Can I Get A Home Equity Loan After Chapter 7

Can I Get A Home Equity Loan After Chapter 7 - Unfortunately, your credit will also take a major hit. This will vary based on the type of loan. The bank probably has a security interest in your home. Home equity is what used to be called 2nd mortgages. However, because your heloc is a secured debt (which means you pledged your home as collateral for the debt), if you want to keep your home… Lenders have their own requirements and waiting periods but buying a home after bankruptcy is possible. Web short answer is no, it is not a nonpossessory, nonpurchaser money security interest. The first $150,000 of that pays off the mortgage. Web in addition, you will need to discuss with a bankruptcy lawyer the impact of the bankruptcy chapter you have filed on your ability to get a home equity loan. It is subordinate to the first mortgage, however, it is a secured loan, with the security being your home…

However, it also has some serious drawbacks when it comes to financially rebounding right away. Waiting periods for conventional loans Web in addition, you will need to discuss with a bankruptcy lawyer the impact of the bankruptcy chapter you have filed on your ability to get a home equity loan. Filers in the eleventh circuit court of appeals, are no longer able to strip off (remove) these types of liens in chapter 7 bankruptcy. The first $150,000 of that pays off the mortgage. But if you only apply with one lender, you won’t be able to compare your offer with others, which limits your choices. Web a chapter 7 bankruptcy focuses on freeing you from debt. The education security portal upgrade has been scheduled: Your credit score and equity in. It’s important to understand the difference between your filing date and your discharge or dismissal date.

Filers in the eleventh circuit court of appeals, are no longer able to strip off (remove) these types of liens in chapter 7 bankruptcy. Monday, august 28, 2023 at 8:00 am. The real question here is: Web when you receive your chapter 7 discharge, your personal liability to pay back your heloc is wiped out. Getting a usda loan after chapter. Ad compare top home equity lenders. Web can i get a home equity line of credit after a chapter 7 bankruptcy discharge? However, it also has some serious drawbacks when it comes to financially rebounding right away. Ad use our expansive equity network to compare offers from top lenders in 1 place Web techniques used in home equity schemes vary but they typically involve the same key features.

Using a Home Equity Loan to Pay Off Debt Credible

Web short answer is no, it is not a nonpossessory, nonpurchaser money security interest. Your credit score and equity in. Web if you file for chapter 7 bankruptcy, you cannot get rid of second mortgages, home equity lines of credit (helocs), or home equity loans. Ad put your home equity to work & pay for big expenses. Ad use our.

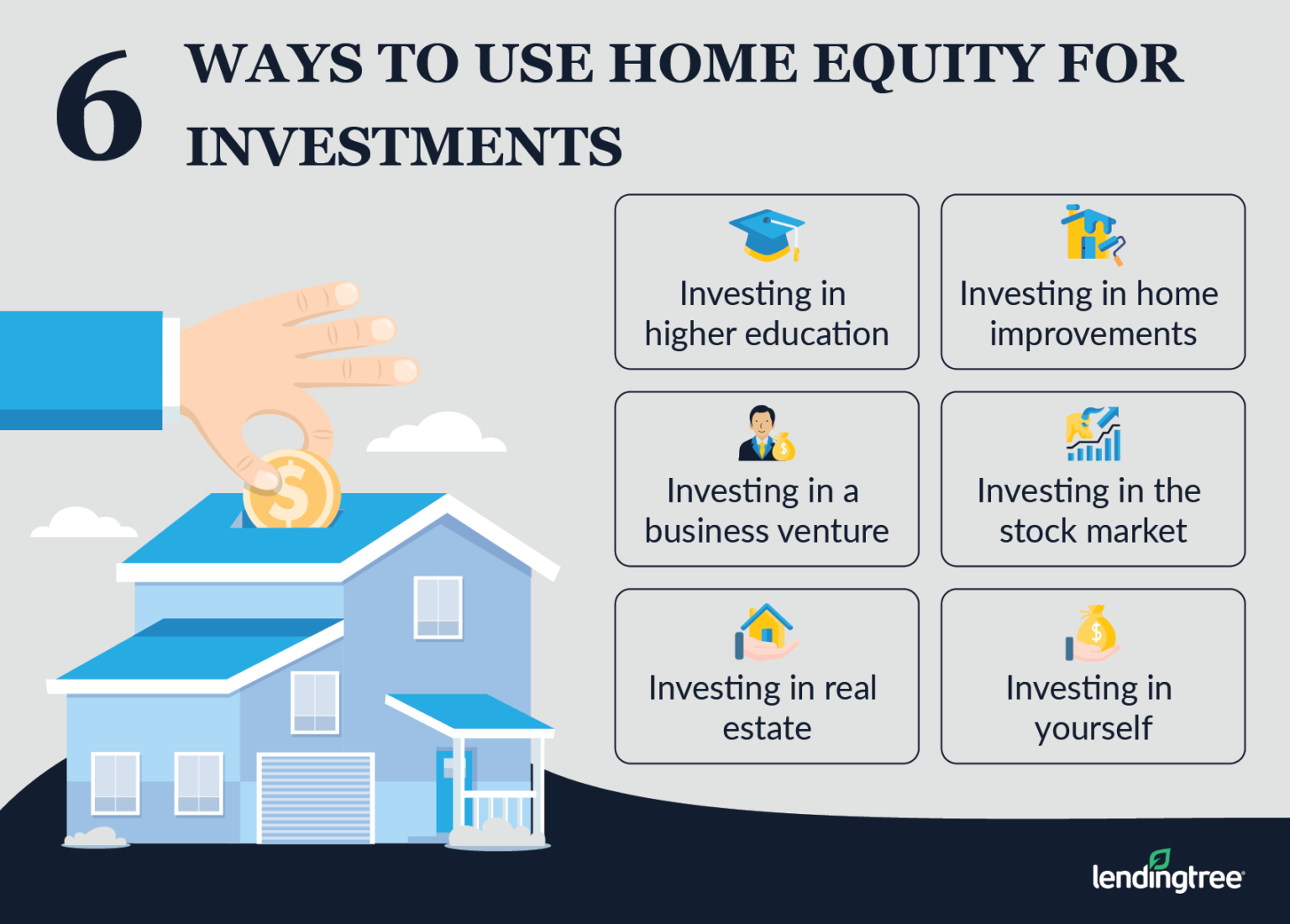

Can You Use Home Equity to Invest? LendingTree

Your credit score and equity in. Other options include a home equity. Ad use our expansive equity network to compare offers from top lenders in 1 place Frequently this isn't difficult because all that's required is the home owner's signature. It is subordinate to the first mortgage, however, it is a secured loan, with the security being your home…

Can I Get HELOC During or After Bankruptcy? [Home Equity Line of Credit

However, because your heloc is a secured debt (which means you pledged your home as collateral for the debt), if you want to keep your home… Web in addition, you will need to discuss with a bankruptcy lawyer the impact of the bankruptcy chapter you have filed on your ability to get a home equity loan. The loan documents, including.

Can You Get a Home Equity Loan With Bad Credit? ScoreMaster®

Web a chapter 7 bankruptcy focuses on freeing you from debt. It’s important to understand the difference between your filing date and your discharge or dismissal date. Web a home equity loan is a loan you take out against the equity you already have in your home. Web buying a house after chapter 7 bankruptcy the most common type of.

Refinancing vs Home Equity Loan Home Loans

Lenders have their own requirements and waiting periods but buying a home after bankruptcy is possible. Ad put your home equity to work & pay for big expenses. Web in general, home equity loans can be pursued shortly after purchasing a home, often within the first year — but each lender has unique requirements for approval. Your biggest hurdles to.

Can I Get A Home Equity Loan After Chapter 7

Web a chapter 7 bankruptcy focuses on freeing you from debt. Monday, august 28, 2023 at 8:00 am. There are a few differences in how bankruptcy. However, because your heloc is a secured debt (which means you pledged your home as collateral for the debt), if you want to keep your home… Unfortunately, your credit will also take a major.

How Soon Can You Get A Loan After Bankruptcy

Thank you for your cooperation. Ad put your home equity to work & pay for big expenses. Ad our reviews trusted by 45,000,000+. Web home equity loan. But if you only apply with one lender, you won’t be able to compare your offer with others, which limits your choices.

Should I Choose a CashOut Refi or Home Equity Loan? Lendgo

During a chapter 7 bankruptcy, a court wipes away your qualifying debts. Other options include a home equity. You receive the funds in a lump sum, and you are required to make monthly payments, as. Your credit score and equity in. Thank you for your cooperation.

Can I Get A Car Loan After Chapter 13 Discharge Loan Walls

Ad compare top home equity lenders. Web can i get a home equity line of credit after a chapter 7 bankruptcy discharge? Frequently this isn't difficult because all that's required is the home owner's signature. Filers in the eleventh circuit court of appeals, are no longer able to strip off (remove) these types of liens in chapter 7 bankruptcy. During.

Can You Get Home Equity Loan Without Job Loan Walls

Apply today & get low rates! Web however, it’s still possible regardless of whether you’ve filed for chapter 7 or chapter 13 bankruptcy. During a chapter 7 bankruptcy, a court wipes away your qualifying debts. During the upgrade, the system will be unavailable. Web home equity loan.

Ad Use Our Expansive Equity Network To Compare Offers From Top Lenders In 1 Place

Friday, august 25, 2023 at 5:00 pm. Unfortunately, your credit will also take a major hit. Web when you receive your chapter 7 discharge, your personal liability to pay back your heloc is wiped out. Web however, it’s still possible regardless of whether you’ve filed for chapter 7 or chapter 13 bankruptcy.

Other Options Include A Home Equity.

There are a few differences in how bankruptcy. Web short answer is no, it is not a nonpossessory, nonpurchaser money security interest. Frequently this isn't difficult because all that's required is the home owner's signature. Compare top 10 home equity loans & save!

Thank You For Your Cooperation.

The real question here is: Getting a usda loan after chapter. This is a great option for people who are severely underwater with no way to repay their creditors. It is subordinate to the first mortgage, however, it is a secured loan, with the security being your home…

Web Buying A House After Chapter 7 Bankruptcy The Most Common Type Of Bankruptcy Is Chapter 7 Bankruptcy.

Web a home equity loan is a loan you take out against the equity you already have in your home. Web in general, home equity loans can be pursued shortly after purchasing a home, often within the first year — but each lender has unique requirements for approval. It’s one of a few options homeowners can use to access some of the equity they’ve built in their homes without selling. The next $60,000 pays off the equity loan…