Ca 590 Form 2022 Instructions

Ca 590 Form 2022 Instructions - Web we last updated california form 590 in february 2023 from the california franchise tax board. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Web purpose use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. General information purpose use form 590 to. Web 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Web withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Web withholding exemption certificate references in these instructions are to the california revenue and taxation code (r&tc). Web we last updated the withholding exemption certificate in february 2023, so this is the latest version of form 590, fully updated for tax year 2022. Wage withholding is administered by the california employment development department (edd). Form 590 does not apply to payments of backup withholding.

Web form 590 does not apply to payments for wages to employees. Web purpose use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. • the individual payee becomes a nonresident. Web 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Wage withholding is administered by the california employment development department (edd). Crescent city, ca 95531 cua coordinator (707). The payee completes this form and submits it to the withholding agent. Web instructions for form 590 instructions for form 590 withholding exemption certificate references in these instructions are to the california revenue and taxation code. Web form 590 instructions 2022 the payee must notify the withholding agent if any of the following situations occur:

Crescent city, ca 95531 cua coordinator (707). The payee completes this form and submits it to the withholding agent. Include images, crosses, check and text boxes, if required. Web instructions for form 590 instructions for form 590 withholding exemption certificate references in these instructions are to the california revenue and taxation code. Form 590 does not apply to payments of backup withholding. Web 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Web 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. The withholding agent keeps this form with their records. Fill in all the info required in ca ftb 590, utilizing fillable fields. The payment is to an estate and the decedent was a california resident.

