California Form 540 Es

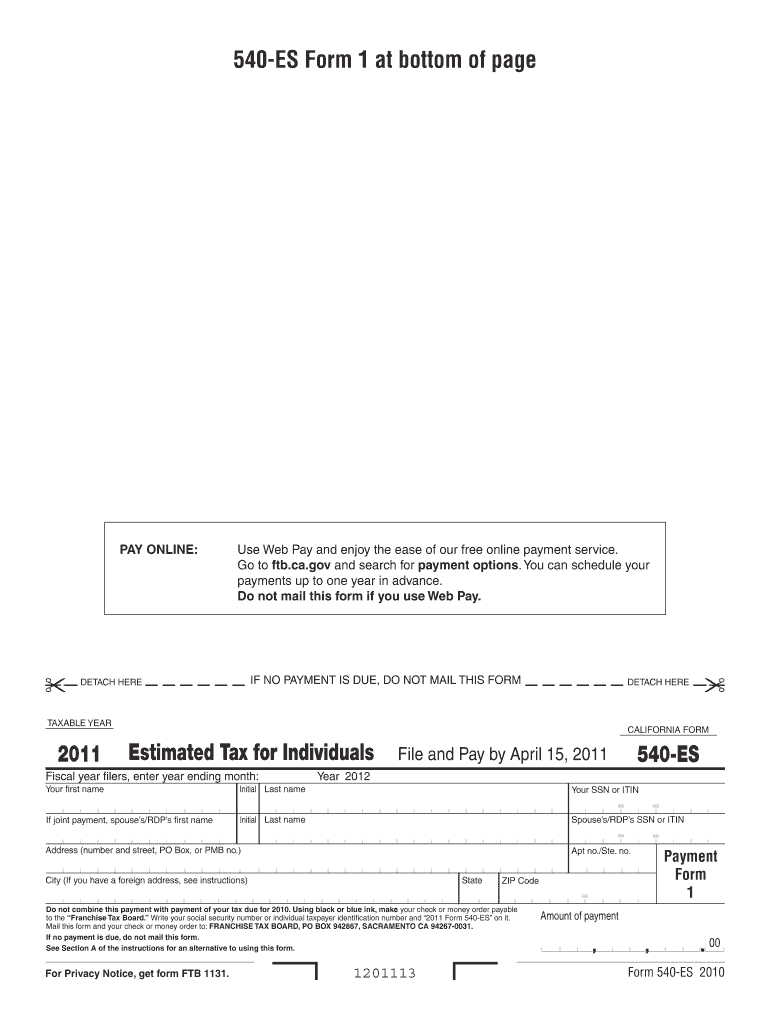

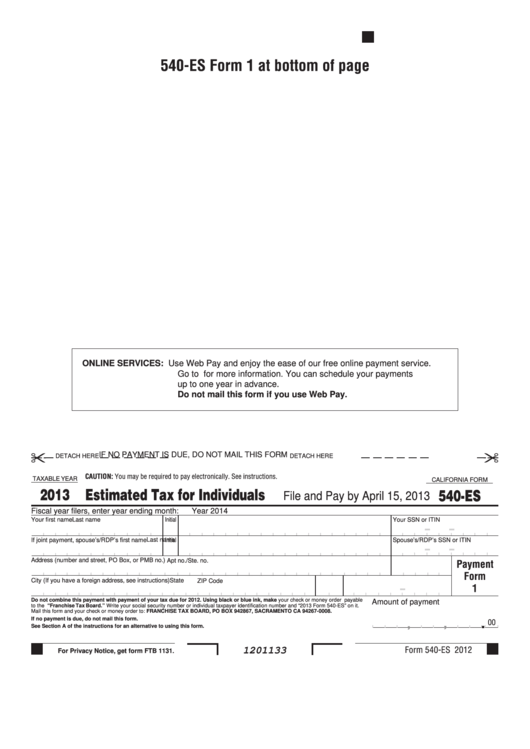

California Form 540 Es - Generally, you must make estimated tax payments if in 2022 you expect to owe at least: If you are self employed or do not have taxes. Complete, edit or print tax forms instantly. You can download or print. Year 2023 do not combine this payment. Your email information will not be collected and will be used solely. Web form 540, california resident income tax return, line 76, and get form ftb 3514, or go to ftb.ca.gov and search for yctc. Please provide your email address and it will be emailed to you. Year 2024 payment form 1 amount of payment file and pay by april 18, 2023. This form is for income earned in tax year 2022, with.

