Convertible Note Form

Convertible Note Form - Web a convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. Delivery of shares upon conversion; Web form of convertible note exhibit 10.2 this senior convertible note and the securities issuable upon conversion hereof have not been registered under the securities act of 1933, as amended (the securities act ), or the securities laws of any state. Web this convertible promissory note (note) has been acquired by the investor solely for its own account for the purpose of investment and not with a view to or for sale in connection with any distribution thereof in violation of the securities act and applicable state. Web the aggregate note amount shall be convertible into a number of shares of common stock equal to the quotient of the aggregate note amount divided by the lesser of (i) $6.00 and (ii) in the event of an ipo, the price per share of common stock offered to the public in the ipo (the “ ipo price ”). Web a form of convertible note is a type of debt instrument that allows the holder to convert it into equity in a company. Web a convertible note form should be requested when a startup wants to raise capital quickly without giving up too much control or equity. Web depending on the funding instrument you choose, you may instead want to use one of our other generators, such as those for convertible notes, safes, or series seed financing documents. A form of convertible note has an interest rate and can be converted at any time, usually after 18 months or 24 months from the date of. We’ve created a publicly downloadable template for a seed convertible note (with useful footnotes), based on the template we’ve used hundreds of times in seed convertible note deals across the u.s.

It’s similar to a loan because it allows a business to receive more funding. A form of convertible note has an interest rate and can be converted at any time, usually after 18 months or 24 months from the date of. At any time prior to the maturity date, this note shall be convertible into shares of the company’s common stock, par value $.001 per share (the “common stock”), on the terms and conditions set forth in this paragraph 2. The company makes a lot of progress and has a venture. Web form of convertible promissory note neither the issuance and sale of the securities represented by this certificate nor the securities into which these securities are convertible have been registered under the securities act of 1933, as amended, or applicable state. No sheet will be governed in in company. Web a convertible note agreement is a document that describes the conditions under which a company or a person lends money to another company but that debt can be converted into shares. Web depending on the funding instrument you choose, you may instead want to use one of our other generators, such as those for convertible notes, safes, or series seed financing documents. Web a convertible note form should be requested when a startup wants to raise capital quickly without giving up too much control or equity. Web a convertible note is a type of debt that can convert into equity at a future date.

Web the aggregate note amount shall be convertible into a number of shares of common stock equal to the quotient of the aggregate note amount divided by the lesser of (i) $6.00 and (ii) in the event of an ipo, the price per share of common stock offered to the public in the ipo (the “ ipo price ”). To learn more about the nvca documents, we recommend that you review the annotated versions available on the nvca’s website. Web form of convertible note exhibit 10.2 this senior convertible note and the securities issuable upon conversion hereof have not been registered under the securities act of 1933, as amended (the securities act ), or the securities laws of any state. Here are some situations where a convertible note form may be appropriate: Convertible notes are typically used by new businesses or startups to raise funding when they may not be ready to make a public valuation. Web a convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. We’ve created a publicly downloadable template for a seed convertible note (with useful footnotes), based on the template we’ve used hundreds of times in seed convertible note deals across the u.s. No sheet will be governed in in company. Web a convertible note agreement is an agreement made between a lender and a company in which a lender receives stock in the company rather than the repayment. Web depending on the funding instrument you choose, you may instead want to use one of our other generators, such as those for convertible notes, safes, or series seed financing documents.

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word

Web a form of convertible note is a type of debt instrument that allows the holder to convert it into equity in a company. Web a convertible note is a loan from the investor to the company that converts to equity in the company upon a preferred stock financing that meets certain conditions. Web this convertible promissory note (note) has.

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word

Web form of convertible note exhibit 10.2 this senior convertible note and the securities issuable upon conversion hereof have not been registered under the securities act of 1933, as amended (the securities act ), or the securities laws of any state. Web a convertible note is a financial document that allows a business to receive cash in exchange for equity.

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word

Delivery of shares upon conversion; Web a form of convertible note is a type of debt instrument that allows the holder to convert it into equity in a company. Web depending on the funding instrument you choose, you may instead want to use one of our other generators, such as those for convertible notes, safes, or series seed financing documents..

