At Risk Limitations Form 6198

At Risk Limitations Form 6198 - Form 6198 should be filed when a taxpayer has a loss in a. Second, the partner's amount at risk under. Generally, any loss from an activity that is. Generally, any loss from an activity (such as a rental). Solved•by intuit•3•updated july 12, 2022. Web these rules and the order in which they apply are: Upload, modify or create forms. First, the adjusted tax basis of the partnership interest under sec. Certain closely held corporations (other than s. Form 6198 isn't currently supported in the.

Second, the partner's amount at risk under. Generally, any loss from an activity that is. Web these rules and the order in which they apply are: Web for s corporation passthrough: Go to the income/deductions > s corporation passthrough worksheet. If that box is checked, the. Web home forms and instructions about form 8582, passive activity loss limitations about form 8582, passive activity loss limitations noncorporate. Try it for free now! Upload, modify or create forms. Form 6198 isn't currently supported in the.

Form 6198 isn't currently supported in the. Solved•by intuit•3•updated july 12, 2022. Generally, any loss from an. Generally, any loss from an activity that is. Web home forms and instructions about form 8582, passive activity loss limitations about form 8582, passive activity loss limitations noncorporate. First, the adjusted tax basis of the partnership interest under sec. Second, the partner's amount at risk under. Go to the income/deductions > s corporation passthrough worksheet. Web these rules and the order in which they apply are: Individuals, including partners and s corporation shareholders;

Partnership Reporting AtRisk Limitations Section 465 and Completing

Web these rules and the order in which they apply are: Generally, any loss from an activity (such as a rental). Web home forms and instructions about form 8582, passive activity loss limitations about form 8582, passive activity loss limitations noncorporate. First, the adjusted tax basis of the partnership interest under sec. Form 6198 should be filed when a taxpayer.

Form 6198 AtRisk Limitations (2009) Free Download

Try it for free now! Web these rules and the order in which they apply are: Generally, any loss from an. First, the adjusted tax basis of the partnership interest under sec. If that box is checked, the.

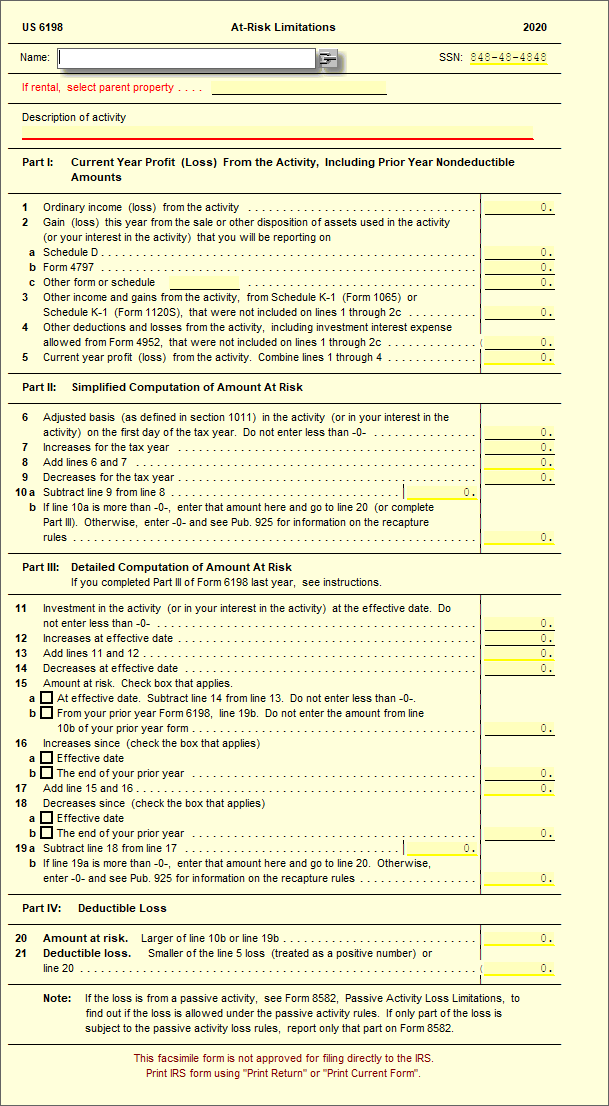

6198 AtRisk Limitations UltimateTax Solution Center

Web home forms and instructions about form 8582, passive activity loss limitations about form 8582, passive activity loss limitations noncorporate. Web for s corporation passthrough: Upload, modify or create forms. Web these rules and the order in which they apply are: Generally, any loss from an activity (such as a rental).

Inheritance N2 Funding & Investment

Web home forms and instructions about form 8582, passive activity loss limitations about form 8582, passive activity loss limitations noncorporate. Try it for free now! Web these rules and the order in which they apply are: Web for s corporation passthrough: Generally, any loss from an activity (such as a rental).

the atrisk rules or the passive activity losses rules?

Generally, any loss from an. Form 6198 should be filed when a taxpayer has a loss in a. Try it for free now! Upload, modify or create forms. First, the adjusted tax basis of the partnership interest under sec.

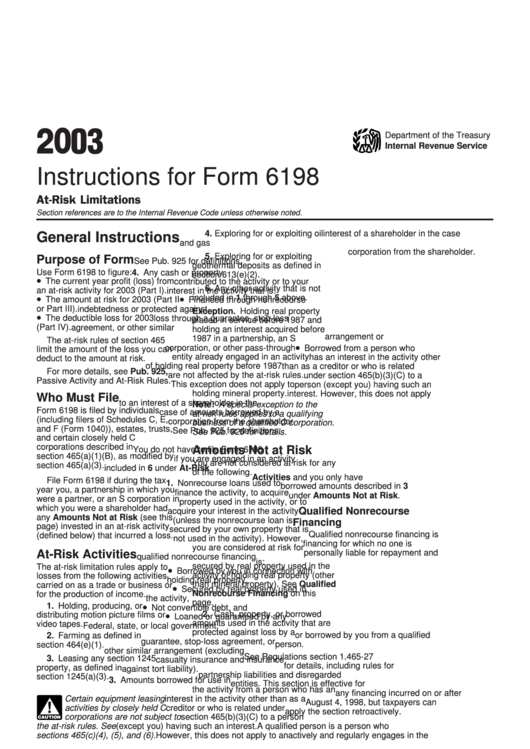

Instructions For Form 6198 AtRisk Limitations 2003 printable pdf

Second, the partner's amount at risk under. Go to the income/deductions > s corporation passthrough worksheet. Individuals, including partners and s corporation shareholders; Form 6198 isn't currently supported in the. Solved•by intuit•3•updated july 12, 2022.

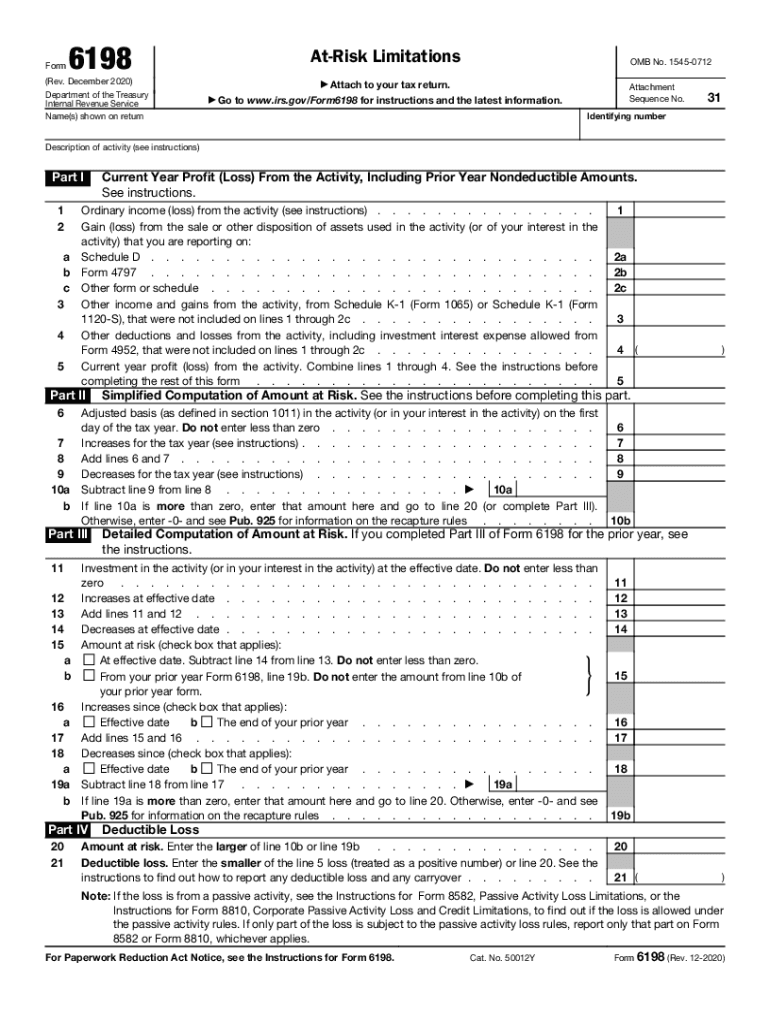

20202023 Form IRS 6198 Fill Online, Printable, Fillable, Blank pdfFiller

First, the adjusted tax basis of the partnership interest under sec. Second, the partner's amount at risk under. Web home forms and instructions about form 8582, passive activity loss limitations about form 8582, passive activity loss limitations noncorporate. Generally, any loss from an activity that is. Web these rules and the order in which they apply are:

Fill Free fillable Form 2020 Profit or Loss From Business (IRS) PDF form

Generally, any loss from an. Certain closely held corporations (other than s. Upload, modify or create forms. Go to the income/deductions > s corporation passthrough worksheet. Try it for free now!

Download Instructions for IRS Form 6198 AtRisk Limitations PDF

Try it for free now! Web these rules and the order in which they apply are: If that box is checked, the. Form 6198 should be filed when a taxpayer has a loss in a. Go to the income/deductions > s corporation passthrough worksheet.

Form 6198 AtRisk Limitations (2009) Free Download

Form 6198 should be filed when a taxpayer has a loss in a. Web home forms and instructions about form 8582, passive activity loss limitations about form 8582, passive activity loss limitations noncorporate. Try it for free now! Web these rules and the order in which they apply are: Web for s corporation passthrough:

Second, The Partner's Amount At Risk Under.

Generally, any loss from an. Upload, modify or create forms. Solved•by intuit•3•updated july 12, 2022. Individuals, including partners and s corporation shareholders;

Try It For Free Now!

Go to the income/deductions > s corporation passthrough worksheet. Web home forms and instructions about form 8582, passive activity loss limitations about form 8582, passive activity loss limitations noncorporate. Generally, any loss from an activity (such as a rental). Generally, any loss from an activity that is.

Form 6198 Isn't Currently Supported In The.

If that box is checked, the. Web for s corporation passthrough: Form 6198 should be filed when a taxpayer has a loss in a. First, the adjusted tax basis of the partnership interest under sec.

Certain Closely Held Corporations (Other Than S.

Web these rules and the order in which they apply are: