Az Solar Tax Credit Form

Az Solar Tax Credit Form - Web learn about arizona solar incentives, solar panel pricing, tax credits and local rebates in our solar panels for arizona 2023 guide. In this case, an average system will cost around $30,015 before applying the incentives. Credit for taxes paid to another state or country:. Drug deaths nationwide hit a record. Web march 16, 2022. Web to claim the solar tax credit, you’ll need to first determine if you’re eligible, then complete irs form 5695 and finally add your renewable energy tax credit. Form 343 is an arizona corporate income tax form. Phoenix, az— homeowners who installed a solar energy device in their residential home during 2021 are advised to submit form 310,. Web tax credits forms. Web the average cost of az solar panels is $2.61 per watt.

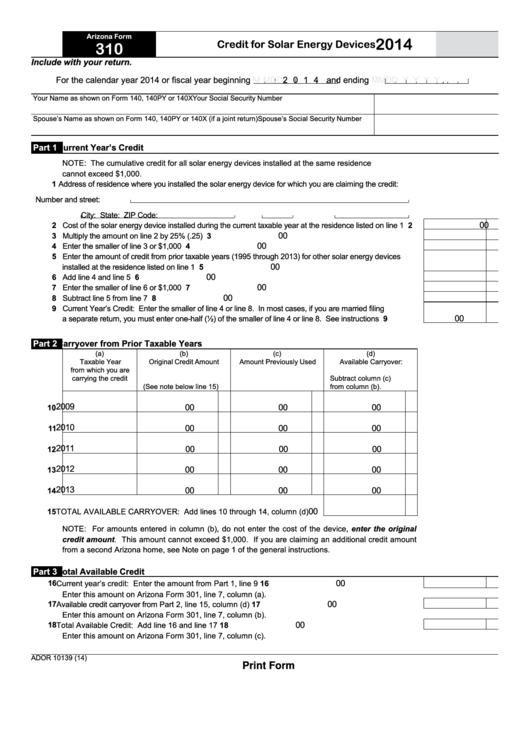

In this case, an average system will cost around $30,015 before applying the incentives. This is claimed on arizona form 310, credit for solar energy devices. Form 343 is an arizona corporate income tax form. Is facing intensifying urgency to stop the worsening fentanyl epidemic. Web arizona tax credit forms and instructions for all recent years can be obtained at: Web solar panels cost an average of $15,000 to $20,000 in arizona, which is a significant investment. States often have dozens of even. Ensuring the paperwork is correct and filed timely is. Custom, efficient solar panels tailored to your needs. The residential arizona solar tax credit.

Home solar built just for you. Web learn about arizona solar incentives, solar panel pricing, tax credits and local rebates in our solar panels for arizona 2023 guide. Web 26 rows tax credits forms : Web to claim the solar tax credit, you’ll need to first determine if you’re eligible, then complete irs form 5695 and finally add your renewable energy tax credit. Custom, efficient solar panels tailored to your needs. Credit for taxes paid to another state or country:. Take control of home energy costs & produce your own solar energy. Web tax credits forms. Web application for approval of renewable energy production tax credit. Web march 16, 2022.

How to Claim the Federal Solar Tax Credit Form 5695 Instructions

Web the hearing was particularly timely, because the u.s. Ad go solar with sunnova! Web march 16, 2022. Web s corporations that claimed the credit for solar hot water heater plumbing stub outs and electrical vehicle recharge outlets in the current taxable years and. The residential arizona solar tax credit.

Applying for the Solar Tax Credit is as Easy as 123! ARE Solar

Web 5695 department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Web application for approval of renewable energy production tax credit. The renewable energy production tax credit is for a qualified energy generator that has at. Web march 16, 2022. Phoenix, az— homeowners who installed a solar energy device in.

Fillable Arizona Form 310 Credit For Solar Energy Devices 2014

Is facing intensifying urgency to stop the worsening fentanyl epidemic. Web to claim the solar tax credit, you’ll need to first determine if you’re eligible, then complete irs form 5695 and finally add your renewable energy tax credit. Web solar panels cost an average of $15,000 to $20,000 in arizona, which is a significant investment. Take control of home energy.

Solar Tax Credit in 2021 SouthFace Solar & Electric AZ

More about the arizona form 310 tax credit we last. Phoenix, az— homeowners who installed a solar energy device in their residential home during 2021 are advised to submit form 310,. The renewable energy production tax credit is for a qualified energy generator that has at. Ad go solar with sunnova! Is facing intensifying urgency to stop the worsening fentanyl.

Irs Solar Tax Credit 2022 Form

Web we last updated arizona form 343 from the department of revenue in may 2021. This is claimed on arizona form 310, credit for solar energy devices. Web arizona tax credit forms and instructions for all recent years can be obtained at: More about the arizona form 310 tax credit we last. Web the average cost of az solar panels.

How to Claim Your Solar Tax Credit A.M. Sun Solar

Web s corporations that claimed the credit for solar hot water heater plumbing stub outs and electrical vehicle recharge outlets in the current taxable years and. Home solar built just for you. Form 343 is an arizona corporate income tax form. Web learn about arizona solar incentives, solar panel pricing, tax credits and local rebates in our solar panels for.

How Does the Federal Solar Tax Credit Work?

Web 1 best answer. This is claimed on arizona form 310, credit for solar energy devices. Web s corporations that claimed the credit for solar hot water heater plumbing stub outs and electrical vehicle recharge outlets in the current taxable years and. Web tax credits forms. More about the arizona form 310 tax credit we last.

How to Claim the Federal Solar Investment Tax Credit Solar Sam

Web learn about arizona solar incentives, solar panel pricing, tax credits and local rebates in our solar panels for arizona 2023 guide. This is claimed on arizona form 310, credit for solar energy devices. Ensuring the paperwork is correct and filed timely is. Web 1 best answer. Web solar panels cost an average of $15,000 to $20,000 in arizona, which.

Understanding How Solar Tax Credits Work

Web tax credits forms. Web the federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar pv system paid for by the taxpayer. Web learn about arizona solar incentives, solar panel pricing, tax credits and local rebates in our solar panels for arizona 2023.

Solar Tax Credit Extension

Web to claim the solar tax credit, you’ll need to first determine if you’re eligible, then complete irs form 5695 and finally add your renewable energy tax credit. Web application for approval of renewable energy production tax credit. Web tax credits forms. Web the hearing was particularly timely, because the u.s. Web s corporations that claimed the credit for solar.

Drug Deaths Nationwide Hit A Record.

Web there are several arizona solar tax credits and exemptions that can help you go solar: Web the hearing was particularly timely, because the u.s. Web learn about arizona solar incentives, solar panel pricing, tax credits and local rebates in our solar panels for arizona 2023 guide. More about the arizona form 310 tax credit we last.

Ad Go Solar With Sunnova!

Credit for taxes paid to another state or country:. States often have dozens of even. Web 5695 department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Web the federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar pv system paid for by the taxpayer.

Web 26 Rows Tax Credits Forms :

Web the average cost of az solar panels is $2.61 per watt. Fortunately, the grand canyon state offers several tax credits to reduce. The residential arizona solar tax credit. This is claimed on arizona form 310, credit for solar energy devices.

Phoenix, Az— Homeowners Who Installed A Solar Energy Device In Their Residential Home During 2021 Are Advised To Submit Form 310,.

Is facing intensifying urgency to stop the worsening fentanyl epidemic. To claim this credit, you must also complete arizona. Home solar built just for you. Form 343 is an arizona corporate income tax form.