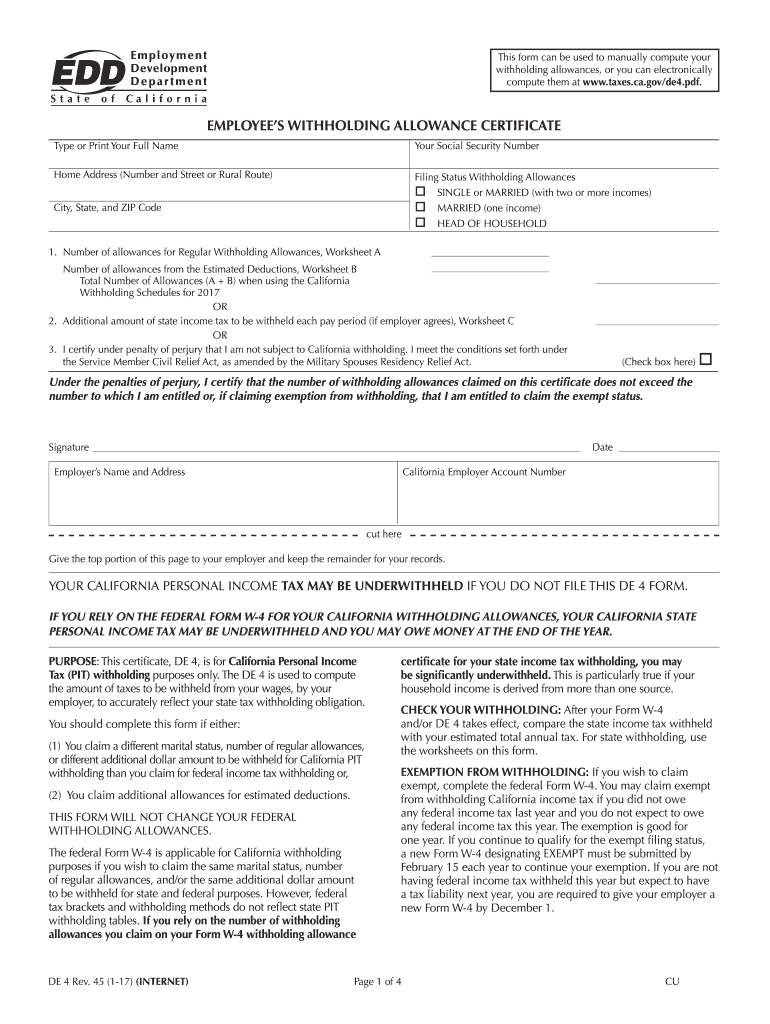

California Tax Form De 4

California Tax Form De 4 - Title 22, california code of regulations (ccr), the ftb or the edd may, by. (1) claim a different number of allowances for. Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Web employee to show the correct california income tax withholding. Web you must file the state form employee’s withholding allowance certificate (de 4) to determine the appropriate california personal income tax (pit) withholding. Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Starting 2020, there are new. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. The de 4 is used to compute the amount of taxes to be withheld from.

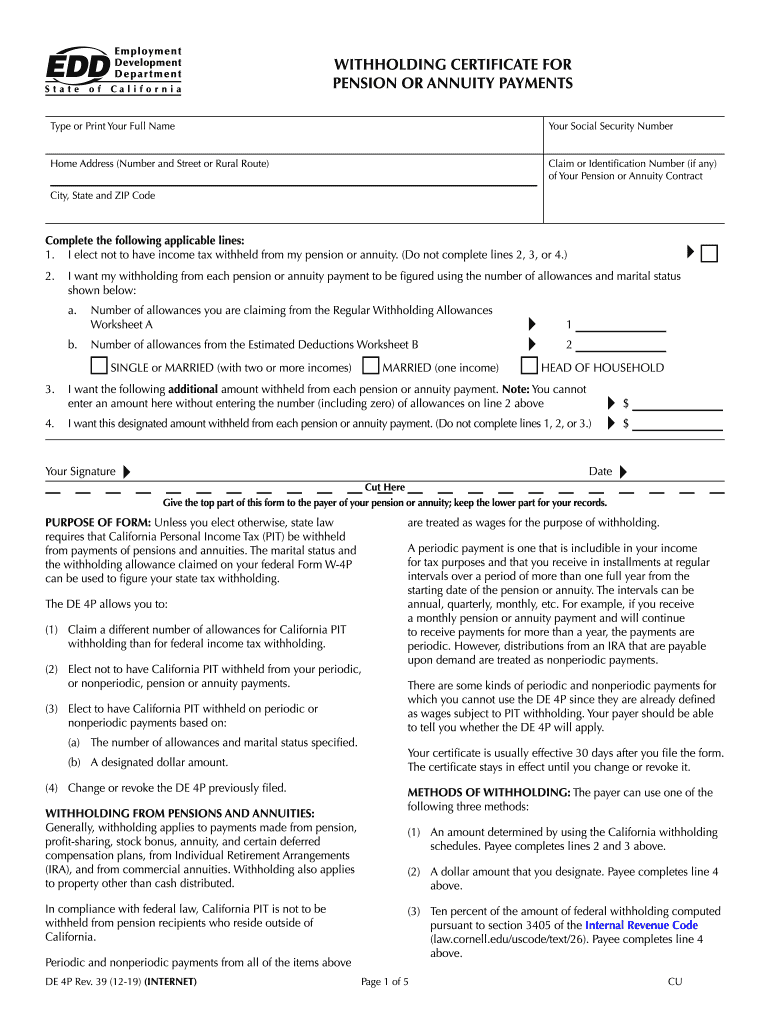

Web this certificate, de 4, is for california personal income tax (pit) withholding purposes only. Title 22, california code of regulations (ccr), the ftb or the edd may, by. Web (de 4) to estimate the amount of income tax you want withheld from each sick pay payment. Web simplified income, payroll, sales and use tax information for you and your business Starting 2020, there are new. We consistently offer best in class solutions to you & your client's tax problems. The de 4s is not valid unless you sign it. The de 4p allows you to: Web employee to show the correct california income tax withholding. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years.

Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you know how much state income tax to withhold from. You may be fined $500 if you file, with no reasonable. Web this certificate, de 4, is for california personal income tax (pit) withholding purposes only. The de 4 is used to compute the amount of taxes to be withheld from. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. The de 4s is not valid unless you sign it. Web simplified income, payroll, sales and use tax information for you and your business Web the franchise tax board or the employment development department (edd) may, by special direction in writing, require an employer to submit a de 4 when such forms are. Web you must file the state form employee’s withholding allowance certificate (de 4) to determine the appropriate california personal income tax (pit) withholding. Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation.

