Chapter 13 Bankruptcy And Car Loans

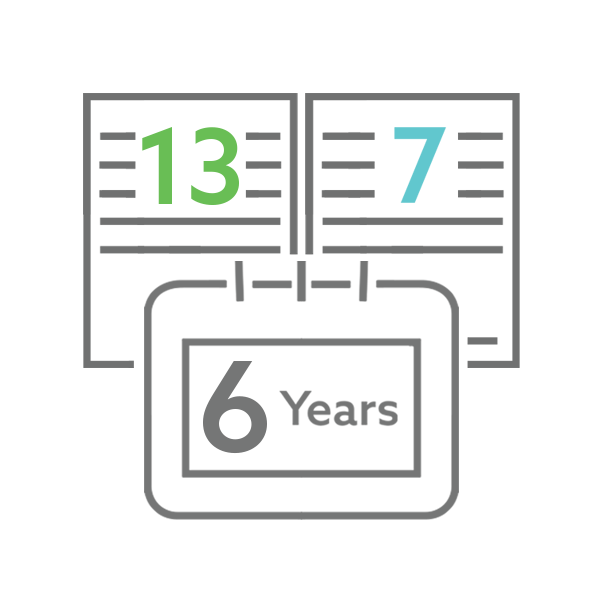

Chapter 13 Bankruptcy And Car Loans - Web pros of switching to chapter 7. A chapter 7 bankruptcy stays on your credit report for 10 years. Up to five years for chapter 13… “in over 20 years of the law practice, 5 star auto plaza is the only auto dealer that received our endorsement. Ad experience the better way to finance & purchase a vehicle at drivetime®. Web there's no easy way around it: By cara o'neill, attorney a chapter 13 bankruptcy debtor can buy a needed car or appliance on credit if approved by the bankruptcy. Web chapter 13 bankruptcy, meanwhile, can stay on your credit for up to seven years. Prepare for an interest rate that may shock you. Web a chapter 13 bankruptcy is also called a wage earner's plan.

Ad bad credit auto loans are no problem for dream nissan. It can be possible to buy a vehicle while in chapter 13 bankruptcy, as long as you continue to make your chapter 13 payments (this type of bankruptcy involves a payment plan). Car loan cramdowns in bankruptcy. Adding your car loan to the repayment plan. 5 star knows what the courts require to approve loans… You may want to work with a legal aid organization if you aren’t comfortable filling out the chapter. Dream nissan we care we delight. A cram down can be used when the amount of your car loan. “in over 20 years of the law practice, 5 star auto plaza is the only auto dealer that received our endorsement. If you have a car loan, your chapter 13 may help you reduce the overall cost of your loan.

Dream nissan we care we delight. 5 star knows what the courts require to approve loans… By cara o'neill, attorney a chapter 13 bankruptcy debtor can buy a needed car or appliance on credit if approved by the bankruptcy. For a more detailed explanation of how cramdowns work for car loans, see car loan. Web a chapter 13 bankruptcy is also called a wage earner's plan. “in over 20 years of the law practice, 5 star auto plaza is the only auto dealer that received our endorsement. Web chapter 13 bankruptcy, meanwhile, can stay on your credit for up to seven years. The first step is finding a dealership that's signed up subprime lenders who are willing to finance an open bankruptcy loan. Ad experience the better way to finance & purchase a vehicle at drivetime®. Web chapter 13 bankruptcy:

Filing for Chapter 13 Bankruptcy in GA to Reduce Your Car Loan and

Web chapter 13 bankruptcy, meanwhile, can stay on your credit for up to seven years. It enables individuals with regular income to develop a plan to repay all or part of their debts. By cara o'neill, attorney a chapter 13 bankruptcy debtor can buy a needed car or appliance on credit if approved by the bankruptcy. Web follow these steps.

Best Cars Choices for Bankruptcy Car Loans Day One Credit

Shop our selection of competitively priced, low miles, late model cars online! For instance, if you owe $10,000 on a car worth $8,000, a cramdown will let you pay it off for $8,000. Under this chapter, debtors propose a repayment plan. Debtors may take advantage of a bankruptcy process known as a cram down. But because of the financial hardships.

What Happens to Student Loans in Chapter 13 Bankruptcy?

The first step is finding a dealership that's signed up subprime lenders who are willing to finance an open bankruptcy loan. A cram down can be used when the amount of your car loan. To make the most of your fresh start, use a chapter 13 bankruptcy car loan to get a better car with lower miles that may cost.

Using Chapter 13 Bankruptcy to Lower Your Car Interest Rate

However, you can expect there. You'll need permission from the court to finance a car. You must pay your monthly car payment in chapter 13,. Discharging most unsecured debts such as credit card balances and medical debt, which saves money. “in over 20 years of the law practice, 5 star auto plaza is the only auto dealer that received our.

Get a Chapter 7 Car Loan Car Loan After Chapter 7 Chapter 7

Web chapter 13 bankruptcy: You'll need permission from the court to finance a car. A chapter 7 bankruptcy stays on your credit report for 10 years. Prepare for an interest rate that may shock you. A cram down can be used when the amount of your car loan.

Car Loans While In Chapter 13, Chapter 13 Bankruptcy Car Loan YouTube

Free unlimited protection that goes wherever you go. Learn how filing for chapter 13 bankruptcy can help you keep your vehicle from being repossessed and when you can use a cramdown to decrease the loan amount you'll need to pay. A chapter 7 bankruptcy stays on your credit report for 10 years. Web chapter 13 bankruptcy, meanwhile, can stay on.

How to Keep Your Car in Chapter 13 Bankruptcy CMC Law

Get a buyer's order from a dealership: Web pros of switching to chapter 7. You may want to work with a legal aid organization if you aren’t comfortable filling out the chapter. Adding your car loan to the repayment plan. Web follow these steps for getting a car loan in chapter 13 bankruptcy:

Getting a car loan during chapter 13 bankruptcy http//www

“in over 20 years of the law practice, 5 star auto plaza is the only auto dealer that received our endorsement. Web if you have a car loan, the amount you owe on it may be reduced in the chapter 13 bankruptcy process if you owe more on it than its current value. It enables individuals with regular income to.

Can You Stop Car Payments in Chapter 13 Bankruptcy?

Dream nissan we care we delight. Web if you qualify for a cramdown, you can reduce the balance on your car loan to the value of the car. For a more detailed explanation of how cramdowns work for car loans, see car loan. Web chapter 13 and car loans. Subprime lenders that are signed up with special finance.

Bankruptcy and Car Loans in Arizona Lerner and Rowe Law Group

It enables individuals with regular income to develop a plan to repay all or part of their debts. Chapter 13 bankruptcy is a type of debt consolidation that eliminates or reduces all of the same debts as chapter 7 bankruptcy while also stopping foreclosure and repossessions, deferring student loans, and even reducing car interest rates and payments. Web yes, many.

Debtors May Take Advantage Of A Bankruptcy Process Known As A Cram Down.

Discharging most unsecured debts such as credit card balances and medical debt, which saves money. Car loan cramdowns in bankruptcy. Web there's no easy way around it: Dream nissan we care we delight.

If You Have A Car Loan, Your Chapter 13 May Help You Reduce The Overall Cost Of Your Loan.

Also, if you can qualify for a repayment plan and get caught up on your loan… A chapter 7 bankruptcy stays on your credit report for 10 years. To make the most of your fresh start, use a chapter 13 bankruptcy car loan to get a better car with lower miles that may cost you less in the long run. By cara o'neill, attorney a chapter 13 bankruptcy debtor can buy a needed car or appliance on credit if approved by the bankruptcy.

Ad Bad Credit Auto Loans Are No Problem For Dream Nissan.

Shop our selection of competitively priced, low miles, late model cars online! Chapter 13 bankruptcy filings stay on your credit. 5 star knows what the courts require to approve loans… Web chapter 13 bankruptcy, meanwhile, can stay on your credit for up to seven years.

Web Chapter 13 Bankruptcy Allows You To Consolidate And Settle Debt For Just Pennies On The Dollar.

The reason is relatively simple. Under this chapter, debtors propose a repayment plan. Web can you get a car loan or new credit card, or incur medical or other debts during your chapter 13 bankruptcy? Web if you have a car loan, the amount you owe on it may be reduced in the chapter 13 bankruptcy process if you owe more on it than its current value.