Colorado Tax Extension Form 2022

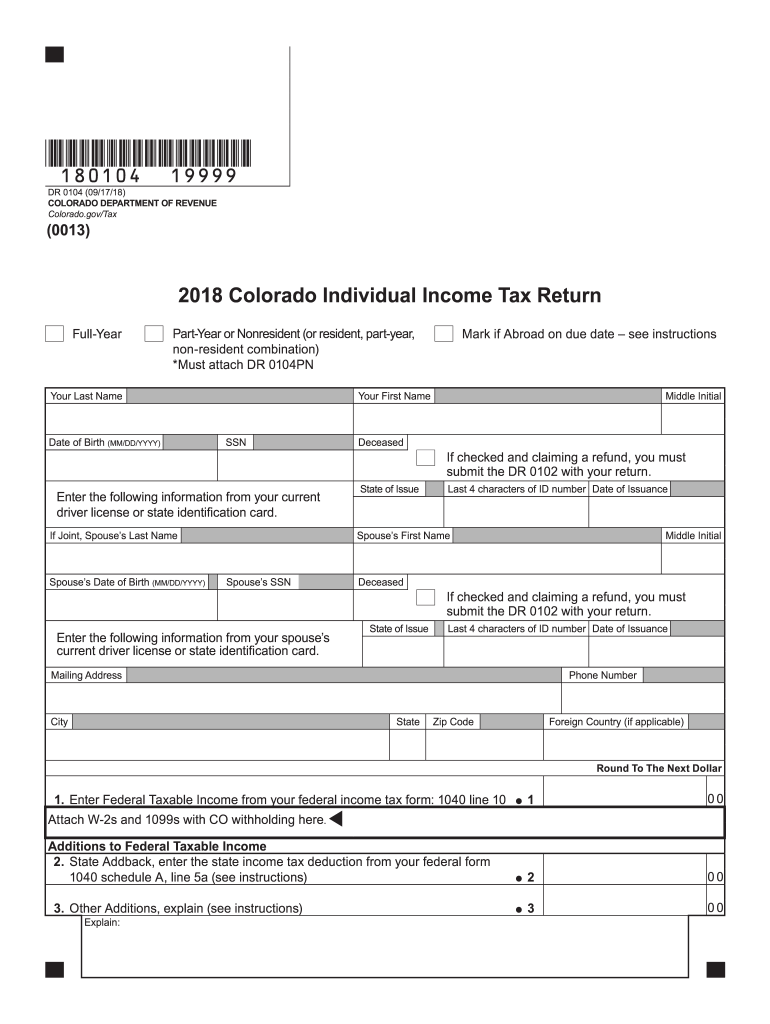

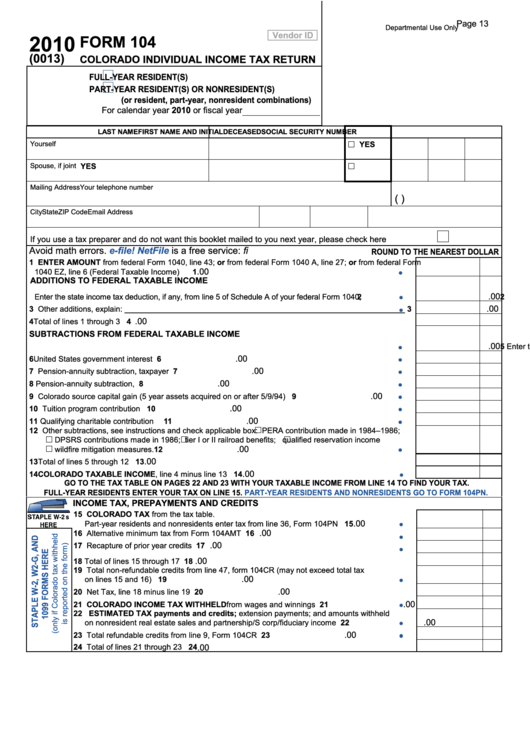

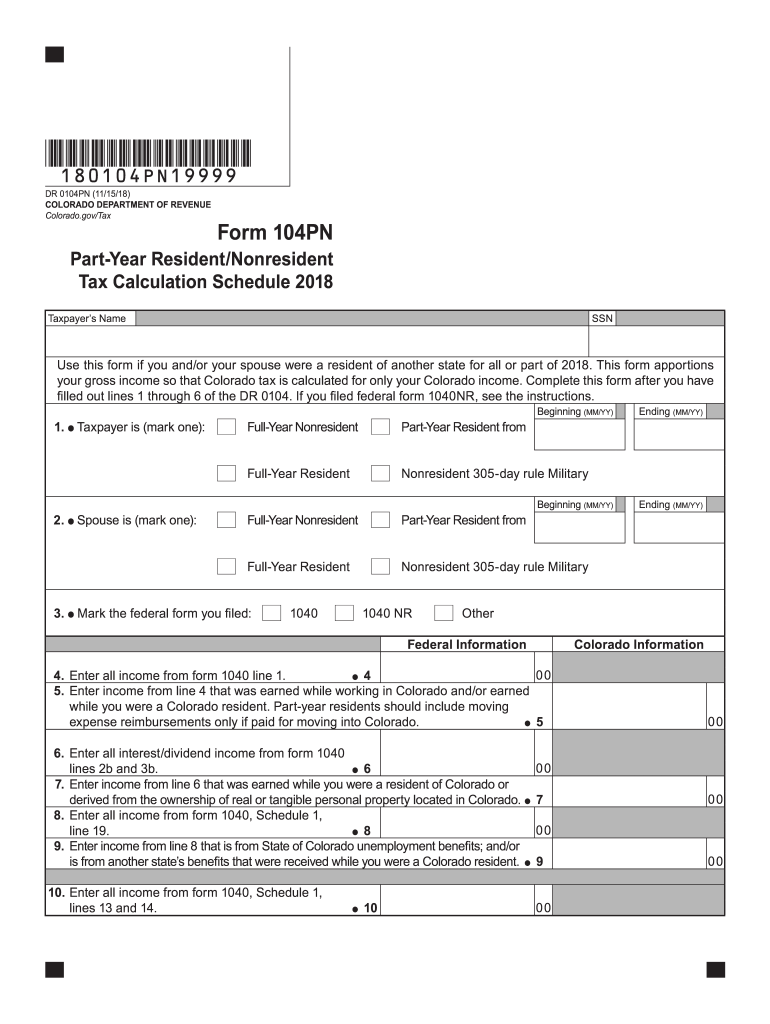

Colorado Tax Extension Form 2022 - Web the state of colorado has issued the following guidance regarding income tax filing deadlines for individuals: Web you need to either pay through revenue online or submit your payment with the extension payment form. The state filing deadline is april 18, 2023. We will update this page with a new version of the form for 2024 as soon as it is made available. Web (calendar year — due april 15, 2022) filing extensions are granted automatically. Complete, edit or print tax forms instantly. Web colorado has a flat state income tax of 4.63% , which is administered by the colorado department of revenue. Instructions on how to efile an irs income tax return extension colorado income. Web more about the colorado dr 0105 estate tax extension ty 2022. Web this form is for income earned in tax year 2022, with tax returns due in april 2023.

Ad discover 2290 form due dates for heavy use vehicles placed into service. Web more about the colorado dr 0105 estate tax extension ty 2022. Instructions on how to efile an irs income tax return extension colorado income. Web the irs will automatically process an extension when a taxpayer selects form 4868 and makes a full or partial federal tax payment by the april 18 due date using. Web 2021 extension payment for colorado individual income tax (calendar year — due april 15, 2022) filing extensions are granted automatically, only return this form if you need to. Colorado personal income tax returns are due by april 15. Web 2022 extension of time for filing a coloradoc corporation income tax return filing extensions are granted automatically, only return this formif you need to make an. You can download or print. Web $34.95 now only $29.95 file your personal tax extension now! Web file your state income taxes online department of revenue file your individual income tax return, submit documentation electronically, or apply for a ptc rebate.

Web you need to either pay through revenue online or submit your payment with the extension payment form. You can download or print. Web file your state income taxes online department of revenue file your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Dr 0105 is a colorado estate tax form. Taxformfinder provides printable pdf copies of 65 current. Web the irs will automatically process an extension when a taxpayer selects form 4868 and makes a full or partial federal tax payment by the april 18 due date using. The state filing deadline is april 18, 2023. Get ready for tax season deadlines by completing any required tax forms today. Web 2021 extension payment for colorado individual income tax (calendar year — due april 15, 2022) filing extensions are granted automatically, only return this form if you need to. Complete, edit or print tax forms instantly.

