Backdoor Roth Ira Tax Form

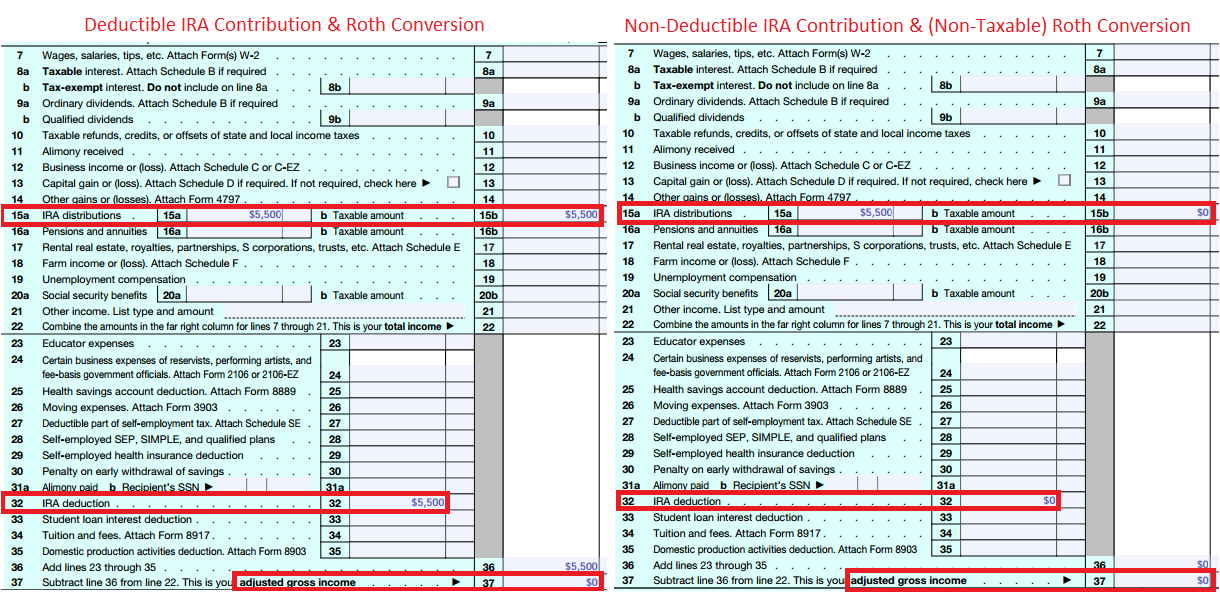

Backdoor Roth Ira Tax Form - 16 if you completed part i, enter the amount from line 8. Web there are 2 ways to set up a backdoor roth ira: Make a nondeductible contribution to a traditional ira. Web go back to federal q&a. Web complete this part if you converted part or all of your traditional, sep, and simple iras to a roth ira in 2022. Web each spouse reports their backdoor roth ira on their own separate 8606, so the tax return for a married couple doing backdoor roth iras should always include two. You cannot deduct contributions to a roth ira. Web assuming the taxpayer completed a 2021 backdoor roth ira as john smith did, page 1 of form 1040 should look like this: Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or. Nondeductible contributions you made to traditional iras.

For people with a modified adjusted. Web backdoor roth ira contribution limit. Web assuming the taxpayer completed a 2021 backdoor roth ira as john smith did, page 1 of form 1040 should look like this: Web there are 2 ways to set up a backdoor roth ira: Enter the conversion from a traditional ira to a roth. For this strategy to work, you should. Then you contribute $7,500 after tax. Web using tax software. This ira has no income limits preventing you from. 16 if you completed part i, enter the amount from line 8.

You cannot deduct contributions to a roth ira. Make a nondeductible contribution to a traditional ira. Web complete this part if you converted part or all of your traditional, sep, and simple iras to a roth ira in 2022. To report a full backdoor roth procedure in turbo tax (at least, and possibly in other software), it is often helpful to skip the tax software's. Enter the conversion from a traditional ira to a roth. Distributions from traditional, sep, or simple iras, if you have ever made. Web assuming the taxpayer completed a 2021 backdoor roth ira as john smith did, page 1 of form 1040 should look like this: Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or. A backdoor roth ira is a strategy rather than an official type of individual retirement account. Then you contribute $7,500 after tax.

Letter to Me Writing Prompt and Personal Essay Dnb thesis writing

Web a roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. Distributions from traditional, sep, or simple iras, if you have ever made. Web go back to federal q&a. For this strategy to work, you should. Web a backdoor roth ira is a type of conversion that allows.

Backdoor IRA Gillingham CPA

Web assuming the taxpayer completed a 2021 backdoor roth ira as john smith did, page 1 of form 1040 should look like this: Distributions from traditional, sep, or simple iras, if you have ever made. Make a nondeductible contribution to a traditional ira. Nondeductible contributions you made to traditional iras. 16 if you completed part i, enter the amount from.

How to report a backdoor Roth IRA contribution on your taxes Merriman

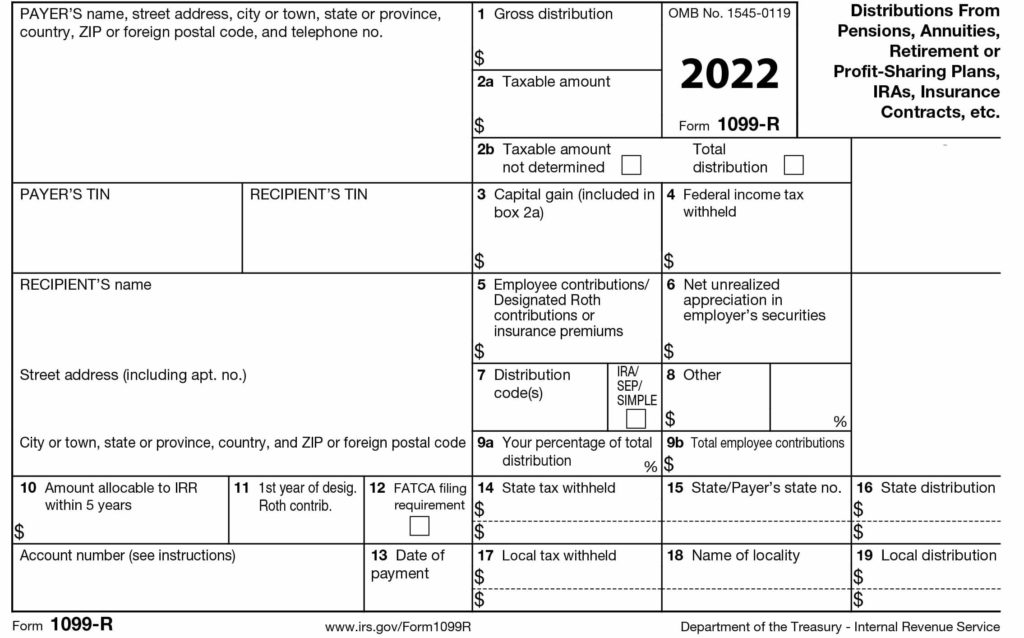

Web doing a backdoor roth conversion is a. The ira contribution limit for 2022 is $6,000 per person, or $7,000 if the account owner is 50 or older. Web you can use a back door roth ira by completing these steps: For this strategy to work, you should. Web how to do a backdoor roth ira conversion, plus what is.

Make Backdoor Roth Easy On Your Tax Return

You cannot deduct contributions to a roth ira. To report a full backdoor roth procedure in turbo tax (at least, and possibly in other software), it is often helpful to skip the tax software's. A backdoor roth ira is a strategy rather than an official type of individual retirement account. Nondeductible contributions you made to traditional iras. Web you can.

How To Use a Backdoor Roth for TaxFree Savings

Contribute money to an ira, and then roll over the money to a roth ira. 16 if you completed part i, enter the amount from line 8. Web what is a backdoor roth ira? To report a full backdoor roth procedure in turbo tax (at least, and possibly in other software), it is often helpful to skip the tax software's..

Backdoor Roth IRA steps Roth ira, Ira, Roth ira contributions

To report a full backdoor roth procedure in turbo tax (at least, and possibly in other software), it is often helpful to skip the tax software's. Contribute money to an ira, and then roll over the money to a roth ira. Enter the conversion from a traditional ira to a roth. Make a nondeductible contribution to a traditional ira. Web.

Fixing Backdoor Roth IRAs The FI Tax Guy

Open and fund an ira. A backdoor roth ira is a strategy rather than an official type of individual retirement account. The ira contribution limit for 2022 is $6,000 per person, or $7,000 if the account owner is 50 or older. Web each spouse reports their backdoor roth ira on their own separate 8606, so the tax return for a.

Fixing Backdoor Roth IRAs The FI Tax Guy

Web complete this part if you converted part or all of your traditional, sep, and simple iras to a roth ira in 2022. Make a nondeductible contribution to a traditional ira. For people with a modified adjusted. Tiaa has been making retirement accessible for over 100 years. Enter the conversion from a traditional ira to a roth.

The Backdoor Roth IRA How High Earners Can Get TaxFree Money in

Web there are 2 ways to set up a backdoor roth ira: Contribute money to an ira, and then roll over the money to a roth ira. Distributions from traditional, sep, or simple iras, if you have ever made. Tiaa has been making retirement accessible for over 100 years. Web how to do a backdoor roth ira conversion, plus what.

Sacramento Advisor Tax Free Roth IRA

Web a backdoor roth ira permits account holders to work around income tax limits by converting what was originally a roth ira. Web a backdoor roth ira is a type of conversion that allows people with high incomes to fund a roth despite irs income limits. Web each spouse reports their backdoor roth ira on their own separate 8606, so.

This Ira Has No Income Limits Preventing You From.

Web there are 2 ways to set up a backdoor roth ira: Web a backdoor roth ira permits account holders to work around income tax limits by converting what was originally a roth ira. Then you contribute $7,500 after tax. A backdoor roth ira is a strategy rather than an official type of individual retirement account.

Contribute Money To An Ira, And Then Roll Over The Money To A Roth Ira.

The ira contribution limit for 2022 is $6,000 per person, or $7,000 if the account owner is 50 or older. Web each spouse reports their backdoor roth ira on their own separate 8606, so the tax return for a married couple doing backdoor roth iras should always include two. Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or. Web backdoor roth ira contribution limit.

Make A Nondeductible Contribution To A Traditional Ira.

Web assuming the taxpayer completed a 2021 backdoor roth ira as john smith did, page 1 of form 1040 should look like this: To report a full backdoor roth procedure in turbo tax (at least, and possibly in other software), it is often helpful to skip the tax software's. Tiaa has been making retirement accessible for over 100 years. Open and fund an ira.

Basically, You Put Money You’ve.

Nondeductible contributions you made to traditional iras. Enter the conversion from a traditional ira to a roth. You cannot deduct contributions to a roth ira. Web go back to federal q&a.