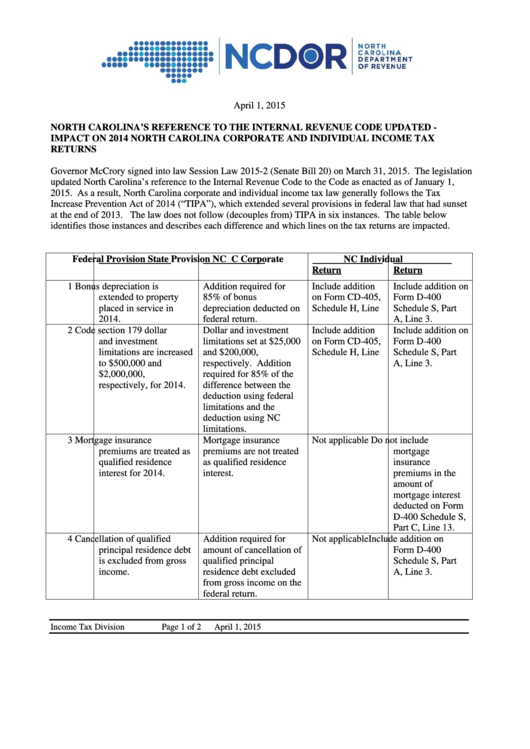

D 400 Tax Form

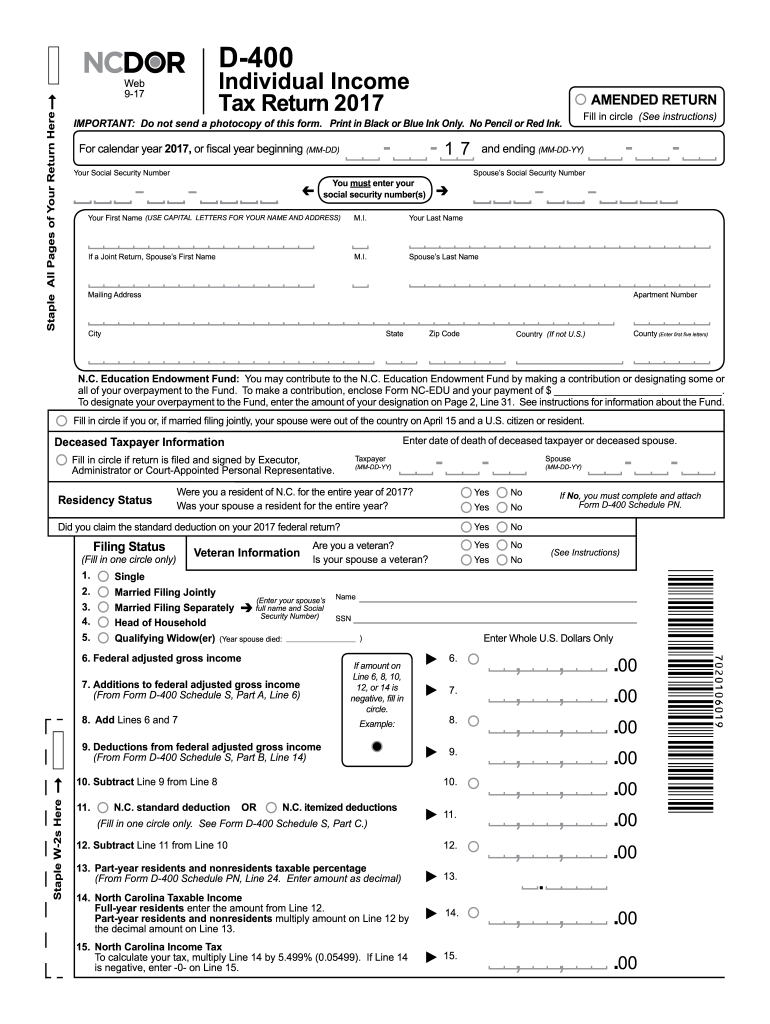

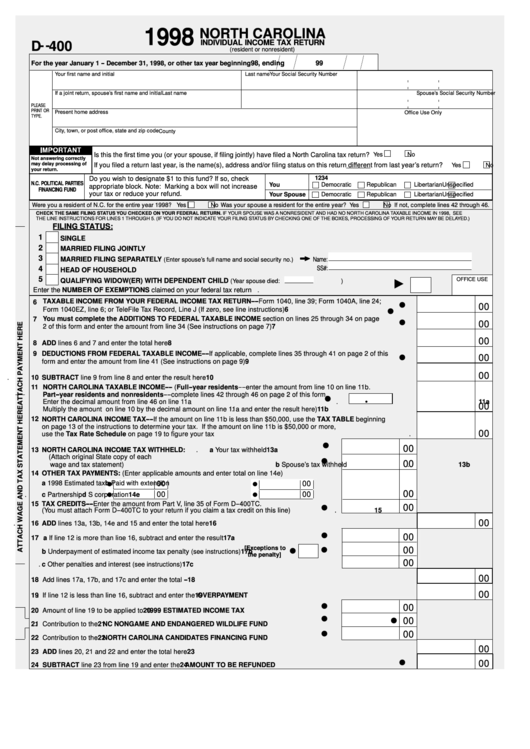

D 400 Tax Form - Multiply line 14 by 5.25% (0.0525). If zero or less, enter a zero. North carolina income tax 15. Turbotax deluxe online posted june 3, 2019 11:49 am last updated june 03, 2019 11:49 am 0 3 11,738 reply bookmark icon 2 best answer. Add lines 29 through 32 subtract line 33 from line 28. Do it right, do it for free. Send all information returns filed on paper to the following. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. Ad free tax software with instructions for each 2021 tax form. Web click here for help if the form does not appear after you click create form.

North carolina income tax 15. Single married filing joint married filing separately head of. Web internal revenue service. If zero or less, enter a zero. Ad free tax software with instructions for each 2021 tax form. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. (fill in one circle only. Sales and use electronic data. Multiply line 14 by 5.25% (0.0525). Turbotax deluxe online posted june 3, 2019 11:49 am last updated june 03, 2019 11:49 am 0 3 11,738 reply bookmark icon 2 best answer.

