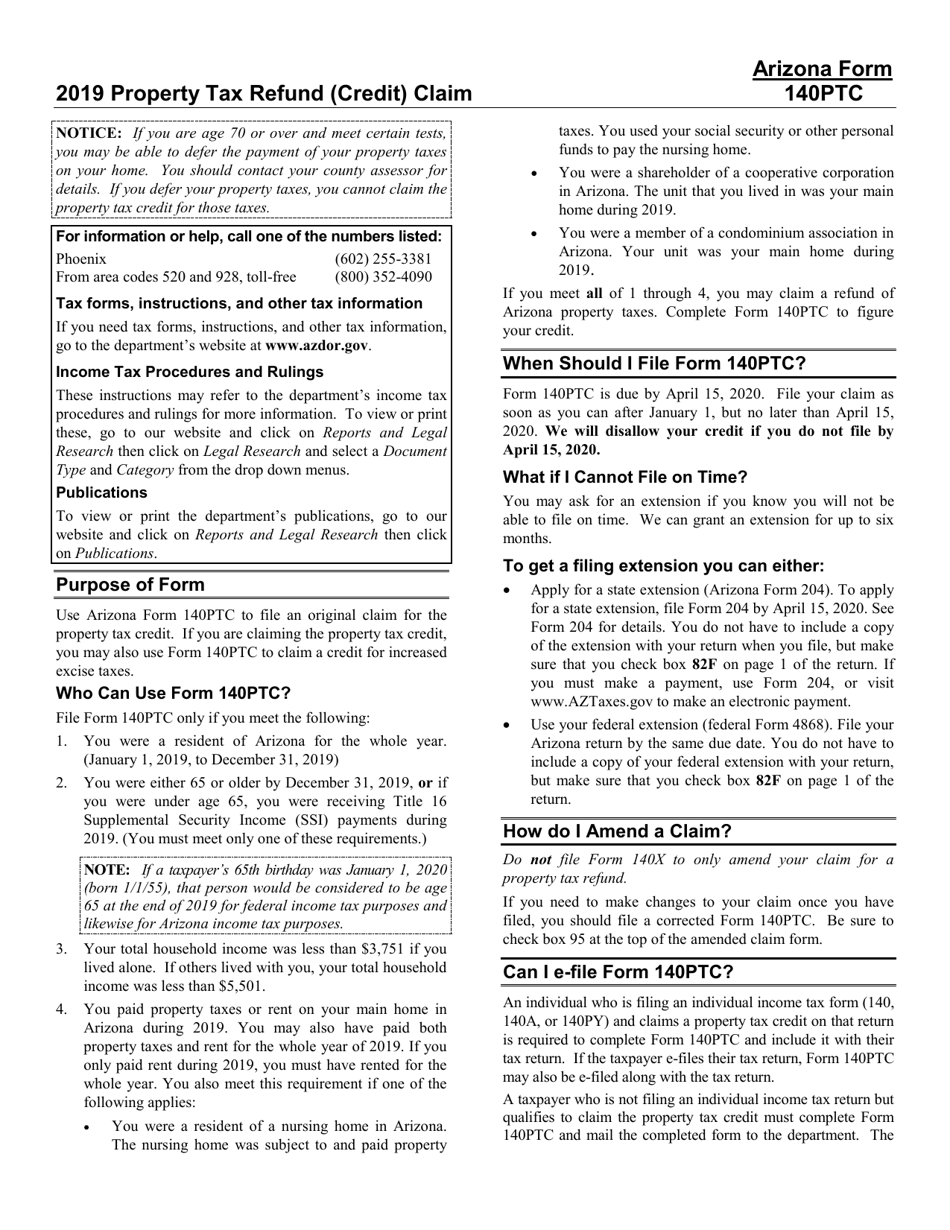

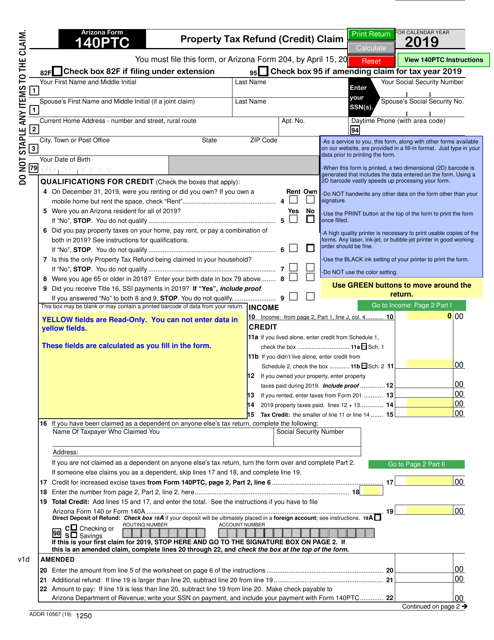

Arizona Tax Form 140Ptc

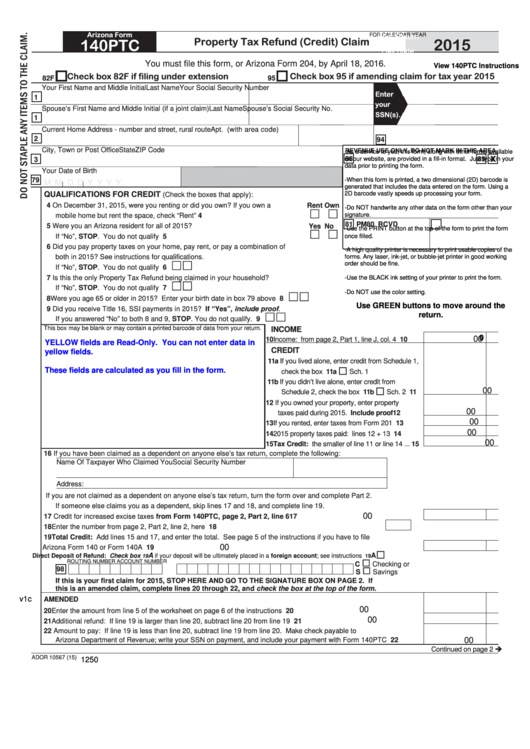

Arizona Tax Form 140Ptc - Web the most common arizona income tax form is the arizona form 140. Do not mark in this area. Get ready for this year's tax season quickly and safely with pdffiller! Web use arizona form 140ptc to file an original claim for the property tax credit. This form should be completed after. File form 140ptc only if you meet the following: If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. Get ready for tax season deadlines by completing any required tax forms today. Register and subscribe now to work on your az ador 140ptc & more fillable forms.

81 pm 80 rcvd do not staple any items to the claim. Web form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or rented by the. Do not mark in this area. Get ready for this year's tax season quickly and safely with pdffiller! This form should be completed after. Web we last updated arizona form 140ptc in february 2023 from the arizona department of revenue. Complete, edit or print tax forms instantly. Web 140ptc property tax refund (credit) claim 2020 88 revenue use only. If you are claiming the property tax credit, you may also use form 140ptc to. This form is used by residents who file an individual income tax return.

File form 140ptc only if you meet the following: Get ready for this year's tax season quickly and safely with pdffiller! Web 140ptc property tax refund (credit) claim 2020 88 revenue use only. Form is used by qualified individuals to claim a refundable income tax credit for taxes paid on. If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. You must use form 140 if any of the following apply: If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. You were a resident of arizona for the entire tax year. Ad register and subscribe now to work on your az ador 140ptc booklet & more fillable forms. Get ready for tax season deadlines by completing any required tax forms today.

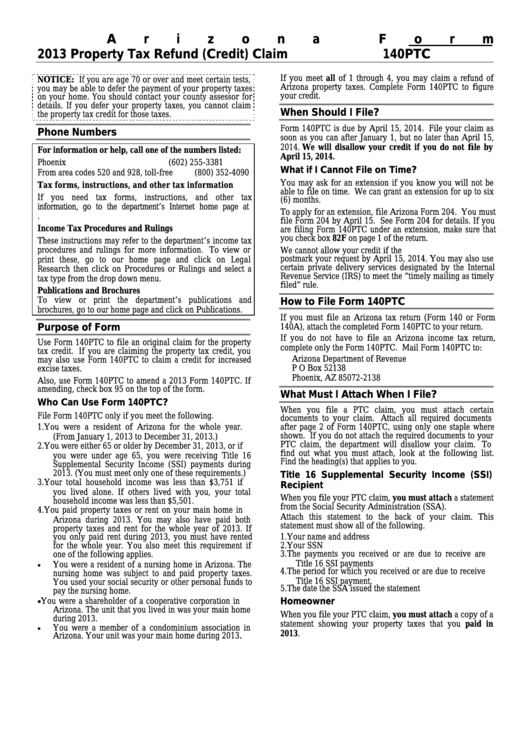

Download Instructions for Arizona Form 140PTC, ADOR10567 Property Tax

Form is used by qualified individuals to claim a refundable income tax credit for taxes paid on. If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. If you are claiming the.

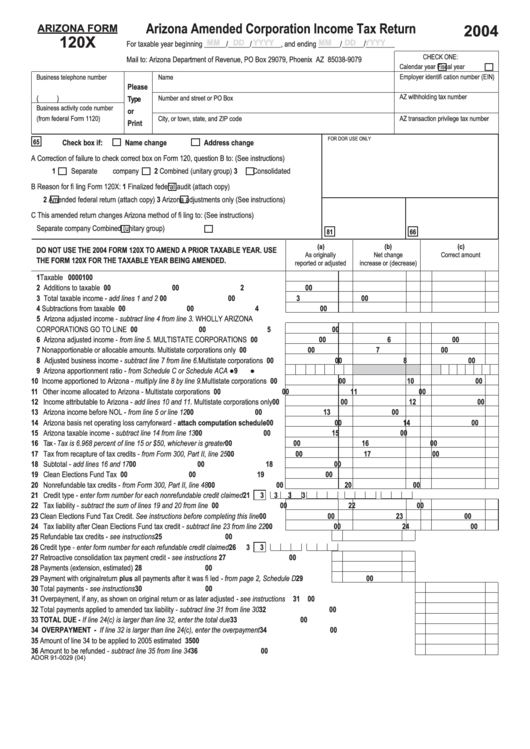

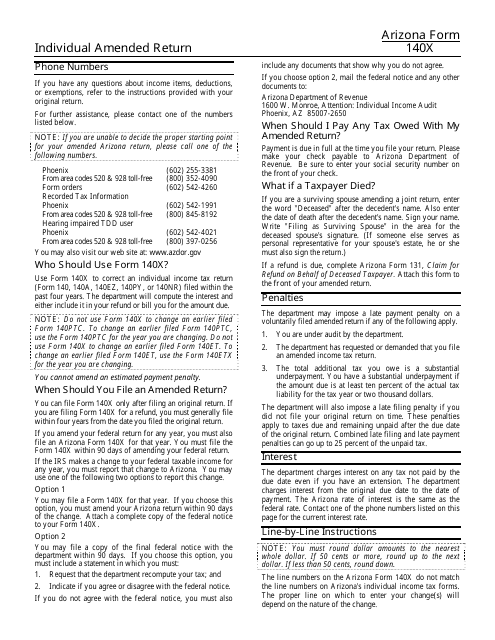

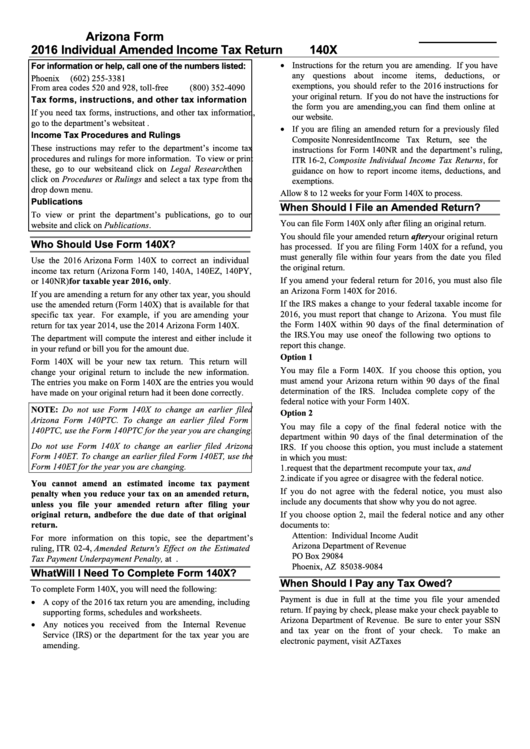

Arizona Form 120x Arizona Amended Corporation Tax Return

Do not mark in this area. Web the most common arizona income tax form is the arizona form 140. Do not mark in this area. File form 140ptc only if you meet the following: This form is for income earned in tax year 2022, with tax returns due in.

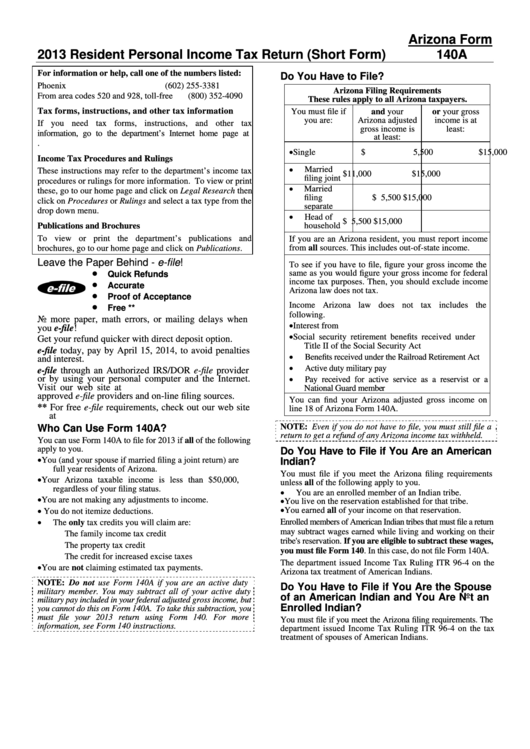

Instructions For Arizona Form 140a Resident Personal Tax

This form is used by residents who file an individual income tax return. You were a resident of arizona for the entire tax year. If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. This form should be completed after. Web use arizona form 140ptc to file an original claim for.

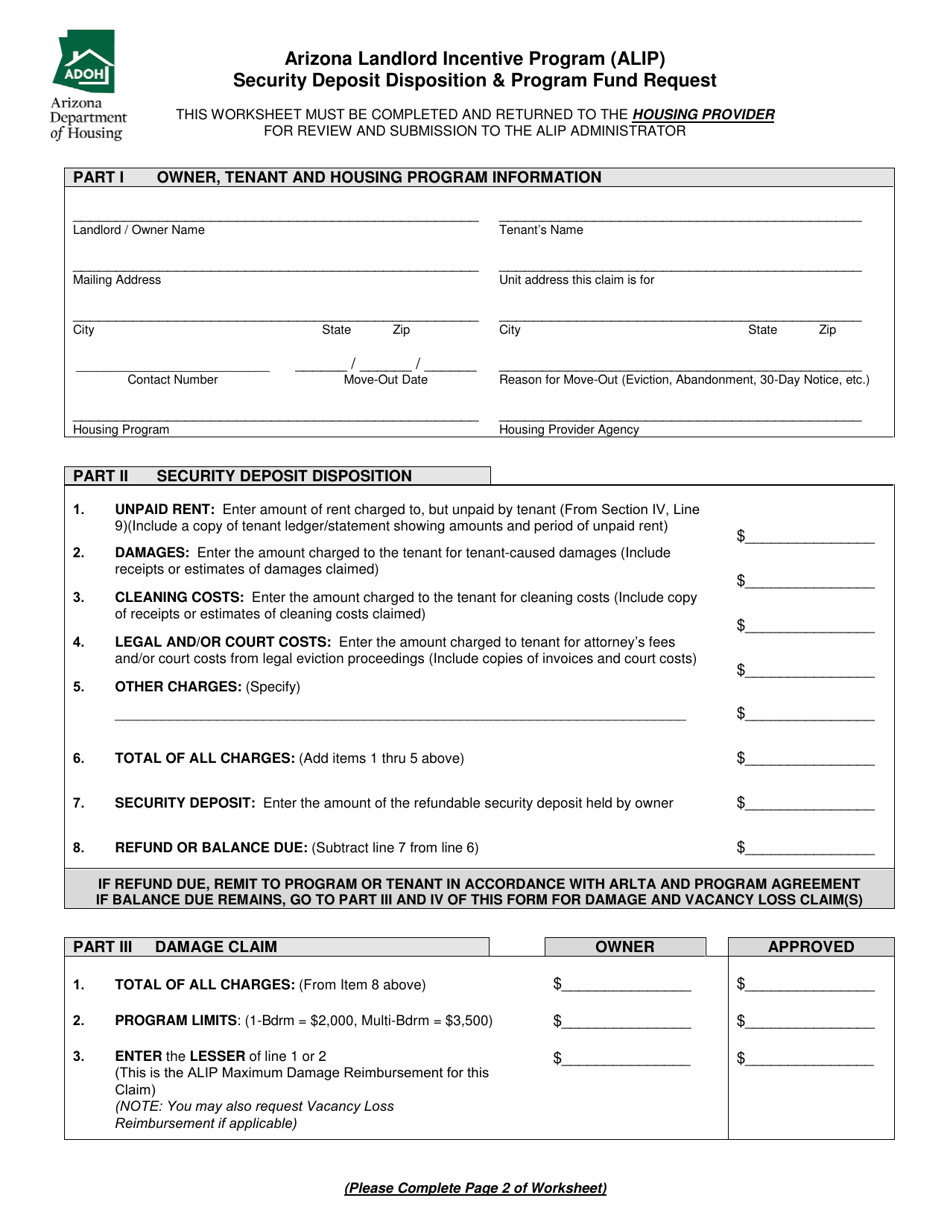

Arizona Arizona Landlord Incentive Program (Alip) Security Deposit

Get ready for tax season deadlines by completing any required tax forms today. Web an individual is filing an who individual income tax form (140 or140a) and claims a property tax credit on that return is required to complete form 140ptc and. Get ready for this year's tax season quickly and safely with pdffiller! Web use arizona form 140ptc to.

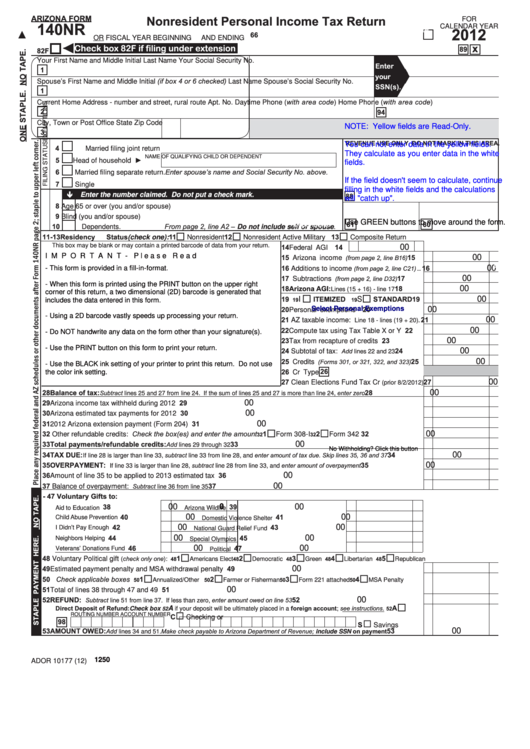

Fillable Arizona Form 140nr Nonresident Personal Tax Return

Web the arizona property tax credit. Web up to $40 cash back easily complete a printable irs arizona form 140ptc 2020 2023 online. Web we last updated arizona form 140ptc in february 2023 from the arizona department of revenue. You must use form 140 if any of the following apply: If you are claiming the property tax credit, you may.

Fillable Arizona Form 140ptc Property Tax Refund (Credit) Claim

This form is for income earned in tax year 2022, with tax returns due in. This form is used by residents who file an individual income tax return. You must use form 140 if any of the following apply: Ad register and subscribe now to work on your az ador 140ptc booklet & more fillable forms. If you are claiming.

Instructions For Form 140ptc Property Tax Refund (Credit) Claim

This form is for income earned in tax year 2022, with tax returns due in. Web use arizona form 140ptc to file an original claim for the property tax credit. Get ready for tax season deadlines by completing any required tax forms today. This form should be completed after. This form is used by residents who file an individual income.

Arizona 140ez Fillable Form

Get ready for this year's tax season quickly and safely with pdffiller! You must use form 140 if any of the following apply: Web use arizona form 140ptc to file an original claim for the property tax credit. Web you may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents.

Arizona Form 140x 6 Individual Amended Tax Return 2016

Form is used by qualified individuals to claim a refundable income tax credit for taxes paid on. Web the most common arizona income tax form is the arizona form 140. You must use form 140 if any of the following apply: 81 pm 80 rcvd do not staple any items to the claim. Web we last updated arizona form 140ptc.

Arizona Form 140PTC (ADOR10567) Download Fillable PDF or Fill Online

Web up to $40 cash back easily complete a printable irs arizona form 140ptc 2020 2023 online. Web the arizona property tax credit. If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. Register and subscribe now to work on your az ador 140ptc & more fillable forms. Web the most.

Web 140Ptc Property Tax Refund (Credit) Claim 2021 88 Revenue Use Only.

Web form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or rented by the. Get ready for this year's tax season quickly and safely with pdffiller! Web use arizona form 140ptc to file an original claim for the property tax credit. Web the most common arizona income tax form is the arizona form 140.

Do Not Mark In This Area.

If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. Do not mark in this area. Register and subscribe now to work on your az ador 140ptc & more fillable forms.

Ad Register And Subscribe Now To Work On Your Az Ador 140Ptc Booklet & More Fillable Forms.

This form should be completed after. If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. If you are claiming the property tax credit, you may also use form 140ptc to. File form 140ptc only if you meet the following:

Web We Last Updated Arizona Form 140Ptc In February 2023 From The Arizona Department Of Revenue.

81 pm 80 rcvd do not staple any items to the claim. Web up to $40 cash back easily complete a printable irs arizona form 140ptc 2020 2023 online. Web you may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. This form is used by residents who file an individual income tax return.