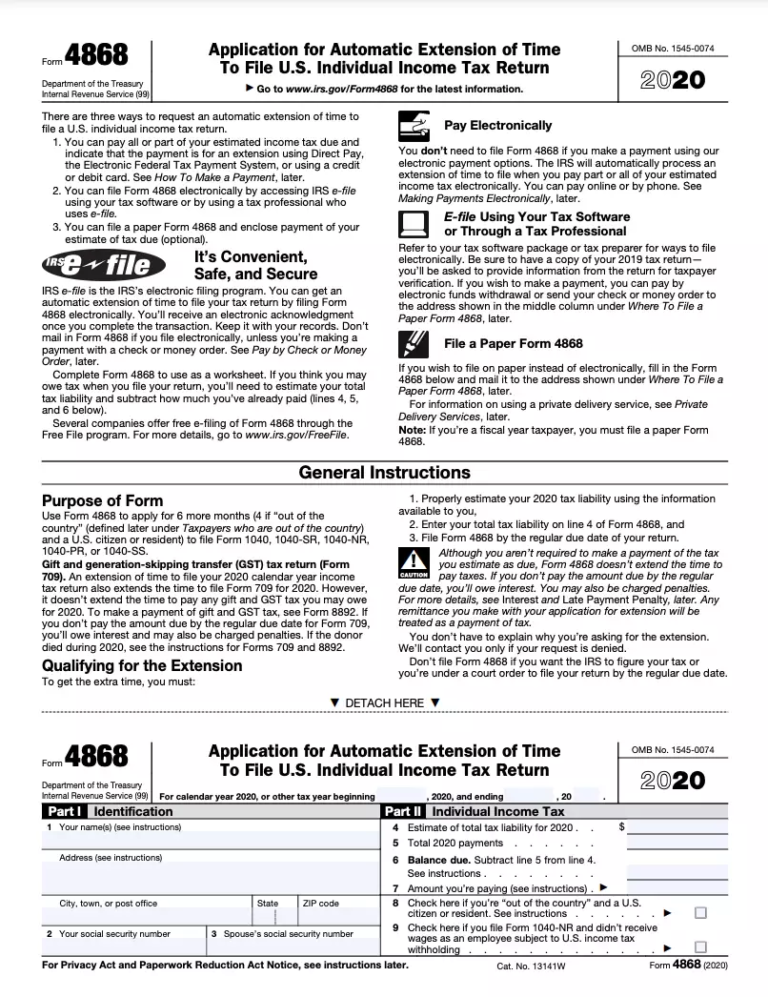

Tax extension IRS automatically give without filing Form 4868 if you do

Taxformfinder provides printable pdf copies of 65 current. Web file your state income taxes online department of revenue file your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web the irs will automatically process an extension when.

Colorado Divorce Forms 1111 Universal Network

Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. Get ready for tax season deadlines by completing any required tax forms today. Ad discover 2290 form due dates for heavy use vehicles placed into service. Ad access irs tax.

Tax Extension Deadline 2021 Colorado TAXIRIN

Web file your state income taxes online department of revenue file your individual income tax return, submit documentation electronically, or apply for a ptc rebate. You can download or print. Colorado personal income tax returns are due by april 15. Web $34.95 now only $29.95 file your personal tax extension now! Once you have paid at least 90% of your.

Top10 US Tax Forms in 2022 Explained PDF.co

This form is for income earned in tax year 2022, with tax returns due in. Complete, edit or print tax forms instantly. Web 2021 extension payment for colorado individual income tax (calendar year — due april 15, 2022) filing extensions are granted automatically, only return this form if you need to. If you miss the tax extension deadline,. Web more.

Colorado Department Of Revenue Online Payment Meyasity

Web the irs will automatically process an extension when a taxpayer selects form 4868 and makes a full or partial federal tax payment by the april 18 due date using. Dr 0105 is a colorado estate tax form. Web more about the colorado dr 0105 estate tax extension ty 2022. You can download or print. Web this will allow you.

Individual Tax Form 104 Colorado Free Download

Web (calendar year — due april 15, 2022) filing extensions are granted automatically. Dr 0105 is a colorado estate tax form. Ad discover 2290 form due dates for heavy use vehicles placed into service. Web $34.95 now only $29.95 file your personal tax extension now! We will update this page with a new version of the form for 2024 as.

Printable 2018 Federal Tax Withholding Tables

Web more about the colorado dr 0105 estate tax extension ty 2022. Web file your state income taxes online department of revenue file your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Return this form only if you need to make an additional payment of tax. Instructions on how to efile an irs income tax.

Tax Form 104Pn Fill Out and Sign Printable PDF Template signNow

Web 2021 extension payment for colorado individual income tax (calendar year — due april 15, 2022) filing extensions are granted automatically, only return this form if you need to. If you cannot file by that date, you can get an. Once you have paid at least 90% of your income tax. If you miss the tax extension deadline,. Web the.

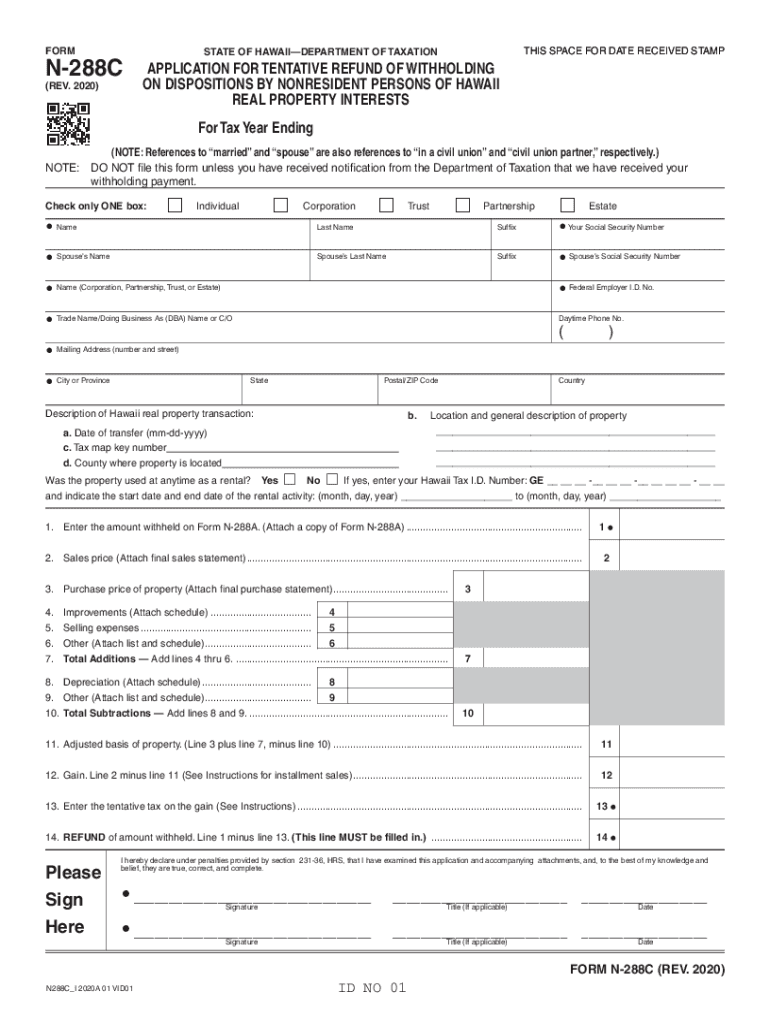

20202022 Form HI DoT N288C Fill Online, Printable, Fillable, Blank

Web more about the colorado dr 0105 estate tax extension ty 2022. We will update this page with a new version of the form for 2024 as soon as it is made available. Colorado personal income tax returns are due by april 15. Web (calendar year — due april 15, 2022) filing extensions are granted automatically. Instructions on how to.

Colorado State Tax Form

Instructions on how to receive an automatic colorado income tax extension step 2: Web you need to either pay through revenue online or submit your payment with the extension payment form. Return this form only if you need to make an additional payment of tax. Web file your state income taxes online department of revenue file your individual income tax.

Web 2022 Extension Of Time For Filing A Coloradoc Corporation Income Tax Return Filing Extensions Are Granted Automatically, Only Return This Formif You Need To Make An.

Colorado personal income tax returns are due by april 15. Complete, edit or print tax forms instantly. Web more about the colorado dr 0105 estate tax extension ty 2022. Return this form only if you need to make an additional payment of tax.

You Can Download Or Print.

Web this will allow you an additional six month to file your return. Web colorado has a flat state income tax of 4.63% , which is administered by the colorado department of revenue. Web (calendar year — due april 15, 2022) filing extensions are granted automatically. Taxformfinder provides printable pdf copies of 65 current.

Web File Your State Income Taxes Online Department Of Revenue File Your Individual Income Tax Return, Submit Documentation Electronically, Or Apply For A Ptc Rebate.

Web 2021 extension payment for colorado individual income tax (calendar year — due april 15, 2022) filing extensions are granted automatically, only return this form if you need to. Instructions on how to efile an irs income tax return extension colorado income. Web the state of colorado has issued the following guidance regarding income tax filing deadlines for individuals: If you cannot file by that date, you can get an.

Instructions On How To Receive An Automatic Colorado Income Tax Extension Step 2:

This form is for income earned in tax year 2022, with tax returns due in. Once you have paid at least 90% of your income tax. Web $34.95 now only $29.95 file your personal tax extension now! Ad access irs tax forms.