Colorado Estimated Tax Payment Form

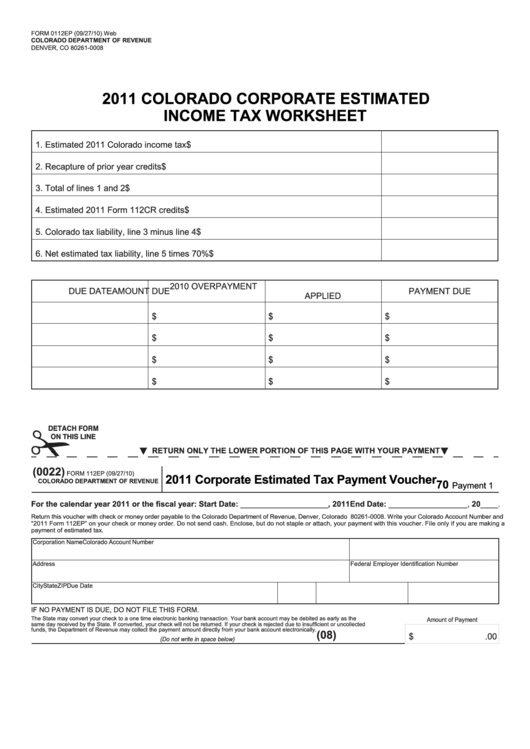

Colorado Estimated Tax Payment Form - Web filling out colorado tax form 112 step 1: You may have to pay estimated tax for the current year if your tax was more than zero in the prior year. Web corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed. Web form dr 0900 is a colorado individual income tax form. Please exercise care when remitting joint estimated payments and when filing joint returns Web estimated tax payments can be made on a quarterly basis. Indicate your tax year dates and select the appropriate boxes for your corporation's status and nature of business. Use the worksheet provided on the following page to. Estimated tax payments are claimed when you file your colorado individual income tax return (dr 0104). This form is for income earned in tax year 2022, with tax returns due in april 2023.

This form is for income earned in tax year 2022, with tax returns due in april 2023. For more information, see publication fyi income 51. View & download form dr 0104ep (2023) Please exercise care when remitting joint estimated payments and when filing joint returns The amount a taxpayer must remit for estimated payments is based upon the taxpayer’s net colorado income tax liability for either the current or prior year. Taxes and government revenue services alerts emergency response guide emergency management homeland security travel alerts road conditions cyber. Web we last updated the colorado composite nonresident estimated tax payment form in january 2022, so this is the latest version of form 106ep, fully updated for tax year 2022. See the individual income tax guidance publications available at tax.colorado.gov for. Estimated tax payments are claimed when you file your colorado individual income tax return (dr 0104). Web corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

See the individual income tax guidance publications available at tax.colorado.gov for. Begin the form enter your corporation's name, address, and federal employer identification number (fein). Payment options by tax type; Web include a colorado estimated income tax payment form (dr 0104ep) with their payment to ensure proper crediting of their account. Taxes and government revenue services alerts emergency response guide emergency management homeland security travel alerts road conditions cyber. You may file by mail with paper forms or efile online. Indicate your tax year dates and select the appropriate boxes for your corporation's status and nature of business. Web filling out colorado tax form 112 step 1: Learn more about each tax type and how to pay them. Web how to make a payment;