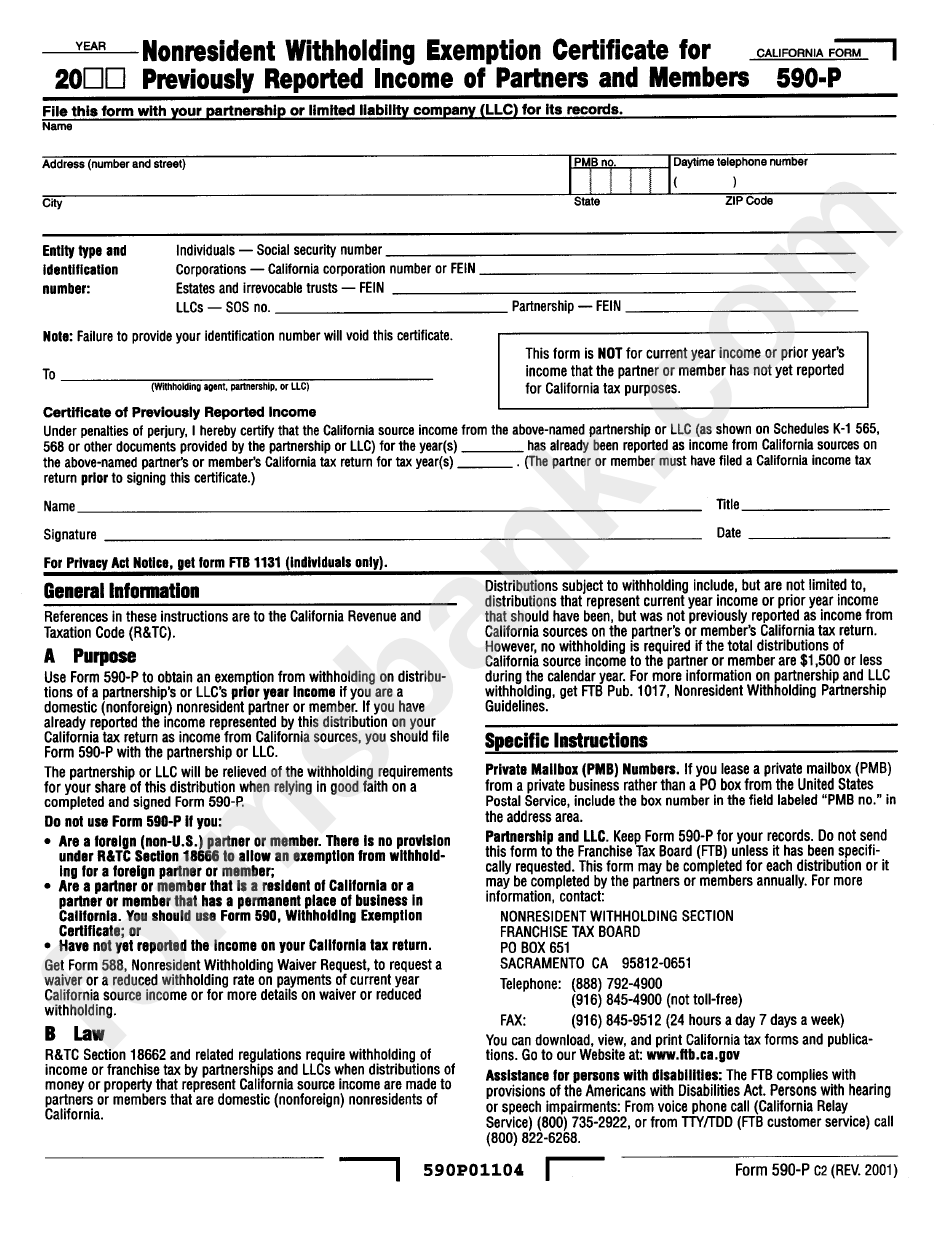

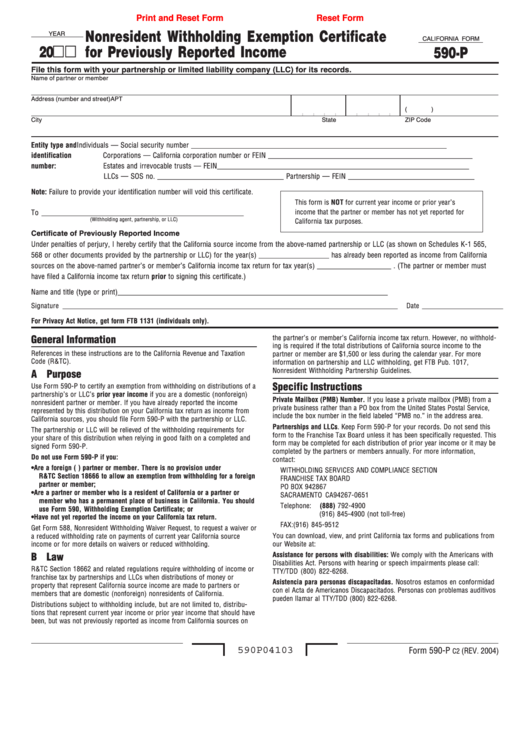

Form 590P Nonresident Withholding Exemption Certificate For

Web instructions for form 590 instructions for form 590 withholding exemption certificate references in these instructions are to the california revenue and taxation code. The withholding agent keeps this form with their records. Crescent city, ca 95531 cua coordinator (707). Web we last updated the withholding exemption certificate in february 2023, so this is the latest version of form 590,.

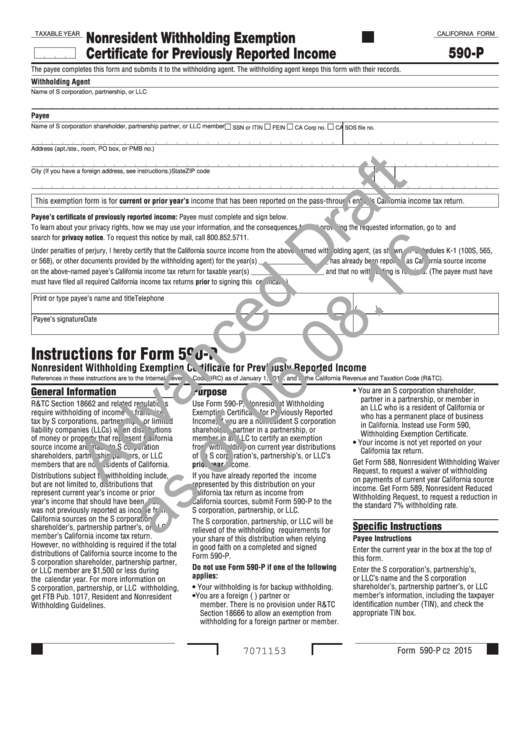

California Form 590P Draft Nonresident Withholding Exemption

Crescent city, ca 95531 cua coordinator (707). Web 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. The payee completes this form and submits it to the withholding agent. Form 590 does not apply to payments of backup withholding. Web taxable year 2022 withholding exemption certificate california form 590 the.

