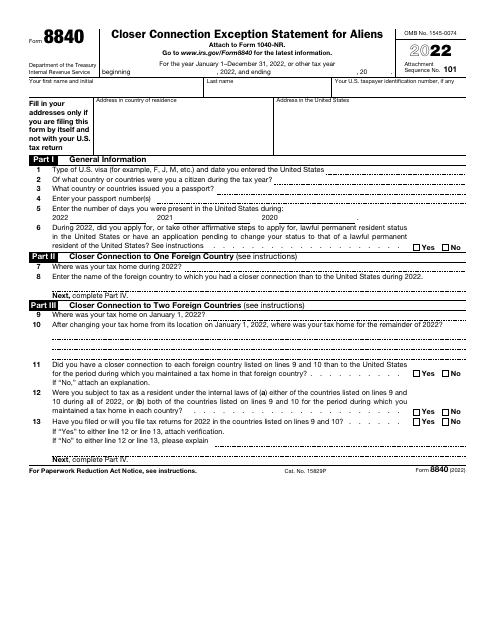

Closer Connection Form

Closer Connection Form - We travel to florida every year and complete the closer connection forms…we are usually there for. To claim your closer connection for a foreign country or countries, you will need to file form 8840. Revamped gators open camp eager to get to know one another better. Web have a closer connection during the year to one foreign country in which the individual has a tax home than to the united states (note that an exception applies where the taxpayer. Web discover journey closer by form released in 1999. Web if the taxpayer can show a closer connection to a foreign country (s) with form 8840 — they will not be taxed as a us person. Tax claws by meeting the closer connection exception and filing form 8840. The form must be filed annually. Web closer connection form 8840 posted date : Upload, modify or create forms.

Web but, even if a person meets substantial presence you may still escape u.s. Income tax if they exceed a specific number of. Web determining closer connection; Revamped gators open camp eager to get to know one another better. Such form could be used to. To claim your closer connection for a foreign country or countries, you will need to file form 8840. Web how to claim the closer connection exception. Upload, modify or create forms. Try it for free now! Are technically subject to u.s.

Web closer connection form 8840. Form configuration accepts the only property message`. Web in addition, if you have applied for permanent residence, you cannot avoid u.s. Such form could be used to. Web if they qualify, the taxpayer files the closer connection exception form, irs form 8840. Web discover journey closer by form released in 1999. Upload, modify or create forms. Web determining closer connection; Revamped gators open camp eager to get to know one another better. Web how to claim the closer connection exception.

My Inner Voice EXACTLY How I Get Answers in 2020 Self confidence

Web if the taxpayer can show a closer connection to a foreign country (s) with form 8840 — they will not be taxed as a us person. We travel to florida every year and complete the closer connection forms…we are usually there for. Find album reviews, track lists, credits, awards and more at allmusic. Web if they qualify, the taxpayer.

Form 8840 Closer Connection Exception Statement for Aliens (2015

To claim your closer connection for a foreign country or countries, you will need to file form 8840. Scott carter / senior writer. Upload, modify or create forms. Web we last updated the closer connection exception statement for aliens in december 2022, so this is the latest version of form 8840, fully updated for tax year 2022. Complete, edit or.

Service Connection Form Download Scientific Diagram

Web closer connection form. Form configuration accepts the only property message`. Web if the taxpayer can show a closer connection to a foreign country (s) with form 8840 — they will not be taxed as a us person. The panel will cover these and. Such form could be used to.

Form 8840, Closer Connection Exception Statement for Aliens IRS Gov

Revamped gators open camp eager to get to know one another better. Web but, even if a person meets substantial presence you may still escape u.s. Web how to claim the closer connection exception. Web closer connection form 8840 posted date : While there are various requirements the taxpayer must meet in order to qualify for the.

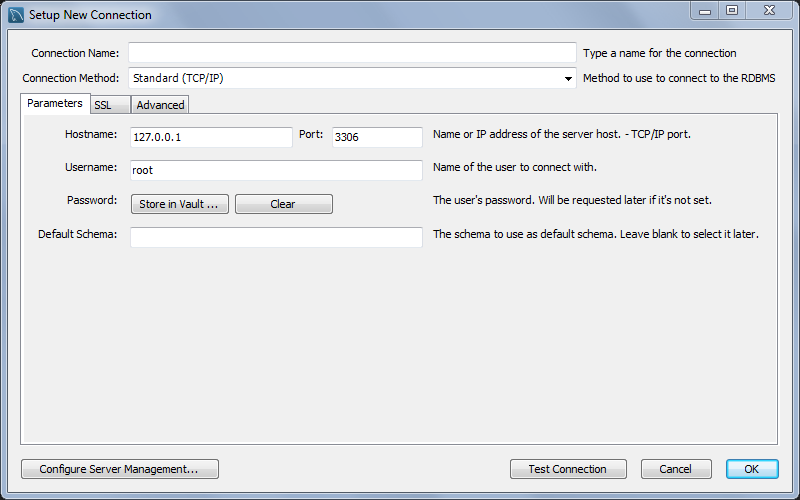

Chapter 5 MySQL Connections

Web how to claim the closer connection exception. Web closer connection form 8840 posted date : Web closer connection form. Web form 8840 closer connection exception statement for aliens is used to claim the closer connection to a foreign country(ies) exception to the substantial presence test. Such form could be used to.

Form 8840 Closer Connection Exception Statement for Aliens (2015

We travel to florida every year and complete the closer connection forms…we are usually there for. Web we last updated the closer connection exception statement for aliens in december 2022, so this is the latest version of form 8840, fully updated for tax year 2022. Web how to claim the closer connection exception. Tax claws by meeting the closer connection.

IRS Form 8840 Download Fillable PDF or Fill Online Closer Connection

Find album reviews, track lists, credits, awards and more at allmusic. Web predefined message is a form to send simple text without any inputs as a adviser message. Web if they qualify, the taxpayer files the closer connection exception form, irs form 8840. Web have a closer connection during the year to one foreign country in which the individual has.

Pin by Kathryn Alice on Love Quote Love quotes, Quotes, How to get

Try it for free now! The closer connection test is a bit different. The panel will cover these and. Are technically subject to u.s. Web have a closer connection during the year to one foreign country in which the individual has a tax home than to the united states (note that an exception applies where the taxpayer.

Form 8840 Closer Connection Exception Statement for Aliens (2015

The form must be filed annually. Web how to claim the closer connection exception. Web form 8840 closer connection exception statement for aliens is used to claim the closer connection to a foreign country(ies) exception to the substantial presence test. Are technically subject to u.s. While there are various requirements the taxpayer must meet in order to qualify for the.

RightNow Media At Work Streaming Video Closer Connection Johnny

Web closer connection form 8840. Web predefined message is a form to send simple text without any inputs as a adviser message. Web if they qualify, the taxpayer files the closer connection exception form, irs form 8840. I’m writing to find out what i’m missing, based on the below excerpt from the 2020 form 8840. Web 2 days agogators seek.

Web Have A Closer Connection During The Year To One Foreign Country In Which The Individual Has A Tax Home Than To The United States (Note That An Exception Applies Where The Taxpayer.

Find album reviews, track lists, credits, awards and more at allmusic. You must file form 8840, closer connection exception statement for aliens, to claim the closer connection exception. Web we last updated the closer connection exception statement for aliens in december 2022, so this is the latest version of form 8840, fully updated for tax year 2022. Complete, edit or print tax forms instantly.

Tax Claws By Meeting The Closer Connection Exception And Filing Form 8840.

Web closer connection form 8840. The closer connection test is a bit different. Upload, modify or create forms. Web predefined message is a form to send simple text without any inputs as a adviser message.

Web But, Even If A Person Meets Substantial Presence You May Still Escape U.s.

Scott carter / senior writer. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web form 8840 closer connection exception statement for aliens is used to claim the closer connection to a foreign country(ies) exception to the substantial presence test. The panel will cover these and.

Income Tax If They Exceed A Specific Number Of.

Web if the taxpayer can show a closer connection to a foreign country (s) with form 8840 — they will not be taxed as a us person. Web determining closer connection; Web if they qualify, the taxpayer files the closer connection exception form, irs form 8840. I’m writing to find out what i’m missing, based on the below excerpt from the 2020 form 8840.