Ar Withholding Form

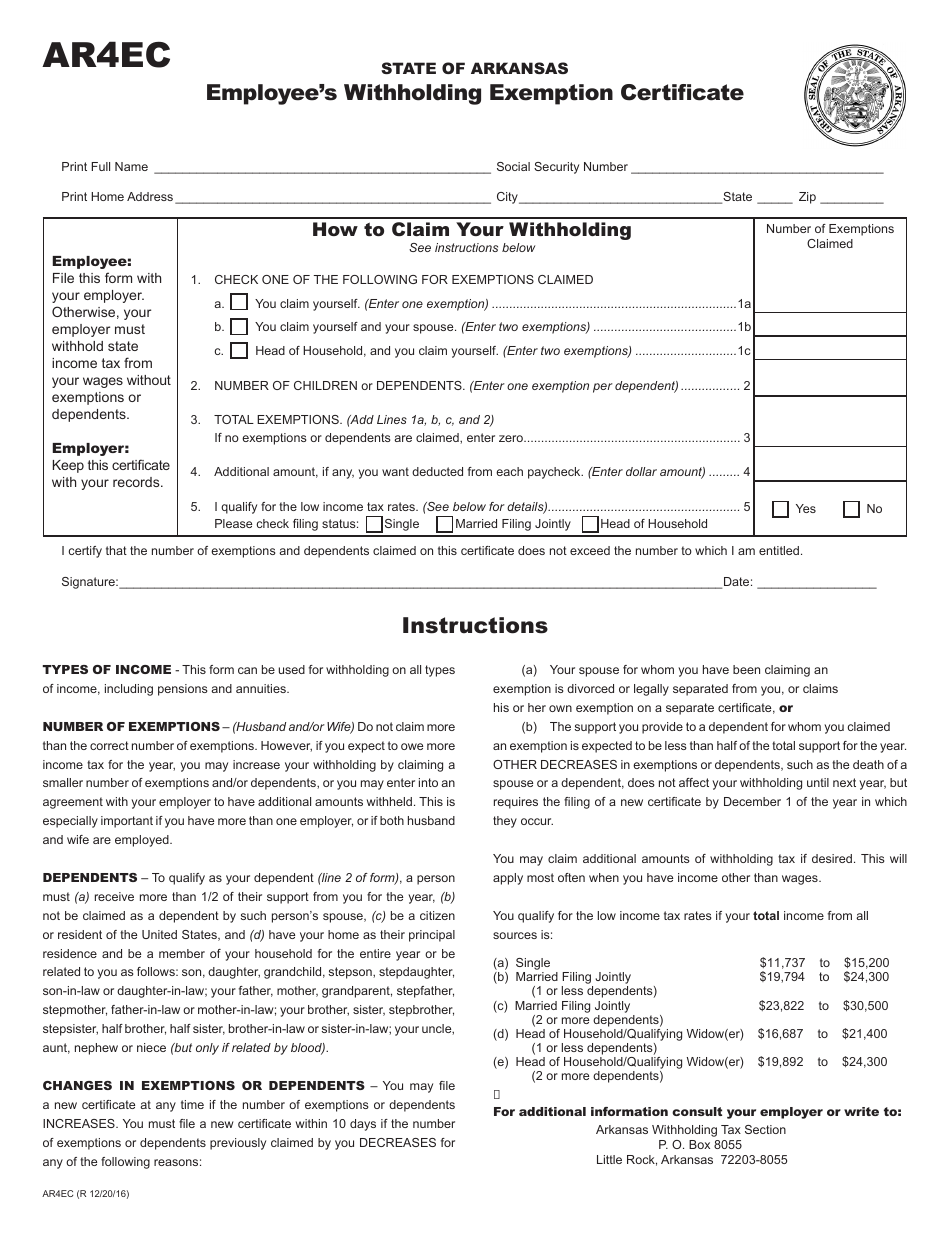

Ar Withholding Form - Check one of the following for exemptions claimed (a) you claim yourself. Computed using the tax tables or tax can be computed using the withholding tax formula, both of which are provided in this publication. Your withholding is subject to review by the irs. Web file ar941, employers annual report for income tax withheld and pay any tax due for the previous calendar year. If too much is withheld, you will generally be due a refund. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. (b) you claim yourself and your spouse. 04/03/2019 page 8 of 65. Keep this certificate with your records. Web withholding tax formula (effective 06/01/2023) 06/05/2023.

