Chapter 13 Bankruptcy Debt Limits

Chapter 13 Bankruptcy Debt Limits - Web there is a new law changes which, among other things, increases the chapter 13 debt limit to $2.75 million dollars. It’s about double what the debt limits had been, and is extremely helpful for los angeles residents who have a second property and mortgage debt. Web as of april 2019, in order to be eligible to file for a chapter 13 bankruptcy (for individuals only), you must owe less than $1,257,850 in liquidated, noncontingent secured debts, and less than $419,275 in liquidated, noncontingent unsecured debts… Web find basic information about chapter 13 bankruptcy below. Chapter 13 cases are now permitted for individuals with unsecured debts of no more than $465,275. Web below, we’ll discuss debt limits, how they work, and what you can do if you owe more than the chapter 13 debt limits allow. Federal tax refunds during bankruptcy. 3823 increases the chapter 13 debt limit under 109 (e) to $2.75 million, and allows both secured and unsecured debt to count towards this single limit. • $1,257,850 in secured debts; Web chapter 13 comes with debt limits, as well.

• $1,257,850 in secured debts; Chapter 13 is only available for people who have less than $465,275 in unsecured debts for cases filed between april 1, 2022, and march 31, 2025. The debt limits for this type of bankruptcy. Effective april 1, 2019, and effective for three (3) years, the applicable debt limits for chapter 13 cases are: Web the bankruptcy code limits the amount of debt that a person may have in their chapter 13 bankruptcy in 11 u.s.c § 109. As of april 1, 2022:. Chapter 13 cases are now permitted for individuals with unsecured debts of no more than $465,275. Debtors have the option of filing a chapter 13 bankruptcy as long as some qualifications are met. Web below, we’ll discuss debt limits, how they work, and what you can do if you owe more than the chapter 13 debt limits allow. Chapter 13 is in contrast to the purpose of chapter 7, which does not provide for a plan of reorganization, but provides for the discharge of certain debt.