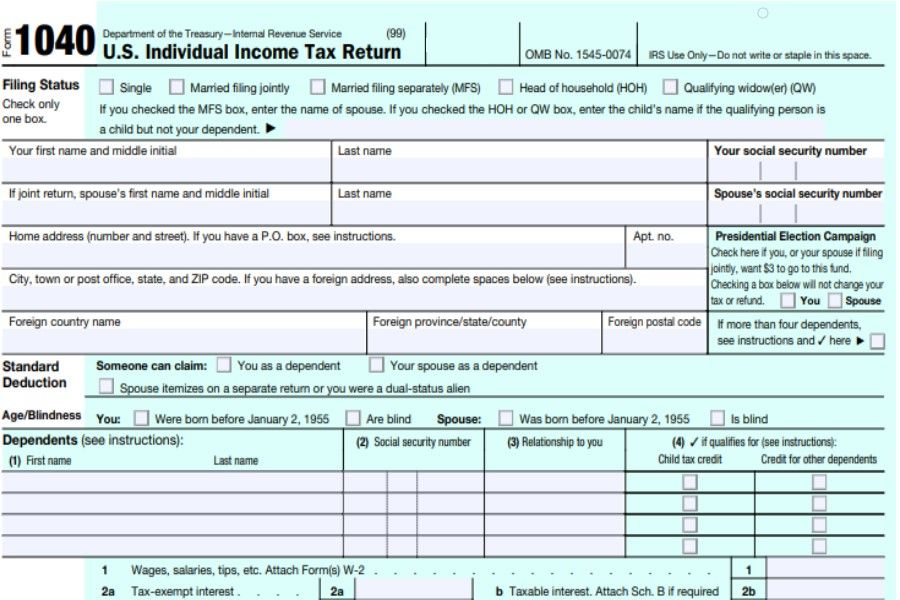

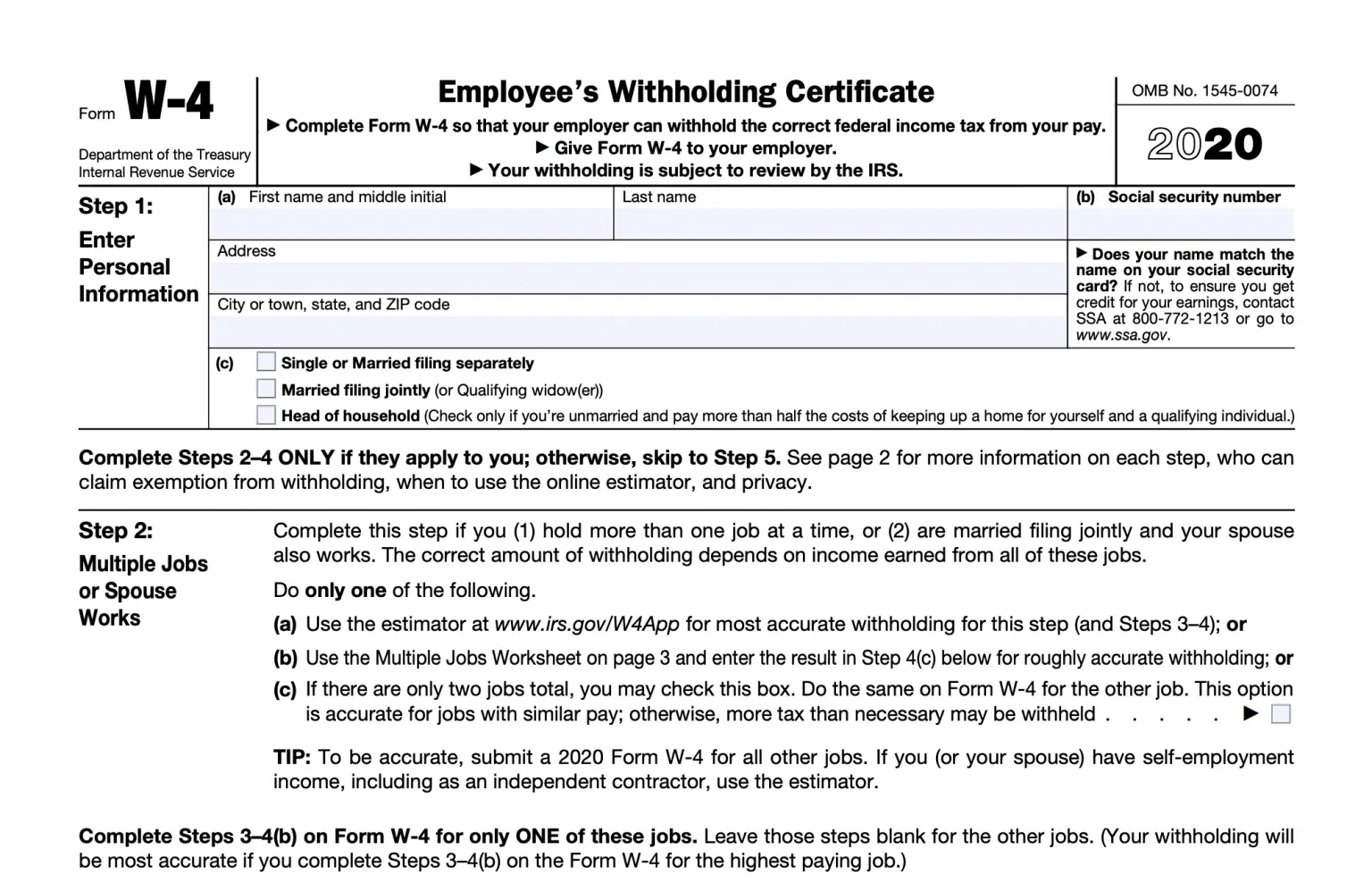

2021 Federal Tax Forms Printable 2022 W4 Form

Web you must file the state form employee’s withholding allowance certificate (de 4) to determine the appropriate california personal income tax (pit) withholding. Web you must file the state form employee’s withholding allowance certificate (de 4) to determine the appropriate california personal income tax (pit) withholding. The de 4s is not valid unless you sign it. Ad join us and.

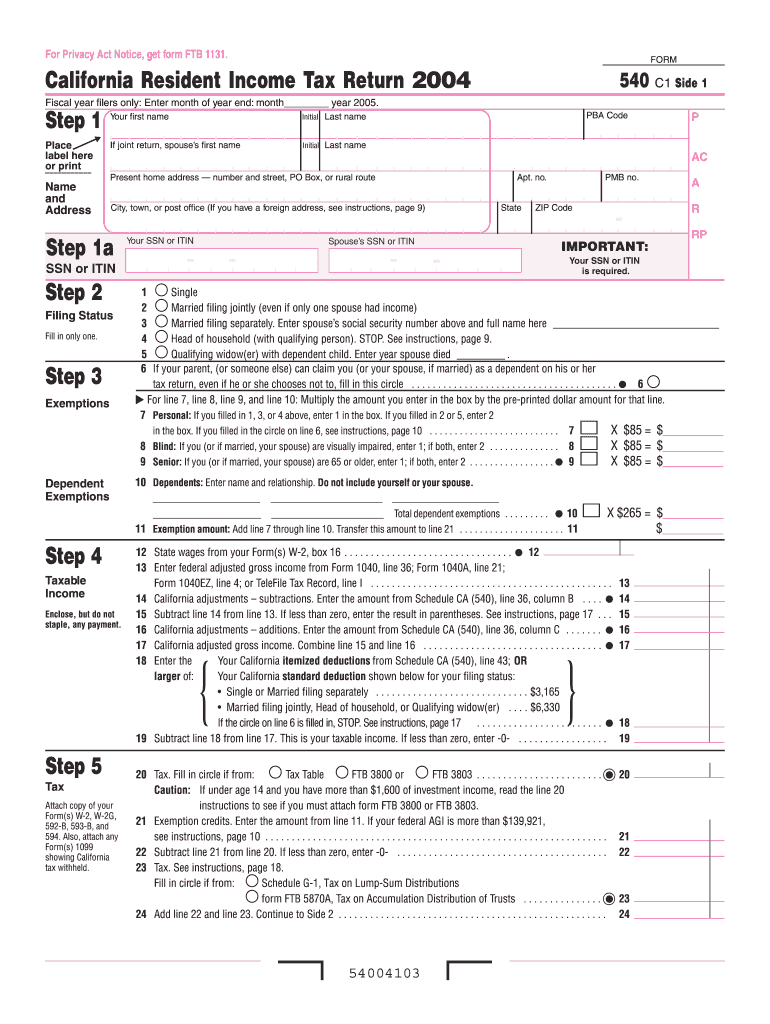

2004 Form CA FTB 540 Fill Online, Printable, Fillable, Blank pdfFiller

Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you know how much state income tax to withhold from. Web this certificate, de 4,.

California DE4 App

(1) claim a different number of allowances for. The de 4p allows you to: Only need to adjust your state withholding allowance, go to the. The de 4 is used to compute the amount of taxes to be withheld from. Web you must file the state form employee’s withholding allowance certificate (de 4) to determine the appropriate california personal income.

Should I Claim 1 or 0 on my W4 Tax Allowances Expert's Answer!

Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. You may be fined $500 if you file, with no reasonable. Only need to adjust your state withholding allowance, go to the. Title 22, california code of regulations (ccr), the ftb.

20182021 Form CA EDD DE 4P Fill Online, Printable, Fillable, Blank

Web (de 4) to estimate the amount of income tax you want withheld from each sick pay payment. Web employee to show the correct california income tax withholding. Web this certificate, de 4, is for california personal income tax (pit) withholding purposes only. Ad join us and see why tax pros have come to us for the latest tax updates.

