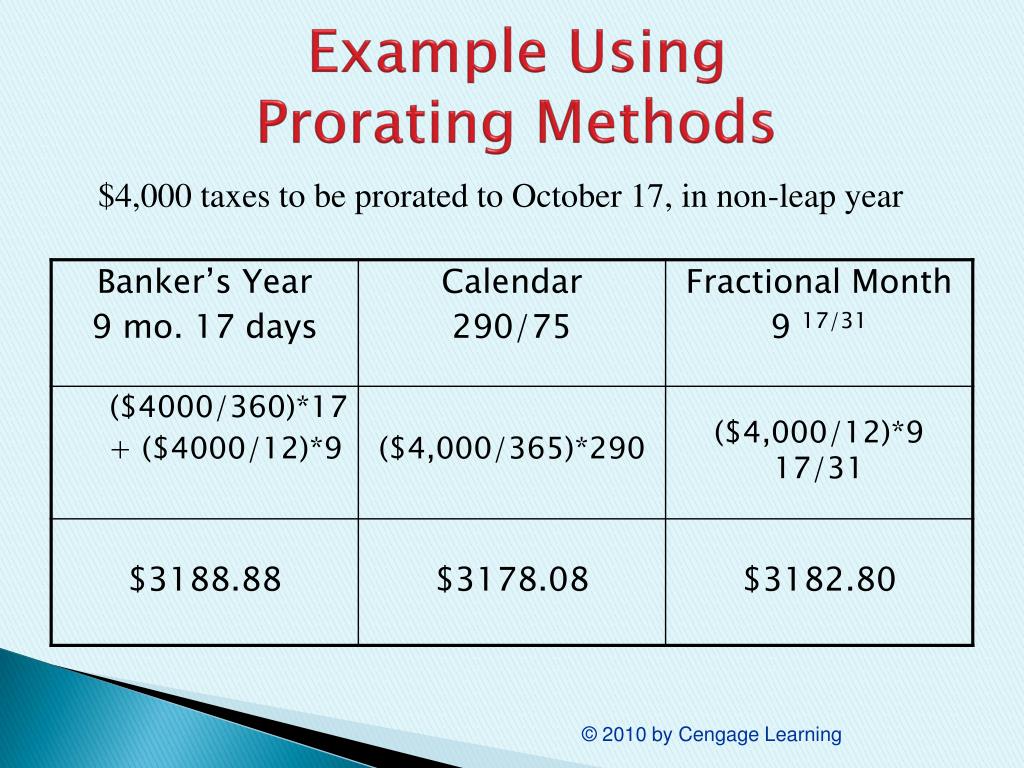

Calendar Year Proration Method

Calendar Year Proration Method - The seller occupied the home from january 1st to may 31st or 151 days. The buyer reimburses the seller. In real estate transactions, calculating prorations accurately ensures. This option is very simple, but it may not accurately reflect economic reality. Proration is inclusive of both specified dates. Web methods to calculate proration. Web prorate a specified amount over a specified portion of the calendar year. Web prs, a calendar year partnership, uses the proration method and calendar day convention to account for varying. Web if the time frame isn’t specified or you’re instructed otherwise on an exam, you need to use the third method, which is to divide a.

Web if the time frame isn’t specified or you’re instructed otherwise on an exam, you need to use the third method, which is to divide a. In real estate transactions, calculating prorations accurately ensures. The seller occupied the home from january 1st to may 31st or 151 days. Proration is inclusive of both specified dates. Web methods to calculate proration. This option is very simple, but it may not accurately reflect economic reality. The buyer reimburses the seller. Web prorate a specified amount over a specified portion of the calendar year. Web prs, a calendar year partnership, uses the proration method and calendar day convention to account for varying.

Proration is inclusive of both specified dates. In real estate transactions, calculating prorations accurately ensures. This option is very simple, but it may not accurately reflect economic reality. Web prs, a calendar year partnership, uses the proration method and calendar day convention to account for varying. The seller occupied the home from january 1st to may 31st or 151 days. The buyer reimburses the seller. Web prorate a specified amount over a specified portion of the calendar year. Web methods to calculate proration. Web if the time frame isn’t specified or you’re instructed otherwise on an exam, you need to use the third method, which is to divide a.

SSA POMS DI 52170.055 Calendars for Proration (19642028) 09/25/2008

Proration is inclusive of both specified dates. Web prorate a specified amount over a specified portion of the calendar year. The seller occupied the home from january 1st to may 31st or 151 days. This option is very simple, but it may not accurately reflect economic reality. Web methods to calculate proration.

Depreciation Calculation for Table and Calculated Methods (Oracle

Web if the time frame isn’t specified or you’re instructed otherwise on an exam, you need to use the third method, which is to divide a. Web prorate a specified amount over a specified portion of the calendar year. Web prs, a calendar year partnership, uses the proration method and calendar day convention to account for varying. The seller occupied.

The Complete Guide To The Calendar Method Birth Control

Web if the time frame isn’t specified or you’re instructed otherwise on an exam, you need to use the third method, which is to divide a. This option is very simple, but it may not accurately reflect economic reality. Web methods to calculate proration. Web prorate a specified amount over a specified portion of the calendar year. Web prs, a.

CALENDAR METHOD Simpliest explanation Vlog 8 YouTube

This option is very simple, but it may not accurately reflect economic reality. Web if the time frame isn’t specified or you’re instructed otherwise on an exam, you need to use the third method, which is to divide a. Web prorate a specified amount over a specified portion of the calendar year. The seller occupied the home from january 1st.

PPT Chapter 16 ________________ Title Closing and Escrow PowerPoint

Proration is inclusive of both specified dates. The buyer reimburses the seller. The seller occupied the home from january 1st to may 31st or 151 days. This option is very simple, but it may not accurately reflect economic reality. Web if the time frame isn’t specified or you’re instructed otherwise on an exam, you need to use the third method,.

Calendar Year Proration Method Real Estate 2024 Calendar 2024 All

In real estate transactions, calculating prorations accurately ensures. Web methods to calculate proration. Web prs, a calendar year partnership, uses the proration method and calendar day convention to account for varying. The seller occupied the home from january 1st to may 31st or 151 days. Web prorate a specified amount over a specified portion of the calendar year.

Property Tax Prorations Case Escrow

Web methods to calculate proration. Proration is inclusive of both specified dates. The seller occupied the home from january 1st to may 31st or 151 days. This option is very simple, but it may not accurately reflect economic reality. The buyer reimburses the seller.

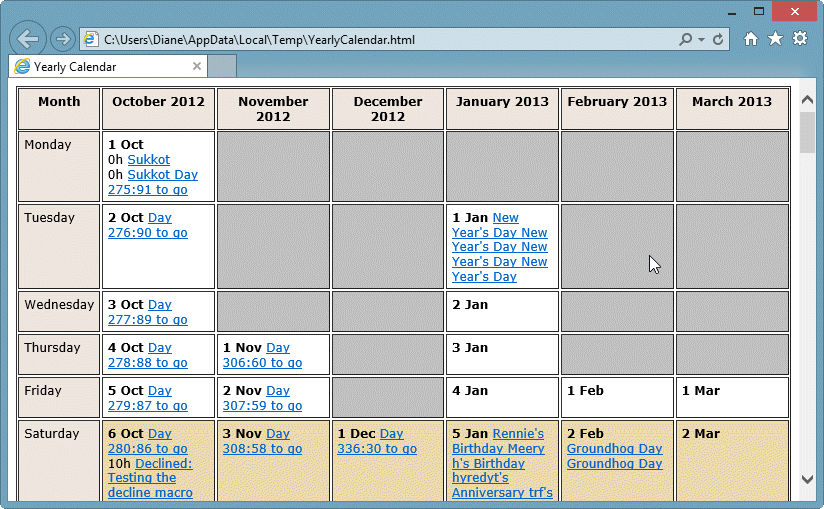

How to View a Yearly Calendar

Proration is inclusive of both specified dates. Web prorate a specified amount over a specified portion of the calendar year. This option is very simple, but it may not accurately reflect economic reality. The buyer reimburses the seller. Web methods to calculate proration.

Adjusting Overhead with the Proration Method Wize University

This option is very simple, but it may not accurately reflect economic reality. The buyer reimburses the seller. The seller occupied the home from january 1st to may 31st or 151 days. Proration is inclusive of both specified dates. Web prs, a calendar year partnership, uses the proration method and calendar day convention to account for varying.

Adjusting Overhead with the Proration Method Wize University

Web if the time frame isn’t specified or you’re instructed otherwise on an exam, you need to use the third method, which is to divide a. This option is very simple, but it may not accurately reflect economic reality. Web methods to calculate proration. In real estate transactions, calculating prorations accurately ensures. Proration is inclusive of both specified dates.

The Buyer Reimburses The Seller.

Web if the time frame isn’t specified or you’re instructed otherwise on an exam, you need to use the third method, which is to divide a. In real estate transactions, calculating prorations accurately ensures. Proration is inclusive of both specified dates. The seller occupied the home from january 1st to may 31st or 151 days.

Web Methods To Calculate Proration.

Web prorate a specified amount over a specified portion of the calendar year. This option is very simple, but it may not accurately reflect economic reality. Web prs, a calendar year partnership, uses the proration method and calendar day convention to account for varying.

.png?1614945017)