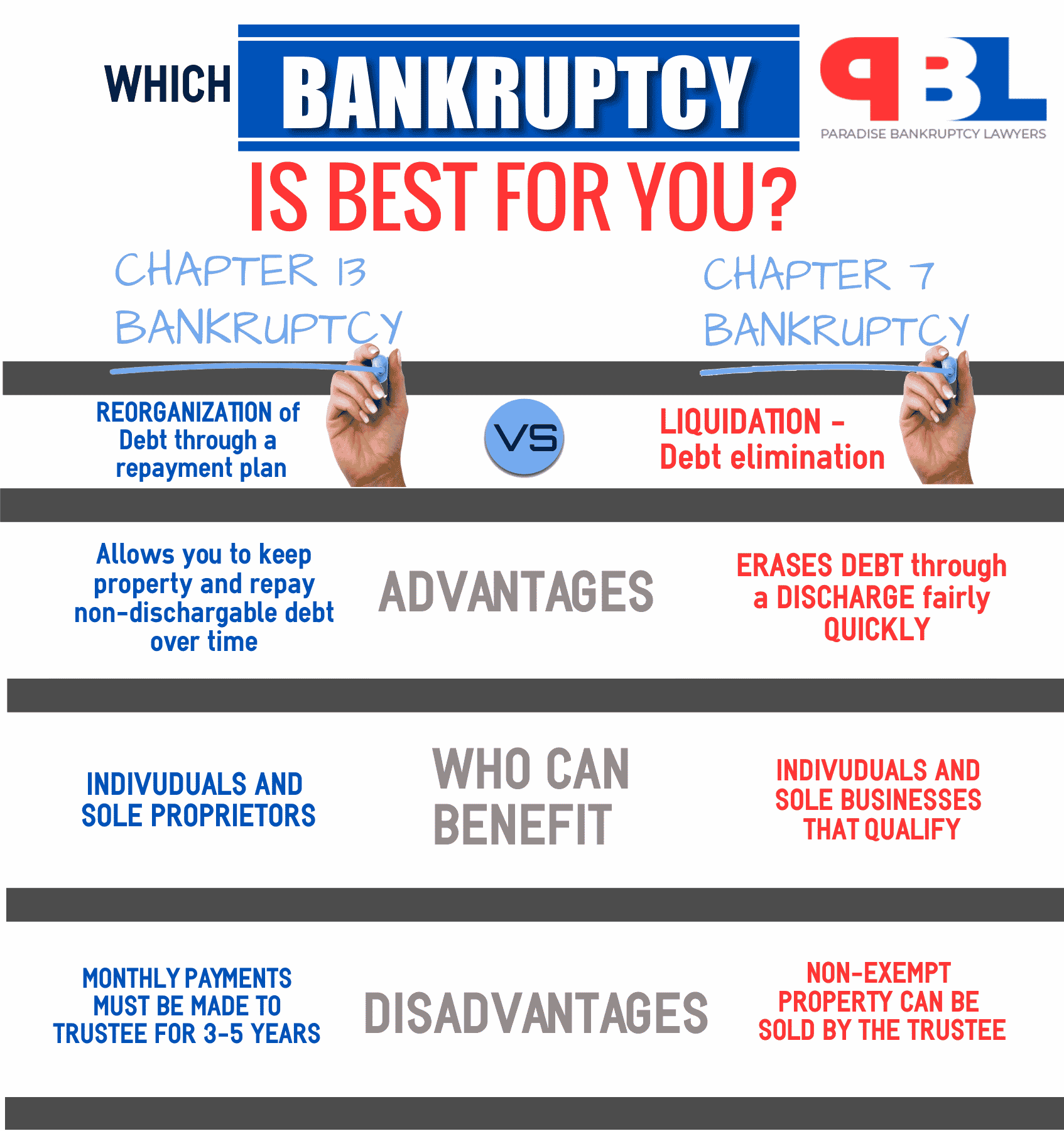

Chapter 13 is only available for people who have less than $465,275 in unsecured debts for cases filed between april 1, 2022, and march 31, 2025. Web chapter 13 bankruptcy is used to reorganize debt, which means that you will have a limit on the unsecured and secured debt that can be discharged with this legal process. Web the most important of these are the increases in the debt limits for debtors under chapter 13 and under the small business reorganization act (the “sbra”)—increases that will continue for. Chapter 13 cases are now permitted for individuals with unsecured debts of no more than $465,275. Under sb 3823, debtors no longer are required to limit debts. Chapter 13 is in contrast to the purpose of chapter 7, which does not provide for a plan of reorganization, but provides for the discharge of certain debt. Web unsecured debt limits in chapter 13 bankruptcy. For example, the debt limit for unsecured debt is around $400,000, while the debt limit for secured debt is up to $1 million. Web as of april 2019, in order to be eligible to file for a chapter 13 bankruptcy (for individuals only), you must owe less than $1,257,850 in liquidated, noncontingent secured debts, and less than $419,275 in liquidated, noncontingent unsecured debts… The debt limits for this type of bankruptcy.