Ca De 4 20202022 Fill and Sign Printable Template Online US Legal

You may be fined $500 if you file, with no reasonable. Starting 2020, there are new. Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. Title 22, california code of regulations (ccr), the ftb or the edd may, by. We.

Proposed California Tax Increases

The de 4 is used to compute the amount of taxes to be withheld from. Web you must file the state form employee’s withholding allowance certificate (de 4) to determine the appropriate california personal income tax (pit) withholding. Web (de 4) to estimate the amount of income tax you want withheld from each sick pay payment. Web this certificate, de.

california property tax assessor

Only need to adjust your state withholding allowance, go to the. Web this certificate, de 4, is for california personal income tax (pit) withholding purposes only. Web (de 4) to estimate the amount of income tax you want withheld from each sick pay payment. You may be fined $500 if you file, with no reasonable. Starting 2020, there are new.

CA EDD DE 4P 20192022 Fill and Sign Printable Template Online US

Web simplified income, payroll, sales and use tax information for you and your business Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Web the franchise tax board or the.

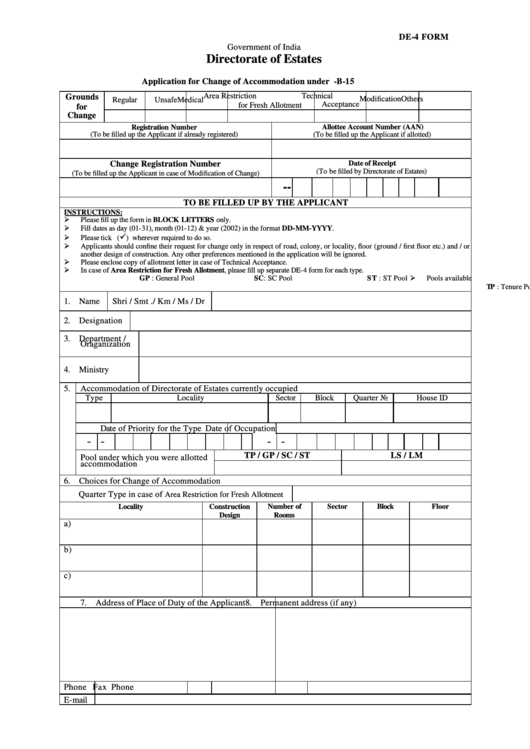

De4 Form Directorate Of Estates Form printable pdf download

Only need to adjust your state withholding allowance, go to the. Starting 2020, there are new. Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you know how much state income tax to withhold from. Web the franchise tax board or the employment development department (edd) may, by special.

Web Filling Out The California Withholding Form De 4 Is An Important Step To Ensure Accurate Tax Withholding From Your Wages Or Salary In California.

Web employee to show the correct california income tax withholding. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Web (de 4) to estimate the amount of income tax you want withheld from each sick pay payment. Web you must file the state form employee’s withholding allowance certificate (de 4) to determine the appropriate california personal income tax (pit) withholding.

Web The De 4 Is Used To Compute The Amount Of Taxes To Be Withheld From Your Wages, By Your Employer, To Accurately Reflect Your State Tax Withholding Obligation.

The de 4s is not valid unless you sign it. Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you know how much state income tax to withhold from. The de 4p allows you to: You may be fined $500 if you file, with no reasonable.

Web The Franchise Tax Board Or The Employment Development Department (Edd) May, By Special Direction In Writing, Require An Employer To Submit A De 4 When Such Forms Are.

Web this certificate, de 4, is for california personal income tax (pit) withholding purposes only. Web you must file the state form employee’s withholding allowance certificate (de 4) to determine the appropriate california personal income tax (pit) withholding. Web simplified income, payroll, sales and use tax information for you and your business We consistently offer best in class solutions to you & your client's tax problems.

(1) Claim A Different Number Of Allowances For.

Title 22, california code of regulations (ccr), the ftb or the edd may, by. Starting 2020, there are new. The de 4 is used to compute the amount of taxes to be withheld from. Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation.