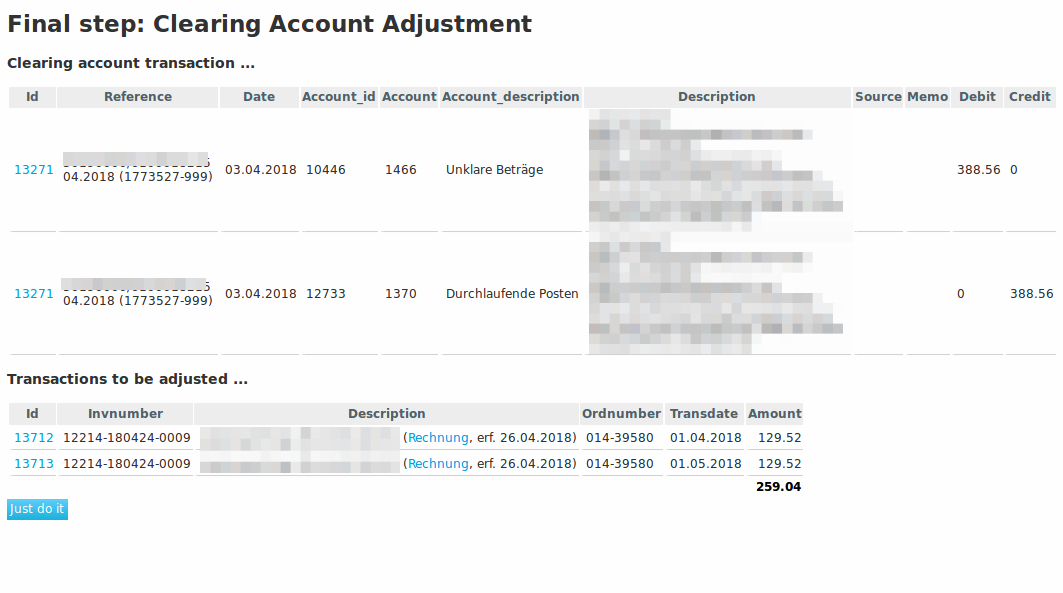

Clearing Account On Balance Sheet

Clearing Account On Balance Sheet - Web what is a clearing account? The purpose of this account is to set aside a sum of money,. Web its purpose is to record income (or expenses) before they are moved to the balance sheet as retained earnings. It’s created to just record the income or. Clearing accounts can be set up to clear daily, monthly, or at the end of the fiscal year. Use an asset clearing account for accounts receivables, such as receiving a payment with no. Web a clearing account is a general ledger, which helps businesses and accountants to keep the details about financial transactions on a temporary basis. To allocate expenses to overhead or class using a zero check, you must use a bank. Web a bank account appears on the balance sheet and on the statement of cash flows to balances and changes in balances. It is a zero balance account in which the clients can put their money, which they want to transfer to.

Web a bank account appears on the balance sheet and on the statement of cash flows to balances and changes in balances. Web what is a clearing account? Use an asset clearing account for accounts receivables, such as receiving a payment with no. The purpose of this account is to set aside a sum of money,. Web a clearing account is a general ledger, which helps businesses and accountants to keep the details about financial transactions on a temporary basis. To allocate expenses to overhead or class using a zero check, you must use a bank. It is a zero balance account in which the clients can put their money, which they want to transfer to. Web its purpose is to record income (or expenses) before they are moved to the balance sheet as retained earnings. Clearing accounts can be set up to clear daily, monthly, or at the end of the fiscal year. Web there are two common types of clearing accounts you may use:

Web there are two common types of clearing accounts you may use: Clearing accounts can be set up to clear daily, monthly, or at the end of the fiscal year. Web a bank account appears on the balance sheet and on the statement of cash flows to balances and changes in balances. Use an asset clearing account for accounts receivables, such as receiving a payment with no. Web a clearing account is a general ledger, which helps businesses and accountants to keep the details about financial transactions on a temporary basis. To allocate expenses to overhead or class using a zero check, you must use a bank. The purpose of this account is to set aside a sum of money,. Web what is a clearing account? It is a zero balance account in which the clients can put their money, which they want to transfer to. Web its purpose is to record income (or expenses) before they are moved to the balance sheet as retained earnings.

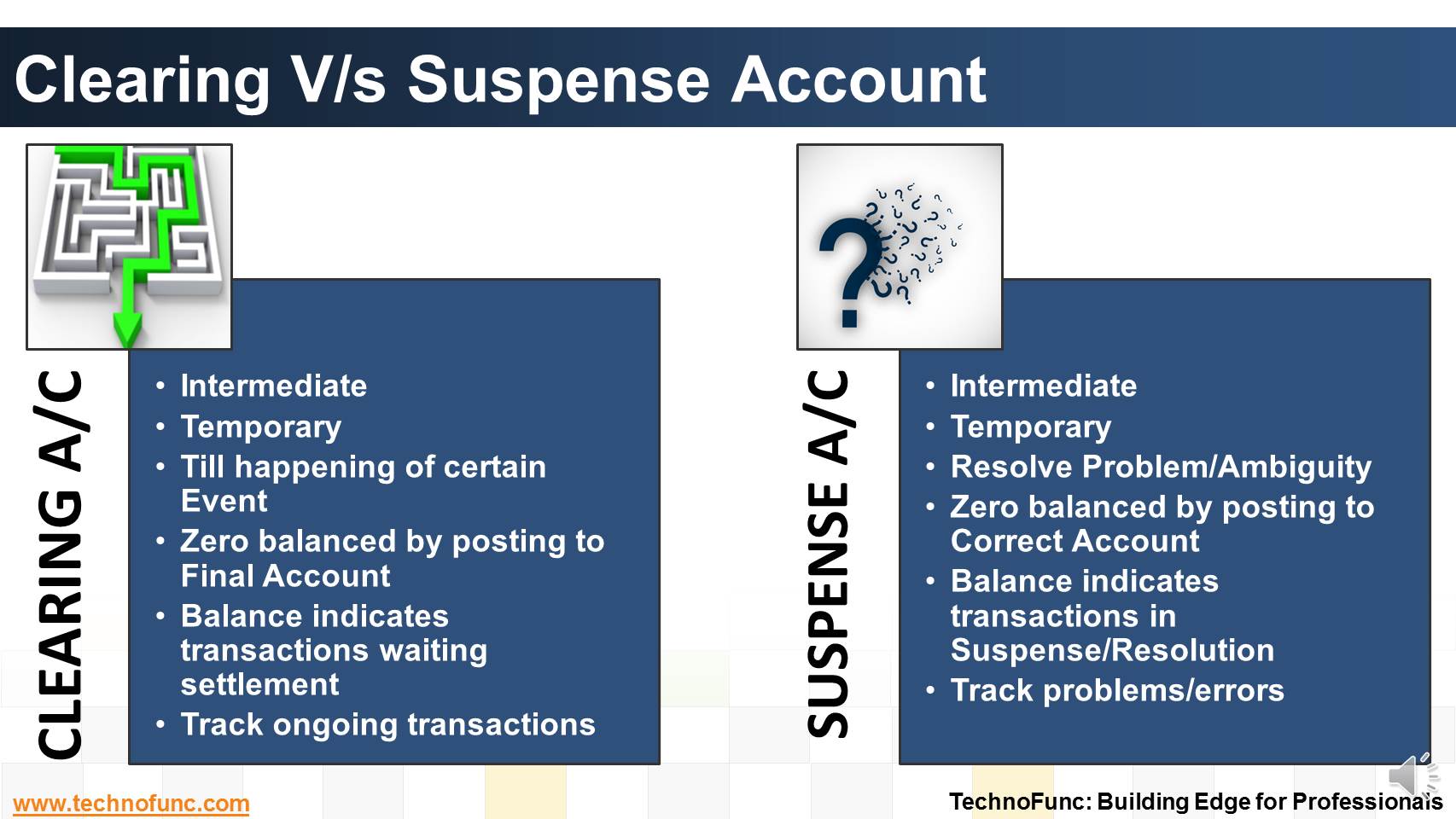

The Difference Between a Suspense Account and a Clearing Account

The purpose of this account is to set aside a sum of money,. Web what is a clearing account? Web a bank account appears on the balance sheet and on the statement of cash flows to balances and changes in balances. Use an asset clearing account for accounts receivables, such as receiving a payment with no. It is a zero.

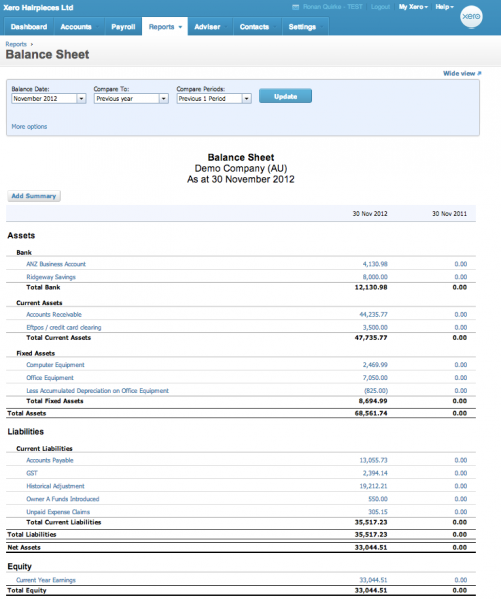

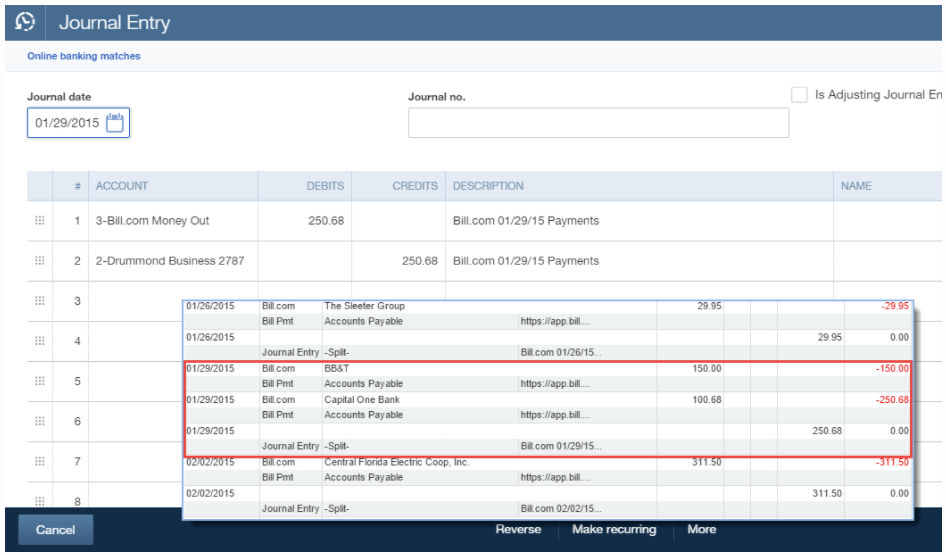

Clearing Account & Reconciling Payments Help Centre

Web a bank account appears on the balance sheet and on the statement of cash flows to balances and changes in balances. Clearing accounts can be set up to clear daily, monthly, or at the end of the fiscal year. Web what is a clearing account? Web its purpose is to record income (or expenses) before they are moved to.

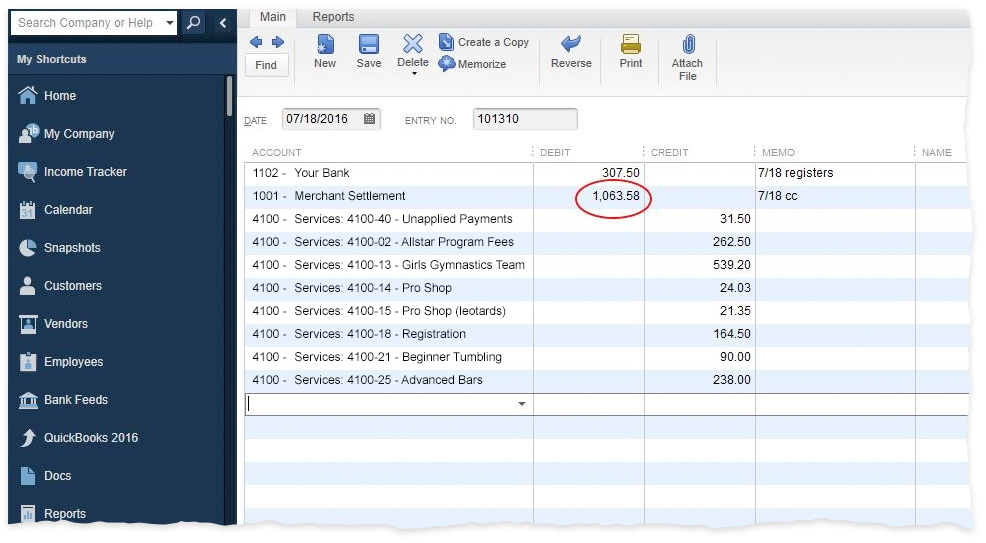

How Can I Reconcile Transactions Using a Clearing Account? iClassPro

Clearing accounts can be set up to clear daily, monthly, or at the end of the fiscal year. Web a clearing account is a general ledger, which helps businesses and accountants to keep the details about financial transactions on a temporary basis. Web there are two common types of clearing accounts you may use: Web its purpose is to record.

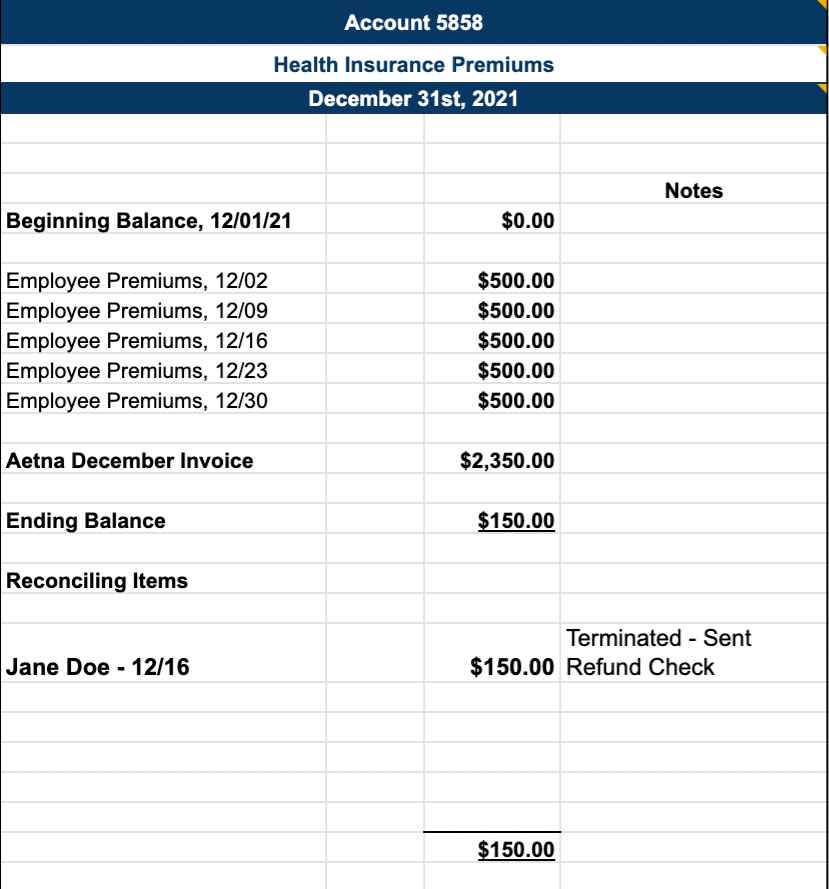

Payroll Reconciliation Excel Template

Web its purpose is to record income (or expenses) before they are moved to the balance sheet as retained earnings. It’s created to just record the income or. To allocate expenses to overhead or class using a zero check, you must use a bank. Use an asset clearing account for accounts receivables, such as receiving a payment with no. Web.

Clearing account — AccountingTools Personal Accounting

Web what is a clearing account? Clearing accounts can be set up to clear daily, monthly, or at the end of the fiscal year. It’s created to just record the income or. Use an asset clearing account for accounts receivables, such as receiving a payment with no. Web its purpose is to record income (or expenses) before they are moved.

Clearing Account Reconciliation Template Master of Documents

Use an asset clearing account for accounts receivables, such as receiving a payment with no. It is a zero balance account in which the clients can put their money, which they want to transfer to. Web a bank account appears on the balance sheet and on the statement of cash flows to balances and changes in balances. Web a clearing.

TechnoFunc Clearing V/s Suspense Account

Web its purpose is to record income (or expenses) before they are moved to the balance sheet as retained earnings. The purpose of this account is to set aside a sum of money,. To allocate expenses to overhead or class using a zero check, you must use a bank. Web a clearing account is a general ledger, which helps businesses.

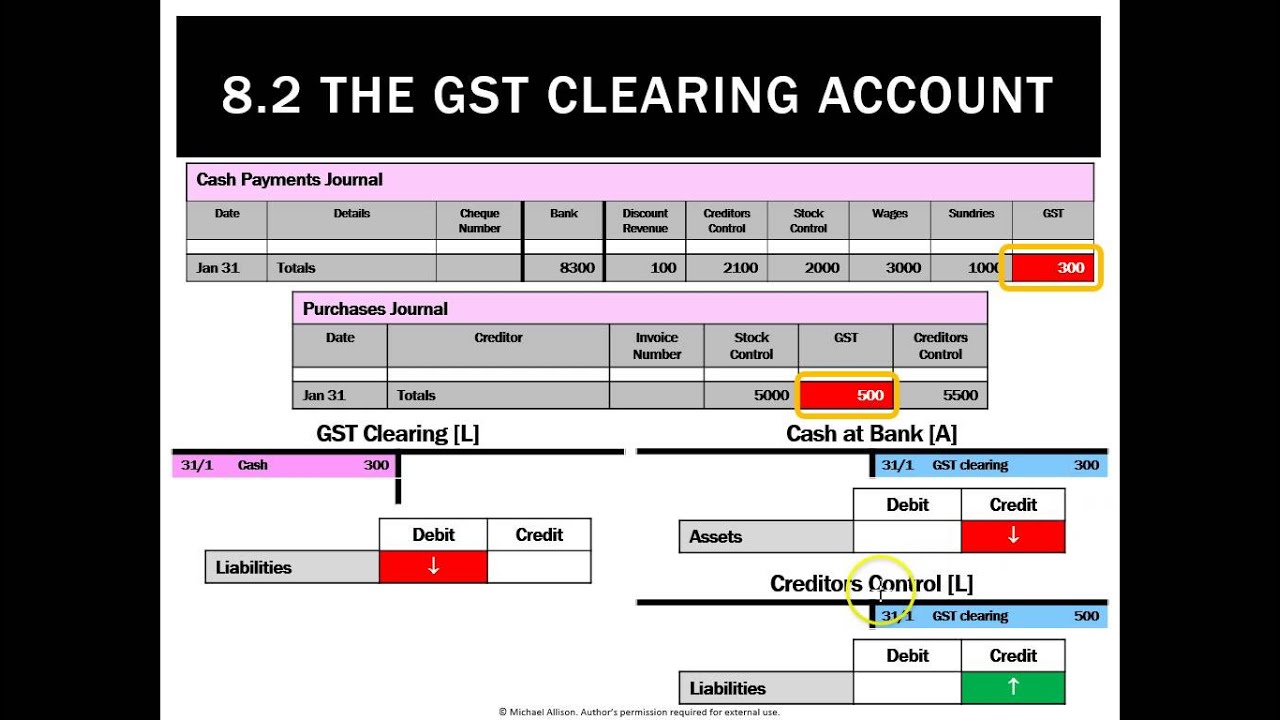

8.2 The GST Clearing account YouTube

Web a clearing account is a general ledger, which helps businesses and accountants to keep the details about financial transactions on a temporary basis. To allocate expenses to overhead or class using a zero check, you must use a bank. Use an asset clearing account for accounts receivables, such as receiving a payment with no. Web a bank account appears.

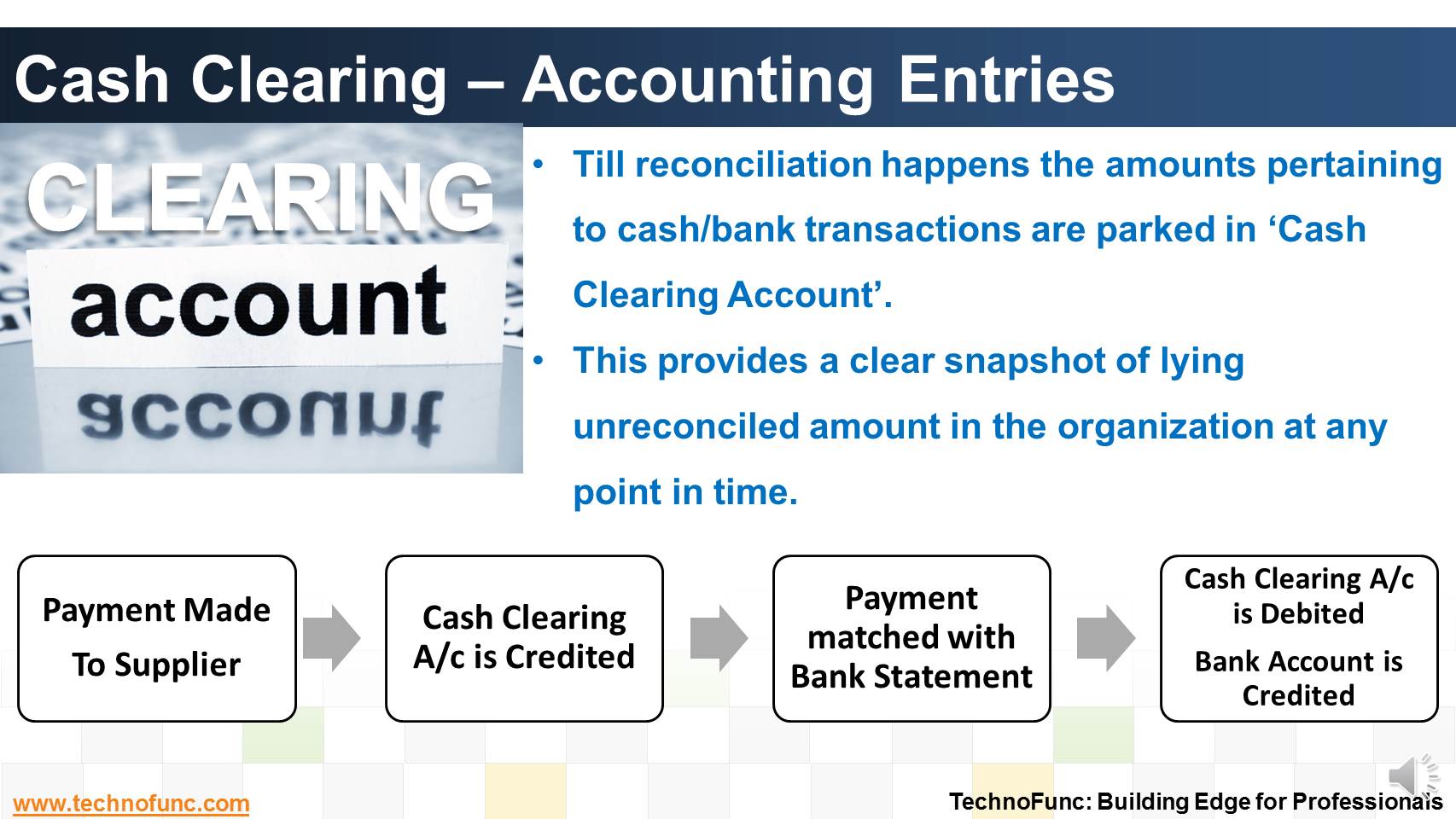

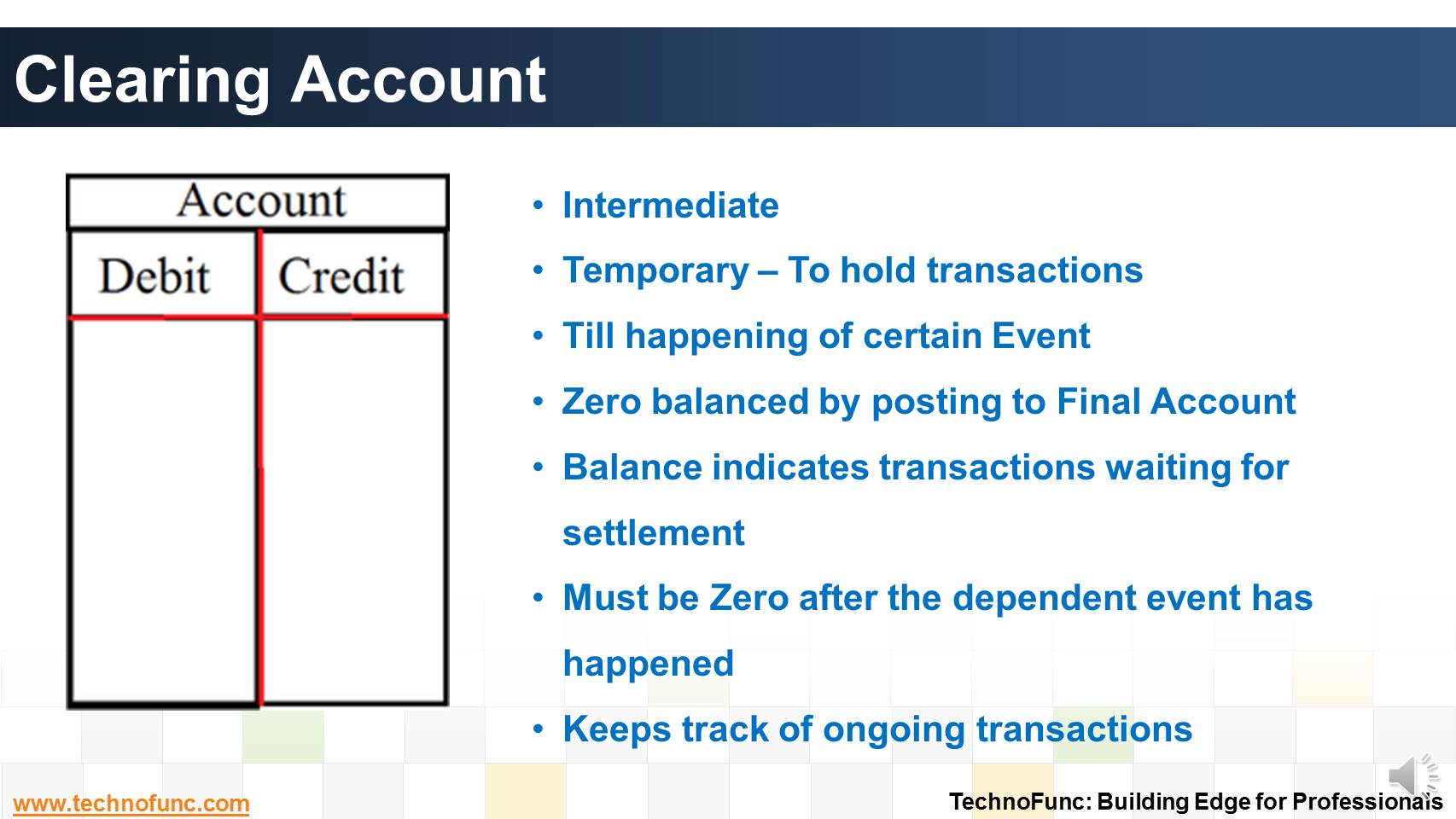

TechnoFunc Clearing Account

To allocate expenses to overhead or class using a zero check, you must use a bank. Web a bank account appears on the balance sheet and on the statement of cash flows to balances and changes in balances. It is a zero balance account in which the clients can put their money, which they want to transfer to. Web a.