Web form ar3mar is your annual reconciliation of monthly withholding. (b) you claim yourself and your spouse. File this form with your employer. Check one of the following for exemptions claimed (a) you claim yourself. Web state of arkansas withholding tax revised: Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. If too much is withheld, you will generally be due a refund. Web withholding tax formula (effective 06/01/2023) 06/05/2023. Web how to claim your withholding instructions on the reverse side 1.

Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself. Web withholding tax formula (effective 06/01/2023) 06/05/2023. [ ] i am married filing jointly with my spouse. 04/03/2019 page 8 of 65. If too much is withheld, you will generally be due a refund. Computed using the tax tables or tax can be computed using the withholding tax formula, both of which are provided in this publication. Web state of arkansas withholding tax revised: Keep this certificate with your records. File this form with your employer. [ ] i am single and my gross income from all sources will not exceed $10,200.

Employee's Withholding Exemption Certificate Arkansas Free Download

File this form with your employer to exempt your earnings from state income tax withholding. (b) you claim yourself and your spouse. Web file ar941, employers annual report for income tax withheld and pay any tax due for the previous calendar year. 04/03/2019 page 8 of 65. File this form with your employer.

Form AR4ec Download Fillable PDF or Fill Online Employee's Withholding

Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. [ ] i am married filing jointly with my spouse. Your withholding is subject to review by the irs. Computed using the tax tables or tax can be computed using the withholding tax formula, both of which are provided in this publication.

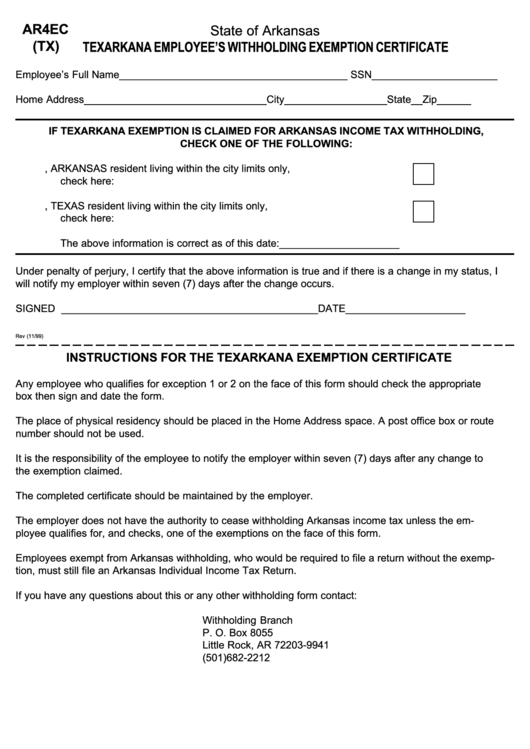

Form Ar4ec (Tx) Texarkana Employee'S Withholding Exemption

File this form with your employer to exempt your earnings from state income tax withholding. Web how to claim your withholding instructions on the reverse side 1. Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. Keep this certificate with your records. (b) you claim yourself and your spouse.

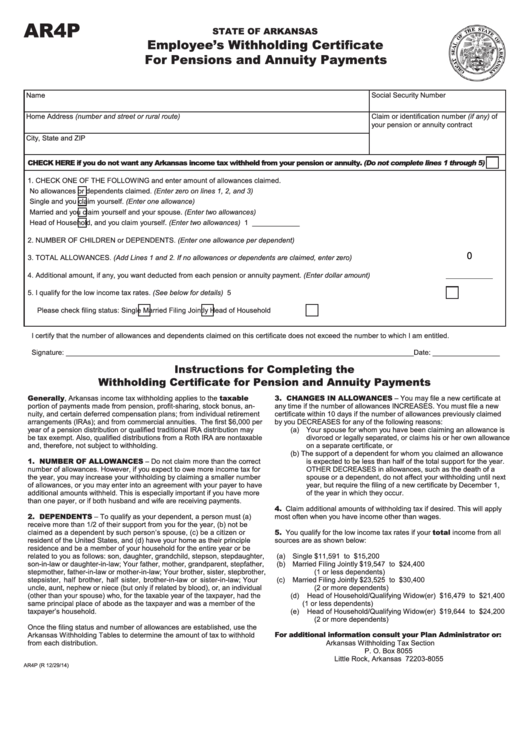

Fillable Form Ar4p Employee'S Withholding Certificate For Pensions

File this form with your employer to exempt your earnings from state income tax withholding. Web file ar941, employers annual report for income tax withheld and pay any tax due for the previous calendar year. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. File this form with your employer. Your withholding is subject to review by the irs.

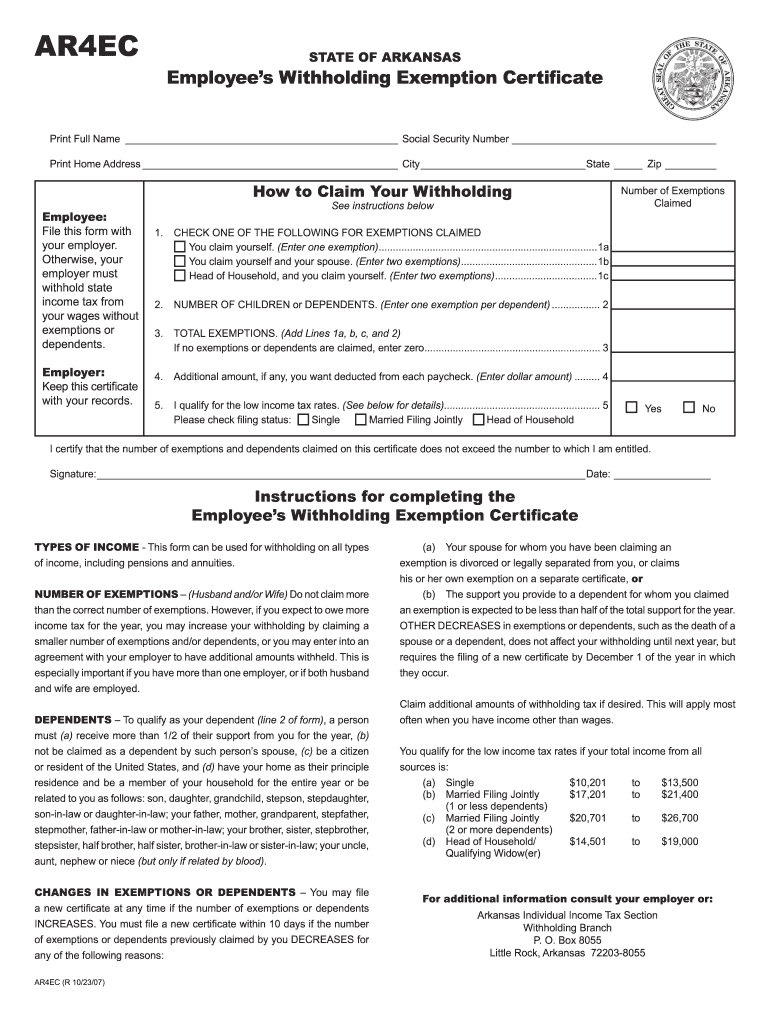

Ar4ec 20202022 Fill and Sign Printable Template Online US Legal Forms

Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Computed using the tax tables or tax can be computed using the withholding tax formula, both of which are provided in this publication. Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself. Web file ar941,.

Fillable Form Ar1055 Arkansas Request For Extension Of Time For

File this form with your employer. Web form ar3mar is your annual reconciliation of monthly withholding. Keep this certificate with your records. Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. Web how to claim your withholding state zip number of exemptions employee:

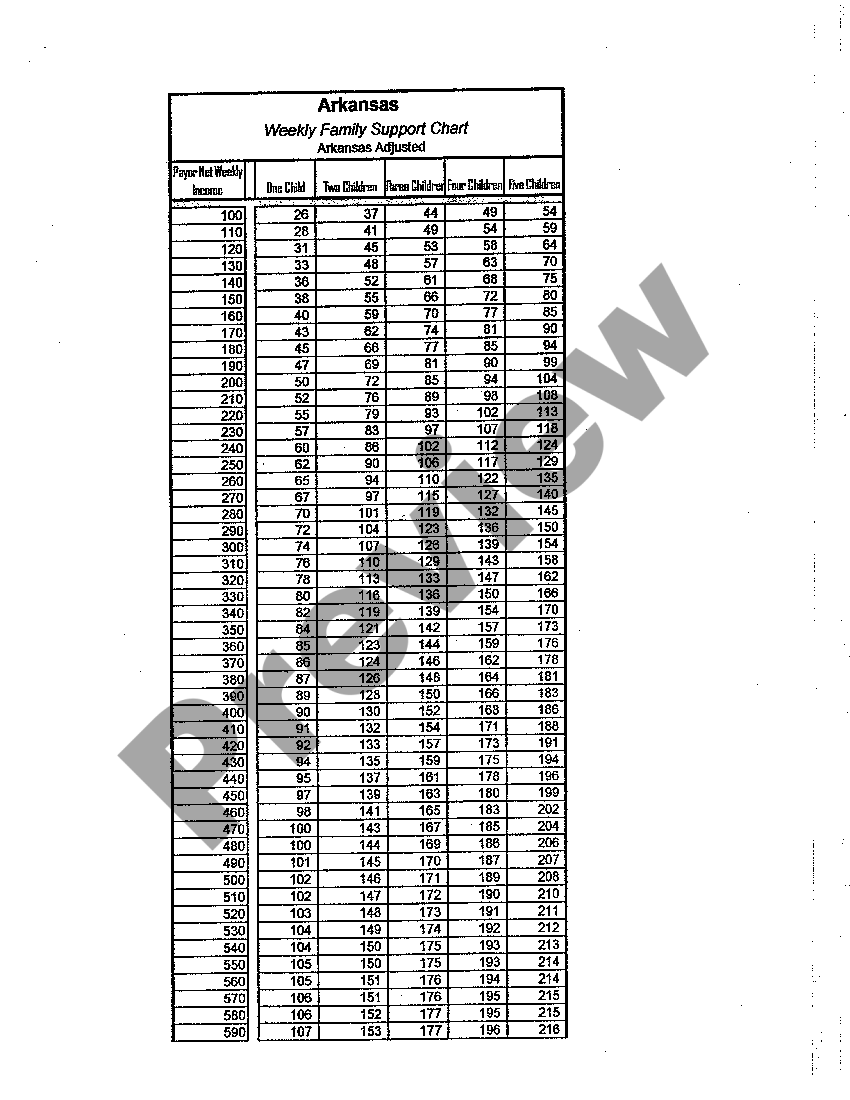

Arkansas Child Support Chart Withholding Limits US Legal Forms

File this form with your employer to exempt your earnings from state income tax withholding. Keep this certificate with your records. We have one or no dependent, and If too much is withheld, you will generally be due a refund. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022.

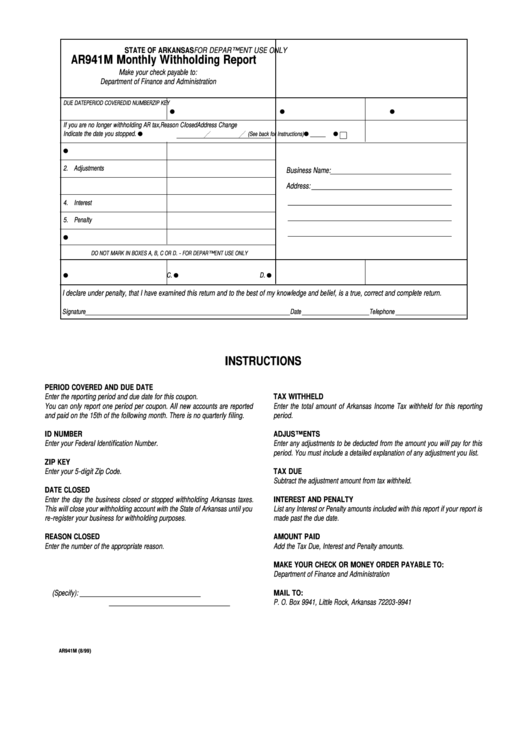

Form Ar941m State Of Arkansas Monthly Withholding Report 1999

Web form ar3mar is your annual reconciliation of monthly withholding. We have one or no dependent, and [ ] i am single and my gross income from all sources will not exceed $10,200. Keep this certificate with your records. (b) you claim yourself and your spouse.

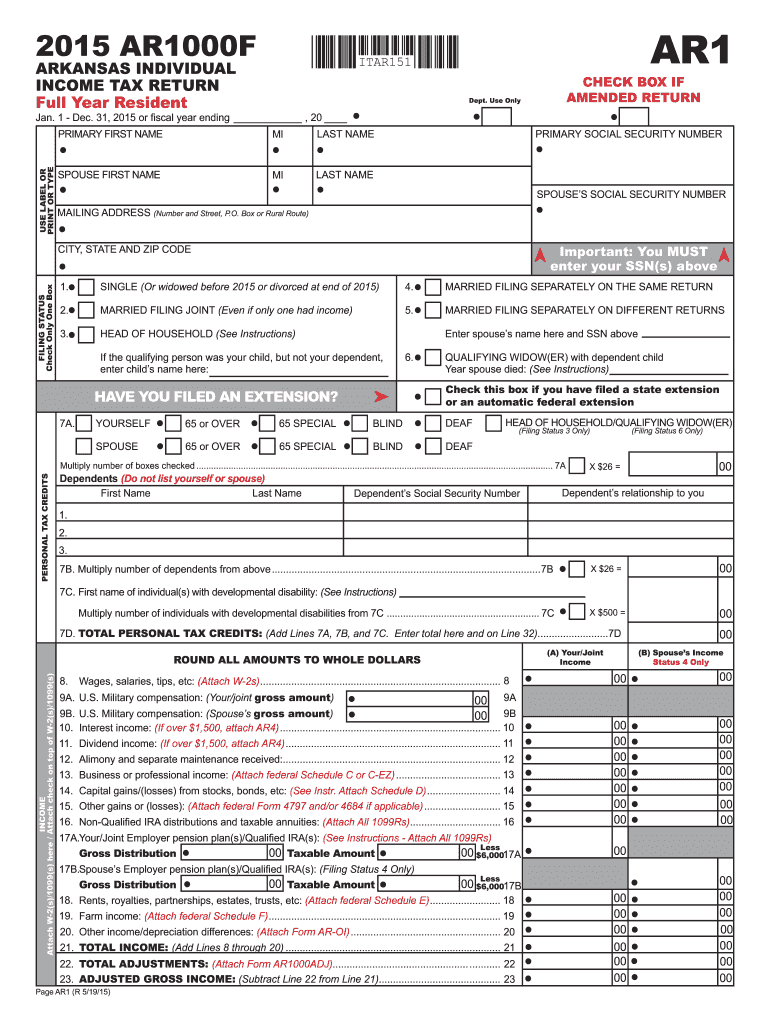

Tax Form Ar Fill Out and Sign Printable PDF Template signNow

Check one of the following for exemptions claimed (a) you claim yourself. [ ] i am single and my gross income from all sources will not exceed $10,200. File this form with your employer to exempt your earnings from state income tax withholding. Computed using the tax tables or tax can be computed using the withholding tax formula, both of.

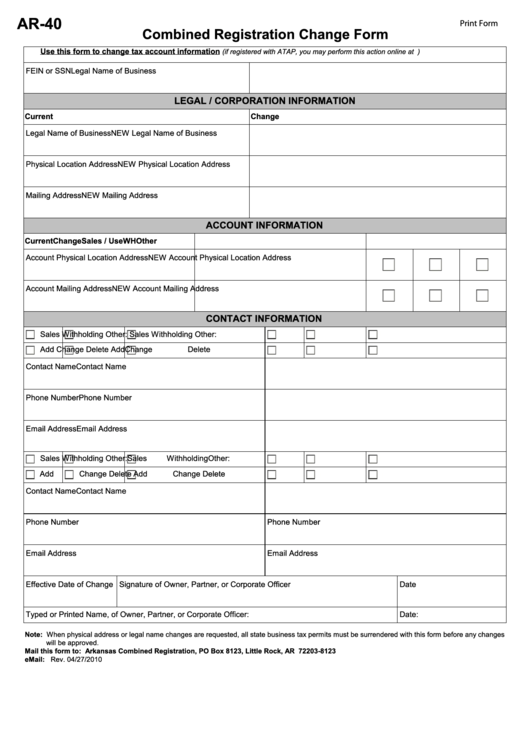

Fillable Form Ar40 Combined Registration Change Form Arkansas

Web form ar3mar is your annual reconciliation of monthly withholding. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Web file ar941, employers annual report for income tax withheld and pay any tax due for the previous calendar year. [ ] i am single and my gross income.

We Have One Or No Dependent, And

File this form with your employer. Your withholding is subject to review by the irs. File this form with your employer to exempt your earnings from state income tax withholding. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty.

Web State Of Arkansas Withholding Tax Revised:

Keep this certificate with your records. (b) you claim yourself and your spouse. [ ] i am married filing jointly with my spouse. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022.

Web Withholding Tax Formula (Effective 06/01/2023) 06/05/2023.

Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Web how to claim your withholding instructions on the reverse side 1. Web file ar941, employers annual report for income tax withheld and pay any tax due for the previous calendar year. Computed using the tax tables or tax can be computed using the withholding tax formula, both of which are provided in this publication.

[ ] I Am Single And My Gross Income From All Sources Will Not Exceed $10,200.

04/03/2019 page 8 of 65. Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself. Check one of the following for exemptions claimed (a) you claim yourself. Web how to claim your withholding state zip number of exemptions employee: