Arizona Form A-4 How Much To Withhold

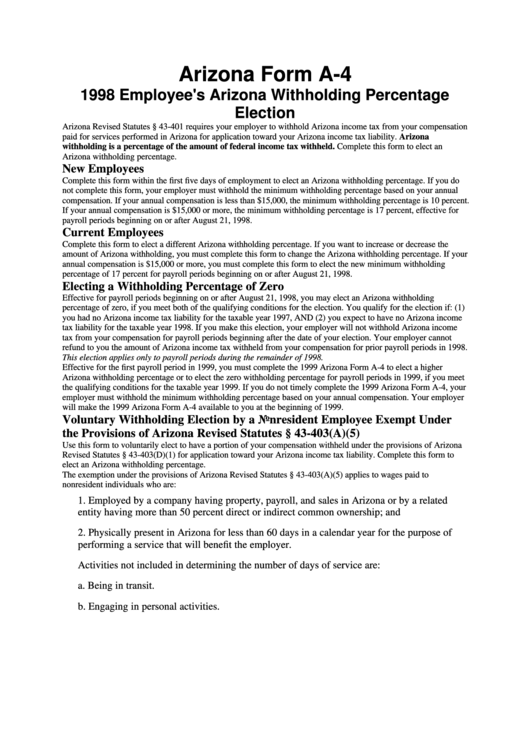

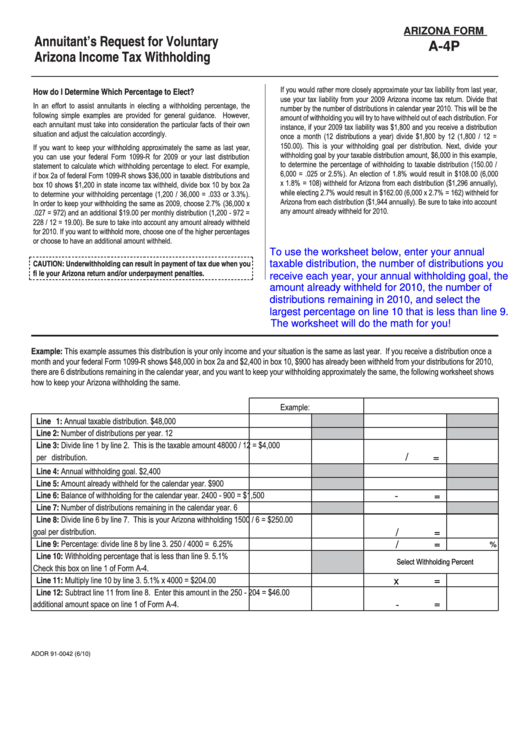

Arizona Form A-4 How Much To Withhold - All employees may update their federal and state income tax withholdings anytime throughout the year. 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% check this box and enter an extra amount to be withheld from each paycheck. Web withheld for arizona from each paycheck ($1,404 annually), while electing each paycheck ($1,872 annually). This form is for income earned in tax year 2022, with tax returns due in april 2023. If you want a little back, pick 3.36% and you'll get 0.38% ($152) back in april. Please encourage employees to consult a tax advisor to make a selection that is appropriate for their particular situation. Web choose either box 1 or box 2: Get ready for tax season deadlines by completing any required tax forms today. Web complete this form to select a percentage of arizona income tax to be withheld, as well as any additional amount to be withheld from each paycheck. Be sure to take into account any amount already withheld for 2010.

This form is for income earned in tax year 2022, with tax returns due in april 2023. Electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Tax season can be a confusing time for many individuals, especially when it comes to determining how much should be withheld from their paychecks. Web with so much up in the air regarding the future of arizona football, the program needed a big recruiting triumph. Please encourage employees to consult a tax advisor to make a selection that is appropriate for their particular situation. We will update this page with a new version of the form for 2024 as soon as it is made available by the arizona government. Web withheld for arizona from each paycheck ($1,404 annually), while electing each paycheck ($1,872 annually). Web 2.88% on your next 15k ($432) 3.36% on your next 15k ($504) your tax burden is $1,195, or 2.98%. § 43‑408(b), the employer understands and agrees that the employer and the employee are subject to the provisions of chapter 4 of title 43 of the arizona revised

Tax season can be a confusing time for many individuals, especially when it comes to determining how much should be withheld from their paychecks. We will update this page with a new version of the form for 2024 as soon as it is made available by the arizona government. Divide the annual arizona income tax withholding by 26 to obtain the biweekly arizona income tax withholding. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Web choose either box 1 or box 2: § 43‑408(b), the employer understands and agrees that the employer and the employee are subject to the provisions of chapter 4 of title 43 of the arizona revised Electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Web with so much up in the air regarding the future of arizona football, the program needed a big recruiting triumph. Web has agreed to withhold arizona income taxes from the employee’s compensation as authorized by a.r.s. 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% check this box and enter an extra amount to be withheld from each paycheck.

Arizona Form A4 1998 Employee'S Arizona Withholding Percentage

If you want a little back, pick 3.36% and you'll get 0.38% ($152) back in april. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web choose either box 1 or box 2: Web 20 rows withholding returns must be filed electronically for taxable years beginning from and after december 31, 2019..

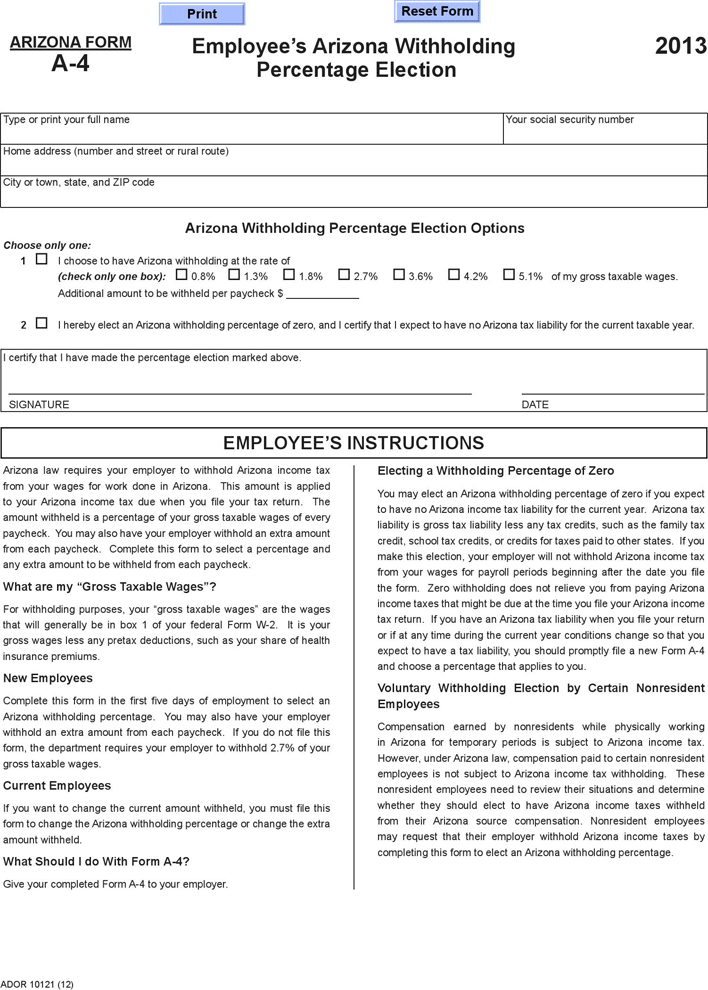

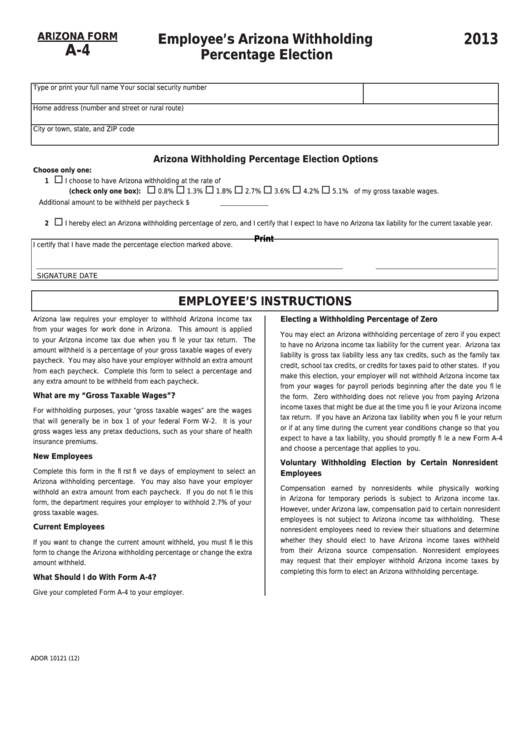

Download Arizona Form A4 (2013) for Free FormTemplate

Tax season can be a confusing time for many individuals, especially when it comes to determining how much should be withheld from their paychecks. Web complete this form to select a percentage of arizona income tax to be withheld, as well as any additional amount to be withheld from each paycheck. Get ready for tax season deadlines by completing any.

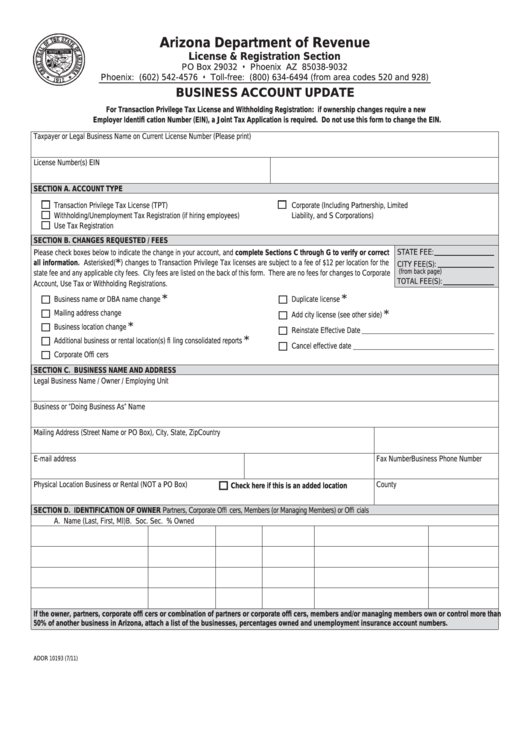

Fillable Arizona Form 10193 Business Account Update printable pdf

Web choose either box 1 or box 2: Web 20 rows withholding returns must be filed electronically for taxable years beginning from and after december 31, 2019. Employee’s arizona withholding percentage election arizona form a. Get ready for tax season deadlines by completing any required tax forms today. Web to change the extra amount withheld.

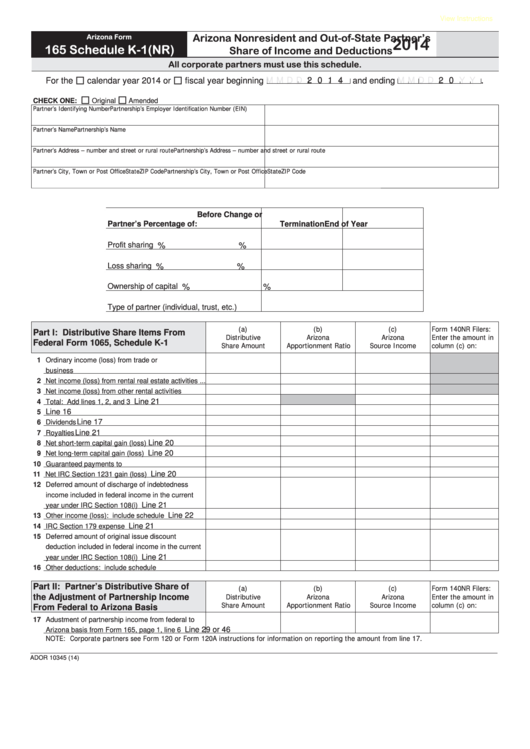

Fillable Schedule K1(Nr) (Arizona Form 165) Arizona Nonresident And

Electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Web with so much up in the air regarding the future of arizona football, the program needed a big recruiting triumph. Please encourage employees to consult a tax advisor to make.

Instructions For Arizona Form A4 Annuitant'S Request For Voluntary

Get ready for tax season deadlines by completing any required tax forms today. Please encourage employees to consult a tax advisor to make a selection that is appropriate for their particular situation. If you want a little back, pick 3.36% and you'll get 0.38% ($152) back in april. Employee’s arizona withholding percentage election arizona form a. Web to change the.

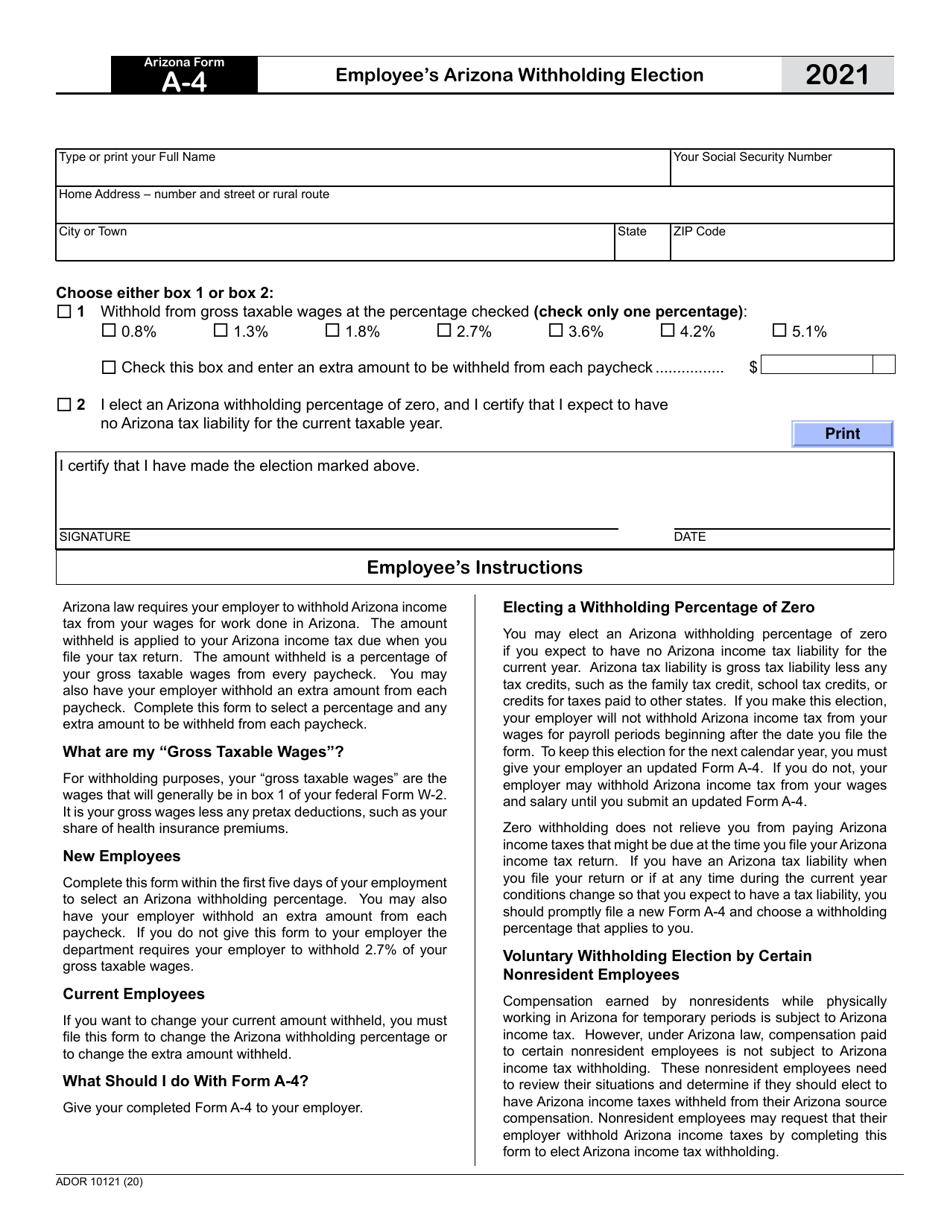

Arizona Form A4 (ADOR10121) Download Fillable PDF or Fill Online

Web 20 rows withholding returns must be filed electronically for taxable years beginning from and after december 31, 2019. Please encourage employees to consult a tax advisor to make a selection that is appropriate for their particular situation. Tax season can be a confusing time for many individuals, especially when it comes to determining how much should be withheld from.

