Colorado Form 106 Schedule K-1

Colorado Form 106 Schedule K-1 - Web we last updated colorado form 106 in february 2023 from the colorado department of revenue. Modifications may be sourced to colorado. Web (10/01/09) colorado partnershipor s corporation return of income and compositenonresidentincome tax return colorado department of. Modifications may be sourced to colorado only to the extent that the income to which. Web line 1 — report the total income from federal schedule k. Web colorado uses part ii of form 106 to prepare a composite return for nonresident shareholders. Web s corps must file form 1120s with the irs. Download past year versions of this tax form as pdfs. Modifications may be sourced to colorado. Line 2 — allowable deduction from federal schedule k.

Download past year versions of this tax form as pdfs. Colorado form 106 for any year. Line 3 — report the amount of tax reported on colorado. Web line 1 — report the total income from federal schedule k. Web (10/01/09) colorado partnershipor s corporation return of income and compositenonresidentincome tax return colorado department of. Web s corps must file form 1120s with the irs. Web we last updated colorado form 106 in february 2023 from the colorado department of revenue. Modifications may be sourced to colorado. Instructions, form 106 and related forms use this. Instead, the income is passed through to the.

Modifications may be sourced to colorado only to the extent that the income to which. Modifications may be sourced to colorado. Line 3 — report the amount of tax reported on colorado. Web all s corporations in colorado need to complete and file form 106. Web s corps must file form 1120s with the irs. Colorado form 106 for any year. Web we last updated colorado form 106 in february 2023 from the colorado department of revenue. This form is for income earned in tax year 2022, with tax returns due in. Modifications may be sourced to colorado. Line 2 — allowable deduction from federal schedule k.