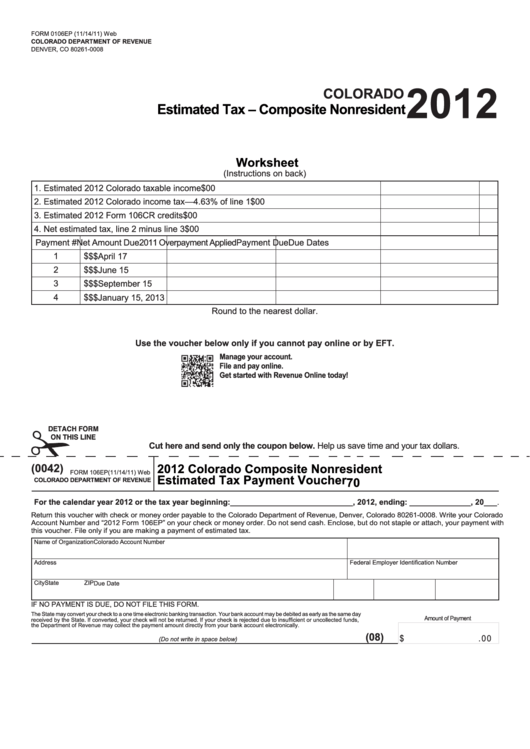

Form 0106ep Colorado Estimated Nonresident 2012

See publication fyi income 51 for more information, available at colorado.gov/tax general rule View & download form dr 0104ep (2023) Web filling out colorado tax form 112 step 1: Begin the form enter your corporation's name, address, and federal employer identification number (fein). Payment options by tax type;