Sales and use electronic data. Web click here for help if the form does not appear after you click create form. Do not send a photocopy of this form. Ad free tax software with instructions for each 2021 tax form. Employee's withholding certificate form 941; Employers engaged in a trade or business who. Add lines 29 through 32 subtract line 33 from line 28. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. Turbotax deluxe online posted june 3, 2019 11:49 am last updated june 03, 2019 11:49 am 0 3 11,738 reply bookmark icon 2 best answer. Web internal revenue service.

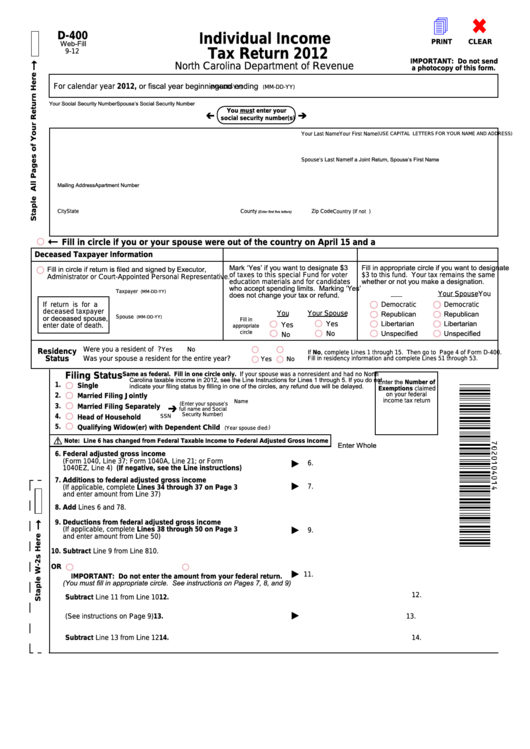

Fillable Form D400 Individual Tax Return 2012 printable pdf

(fill in one circle only. Employee's withholding certificate form 941; Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. Add lines 29 through 32 subtract line 33 from line 28. Web form tax year description electronic options;

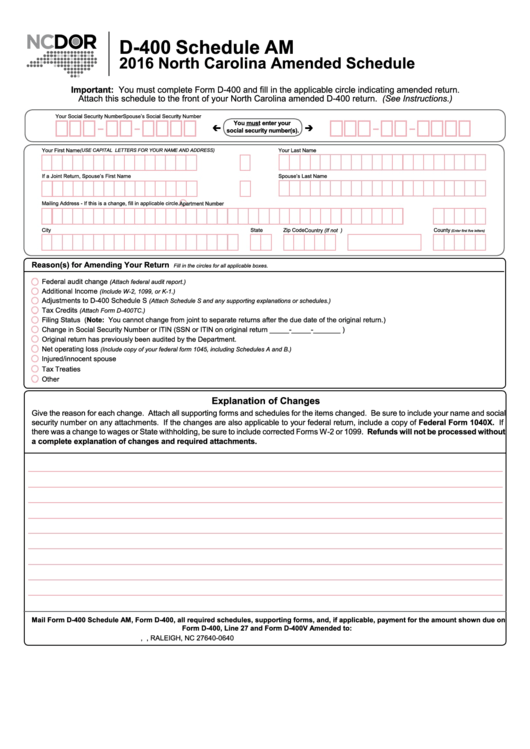

Form D400 Schedule Am North Carolina Amended Schedule 2016

If zero or less, enter a zero. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Do not send a photocopy of this form. Multiply line 14 by 5.25% (0.0525). Web home page | ncdor

