Chapter 13 Refund Check

Chapter 13 Refund Check - These refunds will be generated once per month, near the end of the month, prior to the regular disbursement cycle. Web some chapter 13 plans require debtors to pay into the plan their federal tax refunds. Web case will be disbursed directly to the debtor(s). Taxpayers must file all required tax returns for tax periods ending within four years of their bankruptcy filing. Typically, tax refunds are required on all cases where unsecured creditors are paid. Web tax obligations while filing chapter 13 bankruptcy: Web if you believe your refund has been delayed or offset against your tax debts you can check on its status by going to our where’s my refund? After receiving all required payments under the plan (including any tax refunds owed) and completing an audit to determine that all amounts owed were.

Web tax obligations while filing chapter 13 bankruptcy: These refunds will be generated once per month, near the end of the month, prior to the regular disbursement cycle. Web some chapter 13 plans require debtors to pay into the plan their federal tax refunds. Typically, tax refunds are required on all cases where unsecured creditors are paid. Web case will be disbursed directly to the debtor(s). After receiving all required payments under the plan (including any tax refunds owed) and completing an audit to determine that all amounts owed were. Web if you believe your refund has been delayed or offset against your tax debts you can check on its status by going to our where’s my refund? Taxpayers must file all required tax returns for tax periods ending within four years of their bankruptcy filing.

Taxpayers must file all required tax returns for tax periods ending within four years of their bankruptcy filing. Web case will be disbursed directly to the debtor(s). These refunds will be generated once per month, near the end of the month, prior to the regular disbursement cycle. Web tax obligations while filing chapter 13 bankruptcy: Web if you believe your refund has been delayed or offset against your tax debts you can check on its status by going to our where’s my refund? Web some chapter 13 plans require debtors to pay into the plan their federal tax refunds. Typically, tax refunds are required on all cases where unsecured creditors are paid. After receiving all required payments under the plan (including any tax refunds owed) and completing an audit to determine that all amounts owed were.

I owe the IRS money. What happens if I get a tax refund?

These refunds will be generated once per month, near the end of the month, prior to the regular disbursement cycle. Typically, tax refunds are required on all cases where unsecured creditors are paid. After receiving all required payments under the plan (including any tax refunds owed) and completing an audit to determine that all amounts owed were. Web if you.

Tax Refund Happens Your Tax Refund Chapter 13

Taxpayers must file all required tax returns for tax periods ending within four years of their bankruptcy filing. Typically, tax refunds are required on all cases where unsecured creditors are paid. Web some chapter 13 plans require debtors to pay into the plan their federal tax refunds. After receiving all required payments under the plan (including any tax refunds owed).

Check For United Refund Status SurveyLine

Taxpayers must file all required tax returns for tax periods ending within four years of their bankruptcy filing. Web if you believe your refund has been delayed or offset against your tax debts you can check on its status by going to our where’s my refund? Typically, tax refunds are required on all cases where unsecured creditors are paid. Web.

'Where's My Refund' and Other Ways to Check Your IRS Refund Status

Typically, tax refunds are required on all cases where unsecured creditors are paid. Web tax obligations while filing chapter 13 bankruptcy: Web if you believe your refund has been delayed or offset against your tax debts you can check on its status by going to our where’s my refund? Web case will be disbursed directly to the debtor(s). After receiving.

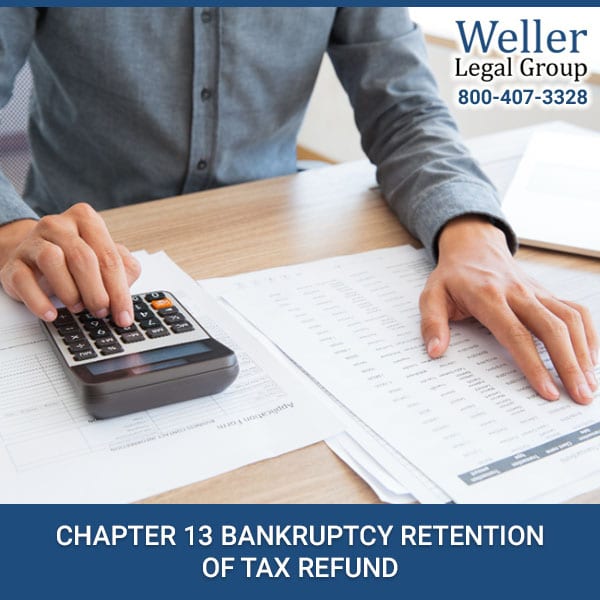

CHAPTER 13 BANKRUPTCY RETENTION OF TAX REFUND

Web some chapter 13 plans require debtors to pay into the plan their federal tax refunds. Web case will be disbursed directly to the debtor(s). Web tax obligations while filing chapter 13 bankruptcy: Web if you believe your refund has been delayed or offset against your tax debts you can check on its status by going to our where’s my.

3 Reasons You Shouldn't Receive a Tax Refund Next Year GOBankingRates

These refunds will be generated once per month, near the end of the month, prior to the regular disbursement cycle. Web some chapter 13 plans require debtors to pay into the plan their federal tax refunds. Web if you believe your refund has been delayed or offset against your tax debts you can check on its status by going to.

Chapter 13 Dismissal Refund and Your Options Ascend Blog

Taxpayers must file all required tax returns for tax periods ending within four years of their bankruptcy filing. These refunds will be generated once per month, near the end of the month, prior to the regular disbursement cycle. Web if you believe your refund has been delayed or offset against your tax debts you can check on its status by.

Can I Keep My Tax Refund After Filing Chapter 7? Cibik Law

Typically, tax refunds are required on all cases where unsecured creditors are paid. Web some chapter 13 plans require debtors to pay into the plan their federal tax refunds. Web if you believe your refund has been delayed or offset against your tax debts you can check on its status by going to our where’s my refund? Web tax obligations.

Refund Check High Resolution Stock Photography and Images Alamy

Web tax obligations while filing chapter 13 bankruptcy: Typically, tax refunds are required on all cases where unsecured creditors are paid. Web case will be disbursed directly to the debtor(s). These refunds will be generated once per month, near the end of the month, prior to the regular disbursement cycle. Web if you believe your refund has been delayed or.

If you have not yet received an tax refund, check your refund

Taxpayers must file all required tax returns for tax periods ending within four years of their bankruptcy filing. Typically, tax refunds are required on all cases where unsecured creditors are paid. These refunds will be generated once per month, near the end of the month, prior to the regular disbursement cycle. Web tax obligations while filing chapter 13 bankruptcy: Web.

These Refunds Will Be Generated Once Per Month, Near The End Of The Month, Prior To The Regular Disbursement Cycle.

Typically, tax refunds are required on all cases where unsecured creditors are paid. Taxpayers must file all required tax returns for tax periods ending within four years of their bankruptcy filing. After receiving all required payments under the plan (including any tax refunds owed) and completing an audit to determine that all amounts owed were. Web if you believe your refund has been delayed or offset against your tax debts you can check on its status by going to our where’s my refund?

Web Case Will Be Disbursed Directly To The Debtor(S).

Web tax obligations while filing chapter 13 bankruptcy: Web some chapter 13 plans require debtors to pay into the plan their federal tax refunds.