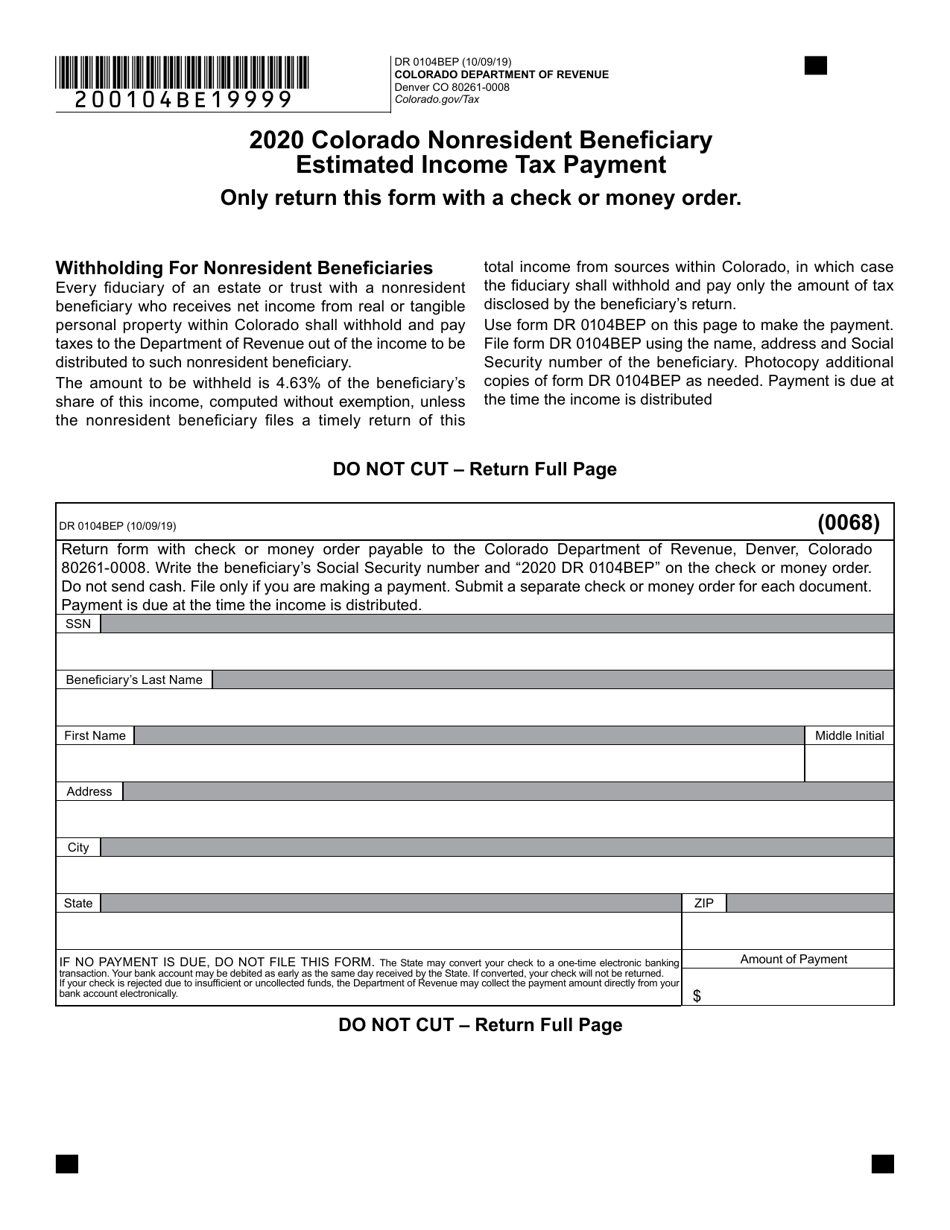

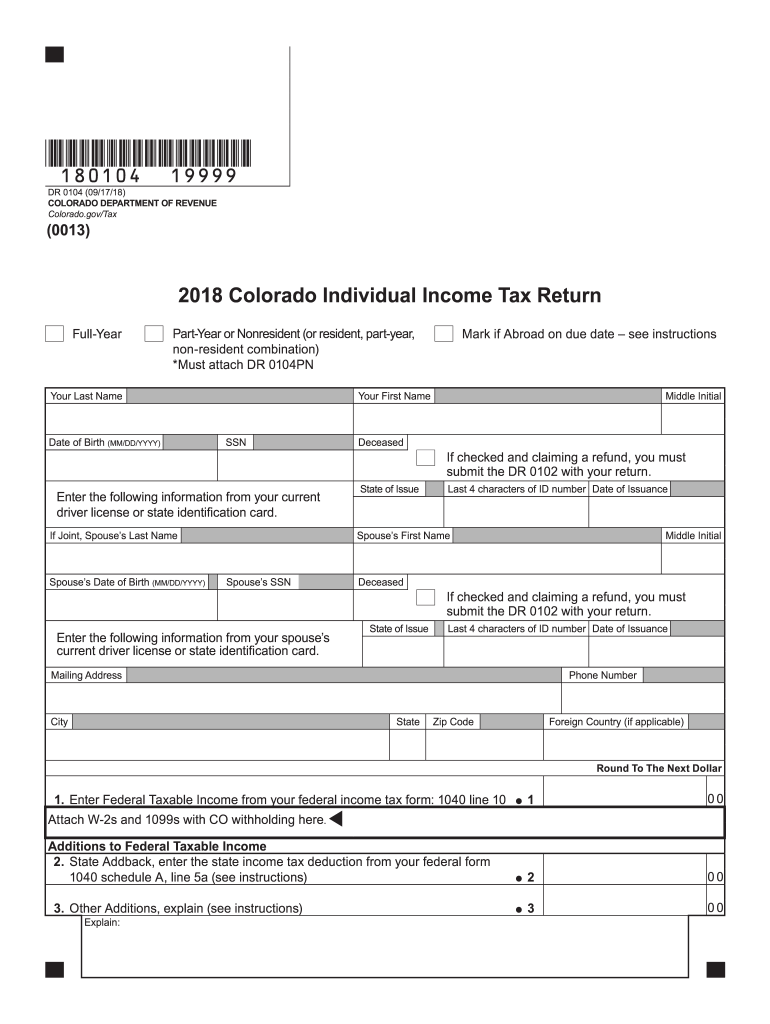

Form DR0104BEP Download Fillable PDF or Fill Online Colorado

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web form dr 0900 is a colorado individual income tax form. Taxes and government revenue services alerts emergency response guide emergency management homeland security travel alerts road conditions cyber. Begin the form enter your corporation's name, address, and federal employer identification number.

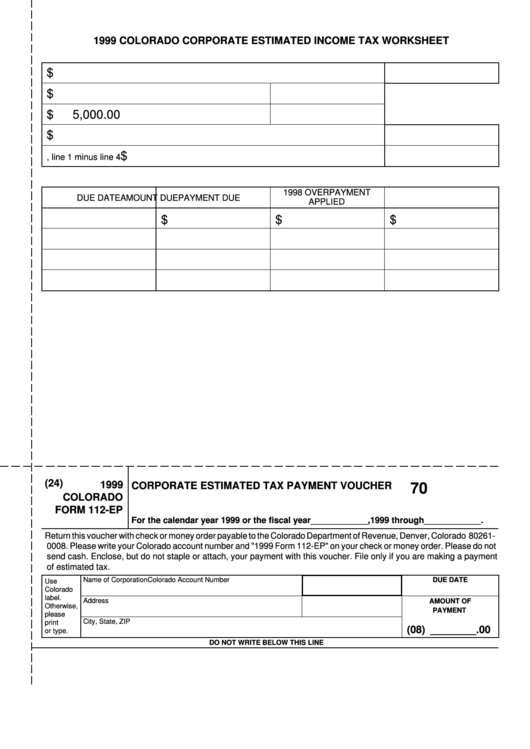

Fillable Form 112Ep Corporate Estimated Tax Payment Voucher 1999

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web estimated tax payments can be made on a quarterly basis. Please exercise care when remitting joint estimated payments and when filing joint returns Web file now with turbotax we last updated colorado form 104ep in february 2023 from the colorado department of.

Maryland Estimated Tax Form 2020

Begin the form enter your corporation's name, address, and federal employer identification number (fein). View & download form dr 0104ep (2023) We will update this page with a new version of the form for 2024 as soon as it is made available by the colorado government. Web corporations generally have to make estimated tax payments if they expect to owe.

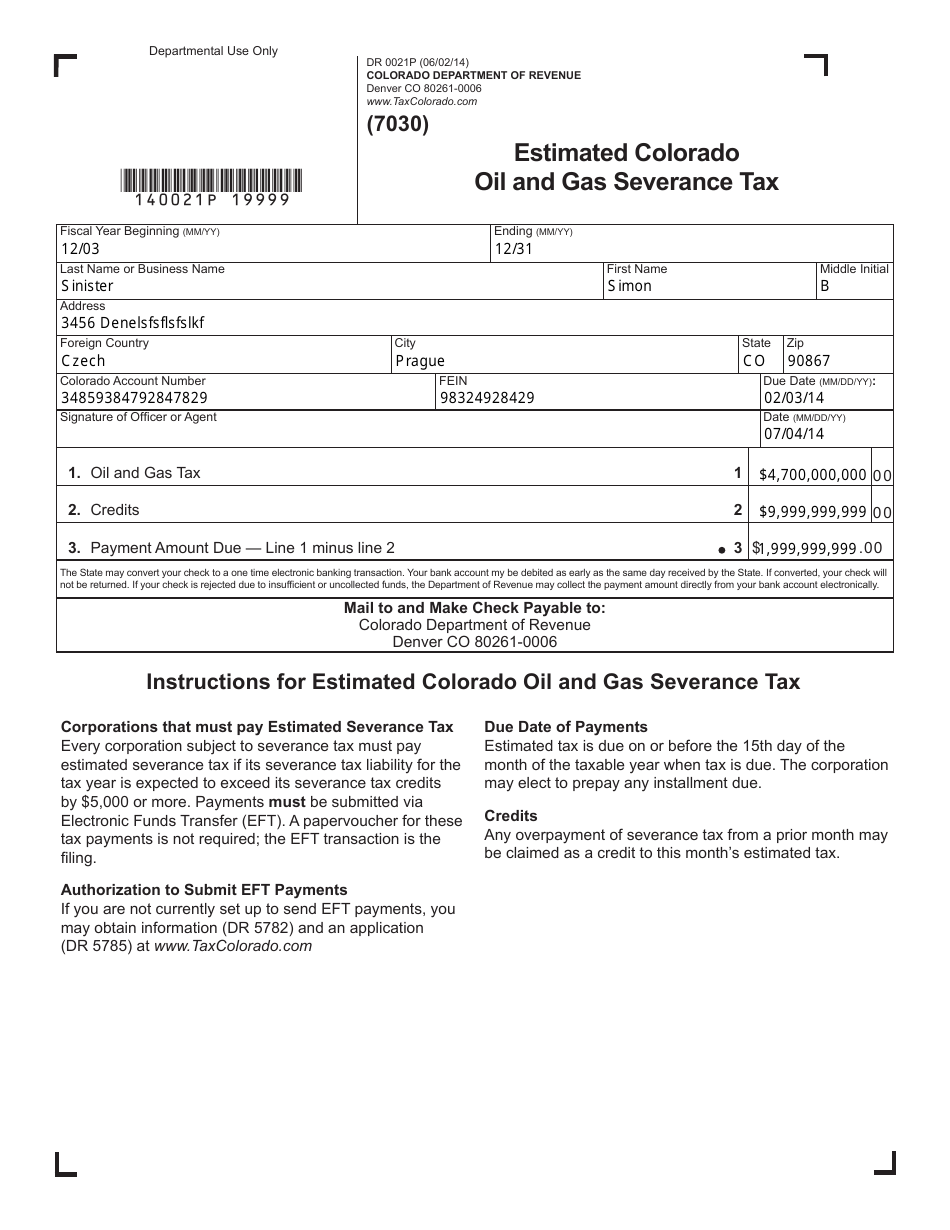

Form DR0021P Download Fillable PDF or Fill Online Estimated Colorado

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the ssn/ein of the taxpayer who sent it. See the individual income tax guidance publications available at tax.colorado.gov for. Web for instructions on how to compute estimated income tax, see the worksheet.

Colorado Department Of Revenue Online Payment Meyasity

Web how to make estimated payments. Web for instructions on how to compute estimated income tax, see the worksheet provided on the dr 0104ep form. Web form dr 0900 is a colorado individual income tax form. You can see a record of your estimated tax payments in your revenue online account. Estimated tax payments must be submitted in the same.

Fill Free fillable Minnesota Department of Revenue PDF forms

Web file now with turbotax we last updated colorado form 104ep in february 2023 from the colorado department of revenue. Payment options by tax type; Web include a colorado estimated income tax payment form (dr 0104ep) with their payment to ensure proper crediting of their account. Estimated tax payments are claimed when you file your colorado individual income tax return.

Estimated Tax Payments Do I Need to Worry About Them? The Motley Fool

Web we last updated the colorado composite nonresident estimated tax payment form in january 2022, so this is the latest version of form 106ep, fully updated for tax year 2022. We will update this page with a new version of the form for 2024 as soon as it is made available by the colorado government. Web corporations generally have to.

Estimated Tax Payment Worksheet 2023

Estimated tax payments are claimed when you file your colorado individual income tax return (dr 0104). Use the worksheet provided on the following page to. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the ssn/ein of the taxpayer who sent.

Form 0112ep Colorado Corporate Estimated Tax Worksheet 2011

These where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in colorado during calendar year 2023. You can print other colorado tax forms here. Other colorado individual income tax forms: Please exercise care when remitting joint estimated payments and when filing joint returns Web find irs mailing addresses for taxpayers.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

Learn more about each tax type and how to pay them. Begin the form enter your corporation's name, address, and federal employer identification number (fein). Estimated tax payments must be submitted in the same manner, whether separate, consolidated or combined, and using the same account number that the corporation expects to use when filing the colorado corporation income tax return. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

Any Taxpayer Who Jointly Files Their Estimated Tax With The Irs Must Also Jointly File Estimated Tax With The State Of Colorado.

See publication fyi income 51 for more information, available at colorado.gov/tax general rule Web form dr 0900 is a colorado individual income tax form. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in colorado. You may have to pay estimated tax for the current year if your tax was more than zero in the prior year.

Web Estimated Tax Payments Can Be Made On A Quarterly Basis.

Estimated tax payments are due on a quarterly basis; Web file now with turbotax we last updated colorado form 104ep in february 2023 from the colorado department of revenue. Web corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed. Web filling out colorado tax form 112 step 1:

For More Information, See Publication Fyi Income 51.

In most cases, you must pay estimated tax if you expect to owe more than $1,000 in net tax for 2023, after subtracting any withholding or credits you might have. Use the worksheet provided on the following page to. We will update this page with a new version of the form for 2024 as soon as it is made available by the colorado government. The amount a taxpayer must remit for estimated payments is based upon the taxpayer’s net colorado income tax liability for either the current or prior year.