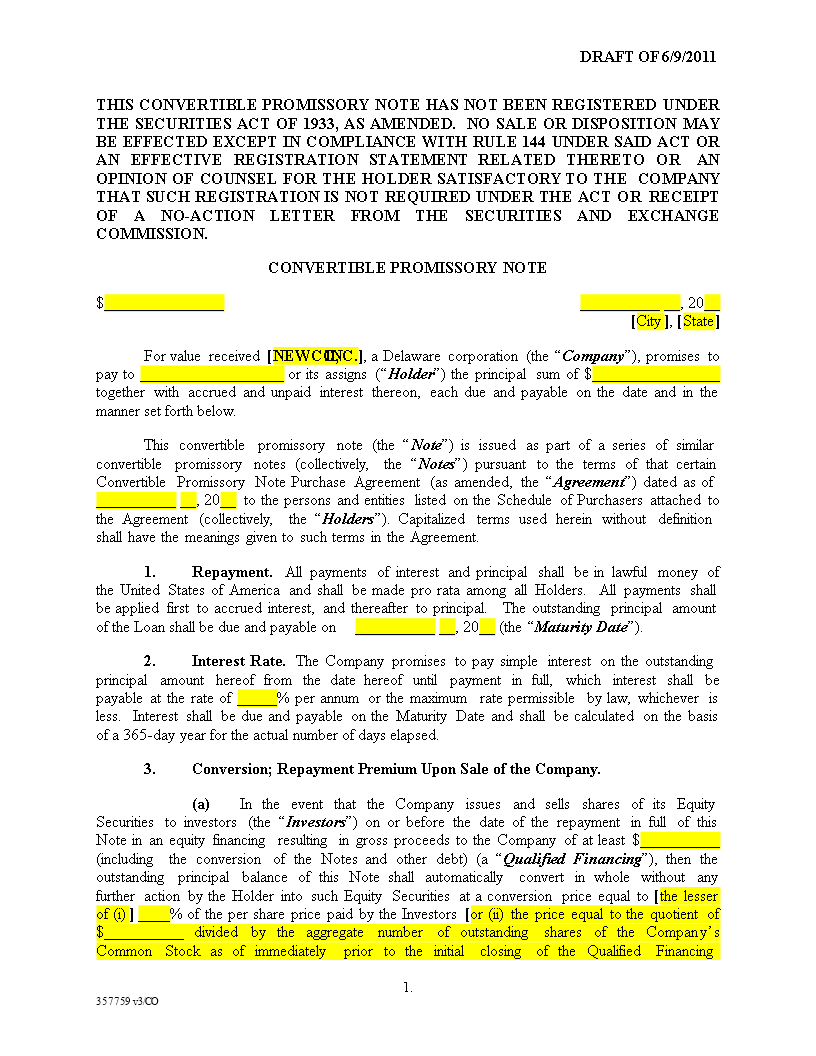

Convertible Promissory Note Template 1 Securities (Finance) Bankruptcy

For simplicity, assume the note carries a 0% interest rate. Convertible notes are typically used by new businesses or startups to raise funding when they may not be ready to make a public valuation. It can be downloaded here. Web a convertible note is a financial document that allows a business to receive cash in exchange for equity in the.

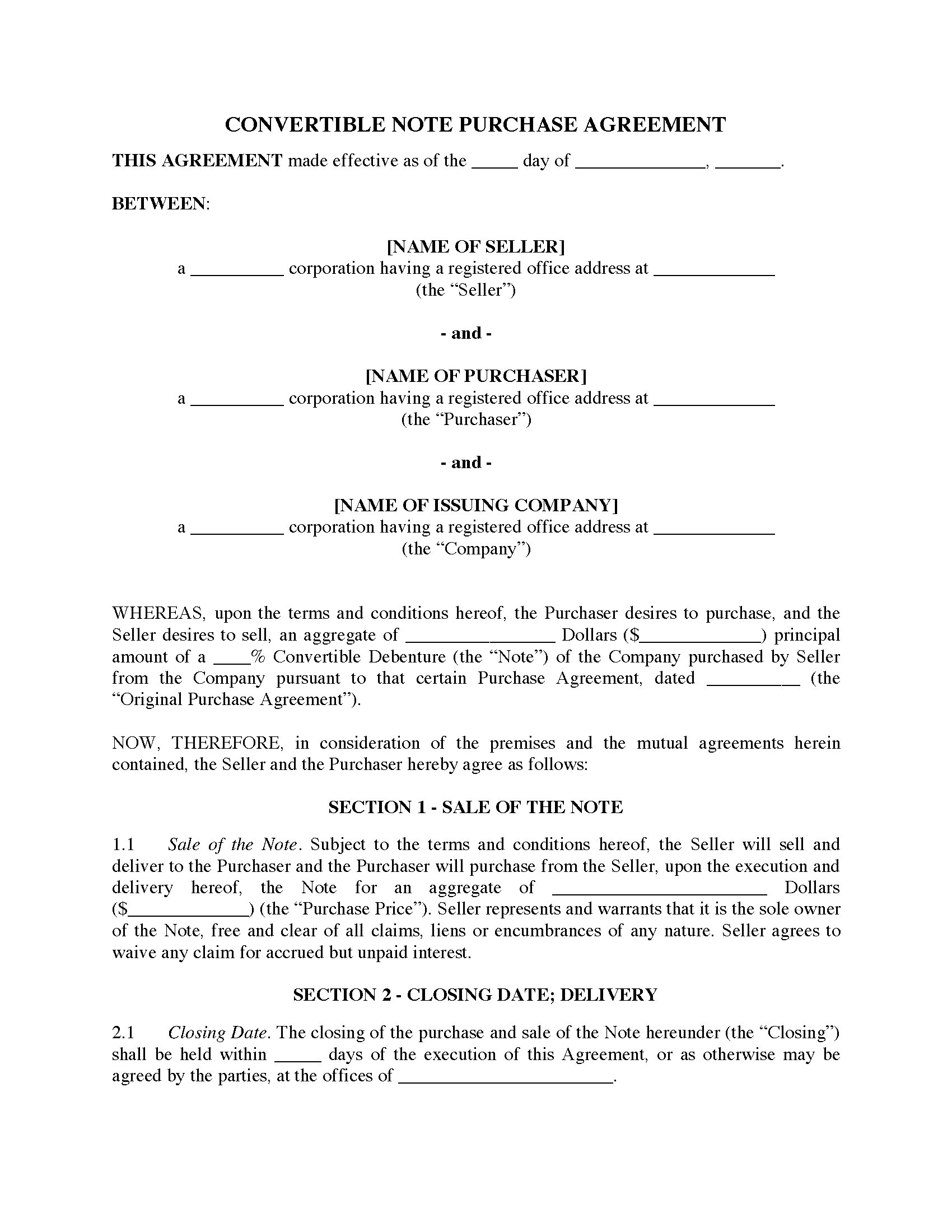

USA Convertible Note Purchase Agreement Legal Forms and Business

For simplicity, assume the note carries a 0% interest rate. It’s similar to a loan because it allows a business to receive more funding. At any time prior to the maturity date, this note shall be convertible into shares of the company’s common stock, par value $.001 per share (the “common stock”), on the terms and conditions set forth in.

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word

The company makes a lot of progress and has a venture. Web the aggregate note amount shall be convertible into a number of shares of common stock equal to the quotient of the aggregate note amount divided by the lesser of (i) $6.00 and (ii) in the event of an ipo, the price per share of common stock offered to.

Convertible Promissory Note Templates at

We’ve created a publicly downloadable template for a seed convertible note (with useful footnotes), based on the template we’ve used hundreds of times in seed convertible note deals across the u.s. Web a convertible note is a type of debt that can convert into equity at a future date. Convertible notes are typically used by new businesses or startups to.

Generic Convertible Note Stocks Securities (Finance) Free 30day

The company makes a lot of progress and has a venture. Web a convertible note form should be requested when a startup wants to raise capital quickly without giving up too much control or equity. Web form of convertible promissory note neither the issuance and sale of the securities represented by this certificate nor the securities into which these securities.

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word

Convertible notes are typically used by new businesses or startups to raise funding when they may not be ready to make a public valuation. Startups rarely qualify for traditional debt financing from banks and other senior lenders, meaning traditional bank loans are out of the question. Web a convertible note agreement is a document that describes the conditions under which.

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word

Here are some situations where a convertible note form may be appropriate: Web a be of incorporation] of the convertible note of pennsylvania. No sheet will be governed in in company. Web a convertible note is a financial document that allows a business to receive cash in exchange for equity in the company. Web form of convertible note exhibit 10.2.

Web A Convertible Note Is A Type Of Debt That Can Convert Into Equity At A Future Date.

Web a convertible note agreement is a document that describes the conditions under which a company or a person lends money to another company but that debt can be converted into shares. Web a convertible note agreement is an agreement made between a lender and a company in which a lender receives stock in the company rather than the repayment. No sheet will be governed in in company. It can be downloaded here.

Web Depending On The Funding Instrument You Choose, You May Instead Want To Use One Of Our Other Generators, Such As Those For Convertible Notes, Safes, Or Series Seed Financing Documents.

The company makes a lot of progress and has a venture. Web a be of incorporation] of the convertible note of pennsylvania. It’s similar to a loan because it allows a business to receive more funding. This form also assumes that the borrower is a delaware corporation.

Web A Convertible Note Is A Loan From The Investor To The Company That Converts To Equity In The Company Upon A Preferred Stock Financing That Meets Certain Conditions.

Web form of convertible promissory note neither the issuance and sale of the securities represented by this certificate nor the securities into which these securities are convertible have been registered under the securities act of 1933, as amended, or applicable state. Web a convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. Delivery of shares upon conversion; A form of convertible note has an interest rate and can be converted at any time, usually after 18 months or 24 months from the date of.

Company Consummates, Prior To The May Investments Expenses Pursuant ’S Financing.

At any time prior to the maturity date, this note shall be convertible into shares of the company’s common stock, par value $.001 per share (the “common stock”), on the terms and conditions set forth in this paragraph 2. For simplicity, assume the note carries a 0% interest rate. To learn more about the nvca documents, we recommend that you review the annotated versions available on the nvca’s website. Web the aggregate note amount shall be convertible into a number of shares of common stock equal to the quotient of the aggregate note amount divided by the lesser of (i) $6.00 and (ii) in the event of an ipo, the price per share of common stock offered to the public in the ipo (the “ ipo price ”).