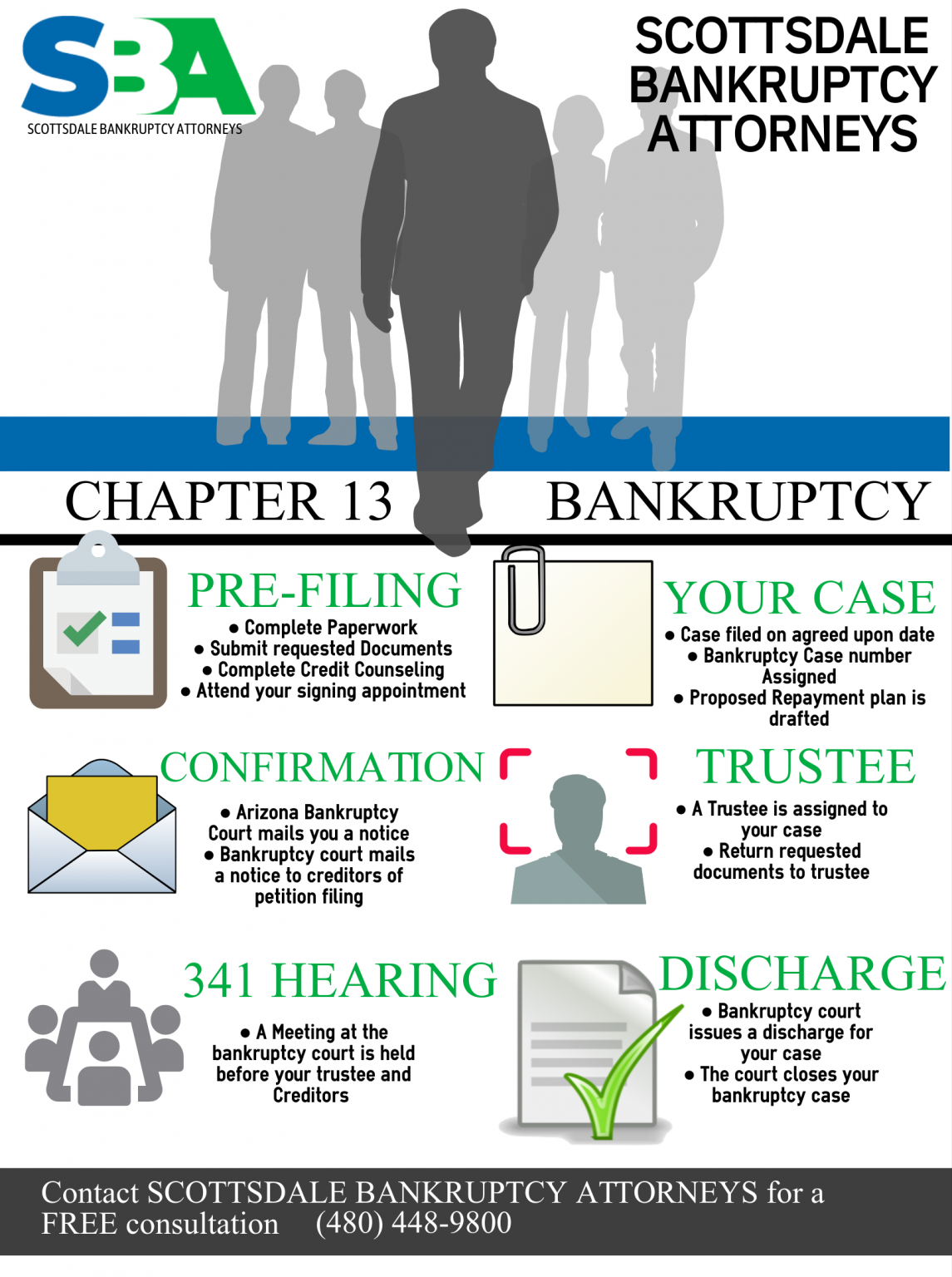

Chapter 13 Bankruptcy Attorney in Scottsdale Low Cost Bankruptcy

Web the bankruptcy code limits the amount of debt that a person may have in their chapter 13 bankruptcy in 11 u.s.c § 109. • $1,257,850 in secured debts; Web according to the united states courts, chapter 13 bankruptcy filings nationwide rose from 120,002 in 2021 to 157,087 in 2022, a 30.9% increase. Federal tax refunds during bankruptcy. It’s about.

Chapter 13 bankruptcy explained YouTube

However, refunds may be subject to delay or used to pay down your tax debts. Under sb 3823, debtors no longer are required to limit debts. Web the bankruptcy code limits the amount of debt that a person may have in their chapter 13 bankruptcy in 11 u.s.c § 109. Debtors have the option of filing a chapter 13 bankruptcy.

Chapter 13 Debt Limits Learn About Them Easy Debt Management

Adults with unsecured debts of less than $465,275 and secured debts of less than $1,395,875 can seek protection by chapter 13. Web there is a new law changes which, among other things, increases the chapter 13 debt limit to $2.75 million dollars. Web as of april 2019, in order to be eligible to file for a chapter 13 bankruptcy (for.

What Is Chapter 13 Bankruptcy and Is It Worth It? TheStreet

Web as of april 2019, in order to be eligible to file for a chapter 13 bankruptcy (for individuals only), you must owe less than $1,257,850 in liquidated, noncontingent secured debts, and less than $419,275 in liquidated, noncontingent unsecured debts… The distinction between secured and unsecured debt. This limit is for both secured and unsecured debt combined. Web current chapter.

2022 Chapter 13 Debt Ceiling Increase Tejes Law, PLLC Orlando Based

Web find basic information about chapter 13 bankruptcy below. On the date you file your chapter 13 bankruptcy petition, your debts cannot exceed these amounts or you cannot qualify for chapter 13. You can receive tax refunds while in bankruptcy. Web chapter 13 requirements impose a limit on the amount of a filer's debt. However, refunds may be subject to.

CHAPTER 11 BANKRUPTCY Zimmermann Law Office S.C.

• $1,257,850 in secured debts; The distinction between secured and unsecured debt. Chapter 13 cases are now permitted for individuals with unsecured debts of no more than $465,275. Web chapter 13 requirements impose a limit on the amount of a filer's debt. Federal tax refunds during bankruptcy.

Paradise, NV Debt Relief Attorney Chapter 13 Bankruptcy, 7026053306

The debt limits for this type of bankruptcy. And, • $419,275 in unsecured debts. Web chapter 13 plans are usually three to five years in length and may not exceed five years. Chapter 13 is only available for people who have less than $465,275 in unsecured debts for cases filed between april 1, 2022, and march 31, 2025. Web current.

Debt Limitations in Bankruptcy Filings David Offen, Esq

However, refunds may be subject to delay or used to pay down your tax debts. For more detailed information see the u.s. Under sb 3823, debtors no longer are required to limit debts. Chapter 13 debt eligibility limits chapter 13:. Web until today, 11 usc §109 (e) limited the eligibility for chapter 13 proceedings to individuals with unsecured debts of.

Chapter 13 Bankruptcy Debt Limits Steiner Law Group

However, bankruptcies as a whole dropped to 387,721. Web below, we’ll discuss debt limits, how they work, and what you can do if you owe more than the chapter 13 debt limits allow. Chapter 13 is only available for people who have less than $465,275 in unsecured debts for cases filed between april 1, 2022, and march 31, 2025. •.

How Long Does Chapter 13 Bankruptcy Take in &

Chapter 13 is in contrast to the purpose of chapter 7, which does not provide for a plan of reorganization, but provides for the discharge of certain debt. Chapter 13 is available to individual debtors with less than $419,275 in unsecured debt (debts that are not secured by property, such as credit card debt and medical bills) and less than.

3823 Increases The Chapter 13 Debt Limit Under 109 (E) To $2.75 Million, And Allows Both Secured And Unsecured Debt To Count Towards This Single Limit.

Web according to the united states courts, chapter 13 bankruptcy filings nationwide rose from 120,002 in 2021 to 157,087 in 2022, a 30.9% increase. However, refunds may be subject to delay or used to pay down your tax debts. Web until today, 11 usc §109 (e) limited the eligibility for chapter 13 proceedings to individuals with unsecured debts of no more than $465,275 and secured debts of no more than $1,395,875. As of april 1, 2019, chapter 13 debt limits are:

Web Find Basic Information About Chapter 13 Bankruptcy Below.

Web chapter 13 comes with debt limits, as well. As of april 1, 2022:. Effective april 1, 2019, and effective for three (3) years, the applicable debt limits for chapter 13 cases are: The code provides that the chapter 13 income limits shall be adjusted every.

Web Unsecured Debt Limits In Chapter 13 Bankruptcy.

Chapter 13 cases are now permitted for individuals with unsecured debts of no more than $465,275. The debt limits for this type of bankruptcy. Web what are the chapter 13 debt limits? The distinction between secured and unsecured debt.

Chapter 13 Debt Eligibility Limits Chapter 13:.

Web the most important of these are the increases in the debt limits for debtors under chapter 13 and under the small business reorganization act (the “sbra”)—increases that will continue for. Debtors have the option of filing a chapter 13 bankruptcy as long as some qualifications are met. Chapter 13 is in contrast to the purpose of chapter 7, which does not provide for a plan of reorganization, but provides for the discharge of certain debt. Web the bankruptcy code limits the amount of debt that a person may have in their chapter 13 bankruptcy in 11 u.s.c § 109.