Uscis Form I 590 Printable and Blank PDF Sample to Download

You can download or print current. This form is for income earned in tax year 2022, with tax returns due in april. Web withholding exemption certificate references in these instructions are to the california revenue and taxation code (r&tc). • the individual payee becomes a nonresident. Crescent city, ca 95531 cua coordinator (707).

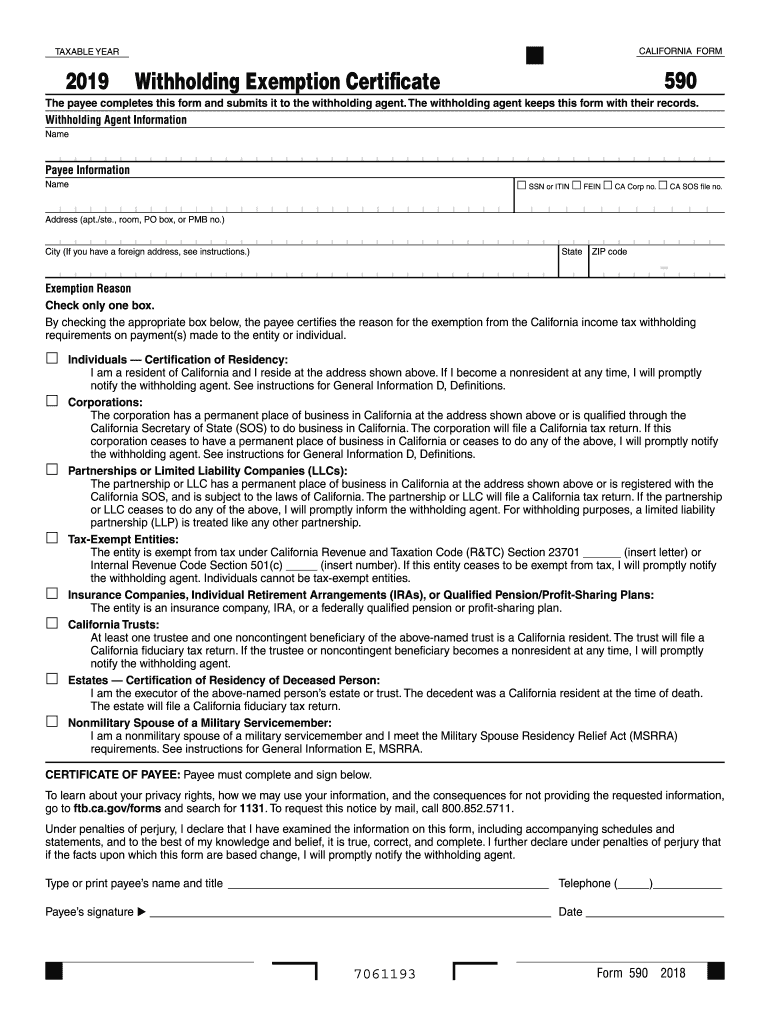

2019 Form CA FTB 590 Fill Online, Printable, Fillable, Blank PDFfiller

Web instructions for form 590 instructions for form 590 withholding exemption certificate references in these instructions are to the california revenue and taxation code. Crescent city, ca 95531 cua coordinator (707). The withholding agent keeps this form with. Web form 590 instructions 2022 the payee must notify the withholding agent if any of the following situations occur: This form is.

California Form 590 Draft Withholding Exemption Certificate With

Web instructions for form 590 instructions for form 590 withholding exemption certificate references in these instructions are to the california revenue and taxation code. Web we last updated california form 590 in february 2023 from the california franchise tax board. Web form 590 does not apply to payments for wages to employees. Web use form 592 to report the total.

Fillable California Form 590P Nonresident Withholding Exemption

Crescent city, ca 95531 cua coordinator (707). Web purpose use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web open the file using our powerful pdf editor. The withholding agent keeps this form with. Web withholding exemption certificate references in these instructions are to the california revenue and taxation code (r&tc).

Ira Deduction Worksheet 2018 —

General information purpose use form 590 to. • the individual payee becomes a nonresident. Wage withholding is administered by the california employment development department (edd). Web we last updated california form 590 in february 2023 from the california franchise tax board. Web instructions for form 590 instructions for form 590 withholding exemption certificate references in these instructions are to the.

ads/responsive.txt Ca 590 form 2018 Awesome California Franchise Tax

The payment is to an estate and the decedent was a california resident. The withholding agent keeps this form with. Include images, crosses, check and text boxes, if required. Web form 50 201 taxable year 2020 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Items of income that are subject.