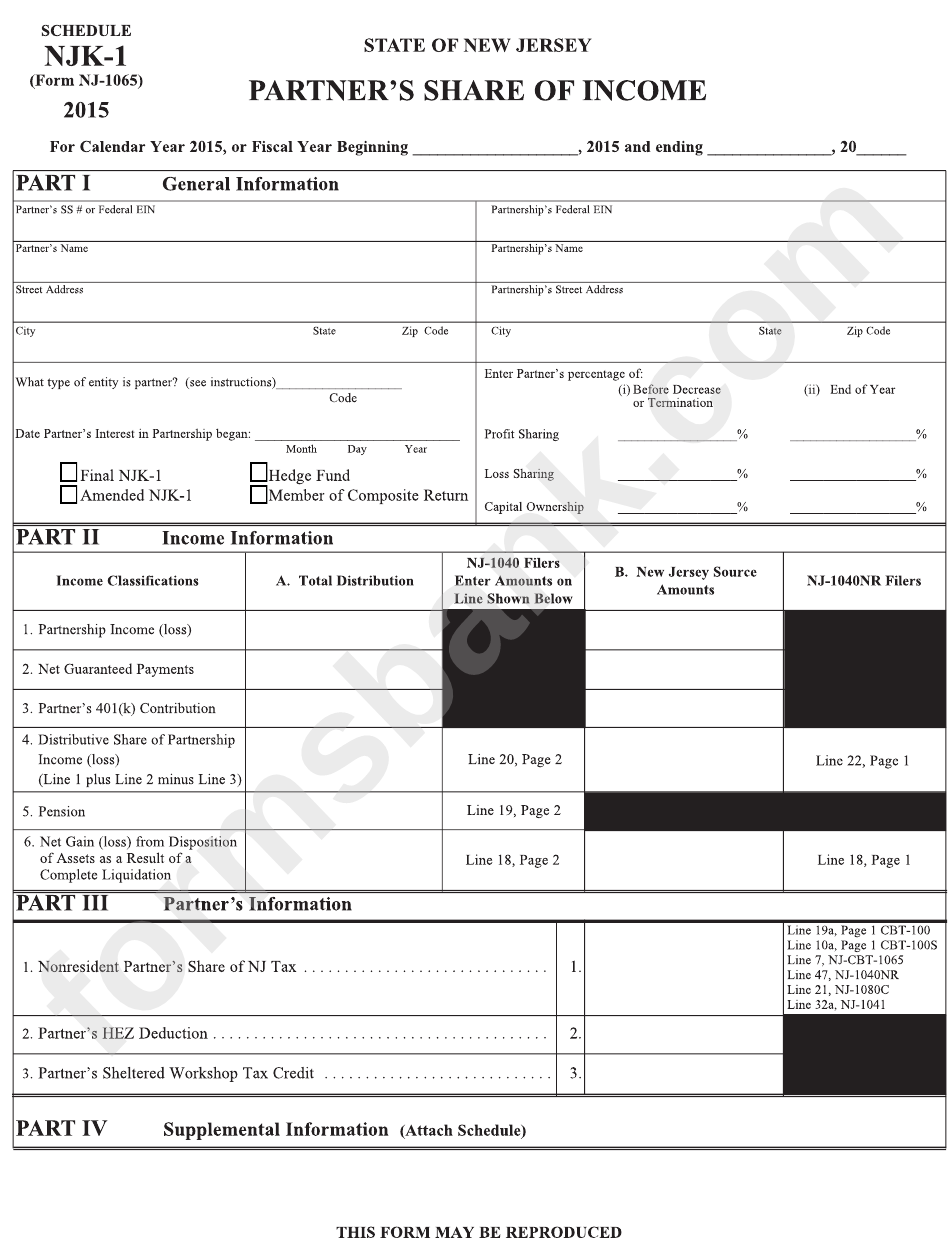

Fillable Schedule Njk1 (Form Nj1065) Partner'S Share Of

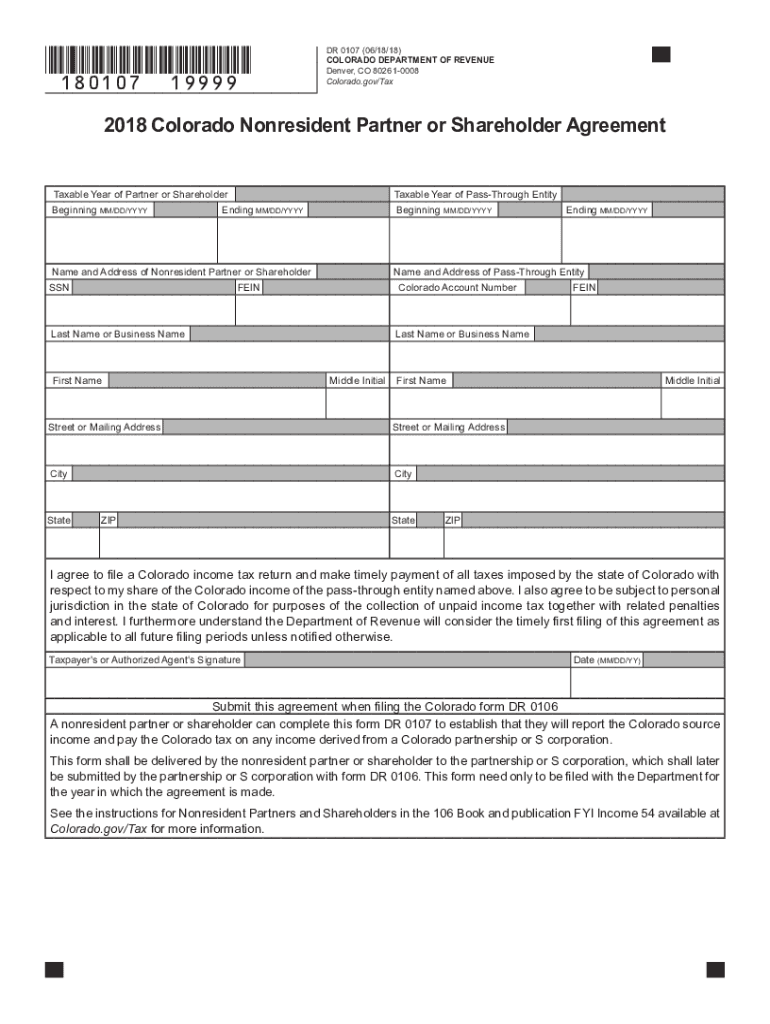

Modifications may be sourced to colorado only to the extent that the income to which. Web (10/01/09) colorado partnershipor s corporation return of income and compositenonresidentincome tax return colorado department of. Identification of partners or shareholders part iii must. Web all s corporations in colorado need to complete and file form 106. You do not need to complete any.

Form 106 Tax Return for Pass Through Entitites YouTube

Line 2 — allowable deduction from federal schedule k. Identification of partners or shareholders part iii must. Modifications may be sourced to colorado. Modifications may be sourced to colorado only to the extent that the income to which. Web we last updated colorado form 106 in february 2023 from the colorado department of revenue.

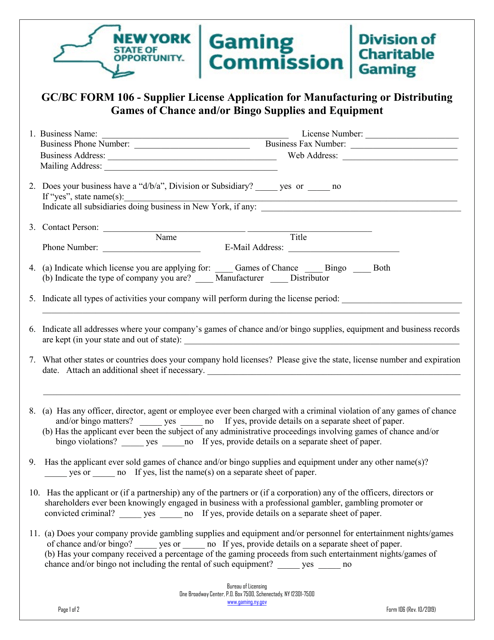

Form 106 Download Printable PDF or Fill Online Supplier License

