Chapter 13 100 Plan

Chapter 13 100 Plan - Debtors are required under this chapter to propose a repayment plan to. The plan complies with the provisions of this chapter and with the other applicable provisions of this title; First name continue debts you must pay in the chapter 13 repayment plan some debts move to the front of the line in bankruptcy. Learn more by reading unsecured debt in chapter 13… Web chapter 13 of the united states bankruptcy code allows individuals with regular income to develop a plan to repay some or all of their debts. There are only two ways to pay off a chapter 13 bankruptcy early: Web paying less than 100% to your unsecured creditors is considered a “composition plan” or a “pot plan”. Web paying 100% of your unsecured debt through a chapter 13 plan looks a lot different than paying 100% of the same debt directly. To understand why your options for an early exit are limited, you need to know how this chapter works, including how your plan. Web chapter 13 bankruptcy is also called the “wage earner’s plan,” because those who file need regular income to qualify.

Web paying less than 100% to your unsecured creditors is considered a “composition plan” or a “pot plan”. To understand why your options for an early exit are limited, you need to know how this chapter works, including how your plan. You owe it to yourself to at least consult with a qualified bankruptcy attorney right now to minimize the. You pay back all secured debt (which is required in all chapter 13 cases) and 100%. Web ending your plan early. It is required to pay back all secured. Web in most chapter 13 bankruptcy cases, you cannot finish your chapter 13 plan early unless you pay creditors in full. If you're in the middle of a chapter 13 bankruptcy, and your financial picture starts looking rosy, it's understandable that you'd want to pay off your repayment plan early—but don't count on being let out of your plan… We've helped 205 clients find attorneys today. Web background a chapter 13 bankruptcy is also called a wage earner's plan.

We explain how to determine whether you qualify for chapter 13 below and what you can expect from the chapter 13 bankruptcy process. It enables individuals with regular income to develop a plan to repay all or part of their debts. Web background a chapter 13 bankruptcy is also called a wage earner's plan. Pay 100% of the allowed claims filed in your case, or; Web paying less than 100% to your unsecured creditors is considered a “composition plan” or a “pot plan”. You owe it to yourself to at least consult with a qualified bankruptcy attorney right now to minimize the. However, some pay all debt owed in what's called a 100% plan, or nothing in a zero percent plan. Qualify for a hardship discharge; Learn more by reading unsecured debt in chapter 13… Web many chapter 13 debtors pay only a small portion of their unsecured debts through the chapter 13 plan.

chapter 13 plan Doc Template pdfFiller

That’s because, in a chapter 13 plan, 100% means 100% of the. It will depend on the type of debt and where it falls in the chapter 13. Debtors are required under this chapter to propose a repayment plan to. Web paying less than 100% to your unsecured creditors is considered a “composition plan” or a “pot plan”. It is.

A Chapter 13 Repayment Plan Can Help You Keep Your Home and Other

Web 100% chapter 13 plans: We explain how to determine whether you qualify for chapter 13 below and what you can expect from the chapter 13 bankruptcy process. Pay 100% of the allowed claims filed in your case, or; You pay back all secured debt (which is required in all chapter 13 cases) and 100%. Web paying less than 100%.

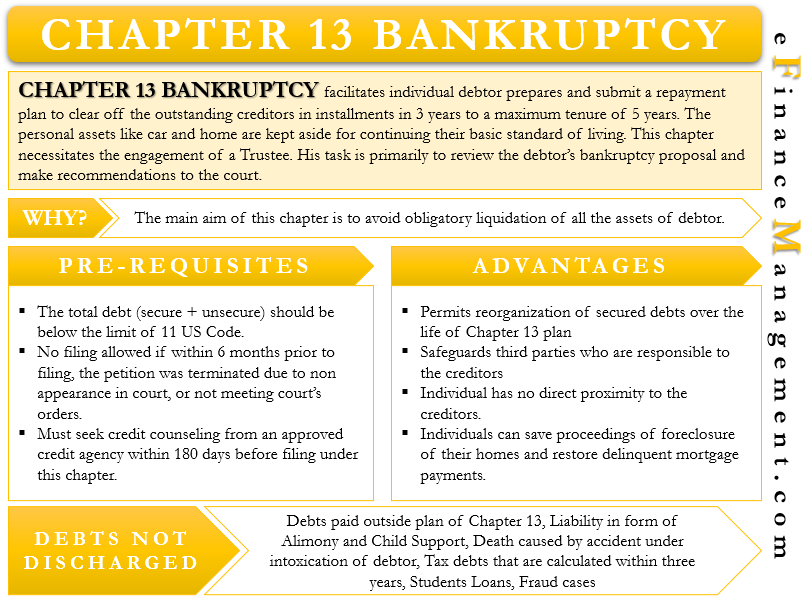

Chapter 13 Bankruptcy Define, Why to file, Eligibility, Advantages eFM

If you're in the middle of a chapter 13 bankruptcy, and your financial picture starts looking rosy, it's understandable that you'd want to pay off your repayment plan early—but don't count on being let out of your plan… Web chapter 13 of the united states bankruptcy code allows individuals with regular income to develop a plan to repay some or.

Completing A Chapter 13 Repayment Plan Liviakis Law Firm

There are only two ways to pay off a chapter 13 bankruptcy early: You owe it to yourself to at least consult with a qualified bankruptcy attorney right now to minimize the. First name continue debts you must pay in the chapter 13 repayment plan some debts move to the front of the line in bankruptcy. Web many chapter 13.

Chapter 13 bankruptcy explained YouTube

Others might receive some or no payment at all. Web chapter 13 bankruptcy is also called the “wage earner’s plan,” because those who file need regular income to qualify. Learn more by reading unsecured debt in chapter 13… To understand why your options for an early exit are limited, you need to know how this chapter works, including how your.

The Key Elements Of A Chapter 13 Bankruptcy Plan

Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years. You owe it to yourself to at least consult with a qualified bankruptcy attorney right now to minimize the. Web ending your plan early. Others might receive some or no payment at all. It enables individuals with regular income to develop a.

Chapter 13 Model Plan Chapter 13 Bankruptcy

Web chapter 13 bankruptcy is also called the “wage earner’s plan,” because those who file need regular income to qualify. Web with this unsecured debt paid back through a 100% chapter 13 plan, you’re provided a fresh start by not having to deal with any additional interest (think interest rates of 15% to 35% or more), penalties or. Web what.

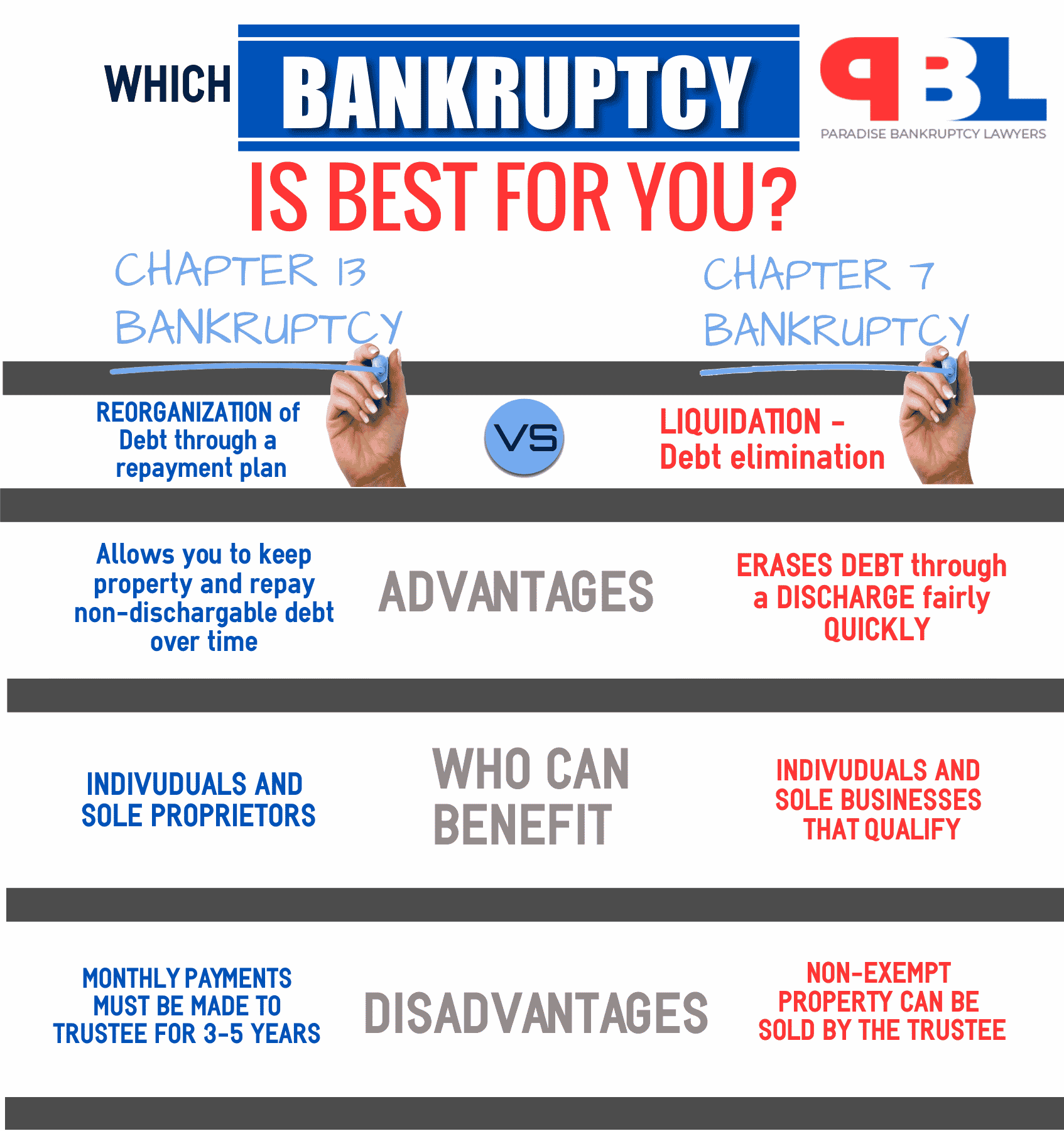

Paradise, NV Debt Relief Attorney Chapter 13 Bankruptcy, 7026053306

Web paying 100% of your unsecured debt through a chapter 13 plan looks a lot different than paying 100% of the same debt directly. Any fee, charge, or amount required under chapter 123 of title 28,. Debtors are required under this chapter to propose a repayment plan to. That’s because, in a chapter 13 plan, 100% means 100% of the..

Chapter 13 Repayment Plan 6 Things You Need to Know

Web paying less than 100% to your unsecured creditors is considered a “composition plan” or a “pot plan”. It enables individuals with regular income to develop a plan to repay all or part of their debts. Qualify for a hardship discharge; Web ending your plan early. Under this chapter, debtors propose a repayment plan to make installments to creditors over.

MEMORIZE Chapter 13

You pay back all secured debt (which is required in all chapter 13 cases) and 100%. Web get debt relief now. Web what is a chapter 13 100 percent bankruptcy plan? We've helped 205 clients find attorneys today. Web chapter 13 bankruptcy is also called the “wage earner’s plan,” because those who file need regular income to qualify.

It Enables Individuals With Regular Income To Develop A Plan To Repay All Or Part Of Their Debts.

Web background a chapter 13 bankruptcy is also called a wage earner's plan. It will depend on the type of debt and where it falls in the chapter 13. Web ending your plan early. The plan complies with the provisions of this chapter and with the other applicable provisions of this title;

There Are Only Two Ways To Pay Off A Chapter 13 Bankruptcy Early:

Web many chapter 13 debtors pay only a small portion of their unsecured debts through the chapter 13 plan. Pay 100% of the allowed claims filed in your case, or; You pay back all secured debt (which is required in all chapter 13 cases) and 100%. However, some pay all debt owed in what's called a 100% plan, or nothing in a zero percent plan.

Others Might Receive Some Or No Payment At All.

Web in most chapter 13 bankruptcy cases, you cannot finish your chapter 13 plan early unless you pay creditors in full. Web what is a chapter 13 100 percent bankruptcy plan? Debtors are required under this chapter to propose a repayment plan to. It is required to pay back all secured.

Web Paying 100% Of Your Unsecured Debt Through A Chapter 13 Plan Looks A Lot Different Than Paying 100% Of The Same Debt Directly.

Web paying less than 100% to your unsecured creditors is considered a “composition plan” or a “pot plan”. Web chapter 13 bankruptcy is also called the “wage earner’s plan,” because those who file need regular income to qualify. First name continue debts you must pay in the chapter 13 repayment plan some debts move to the front of the line in bankruptcy. Web with this unsecured debt paid back through a 100% chapter 13 plan, you’re provided a fresh start by not having to deal with any additional interest (think interest rates of 15% to 35% or more), penalties or.