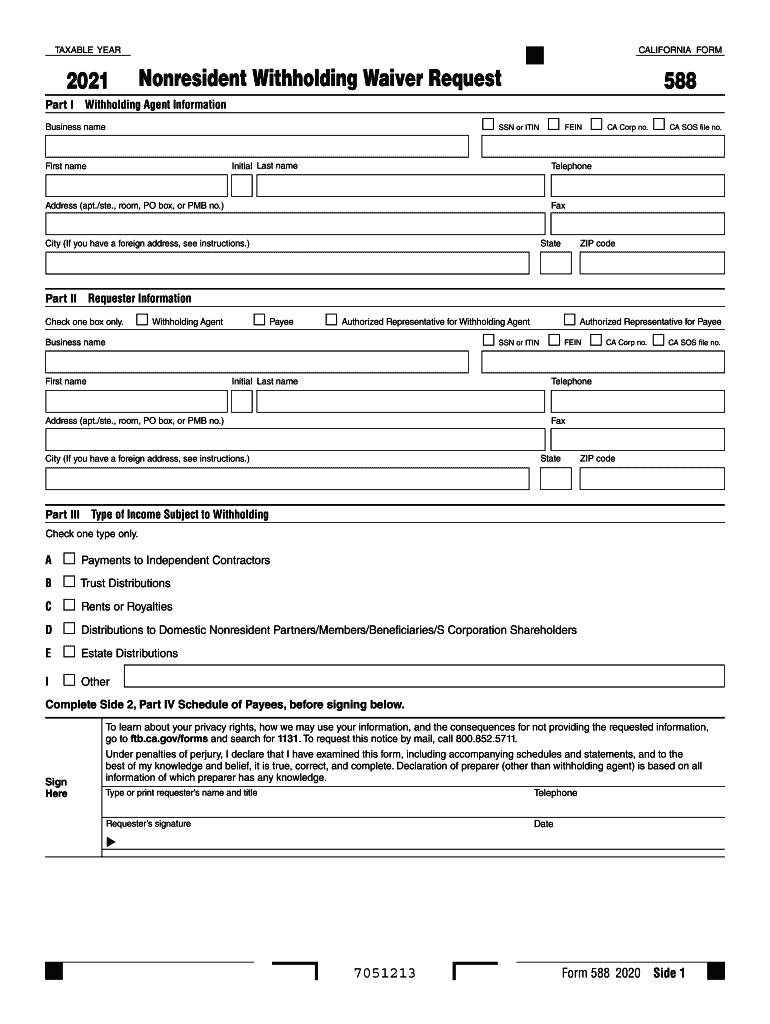

CA FTB 588 20212022 Fill out Tax Template Online US Legal Forms

The withholding agent keeps this form with. Form 590 does not apply to payments of backup withholding. Include images, crosses, check and text boxes, if required. Web 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Web use form 592 to report the total withholding under california revenue and taxation.

Form 590 Withholding Exemption Certificate City Of Fill Out and Sign

The payee completes this form and submits it to the withholding agent. Form 590 does not apply to payments of backup withholding. Web 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Web form 50 201 taxable year 2020 withholding exemption certificate california form 590 the payee completes this form.

Items Of Income That Are Subject To.

Wage withholding is administered by the california employment development department (edd). The payee completes this form and submits it to the withholding agent. Form 590 does not apply to payments of backup withholding. Web taxable year 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent.

Web Purpose Use Form 590, Withholding Exemption Certificate, To Certify An Exemption From Nonresident Withholding.

The withholding agent keeps this form with their. Web notice from the ca franchise tax board that a withholding waiver was authorized (you must first file ca form 588, nonresident withholding waiver request) for your convenience,. Web 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. The withholding agent keeps this form with their records.

The Payment Is To An Estate And The Decedent Was A California Resident.

Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. • the individual payee becomes a nonresident. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated the withholding exemption certificate in february 2023, so this is the latest version of form 590, fully updated for tax year 2022.

The Withholding Agent Keeps This Form With.

Web 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. The withholding agent keeps this form with. Web withholding exemption certificate references in these instructions are to the california revenue and taxation code (r&tc). Web form 590 does not apply to payments for wages to employees.