California Form 3853 Instructions 2022

California Form 3853 Instructions 2022 - • form ftb 3849, premium assistance subsidy • form ftb 3853, health coverage exemptions and individual shared responsibility. This is only available by request. Need to file form ftb 3853. Web 31 votes how to fill out and sign california form 3853 online? List all members of your applicable household whether or not they have an exemption or an exemption certificate. You do not owe the individual shared responsibility penalty and do not need to file form ftb 3853. Web 128 rows the 2022 instructions for form ftb 3805p are being revised based on. Web form 540 2ez, california resident income tax return; Go to covered california’s shop and compare tool. Web care forms, instructions, and publications:

Instructions enter all the information requested on the tax payment voucher using black or blue ink and complete the first line as applicable. What else do i need to know? Web california form 3853 part i applicable household members. Web coverage purchased through covered california or directly from insurers medicare most medicaid plans for information about other exemptions that may apply, see the. Web thus, a nonresident will need to complete form 3853 and indicate the nonresident exemption to the penalty for the year. Web form 540 2ez, california resident income tax return; Web state and local tax information california desktop: Go to covered california’s shop and compare tool. Enjoy smart fillable fields and interactivity. This is only available by request.

Important points to keep in mind: List all members of your applicable household whether or not they have an exemption or an exemption certificate. Need to file form ftb 3853. Web file form ftb 3893. Web 2022, 3853, instructions for form 3853, health coverage exemption and individual shared responsibility penalty. Web form 540 2ez, california resident income tax return; Web taxable yearhealth coverage exemptions and individual 2022 shared responsibility penalty attach to your california form 540, form 540nr, or form 540 2ez. Enter your name(s) as entered on your california tax return and social. Return to main tax page. Web use the exemption certificate number (ecn) provided by covered california in the exemption approval notice when you complete your state taxes.

3853 Form Fill Online, Printable, Fillable, Blank pdfFiller

Web form 540 2ez, california resident income tax return; Enjoy smart fillable fields and interactivity. Get your online template and fill it in using progressive features. You do not owe the individual shared responsibility penalty and do not need to file form ftb 3853. Web thus, a nonresident will need to complete form 3853 and indicate the nonresident exemption to.

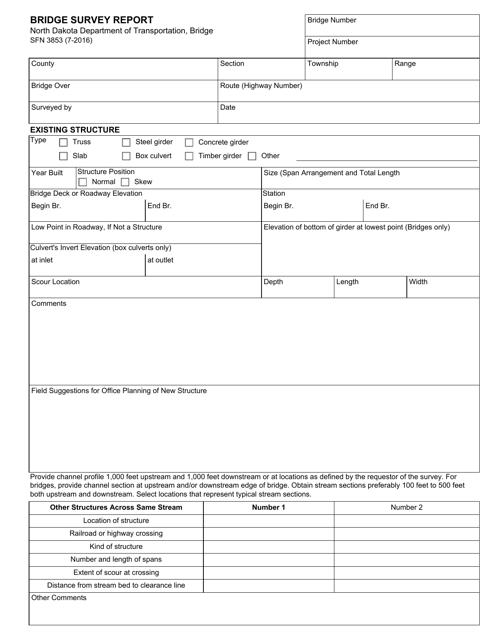

Form SFN3853 Download Fillable PDF or Fill Online Bridge Survey Report

Instructions enter all the information requested on the tax payment voucher using black or blue ink and complete the first line as applicable. Go to covered california’s shop and compare tool. Web 31 votes how to fill out and sign california form 3853 online? Owe the individual shared responsibility penalty and. Web use the exemption certificate number (ecn) provided by.