State Tax Withholding Forms Template Free Download Speedy Template

1 withhold from gross taxable wages at the percentage checked (check only one percentage): Complete, edit or print tax forms instantly. Web to change the extra amount withheld. Web complete this form to select a percentage of arizona income tax to be withheld, as well as any additional amount to be withheld from each paycheck. Web withheld for arizona from.

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Web choose either box 1 or box 2: Complete, edit or print tax forms instantly. Web has agreed to withhold arizona income taxes from the employee’s compensation as authorized by a.r.s. If you want a little back, pick 3.36% and you'll get 0.38% ($152) back in april. Complete, edit or print tax forms instantly.

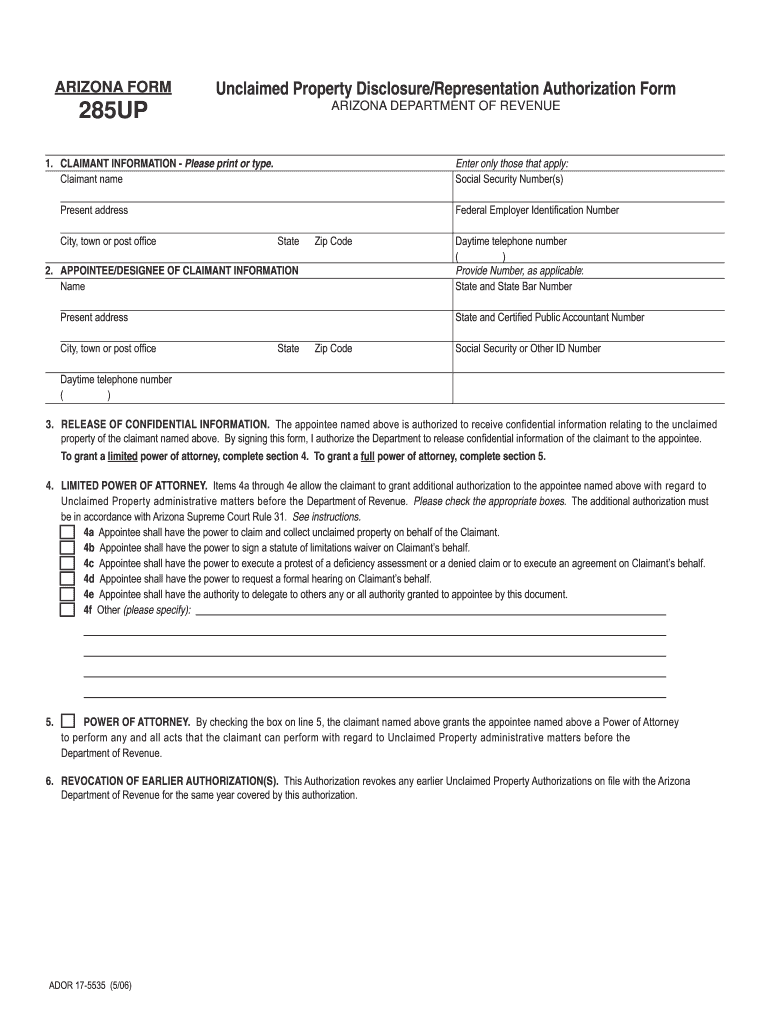

Arizona Form Property Disclosure Fill Out and Sign Printable PDF

Web 2.88% on your next 15k ($432) 3.36% on your next 15k ($504) your tax burden is $1,195, or 2.98%. Please encourage employees to consult a tax advisor to make a selection that is appropriate for their particular situation. Tax season can be a confusing time for many individuals, especially when it comes to determining how much should be withheld.

