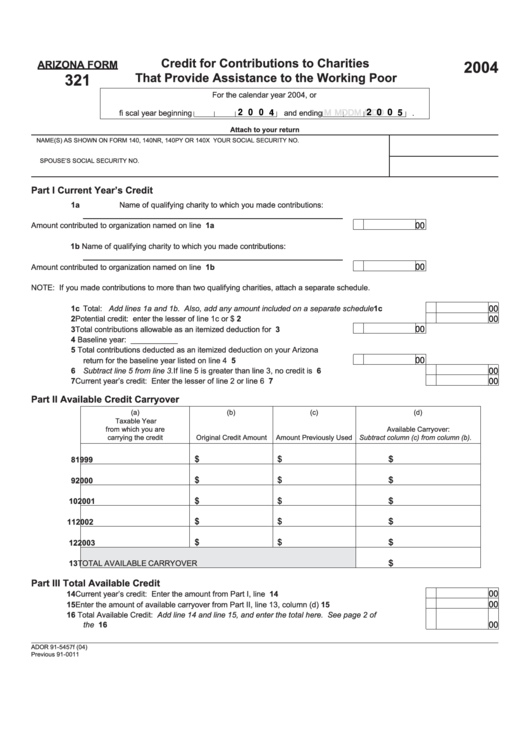

Arizona Form 321 Qualifying Charities

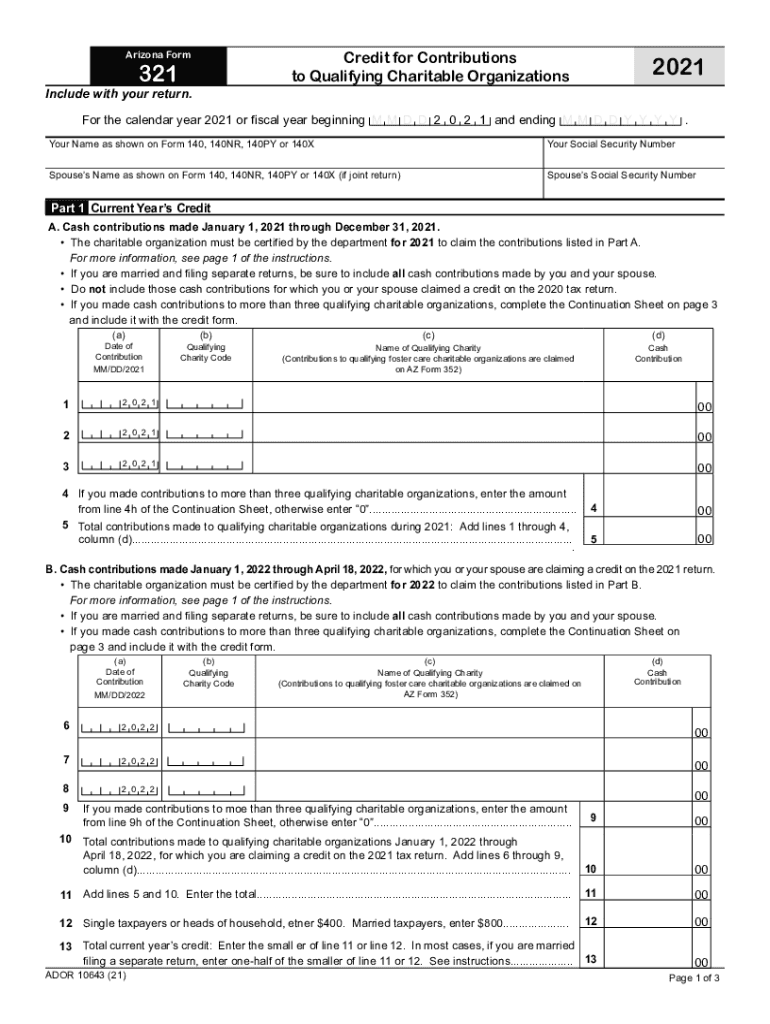

Arizona Form 321 Qualifying Charities - The five digit code number of the qualifying charity or the uco fund code (for example: A cash contribution to a qualifying foster care charitable organization does not qualify for, and cannot be included in, a credit claimed on form 321 for cash. Web 2021 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: The name of the qualifying charity or. Web 321to qualifying charitable organizations2021 include with your return. Web arizona form 321 3 column (a): Web use arizona form 321, “credit for contributions to qualifying charitable organizations” to claim your tax credit. For the calendar year 2021 or fiscal year beginning mmdd2021 and ending mmddyyyy. This will be a form of documentation that must be. Web for a complete list of 2022 approved charities, click 2022 secc approved charities.

