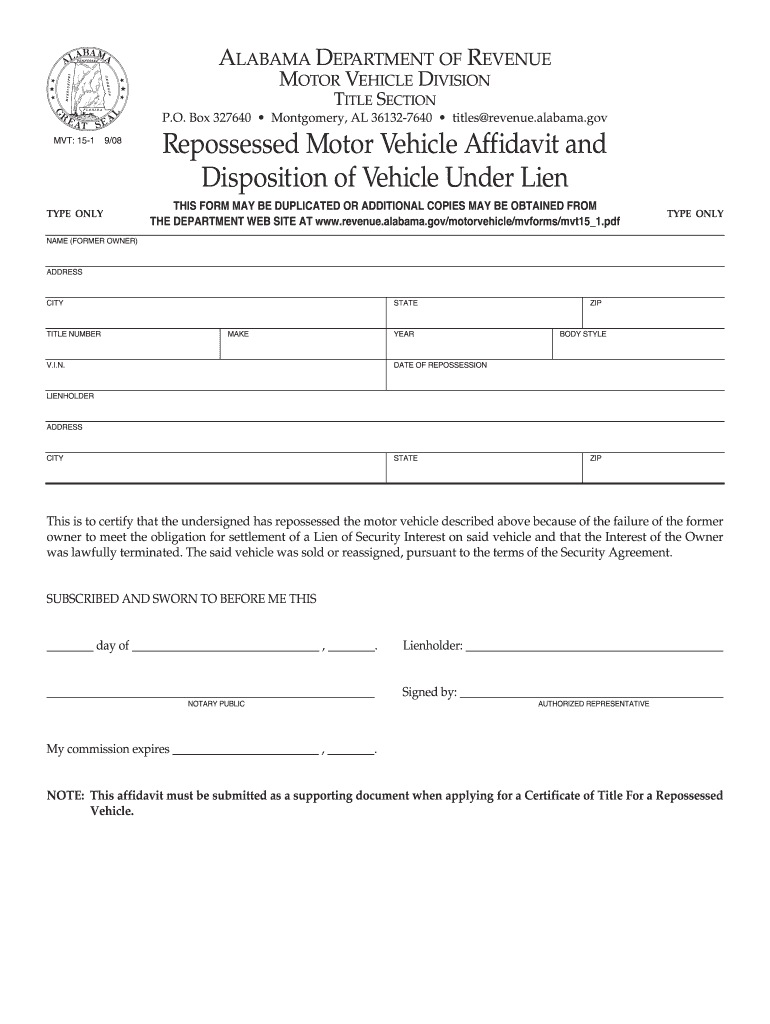

Mvt 15 1 Alabama Fill Out and Sign Printable PDF Template signNow

Nonresident military spouse withholding exemption certificate (revised september 2019) View all forms, individual income tax faqs. Only use the print form button if the form you are printing does not have a green print button. Web annual reconciliation of alabama income tax withheld. Employee’s withholding exemption certificate (revised march 2014) forma a4:

2007 Form AL DoR A4 Fill Online, Printable, Fillable, Blank pdfFiller

Employee’s withholding exemption certificate (revised march 2014) forma a4: To obtain the best print quality, see additional instructions on the form faqs page. Authorization for access to third party records by alabama department of revenue employees. To claim exempt status, check this block, sign and. View all forms, individual income tax faqs.

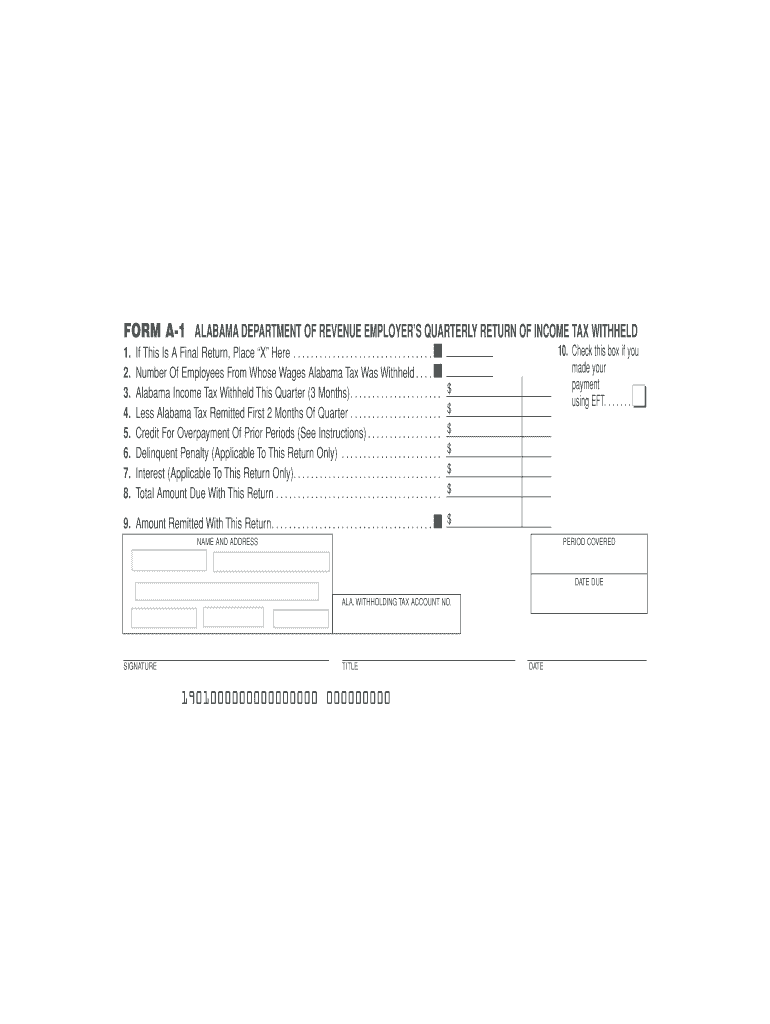

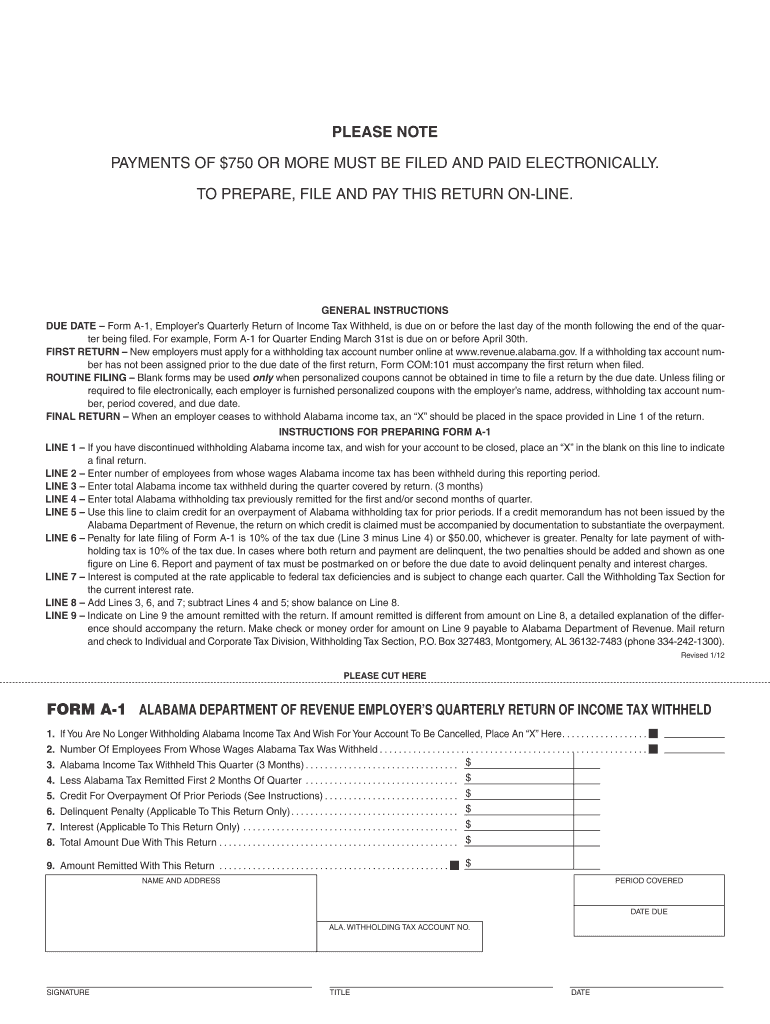

Form A 1 Alabama Fill Out and Sign Printable PDF Template signNow

View all forms, individual income tax faqs. To obtain the best print quality, see additional instructions on the form faqs page. Nonresident military spouse withholding exemption certificate (revised september 2019) Web annual reconciliation of alabama income tax withheld. Application to become a bulk filer.

2012 Form AL A1 Fill Online, Printable, Fillable, Blank pdfFiller

Employee’s full name socialsecurity no. Employee’s withholding exemption certificate (revised march 2014) forma a4: Authorization for access to third party records by alabama department of revenue employees. Web if you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim ''exempt'' from alabama withholding tax. To claim exempt status,.

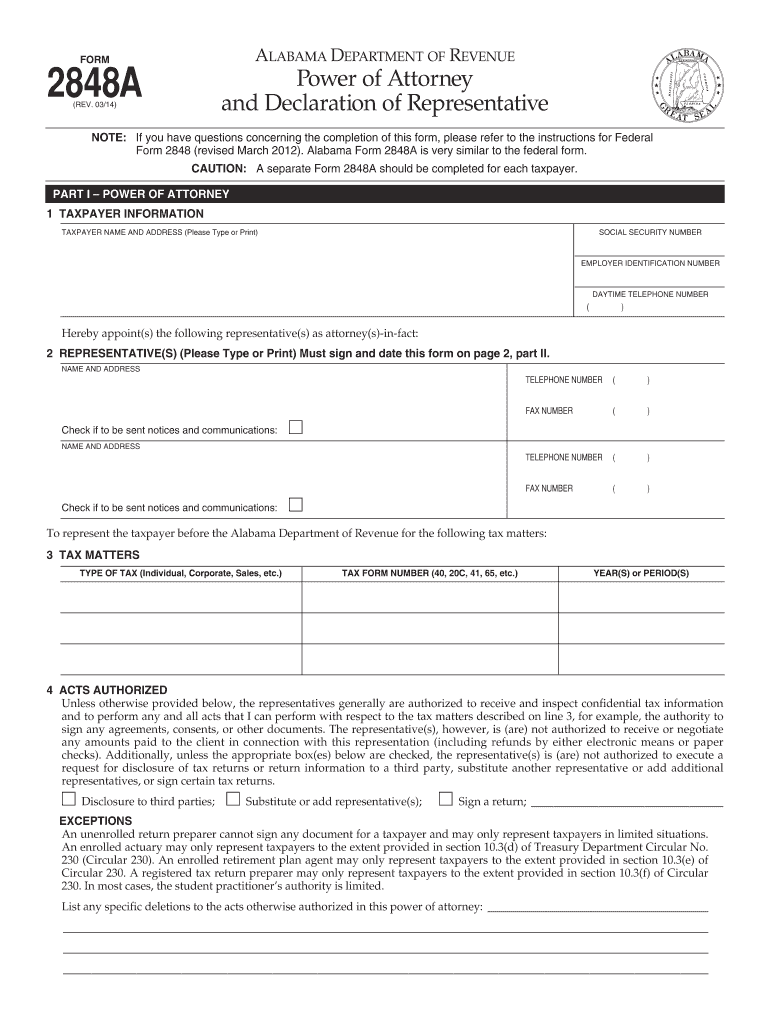

2848A Fill Out and Sign Printable PDF Template signNow

Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. View all forms, individual income tax faqs. To claim exempt status, check this block, sign and. Web if you had no alabama income tax liability last year and you anticipate no.

Fillable Form A4 Alabama Employee'S Withholding Tax Exemption

Web if you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim ''exempt'' from alabama withholding tax. Application to become a bulk filer. Only use the print form button if the form you are printing does not have a green print button. Nonresident military spouse withholding exemption certificate.

To Obtain The Best Print Quality, See Additional Instructions On The Form Faqs Page.

Employee’s full name socialsecurity no. Authorization for access to third party records by alabama department of revenue employees. Application to become a bulk filer. To claim exempt status, check this block, sign and.

State Of Alabama A4 Tax Withholding Form Created Date:

Employee’s withholding exemption certificate (revised march 2014) forma a4: Nonresident military spouse withholding exemption certificate (revised september 2019) View all forms, individual income tax faqs. Web annual reconciliation of alabama income tax withheld.

Military Spouses Residency Relief Act.

Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Only use the print form button if the form you are printing does not have a green print button. Web if you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim ''exempt'' from alabama withholding tax.