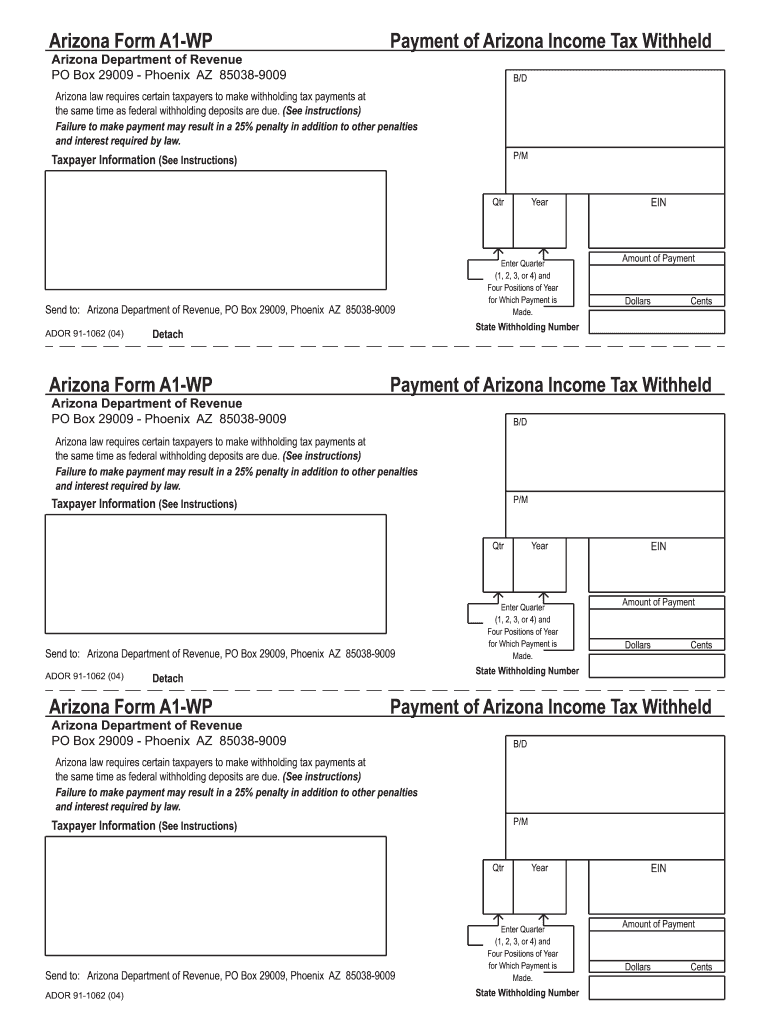

2004 Form AZ ADOR A1WP Fill Online, Printable, Fillable, Blank pdfFiller

Web complete this form to select a percentage of arizona income tax to be withheld, as well as any additional amount to be withheld from each paycheck. We will update this page with a new version of the form for 2024 as soon as it is made available by the arizona government. Web withheld for arizona from each paycheck ($1,404.

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available By The Arizona Government.

Employee’s arizona withholding percentage election arizona form a. Please encourage employees to consult a tax advisor to make a selection that is appropriate for their particular situation. Web has agreed to withhold arizona income taxes from the employee’s compensation as authorized by a.r.s. Electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year.

Web Complete This Form To Select A Percentage Of Arizona Income Tax To Be Withheld, As Well As Any Additional Amount To Be Withheld From Each Paycheck.

0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% check this box and enter an extra amount to be withheld from each paycheck. Web to change the extra amount withheld. § 43‑408(b), the employer understands and agrees that the employer and the employee are subject to the provisions of chapter 4 of title 43 of the arizona revised If you want a little back, pick 3.36% and you'll get 0.38% ($152) back in april.

Web 2.88% On Your Next 15K ($432) 3.36% On Your Next 15K ($504) Your Tax Burden Is $1,195, Or 2.98%.

Arizona tax liability is gross tax liability. Tax season can be a confusing time for many individuals, especially when it comes to determining how much should be withheld from their paychecks. Get ready for tax season deadlines by completing any required tax forms today. Web withheld for arizona from each paycheck ($1,404 annually), while electing each paycheck ($1,872 annually).

Be Sure To Take Into Account Any Amount Already Withheld For 2010.

Web 20 rows withholding returns must be filed electronically for taxable years beginning from and after december 31, 2019. Complete, edit or print tax forms instantly. Web with so much up in the air regarding the future of arizona football, the program needed a big recruiting triumph. 1 withhold from gross taxable wages at the percentage checked (check only one percentage):