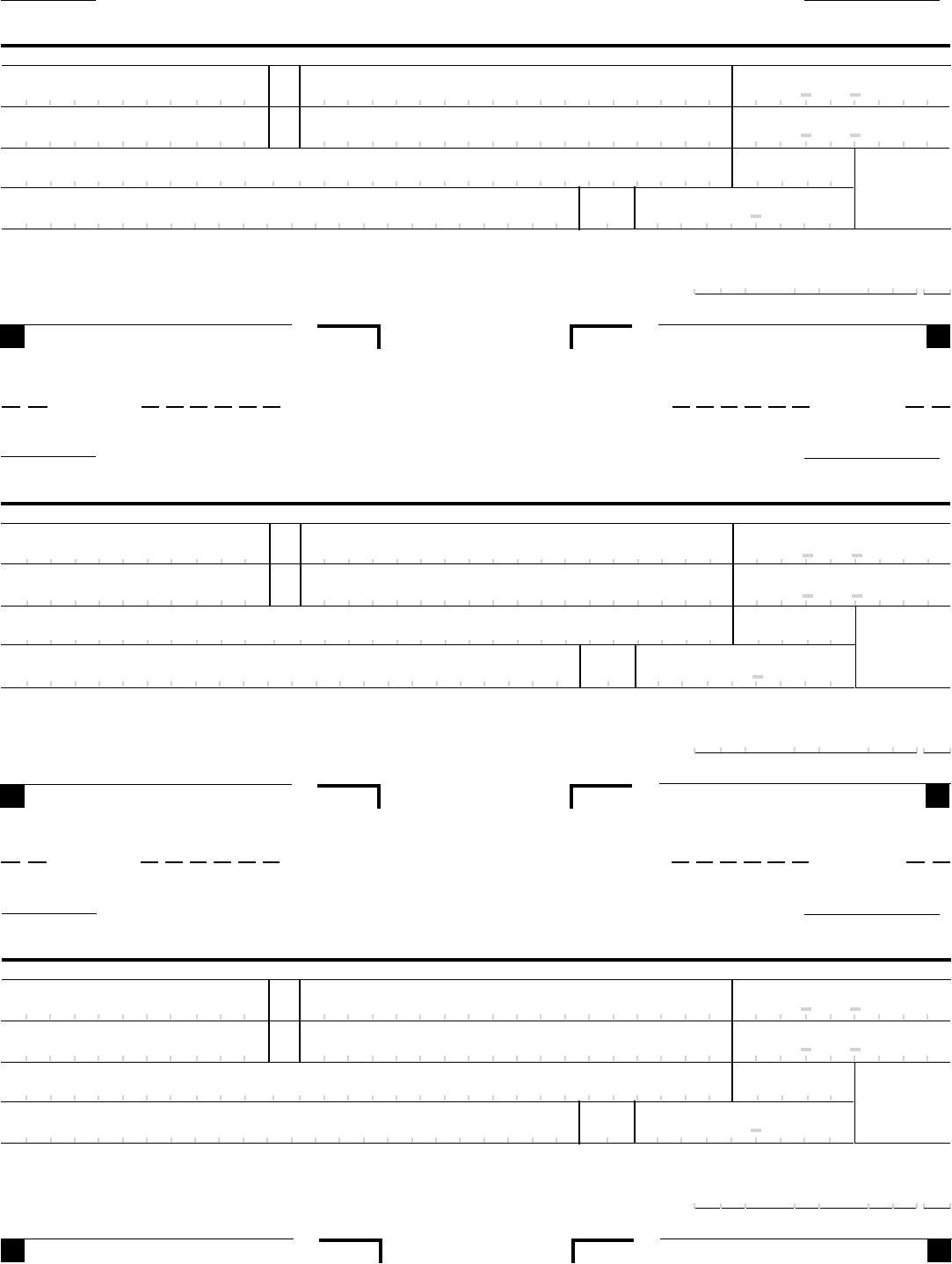

Your email information will not be collected and will be used solely. If your california filing status is different from your federal filing status, check. If you are self employed or do not have taxes. Web form 540, california resident income tax return, line 76, and get form ftb 3514, or go to ftb.ca.gov and search for yctc. Year 2023 do not combine this payment. Web taxable year california form 2018 estimated tax for individuals file and pay by june 15, 2018 fiscal year filers, enter year ending month: You may be required to enter your email for forms not available to download. You can download or print. Web form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax payments. Year 2024 payment form 1 amount of payment file and pay by april 18, 2023.

Using black or blue ink, make your check or money order payable amount of to the. Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with. Year 2023 do not combine this payment. Year 2024 payment form 1 amount of payment file and pay by april 18, 2023. Web 2022 california resident income tax return form 540 single married/rdp filing jointly. Web form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax payments. Your email information will not be collected and will be used solely. This is directly tied to your state income tax bill and each payment. Generally, you must make estimated tax payments if in 2022 you expect to owe at least:

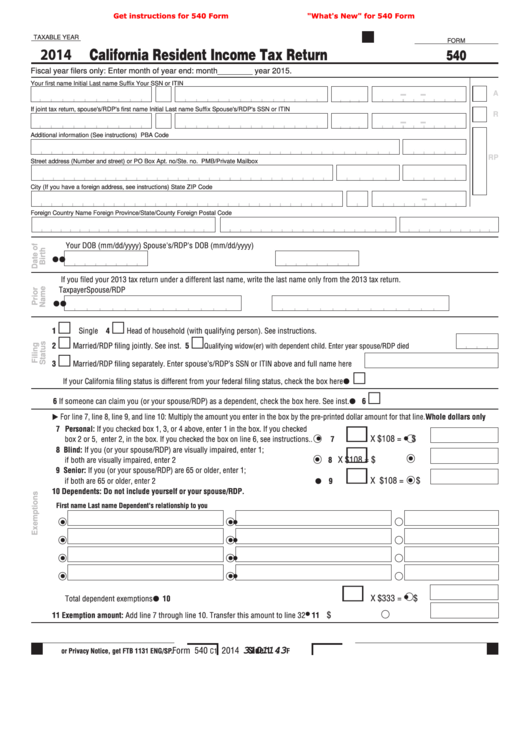

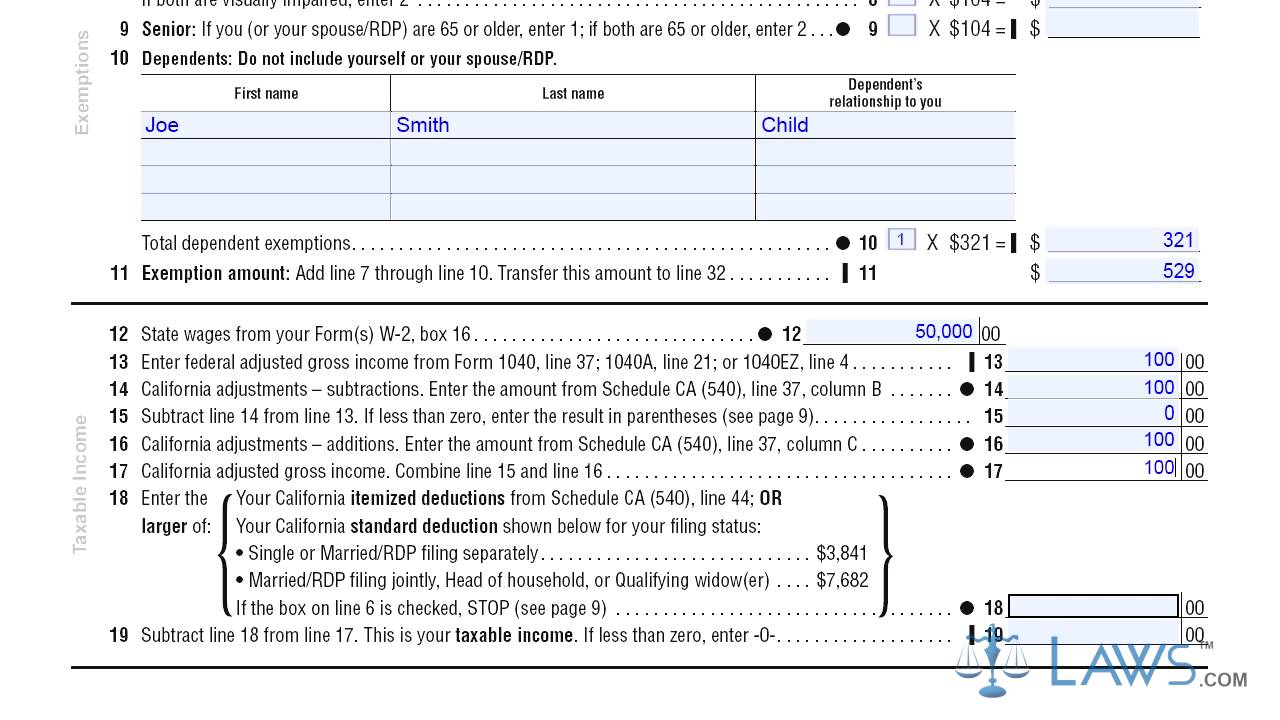

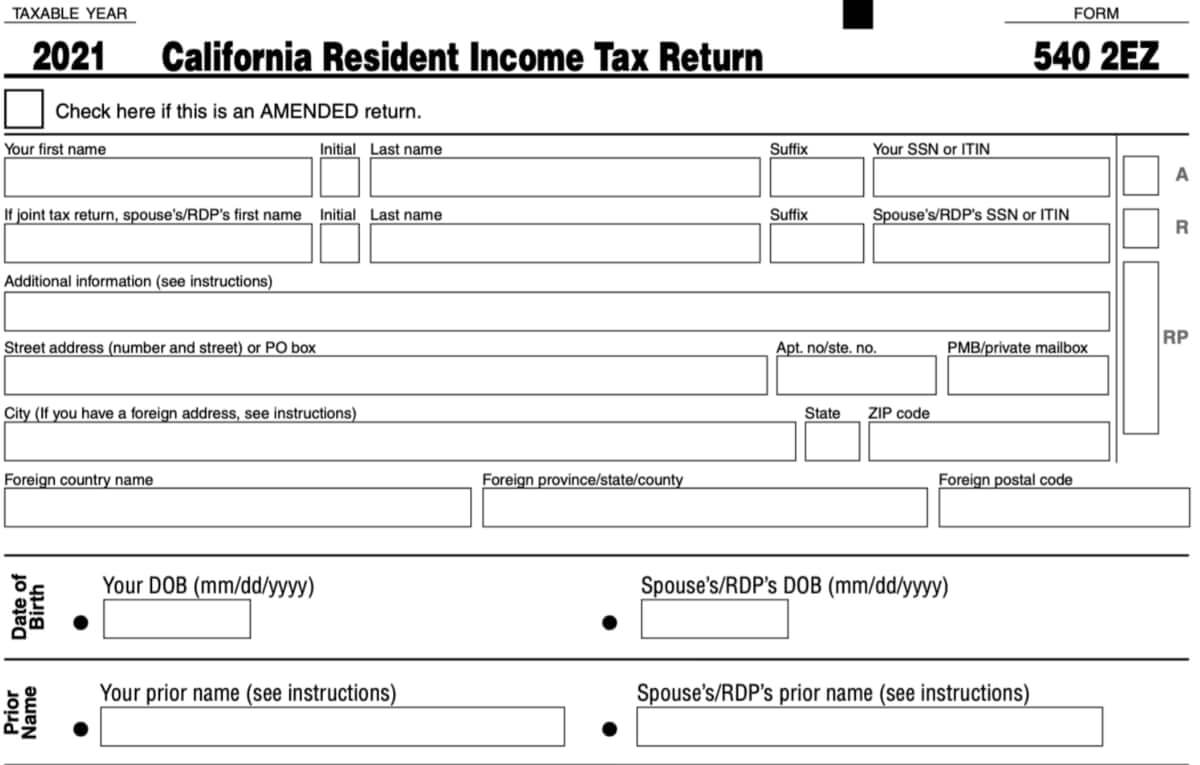

Fillable Form 540 California Resident Tax Return 2014

Web form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax payments. This form is for income earned in tax year 2022, with. Generally, you must make estimated tax payments if in 2022 you expect to owe at least: Year 2023 do not combine this payment. Please provide your email address and.

ftb.ca.gov forms 09_540esins

Year 2023 do not combine this payment. Year 2024 payment form 1 amount of payment file and pay by april 18, 2023. Please provide your email address and it will be