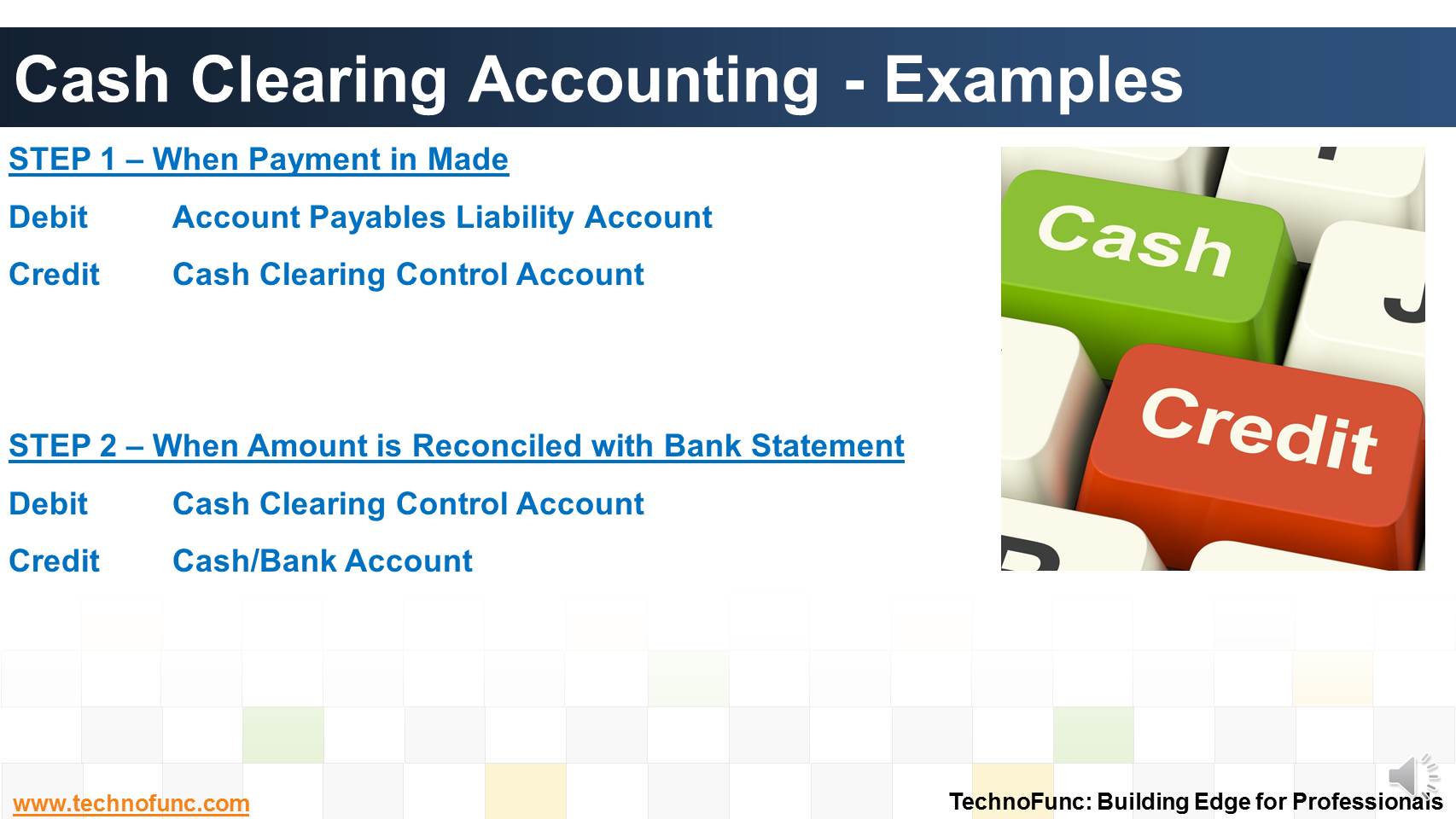

TechnoFunc Cash Clearing Accounting Entries

Web there are two common types of clearing accounts you may use: It is a zero balance account in which the clients can put their money, which they want to transfer to. Clearing accounts can be set up to clear daily, monthly, or at the end of the fiscal year. Web its purpose is to record income (or expenses) before.

Use An Asset Clearing Account For Accounts Receivables, Such As Receiving A Payment With No.

Web a clearing account is a general ledger, which helps businesses and accountants to keep the details about financial transactions on a temporary basis. It is a zero balance account in which the clients can put their money, which they want to transfer to. Web what is a clearing account? The purpose of this account is to set aside a sum of money,.

It’s Created To Just Record The Income Or.

Clearing accounts can be set up to clear daily, monthly, or at the end of the fiscal year. Web a bank account appears on the balance sheet and on the statement of cash flows to balances and changes in balances. Web there are two common types of clearing accounts you may use: To allocate expenses to overhead or class using a zero check, you must use a bank.