Can I File Form 568 Online

Can I File Form 568 Online - From within your taxact return ( online or desktop), click state to expand, then click california (or ca ). Web smllcs, owned by an individual, are required to file form 568 on or before april 15. 2021 limited liability company return of income. Start basic federal filing for free. • form 568, limited liability company return of income • form 565, partnership return of income • form 100, california. Web open an llc to register or organize an llc in california, contact the secretary of state (sos): Web to complete california form 568 for a partnership, from the main menu of the california return, select: Web california form 568 is available in the turbotax business version. Click here about the product. Currently, drake software does not support the e.

Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use. You will need to upgrade from your current online version. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. They are subject to the annual tax, llc fee and credit limitations. 2021 limited liability company return of income. I (1) during this taxable year, did another person or legal entity acquire control or. We found that 540 has been generated in the state section of the tax return. Web open an llc to register or organize an llc in california, contact the secretary of state (sos): Web california form 568 is available in the turbotax business version. Web to enter the information for form 568 in the 1040 taxact ® program:

Web to enter the information for form 568 in the 1040 taxact ® program: I (1) during this taxable year, did another person or legal entity acquire control or. You will need to upgrade from your current online version. You and your clients should be aware that a disregarded smllc is required to: They are subject to the annual tax, llc fee and credit limitations. Click here about the product. Web california form 568 is available in the turbotax business version. Web expert alumni in 2020, electronic filing of your form 568 is supported when you file your personal income tax return as long as you only have one form 568. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use. Ad over 90 million taxes filed with taxact.

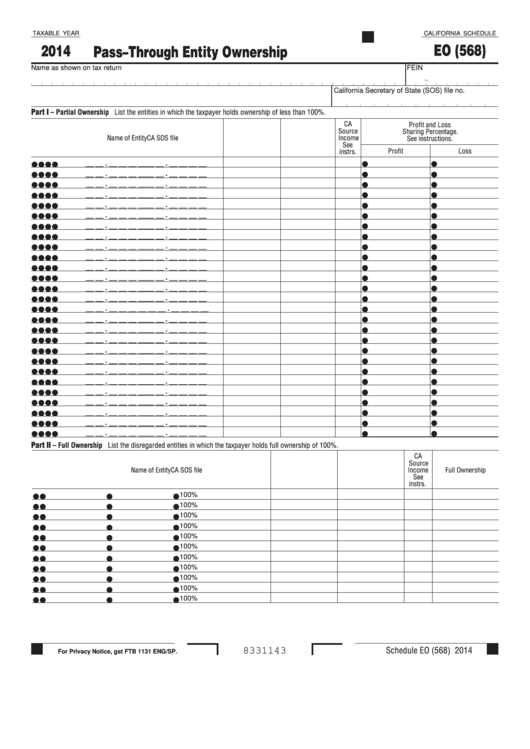

Fillable Form California Schedule Eo (568) PassThrough Entity

Web smllcs, owned by an individual, are required to file form 568 on or before april 15. I just talked to an intuit rep. Click here about the product. You will need to upgrade from your current online version. Currently, drake software does not support the e.

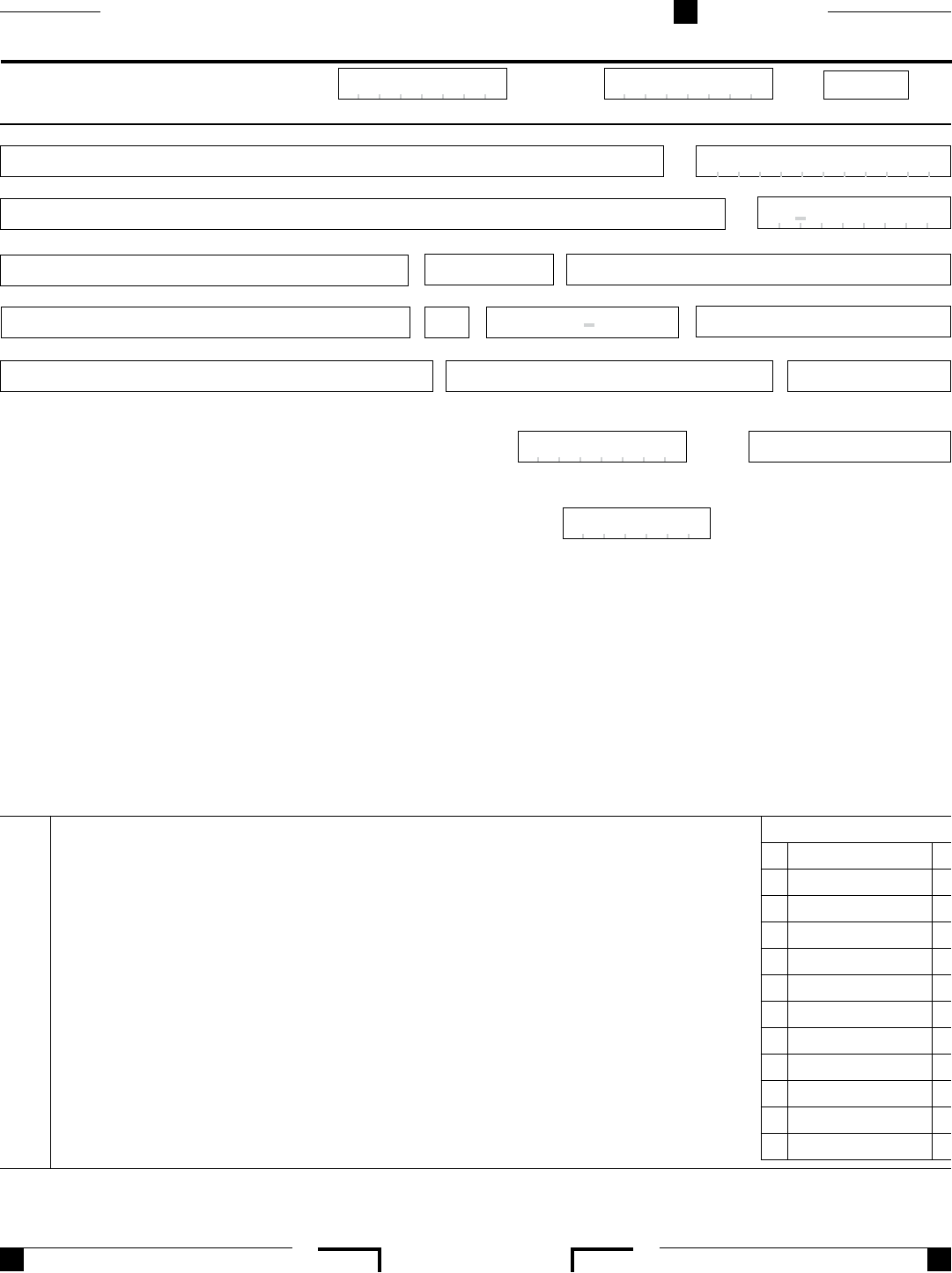

Form 568 Instructions 2022 State And Local Taxes Zrivo

Web if you have an llc, here’s how to fill in the california form 568: Start basic federal filing for free. Web california form 568 is available in the turbotax business version. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and.

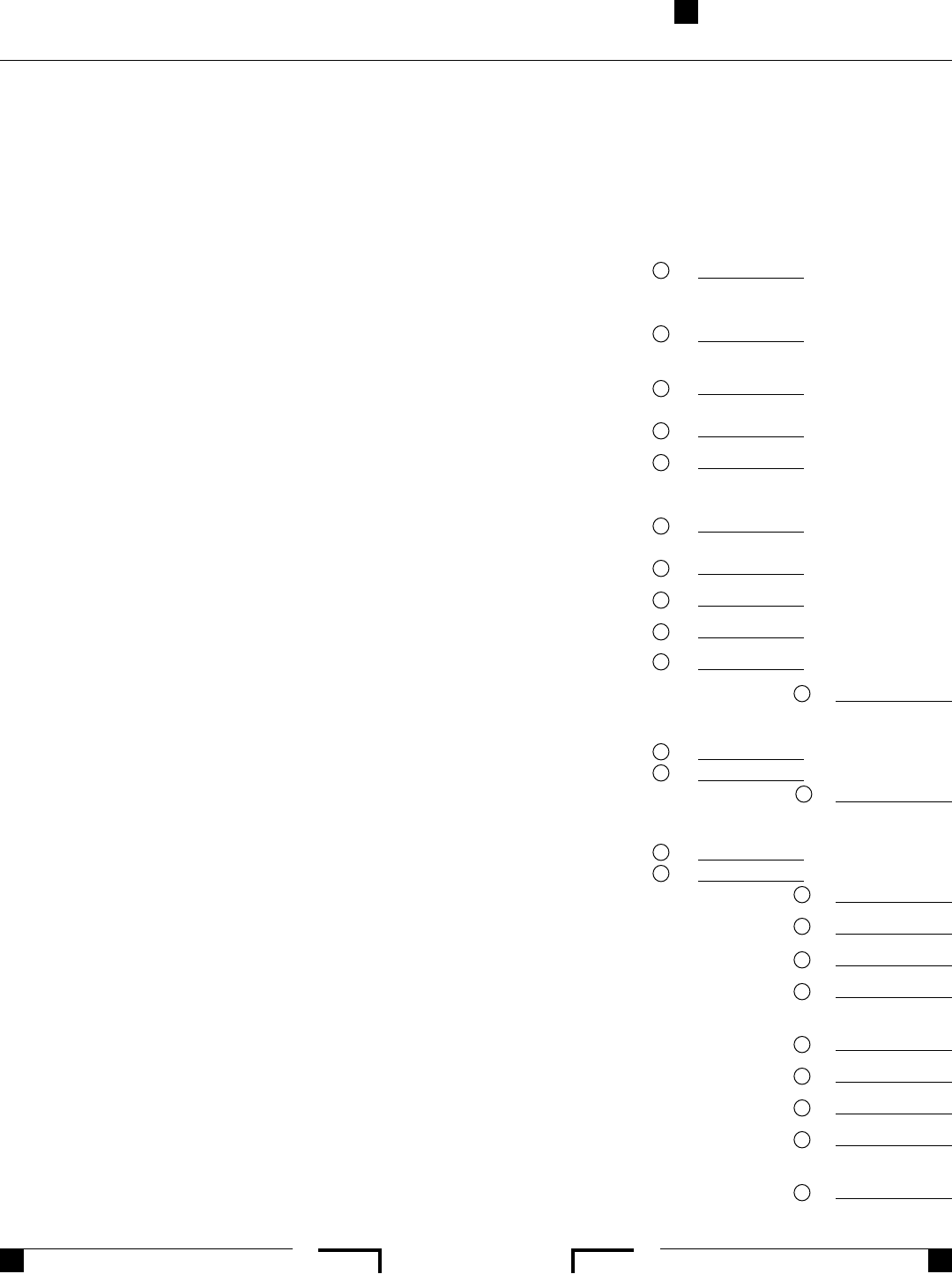

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. 2021 limited liability company return of income. They are subject to the annual tax, llc fee and credit limitations. We found that 540 has been generated in the state section of the tax.

How Much Does It Cost To Get A Copy Of My Naturalization Certificate

We found that 540 has been generated in the state section of the tax return. • form 568, limited liability company return of income • form 565, partnership return of income • form 100, california. Web open an llc to register or organize an llc in california, contact the secretary of state (sos): However 568 is not supported in single.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

They are subject to the annual tax, llc fee and credit limitations. We found that 540 has been generated in the state section of the tax return. You will need to upgrade from your current online version. Web expert alumni in 2020, electronic filing of your form 568 is supported when you file your personal income tax return as long.

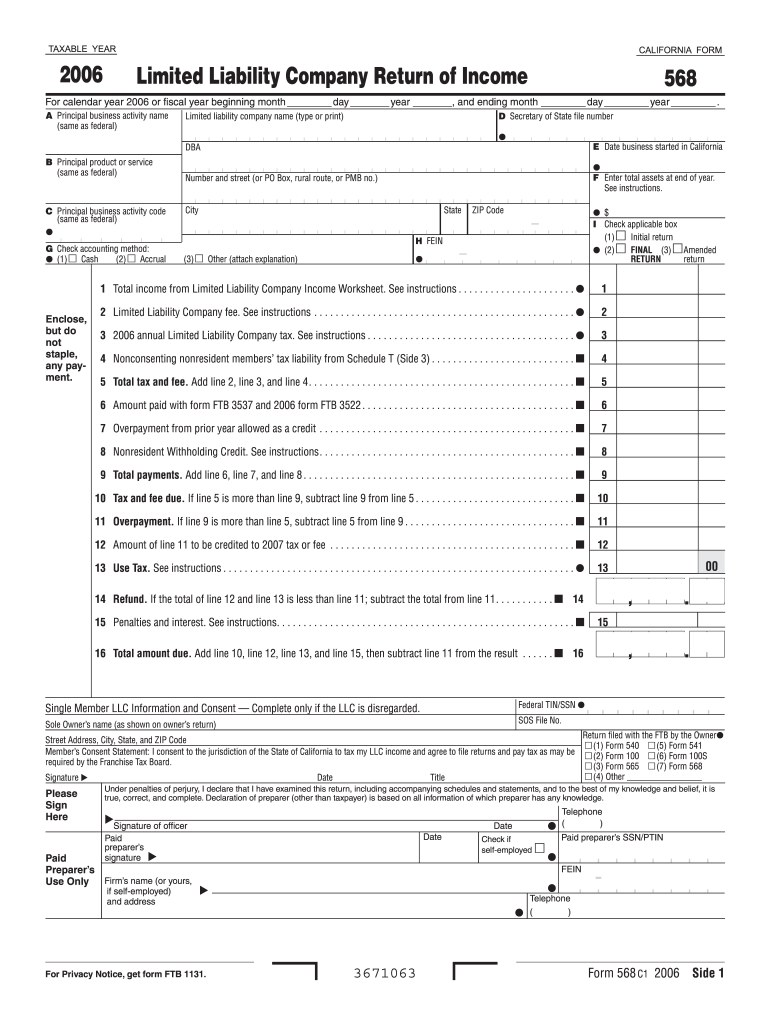

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

We found that 540 has been generated in the state section of the tax return. Line 1—total income from schedule iw. • form 568, limited liability company return of income • form 565, partnership return of income • form 100, california. Ad over 90 million taxes filed with taxact. Web since the limited liability company is doing business in both.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Web expert alumni in 2020, electronic filing of your form 568 is supported when you file your personal income tax return as long as you only have one form 568. Web an llc must file form 568, pay any nonconsenting.

Form 568 Limited Liability Company Return of Fill Out and Sign

I just talked to an intuit rep. Web open an llc to register or organize an llc in california, contact the secretary of state (sos): They are subject to the annual tax, llc fee and credit limitations. 2021 limited liability company return of income. Web smllcs, owned by an individual, are required to file form 568 on or before april.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

Web to enter the information for form 568 in the 1040 taxact ® program: Import tax data online in no time with our easy to use simple tax software. We found that 540 has been generated in the state section of the tax return. Web if you have an llc, here’s how to fill in the california form 568: Web.

Form Ca 568 Fill Out and Sign Printable PDF Template signNow

Line 1—total income from schedule iw. • form 568, limited liability company return of income • form 565, partnership return of income • form 100, california. We found that 540 has been generated in the state section of the tax return. Web to enter the information for form 568 in the 1040 taxact ® program: I (1) during this taxable.

• Form 568, Limited Liability Company Return Of Income • Form 565, Partnership Return Of Income • Form 100, California.

Web california form 568 is available in the turbotax business version. Web to complete california form 568 for a partnership, from the main menu of the california return, select: Web open an llc to register or organize an llc in california, contact the secretary of state (sos): Web an llc must file form 568, pay any nonconsenting nonresident members’ tax, and pay any amount of the llc fee owed that was not paid as an estimated fee with form ftb.

Start Basic Federal Filing For Free.

Web to enter the information for form 568 in the 1040 taxact ® program: From within your taxact return ( online or desktop), click state to expand, then click california (or ca ). Ad over 90 million taxes filed with taxact. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use.

Click Here About The Product.

Web if you have an llc, here’s how to fill in the california form 568: Web expert alumni in 2020, electronic filing of your form 568 is supported when you file your personal income tax return as long as you only have one form 568. You will need to upgrade from your current online version. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including.

However 568 Is Not Supported In Single Member.

I (1) during this taxable year, did another person or legal entity acquire control or. 2021 limited liability company return of income. Import tax data online in no time with our easy to use simple tax software. They are subject to the annual tax, llc fee and credit limitations.