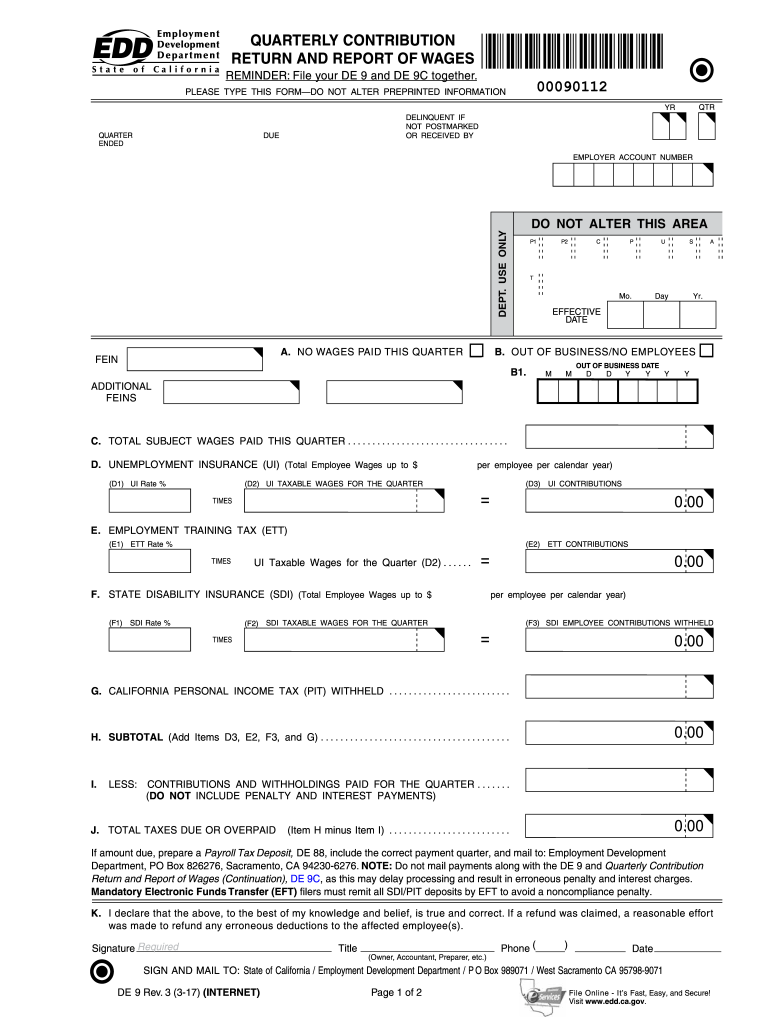

Ca De 9 Form

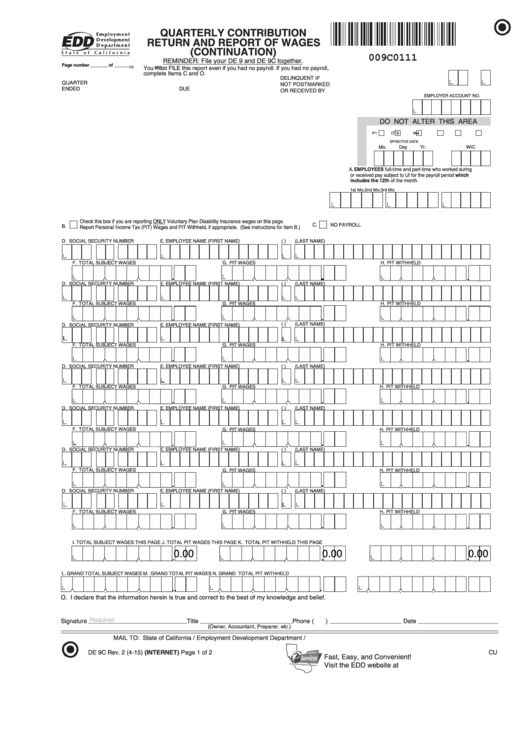

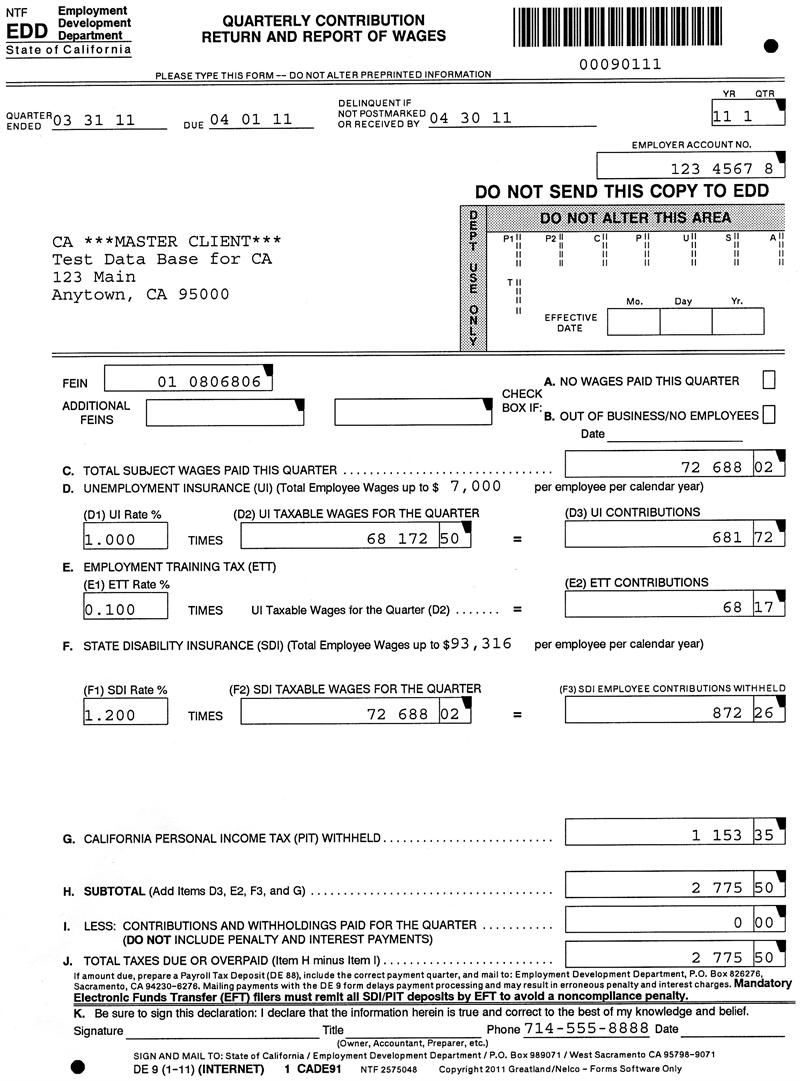

Ca De 9 Form - You may be required to electronically file this form. Web wages and withholdings to report on a separate de 9c. Special red paper is not needed. Quarterly contribution and wage adjustment form. (please print) year / quarter. Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously reported quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of wages (continuation) (de 9c). The form is printed as a black, scannable version. Quarterly contribution return and report of wages, de 9. Web most employers, including quarterly household employers, are required to file the de 9 and de 9c. Web quarterly contribution return and report of wages (de 9) and (continuation) (de 9c) payroll tax deposit (de 88) how to report electronic filing paper filing submission requirements timeliness of forms deposit requirements

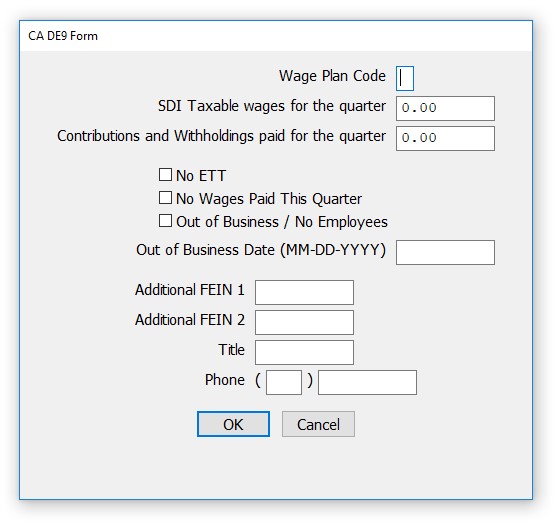

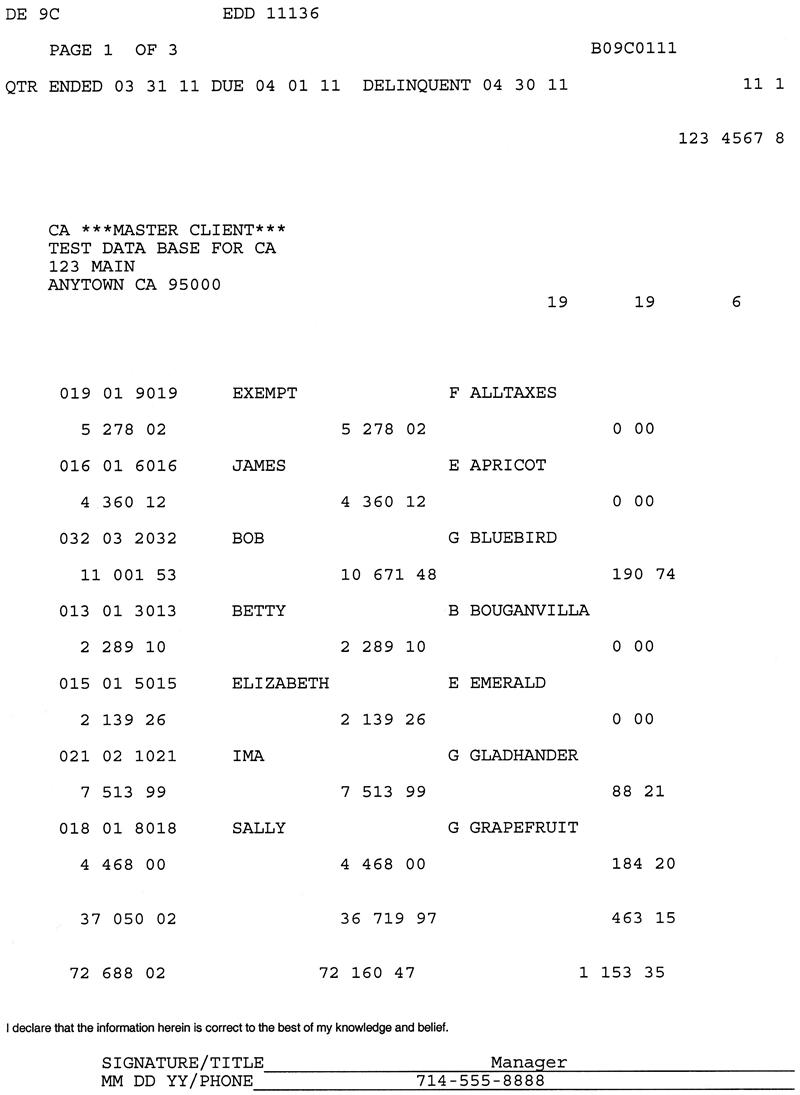

Web this module contains california form de 9, quarterly contribution return and report of wages. Write the exemption title(s) at the top of the form (e.g., sole shareholder), and report only those individuals under these categories. All three exemptions can be reported on one de 9c. Prepare a de 9c to report the types of exemptions listed below. For a faster, easier, and more convenient method of reporting your de 9 information, visit the edd’s website at www.edd.ca.gov. Web quarterly contribution return and report of wages (de 9) and (continuation) (de 9c) payroll tax deposit (de 88) how to report electronic filing paper filing submission requirements timeliness of forms deposit requirements You may be required to electronically file this form. (please print) year / quarter. Web thequarterly contribution and wage adjustment form (de 9adj) is used to request corrections to information previously reported on a quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of. Data may be imported from the payroll data previously entered by selecting import data from the menu.

For a faster, easier, and more convenient method of reporting your de 9 information, visit the edd’s website at www.edd.ca.gov. Web wages and withholdings to report on a separate de 9c. Write the exemption title(s) at the top of the form (e.g., sole shareholder), and report only those individuals under these categories. Special red paper is not needed. All three exemptions can be reported on one de 9c. Prepare a de 9c to report the types of exemptions listed below. Quarterly contribution and wage adjustment form. Web this module contains california form de 9, quarterly contribution return and report of wages. Web most employers, including quarterly household employers, are required to file the de 9 and de 9c. Data may be imported from the payroll data previously entered by selecting import data from the menu.

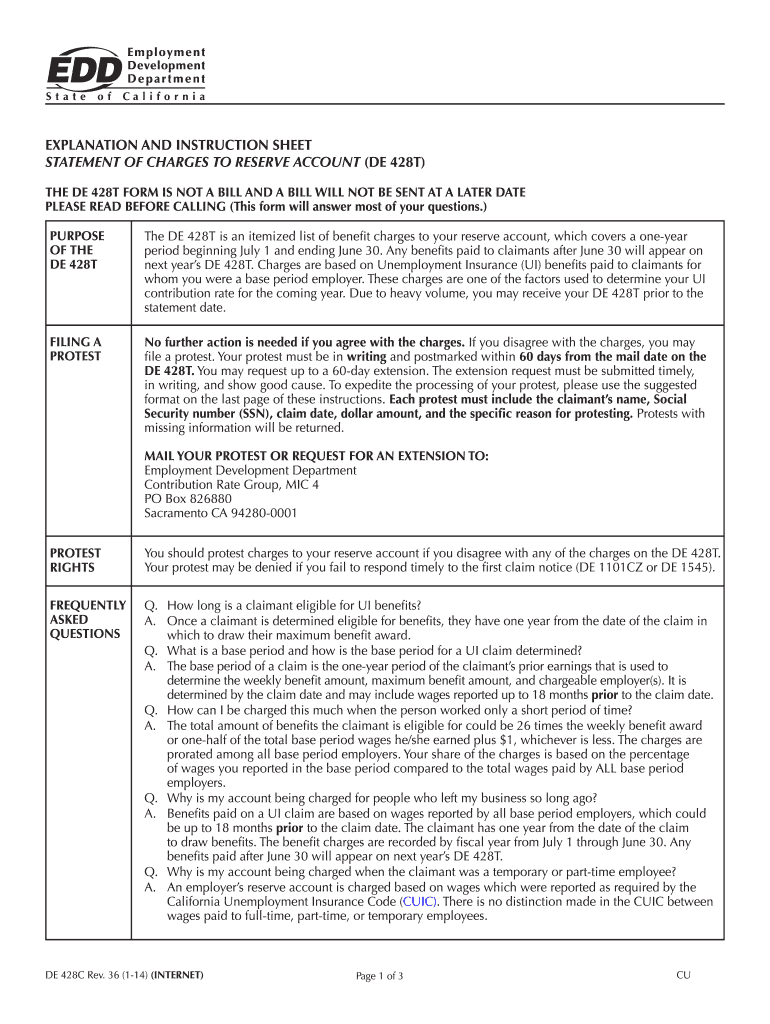

2014 Form CA DE 428C Fill Online, Printable, Fillable, Blank pdfFiller

Write the exemption title(s) at the top of the form (e.g., sole shareholder), and report only those individuals under these categories. Web wages and withholdings to report on a separate de 9c. (please print) year / quarter. Quarterly contribution return and report of wages, de 9. Data may be imported from the payroll data previously entered by selecting import data.

EDD DE9 PDF

Web most employers, including quarterly household employers, are required to file the de 9 and de 9c. (please print) year / quarter. Data may be imported from the payroll data previously entered by selecting import data from the menu. Web this module contains california form de 9, quarterly contribution return and report of wages. Web (de 9) please type all.

How to Print California DE9 Form in CheckMark Payroll CheckMark

Web thequarterly contribution and wage adjustment form (de 9adj) is used to request corrections to information previously reported on a quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of. All three exemptions can be reported on one de 9c. Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used.

U.S.C. Title 11 BANKRUPTCY

Write the exemption title(s) at the top of the form (e.g., sole shareholder), and report only those individuals under these categories. You may be required to electronically file this form. Web wages and withholdings to report on a separate de 9c. Prepare a de 9c to report the types of exemptions listed below. (please print) year / quarter.

Form De 9c With Instructions Quarterly Contribution Return And Report

You may be required to electronically file this form. Web (de 9) please type all information. All three exemptions can be reported on one de 9c. Quarterly contribution return and report of wages, de 9. Write the exemption title(s) at the top of the form (e.g., sole shareholder), and report only those individuals under these categories.

Form I9 Wikipedia

Write the exemption title(s) at the top of the form (e.g., sole shareholder), and report only those individuals under these categories. You may be required to electronically file this form. For a faster, easier, and more convenient method of reporting your de 9 information, visit the edd’s website at www.edd.ca.gov. Web wages and withholdings to report on a separate de.

20142021 Form CA DE 9 Fill Online, Printable, Fillable, Blank pdfFiller

For a faster, easier, and more convenient method of reporting your de 9 information, visit the edd’s website at www.edd.ca.gov. Special red paper is not needed. Web quarterly contribution return and report of wages (de 9) and (continuation) (de 9c) payroll tax deposit (de 88) how to report electronic filing paper filing submission requirements timeliness of forms deposit requirements Web.

California DE 9 and DE 9C Fileable Reports

Web most employers, including quarterly household employers, are required to file the de 9 and de 9c. (please print) year / quarter. All three exemptions can be reported on one de 9c. Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously reported quarterly contribution return and report of wages.

California DE 9 and DE 9C Fileable Reports

(please print) year / quarter. Quarterly contribution return and report of wages, de 9. The form is printed as a black, scannable version. For a faster, easier, and more convenient method of reporting your de 9 information, visit the edd’s website at www.edd.ca.gov. Web this module contains california form de 9, quarterly contribution return and report of wages.

CA DE 9ADJ 2013 Fill and Sign Printable Template Online US Legal Forms

Write the exemption title(s) at the top of the form (e.g., sole shareholder), and report only those individuals under these categories. Special red paper is not needed. Web this module contains california form de 9, quarterly contribution return and report of wages. All three exemptions can be reported on one de 9c. Web most employers, including quarterly household employers, are.

Quarterly Contribution And Wage Adjustment Form.

Web most employers, including quarterly household employers, are required to file the de 9 and de 9c. Quarterly contribution return and report of wages, de 9. Web thequarterly contribution and wage adjustment form (de 9adj) is used to request corrections to information previously reported on a quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of. Web this module contains california form de 9, quarterly contribution return and report of wages.

Write The Exemption Title(S) At The Top Of The Form (E.g., Sole Shareholder), And Report Only Those Individuals Under These Categories.

Special red paper is not needed. For a faster, easier, and more convenient method of reporting your de 9 information, visit the edd’s website at www.edd.ca.gov. Web wages and withholdings to report on a separate de 9c. Prepare a de 9c to report the types of exemptions listed below.

Data May Be Imported From The Payroll Data Previously Entered By Selecting Import Data From The Menu.

You may be required to electronically file this form. All three exemptions can be reported on one de 9c. (please print) year / quarter. Web (de 9) please type all information.

The Form Is Printed As A Black, Scannable Version.

Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously reported quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of wages (continuation) (de 9c). Web quarterly contribution return and report of wages (de 9) and (continuation) (de 9c) payroll tax deposit (de 88) how to report electronic filing paper filing submission requirements timeliness of forms deposit requirements