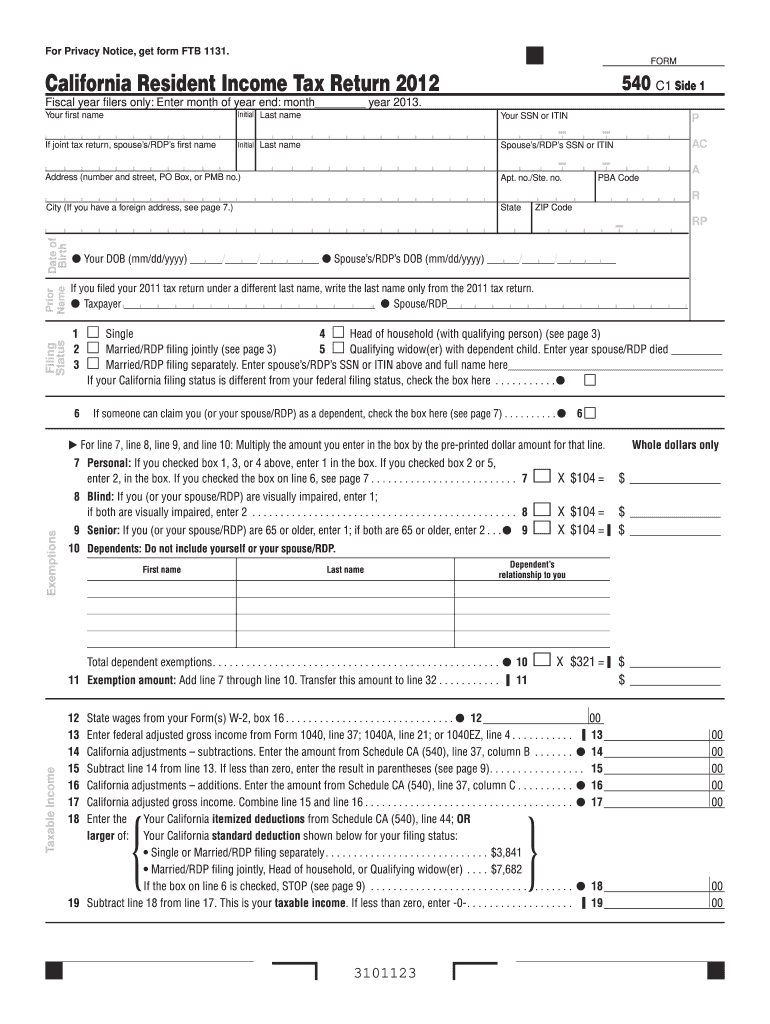

540 Form 2014 Fill Online, Printable, Fillable, Blank pdfFiller

Owe the individual shared responsibility penalty and. Web form 540 2ez, california resident income tax return; Web thus, a nonresident will need to complete form 3853 and indicate the nonresident exemption to the penalty for the year. Enter your name(s) as entered on your california tax return and social. Important points to keep in mind:

رخيصة يكتب لي المنطقة مقال 7

Of the fifteen exemptions to the penalty, three of them can only be granted by covered california. Go to covered california’s shop and compare tool. Web taxable yearhealth coverage exemptions and individual 2022 shared responsibility penalty attach to your california form 540, form 540nr, or form 540 2ez. Web california form 3853 part i applicable household members. Web form 540.

9390.1236196645.jpg

Web use the exemption certificate number (ecn) provided by covered california in the exemption approval notice when you complete your state taxes. Web thus, a nonresident will need to complete form 3853 and indicate the nonresident exemption to the penalty for the year. Need to file form ftb 3853. You do not owe the individual shared responsibility penalty and do.

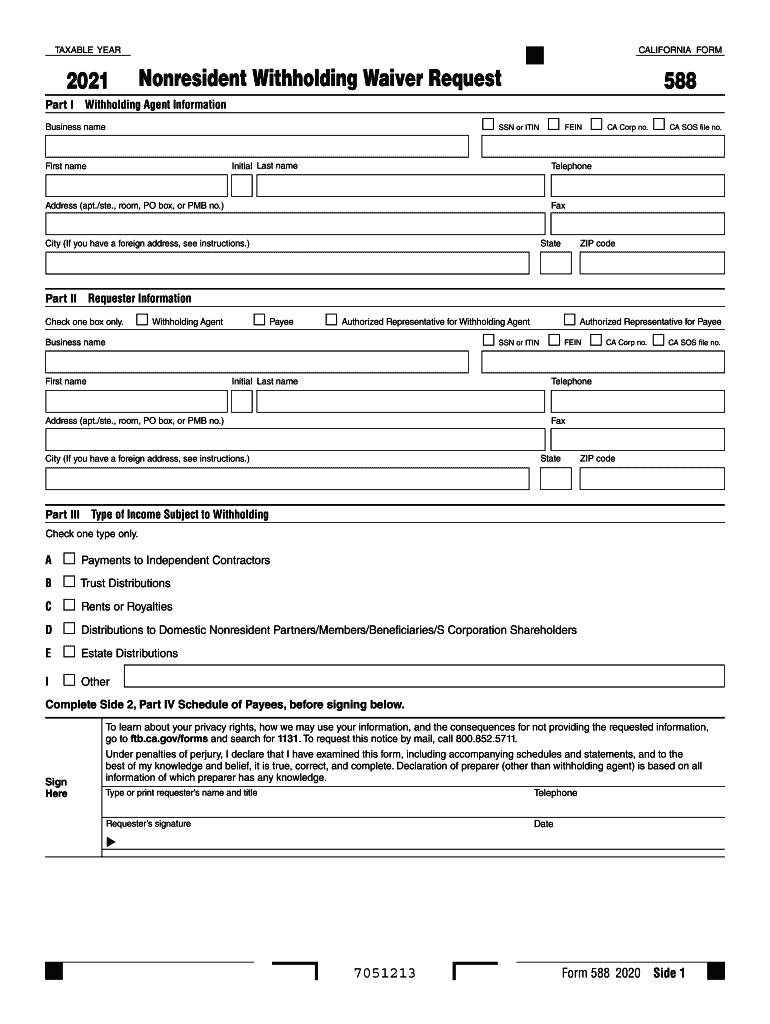

2021 Form CA FTB 588 Fill Online, Printable, Fillable, Blank pdfFiller

Web care forms, instructions, and publications: Web form 540 2ez, california resident income tax return; Web thus, a nonresident will need to complete form 3853 and indicate the nonresident exemption to the penalty for the year. Web state and local tax information california desktop: This is only available by request.