NC DoR D400 2006 Fill out Tax Template Online US Legal Forms

Send all information returns filed on paper to the following. Sales and use electronic data. Turbotax deluxe online posted june 3, 2019 11:49 am last updated june 03, 2019 11:49 am 0 3 11,738 reply bookmark icon 2 best answer. Web internal revenue service. (fill in one circle only.

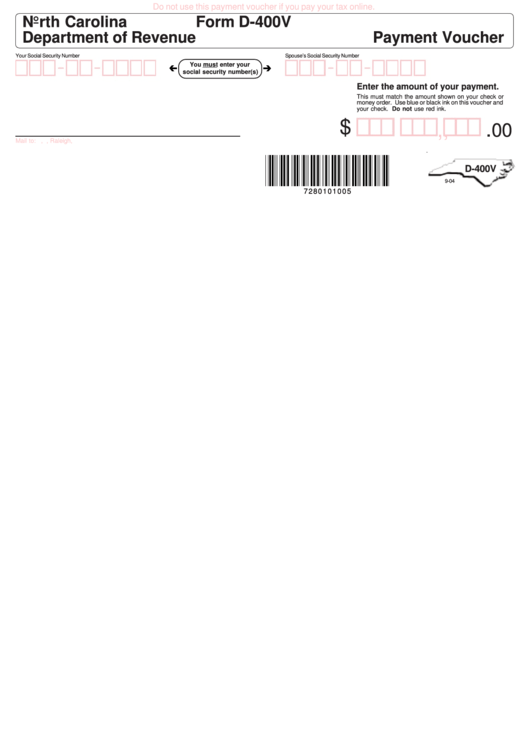

Form D400v Payment Voucher North Carolina Department Of Revenue

Do it right, do it for free. *permanent residents of guam or the virgin islands cannot use form 9465. North carolina income tax 15. Single married filing joint married filing separately head of. If zero or less, enter a zero.

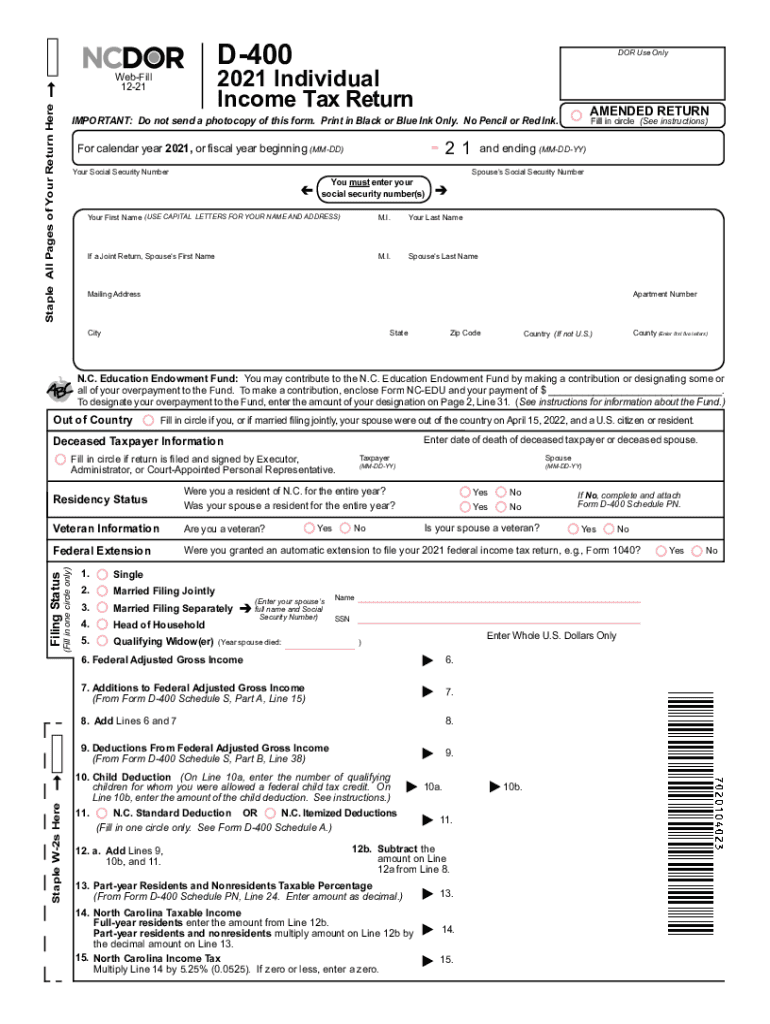

2021 Form NC DoR D400 Fill Online, Printable, Fillable, Blank pdfFiller

Ad free tax software with instructions for each 2021 tax form. Single married filing joint married filing separately head of. Turbotax deluxe online posted june 3, 2019 11:49 am last updated june 03, 2019 11:49 am 0 3 11,738 reply bookmark icon 2 best answer. Add lines 29 through 32 subtract line 33 from line 28. *permanent residents of guam.

Form D400 Individual Tax Return 2014 printable pdf download

Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. *permanent residents of guam or the virgin islands cannot use form 9465. Employee's withholding certificate form 941; Web click here for help if the form does not appear after you click create form. Do it right, do it.

2014 Form NC DoR D400TC Fill Online, Printable, Fillable, Blank

Sales and use electronic data. Multiply line 14 by 5.25% (0.0525). Web form tax year description electronic options; Do not send a photocopy of this form. Do it right, do it for free.

NC DoR D400 2017 Fill out Tax Template Online US Legal Forms

Turbotax deluxe online posted june 3, 2019 11:49 am last updated june 03, 2019 11:49 am 0 3 11,738 reply bookmark icon 2 best answer. *permanent residents of guam or the virgin islands cannot use form 9465. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. (fill.

Fillable Form D400 Individual Tax Return North Carolina

Add lines 29 through 32 subtract line 33 from line 28. Employers engaged in a trade or business who. Web form tax year description electronic options; Sales and use electronic data. Single married filing joint married filing separately head of.

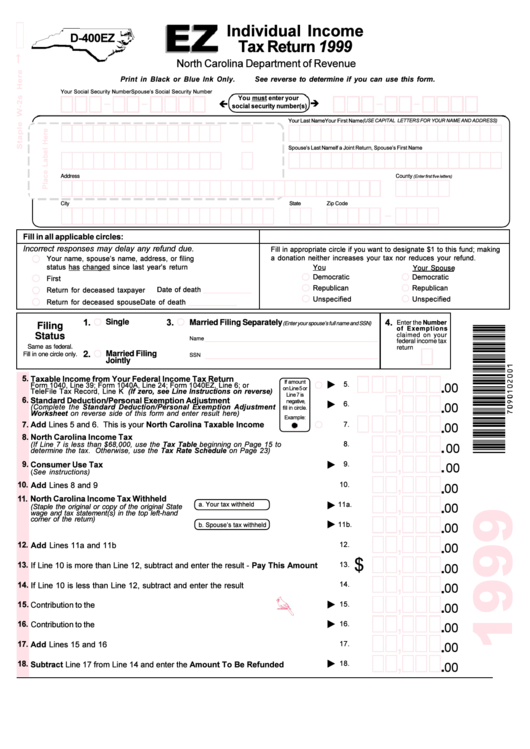

Form D400ez 1999 Individual Tax Return printable pdf download

Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. If zero or less, enter a zero. Ad free tax software with instructions for each 2021 tax form. Do not send a photocopy of this form. (fill in one circle only.

Single Married Filing Joint Married Filing Separately Head Of.

Web click here for help if the form does not appear after you click create form. Employers engaged in a trade or business who. Turbotax deluxe online posted june 3, 2019 11:49 am last updated june 03, 2019 11:49 am 0 3 11,738 reply bookmark icon 2 best answer. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003.

If Zero Or Less, Enter A Zero.

(fill in one circle only. Add lines 29 through 32 subtract line 33 from line 28. Multiply line 14 by 5.25% (0.0525). Do it right, do it for free.

Web Internal Revenue Service.

North carolina income tax 15. Web home page | ncdor Sales and use electronic data. Web form tax year description electronic options;

Web This Page Provides The Addresses For Taxpayers And Tax Professionals To Mail Paper Forms 1096 To The Irs.

Do not send a photocopy of this form. Ad free tax software with instructions for each 2021 tax form. Employee's withholding certificate form 941; *permanent residents of guam or the virgin islands cannot use form 9465.