emailed to you. Complete, edit or print tax forms instantly. Your email information will not be collected and will be used solely.

Form 540 California Resident Tax Return YouTube

Year 2023 do not combine this payment. Generally, you must make estimated tax payments if in 2022 you expect to owe at least: Web 2022 california resident income tax return form 540 single married/rdp filing jointly. Web 540 es estimated tax for individuals. If you are self employed or do not have taxes.

540Es Fill Out and Sign Printable PDF Template signNow

You may be required to enter your email for forms not available to download. Year 2024 payment form 1 amount of payment file and pay by april 18, 2023. Web 2022 california resident income tax return form 540 single married/rdp filing jointly. You can download or print. If your california filing status is different from your federal filing status, check.

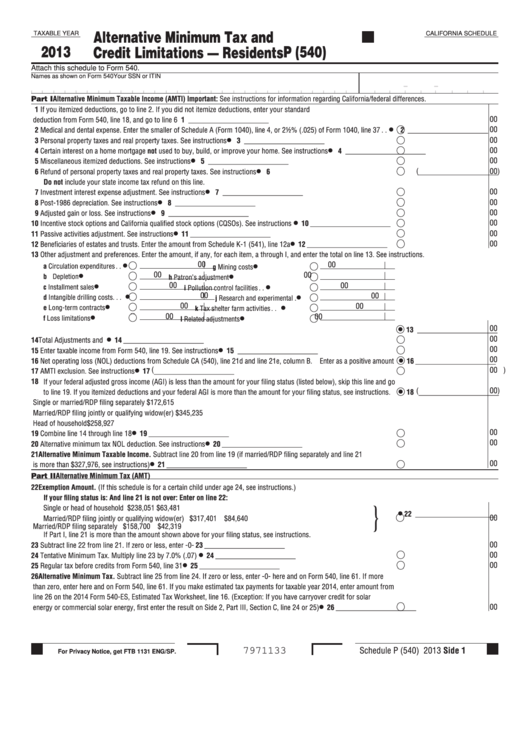

Fillable California Form 540Es Estimated Tax For Individuals 2013

Generally, you must make estimated tax payments if in 2022 you expect to owe at least: Year 2023 do not combine this payment. Web 540 es estimated tax for individuals. Web form 540, california resident income tax return, line 76, and get form ftb 3514, or go to ftb.ca.gov and search for yctc. Complete, edit or print tax forms instantly.

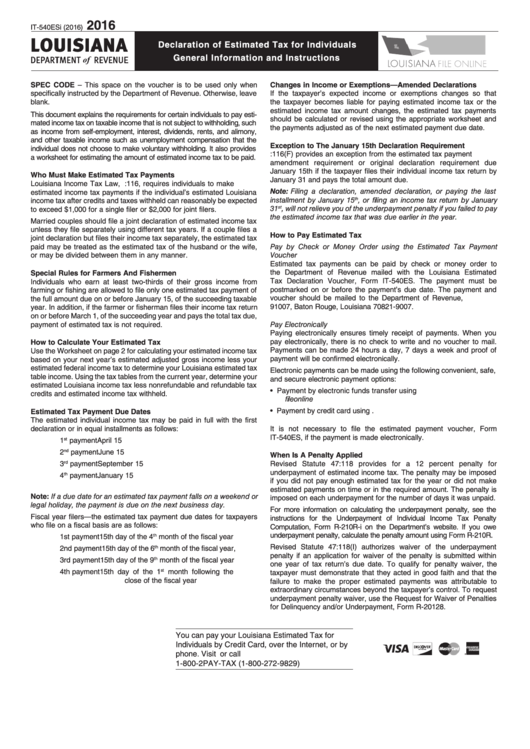

Form It540esi Declaration Of Estimated Tax For Individuals General

Your email information will not be collected and will be used solely. Web 2022 california resident income tax return form 540 single married/rdp filing jointly. You can download or print. Web 540 es estimated tax for individuals. Web form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax payments.

2017 Form 540Es Estimated Tax For Individuals Edit, Fill, Sign

Web taxable year california form 2018 estimated tax for individuals file and pay by june 15, 2018 fiscal year filers, enter year ending month: You can download or print. Generally, you must make estimated tax payments if in 2022 you expect to owe at least: This form is for income earned in tax year 2022, with. Complete, edit or print.

Top 22 California Ftb Form 540 Templates free to download in PDF format

Web 540 es estimated tax for individuals. Web 2022 california resident income tax return form 540 single married/rdp filing jointly. Year 2024 payment form 1 amount of payment file and pay by april 18, 2023. If you are self employed or do not have taxes. You can download or print.

Form 5402EZ California 2022 2023 State And Local Taxes Zrivo

This is directly tied to your state income tax bill and each payment. Your email information will not be collected and will be used solely. Web form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax payments. Web 540 es estimated tax for individuals. Year 2023 do not combine this payment.

California Form 540 2ez Tax Tables

Web 2022 california resident income tax return form 540 single married/rdp filing jointly. You can download or print. Web form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax payments. This form is for income earned in tax year 2022, with. This is directly tied to your state income tax bill and.

Web 2022 California Resident Income Tax Return Form 540 Single Married/Rdp Filing Jointly.

Web form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax payments. Please provide your email address and it will be emailed to you. You can download or print. Web form 540, california resident income tax return, line 76, and get form ftb 3514, or go to ftb.ca.gov and search for yctc.

If Your California Filing Status Is Different From Your Federal Filing Status, Check.

Year 2023 do not combine this payment. This is directly tied to your state income tax bill and each payment. If you are self employed or do not have taxes. Your email information will not be collected and will be used solely.

This Form Is For Income Earned In Tax Year 2022, With.

Complete, edit or print tax forms instantly. Web taxable year california form 2018 estimated tax for individuals file and pay by june 15, 2018 fiscal year filers, enter year ending month: Web 540 es estimated tax for individuals. You may be required to enter your email for forms not available to download.

Generally, You Must Make Estimated Tax Payments If In 2022 You Expect To Owe At Least:

Year 2024 payment form 1 amount of payment file and pay by april 18, 2023. Using black or blue ink, make your check or money order payable amount of to the.