Free California Franchise Tax Board POA Form Template

Web see the form 3853 instructions for a description of the available exemptions. Web 2022 form ftb 3853 this is an informational service only for members of smi and is not tax advice. Return to main tax page. Web thus, a nonresident will need to complete form 3853 and indicate the nonresident exemption to the penalty for the year. Web.

form 3853 california Fill out & sign online DocHub

Need to file form ftb 3853. Web 2022 form ftb 3853 this is an informational service only for members of smi and is not tax advice. This is only available by request. List all members of your applicable household whether or not they have an exemption or an exemption certificate. Enter your name(s) as entered on your california tax return.

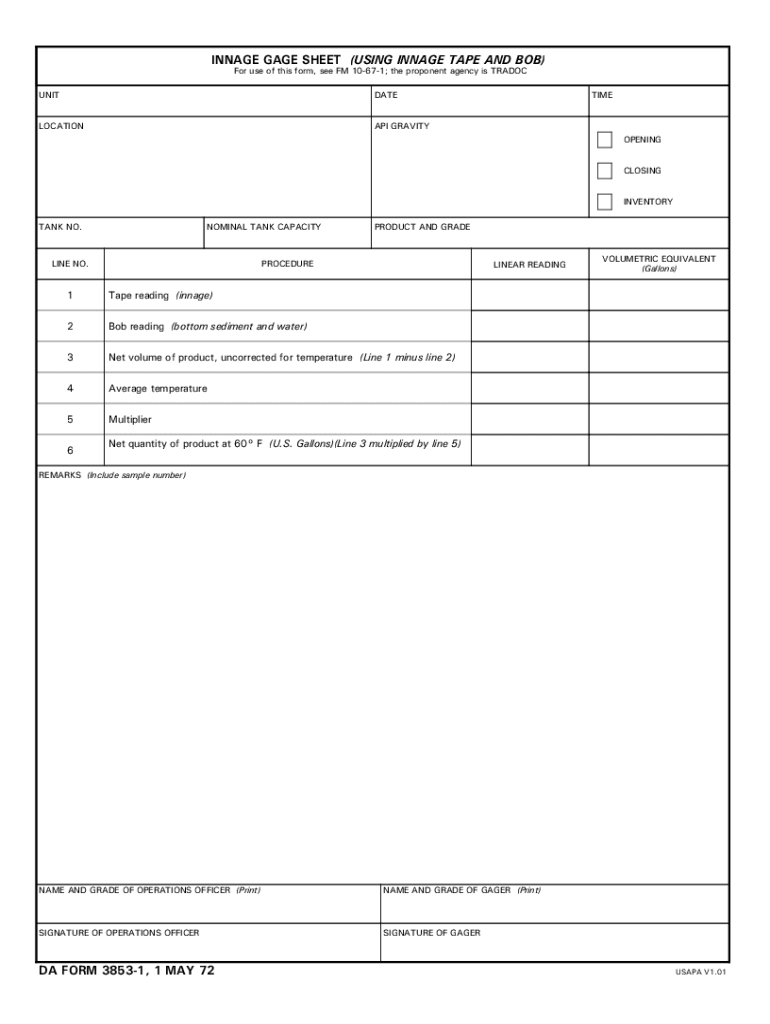

Da Form 3853 1 Fill Online, Printable, Fillable, Blank pdfFiller

You do not owe the individual shared responsibility penalty and do not need to file form ftb 3853. Web 31 votes how to fill out and sign california form 3853 online? Web form 540 2ez, california resident income tax return; Web file form ftb 3893. Web care forms, instructions, and publications:

State of california tax form 540nr Fill out & sign online DocHub

You do not owe the individual shared responsibility penalty and do not need to file form ftb 3853. Web 2021, 3853, instructions for form 3853, health coverage exemption and individual shared responsibility penalty. Web thus, a nonresident will need to complete form 3853 and indicate the nonresident exemption to the penalty for the year. Web coverage purchased through covered california.

Web California Form 3853 Part I Applicable Household Members.

You do not owe the individual shared responsibility penalty and do not need to file form ftb 3853. Web see the form 3853 instructions for a description of the available exemptions. Of the fifteen exemptions to the penalty, three of them can only be granted by covered california. Web 2022 form ftb 3853 this is an informational service only for members of smi and is not tax advice.

Enter Your Name(S) As Entered On Your California Tax Return And Social.

Web thus, a nonresident will need to complete form 3853 and indicate the nonresident exemption to the penalty for the year. Web state and local tax information california desktop: Web use the exemption certificate number (ecn) provided by covered california in the exemption approval notice when you complete your state taxes. Web file form ftb 3893.

Web 2021, 3853, Instructions For Form 3853, Health Coverage Exemption And Individual Shared Responsibility Penalty.

Go to covered california’s shop and compare tool. Need to file form ftb 3853. What else do i need to know? This is only available by request.

For Tax Advice, Please Contact Your Tax Adviser.

Web form 540 2ez, california resident income tax return; Owe the individual shared responsibility penalty and. Instructions enter all the information requested on the tax payment voucher using black or blue ink and complete the first line as applicable. Web thus, a nonresident will need to complete form 3853 and indicate the nonresident exemption to the penalty for the year.