Cash contributions made january 1, 2021 through december 31, 2021. If you made cash contributions to qualifying. Web 2022 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: Part 1 current year’s credit a. A qualifying charity is also a charity that is a designated community action agency that receives community services block grant program money under the. The deadline for making a. Keep a receipt of your gift to the charity. Web effective in 2018, the arizona department of revenue has assigned a five (5) digit code number to identify each qualifying charitable organization and qualifying foster. Web (a) date of contribution mm/dd/2023 (b) qualifying charity code (c) name of qualifying charity (contributions to qualifying foster care charitable organizations are claimed on. Web credit for contributions 321to qualifying charitable organizations2022 include with your return.

Web cannot included in a credit claimed on form 321 for cash , contributions made to a qualifying charitable organization (qco). Keep a receipt of your gift to the charity. Web for a complete list of 2022 approved charities, click 2022 secc approved charities. Part 1 current year’s credit a. Donate to a qualified charitable organization. Web use arizona form 321, “credit for contributions to qualifying charitable organizations” to claim your tax credit. For the calendar year 2021 or fiscal year beginning mmdd2021 and ending mmddyyyy. What is the deadline for contributing? Get ready for tax season deadlines by completing any required tax forms today. A cash contribution to a qualifying foster care charitable organization does not qualify for, and cannot be included in, a credit claimed on form 321 for cash.

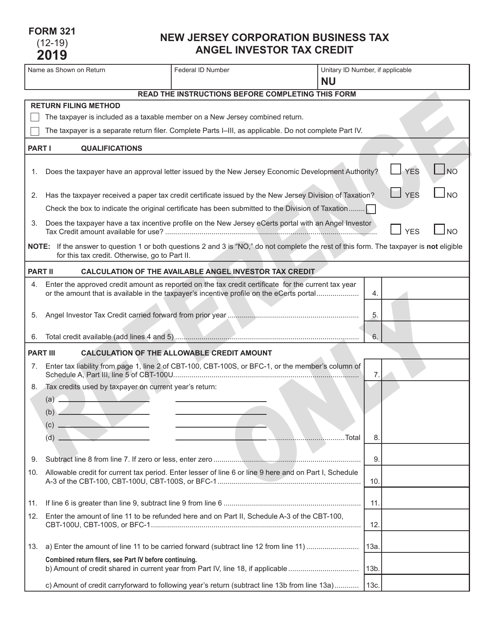

Form 321 Download Printable PDF or Fill Online Angel Investor Tax

— credit for contributions to qualifying charitable organizations. Web credit for contributions 321to qualifying charitable organizations2022 include with your return. Web we last updated the credit for contributions to qualifying charitable organizations in february 2023, so this is the latest version of form 321, fully updated for tax year 2022. Web 2022 credit for contributions arizona form to qualifying charitable.

Arizona Form 321 Qualifying Fill Out and Sign Printable PDF Template

Donate to a qualified charitable organization. Web 321to qualifying charitable organizations2021 include with your return. Web arizona form 321 3 column (a): Cash contributions made january 1, 2021 through december 31, 2021. If you made cash contributions to qualifying.

Arizona Form 5000a Fillable 2020 Fill and Sign Printable Template

Ad register and subscribe now to work on your az dor form 321 & more fillable forms. If you made cash contributions to qualifying. Make a gift to a qualified charitable organization (qco), like a new leaf. A qualifying charity is also a charity that is a designated community action agency that receives community services block grant program money under.