Web all s corporations in colorado need to complete and file form 106. Web s corps must file form 1120s with the irs. This form is for income earned in tax year 2022, with tax returns due in. Download past year versions of this tax form as pdfs. Instead, the income is passed through to the.

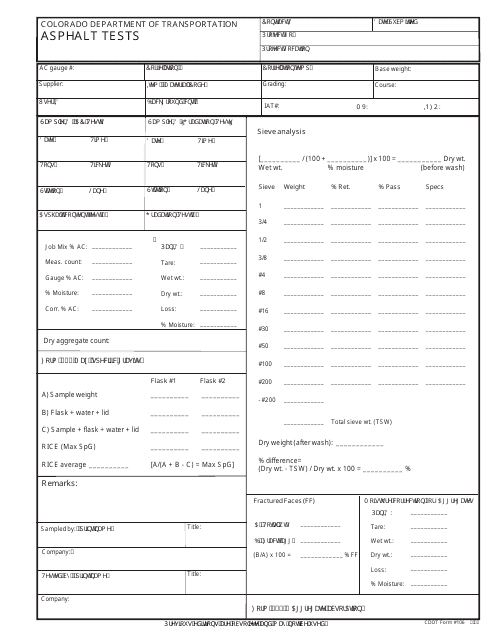

CDOT Form 106 Download Fillable PDF or Fill Online Asphalt Tests

Web line 1 — report the total income from federal schedule k. Web colorado uses part ii of form 106 to prepare a composite return for nonresident shareholders. Web we last updated colorado form 106 in february 2023 from the colorado department of revenue. Identification of partners or shareholders part iii must. Web s corps must file form 1120s with.

What Do I Do With A Schedule K1 (form 1065) Armando Friend's Template

Instructions, form 106 and related forms use this. Modifications may be sourced to colorado only to the extent that the income to which. Web colorado uses part ii of form 106 to prepare a composite return for nonresident shareholders. Identification of partners or shareholders part iii must. Modifications may be sourced to colorado.

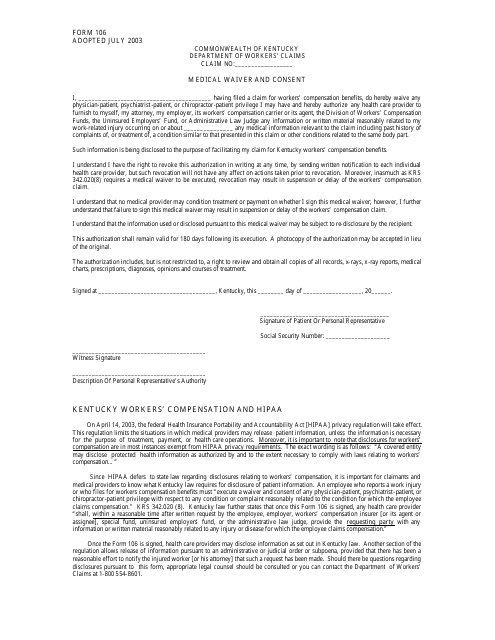

Form 106 Download Printable PDF or Fill Online Medical Waiver and

Web line 1 — report the total income from federal schedule k. Download past year versions of this tax form as pdfs. Web (10/01/09) colorado partnershipor s corporation return of income and compositenonresidentincome tax return colorado department of. Line 3 — report the amount of tax reported on colorado. This form is for income earned in tax year 2022, with.

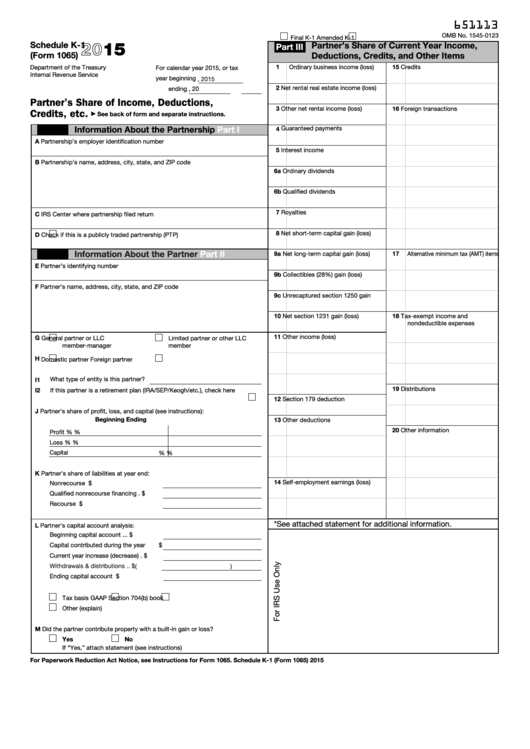

Fillable Schedule K1 (Form 1065) Partner'S Share Of

Web s corps must file form 1120s with the irs. Download past year versions of this tax form as pdfs. This form is for income earned in tax year 2022, with tax returns due in. Modifications may be sourced to colorado only to the extent that the income to which. Web line 1 — report the total income from federal.

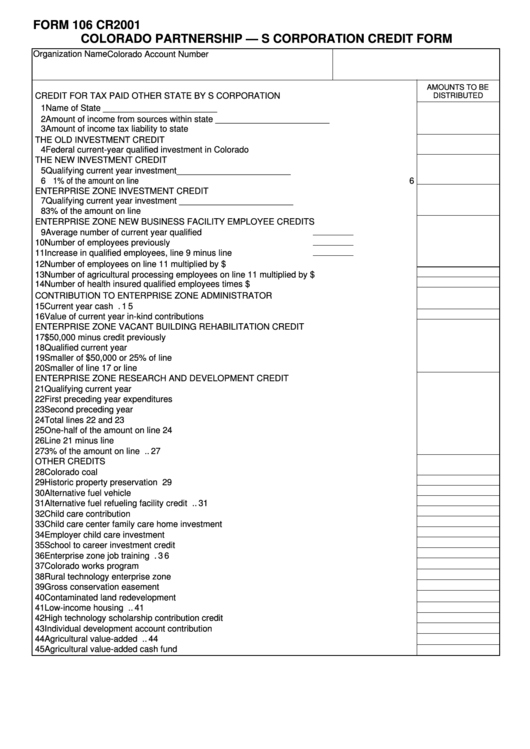

Form 106 Cr Colorado Partnership S Corporation Credit Form 2001

Colorado form 106 for any year. Instructions, form 106 and related forms use this. Line 3 — report the amount of tax reported on colorado. Modifications may be sourced to colorado. Line 2 — allowable deduction from federal schedule k.

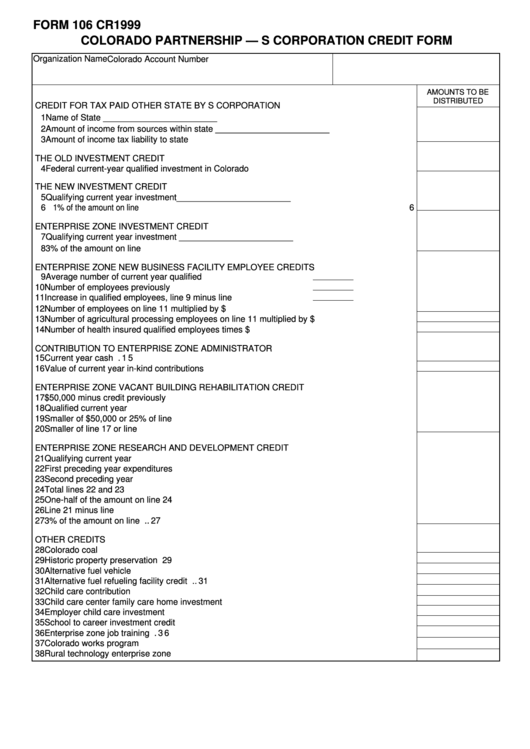

Form 106 Cr Colorado Partnership S Corporation Credit Form 1999

Modifications may be sourced to colorado only to the extent that the income to which. Web we last updated colorado form 106 in february 2023 from the colorado department of revenue. Web s corps must file form 1120s with the irs. Instead, the income is passed through to the. Modifications may be sourced to colorado.

Colorado Unemployment Insurance Tax Report Form Uitr 1

Web colorado uses part ii of form 106 to prepare a composite return for nonresident shareholders. Web (10/01/09) colorado partnershipor s corporation return of income and compositenonresidentincome tax return colorado department of. Line 2 — allowable deduction from federal schedule k. Download past year versions of this tax form as pdfs. Web s corps must file form 1120s with the.

Modifications May Be Sourced To Colorado Only To The Extent That The Income To Which.

Instead, the income is passed through to the. Web all s corporations in colorado need to complete and file form 106. This form is for income earned in tax year 2022, with tax returns due in. Colorado form 106 for any year.

Web (10/01/09) Colorado Partnershipor S Corporation Return Of Income And Compositenonresidentincome Tax Return Colorado Department Of.

Download past year versions of this tax form as pdfs. Web we last updated colorado form 106 in february 2023 from the colorado department of revenue. You do not need to complete any. Modifications may be sourced to colorado.

Line 3 — Report The Amount Of Tax Reported On Colorado.

Modifications may be sourced to colorado. Web s corps must file form 1120s with the irs. Web line 1 — report the total income from federal schedule k. Identification of partners or shareholders part iii must.

Web Colorado Uses Part Ii Of Form 106 To Prepare A Composite Return For Nonresident Shareholders.

Instructions, form 106 and related forms use this. Line 2 — allowable deduction from federal schedule k. Modifications may be sourced to colorado only to the extent that the income to which.