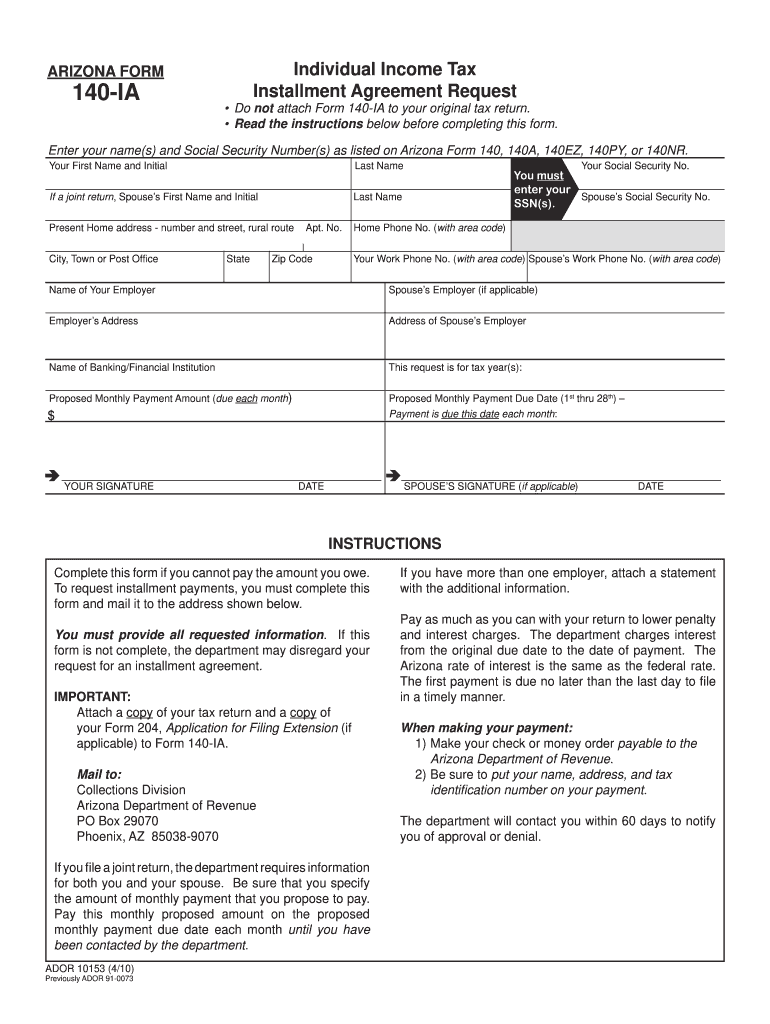

Arizona Form 140IA Arizona Department Of Revenue Fill and Sign

Web 321to qualifying charitable organizations2021 include with your return. Web 2021 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: The deadline for making a. Web (a) date of contribution mm/dd/2023 (b) qualifying charity code (c) name of qualifying charity (contributions to qualifying foster care charitable organizations are claimed.

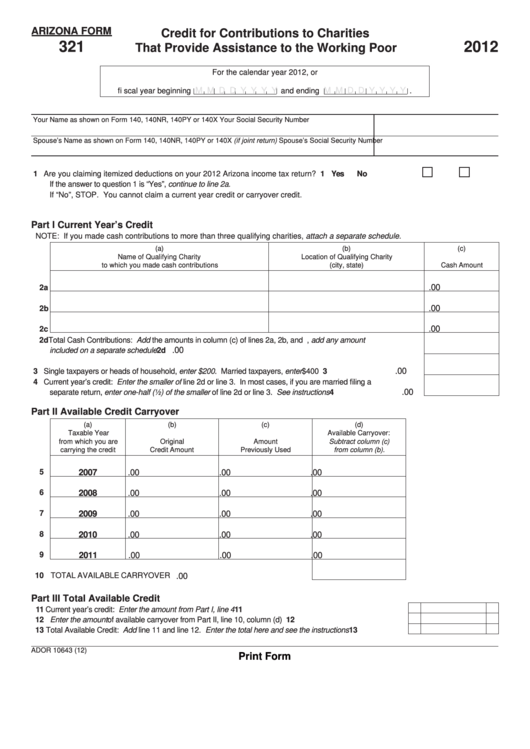

Fillable Arizona Form 321 Credit For Contributions To Charities That

A qualifying charity is also a charity that is a designated community action agency that receives community services block grant program money under the. Web 2022 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: Web arizona form 321 1 (1) include with your return. Get ready for tax.

Fillable Arizona Form 321 Credit For Contributions To Charities That

Web 2021 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: Web for a complete list of 2022 approved charities, click 2022 secc approved charities. The deadline for making a. The five digit code number of the qualifying charity or the uco fund code (for example: Web 321to qualifying.

Arizona Form 285Up Fill Out and Sign Printable PDF Template signNow

Donate to a qualified charitable organization. The five digit code number of the qualifying charity or the uco fund code (for example: Complete, edit or print tax forms instantly. Web effective in 2018, the arizona department of revenue has assigned a five (5) digit code number to identify each qualifying charitable organization and qualifying foster. For the calendar year 2022.

PPT Arizona State Tax Return 2012 PowerPoint Presentation, free

— credit for contributions to qualifying charitable organizations. Web 321to qualifying charitable organizations2021 include with your return. A qualifying charity is also a charity that is a designated community action agency that receives community services block grant program money under the. Web use arizona form 321, “credit for contributions to qualifying charitable organizations” to claim your tax credit. Ad register.

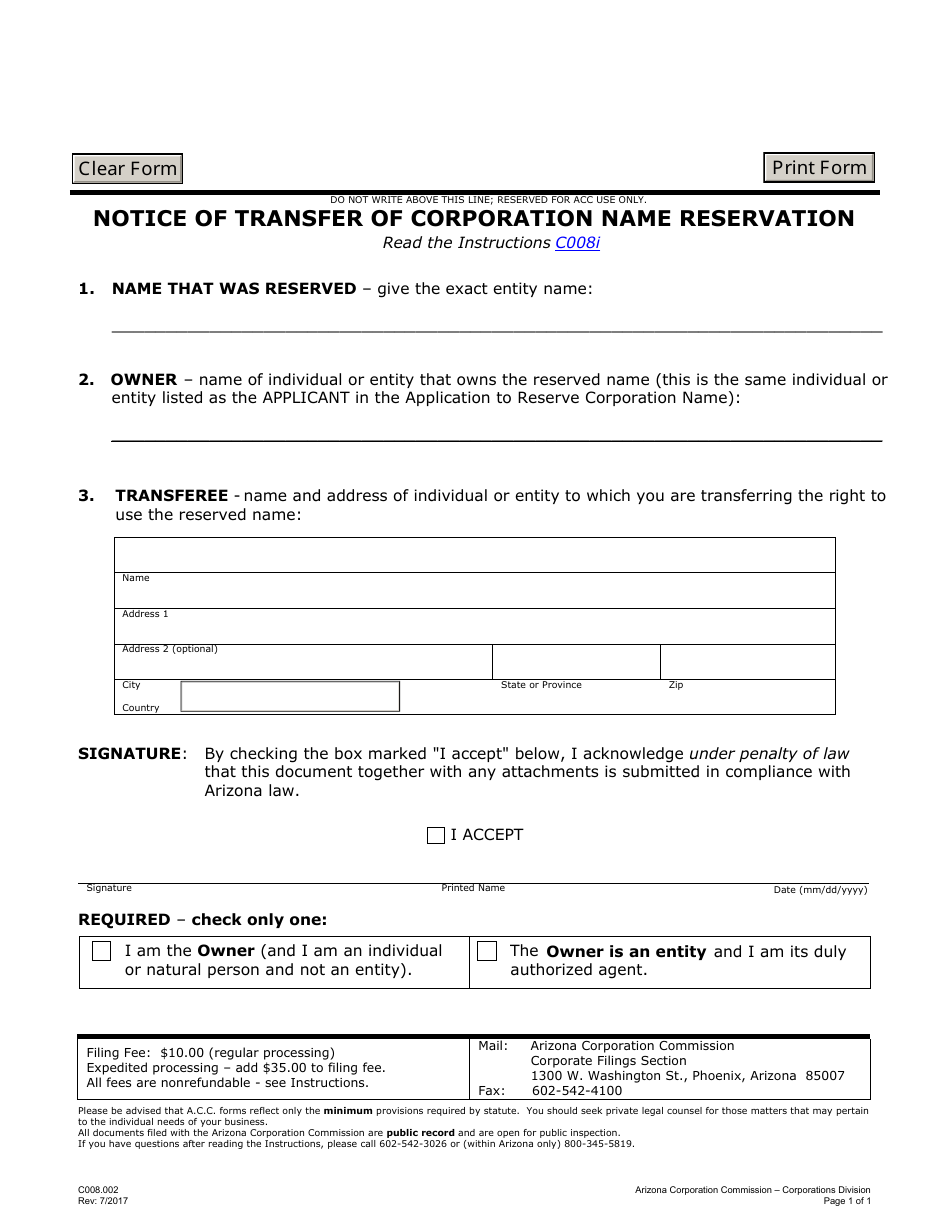

Form C008.002 Download Fillable PDF or Fill Online Notice of Transfer

Web 2022 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: Get ready for tax season deadlines by completing any required tax forms today. Web credit for contributions 321to qualifying charitable organizations2022 include with your return. For the calendar year 2022 or fiscal year beginning mmdd2022 and ending. What.

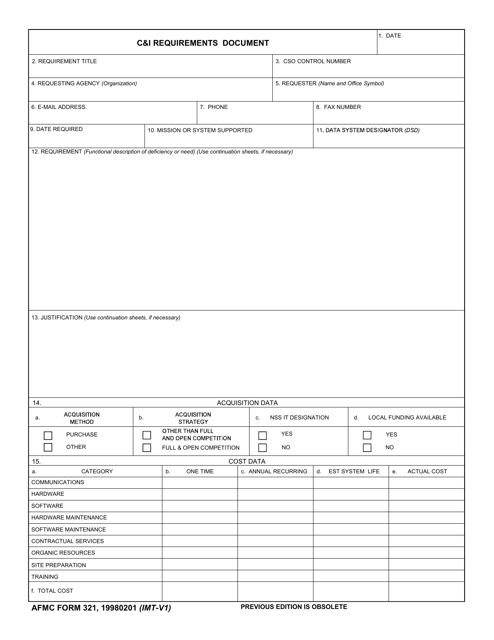

AFMC Form 321 Download Fillable PDF or Fill Online C & I Requirements

For the calendar year 2022 or fiscal year beginning mmdd2022 and ending. Web arizona form 321 1 (1) include with your return. Keep a receipt of your gift to the charity. The deadline for making a. What is the deadline for contributing?

Web 2021 Credit For Contributions Arizona Form To Qualifying Charitable Organizations 321 For Information Or Help, Call One Of The Numbers Listed:

A qualifying charity is also a charity that is a designated community action agency that receives community services block grant program money under the. Web arizona form 321 2. Get ready for tax season deadlines by completing any required tax forms today. Ad register and subscribe now to work on your az dor form 321 & more fillable forms.

Web Arizona Form 321 3 Column (A):

Web use arizona form 321, “credit for contributions to qualifying charitable organizations” to claim your tax credit. Keep a receipt of your gift to the charity. A cash contribution to a qualifying foster care charitable organization does not qualify for, and cannot be included in, a credit claimed on form 321 for cash. Web effective in 2018, the arizona department of revenue has assigned a five (5) digit code number to identify each qualifying charitable organization and qualifying foster.

Complete, Edit Or Print Tax Forms Instantly.

Cash contributions made january 1, 2021 through december 31, 2021. — credit for contributions to qualifying charitable organizations. The deadline for making a. If you made cash contributions to qualifying.

Ad Register And Subscribe Now To Work On Your Az Dor Form 321 & More Fillable Forms.

For the calendar year 2022 or fiscal year beginning mmdd2022 and ending. Web cannot included in a credit claimed on form 321 for cash , contributions made to a qualifying charitable organization (qco). Web (a) date of contribution mm/dd/2023 (b) qualifying charity code (c) name of qualifying charity (contributions to qualifying foster care charitable organizations are claimed on. The five digit code number of the qualifying charity or the uco fund code (for example: